Home>Renovation & DIY>Home Renovation Guides>What Kind Of Credit Score To Get A Home Improvement Loan

Home Renovation Guides

What Kind Of Credit Score To Get A Home Improvement Loan

Modified: January 9, 2024

Learn how to improve your credit score to secure a home improvement loan with our comprehensive home renovation guides. Get the financing you need today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

**

Introduction

**

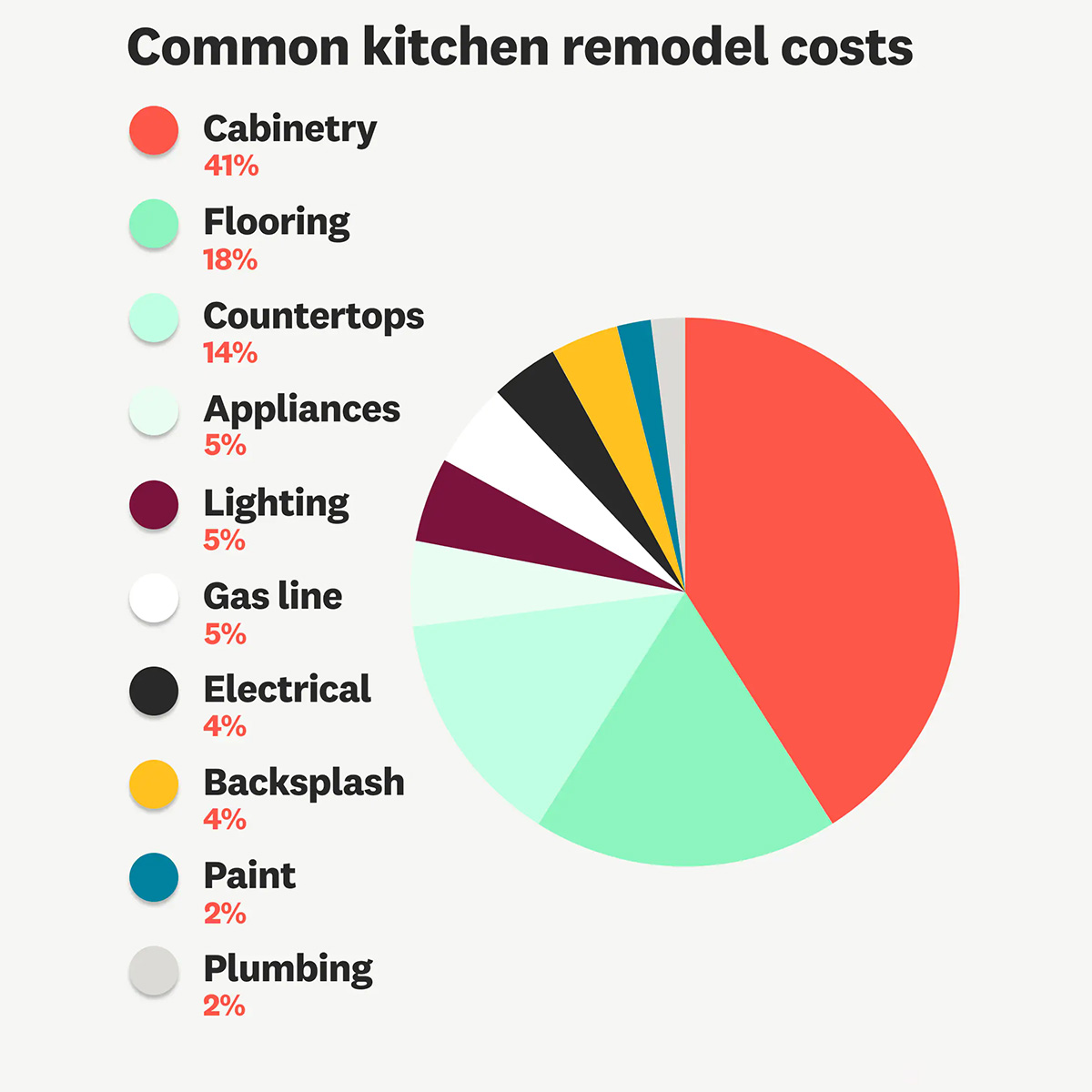

So, you've decided to renovate your home to enhance its comfort, functionality, or aesthetic appeal. Whether it's a kitchen remodel, bathroom upgrade, or a complete home makeover, home improvement projects often require a significant financial investment. While you may have some savings set aside, you might find that a home improvement loan is the ideal solution to fund your renovation dreams.

However, before you can secure a home improvement loan, it's crucial to understand the role of your credit score in the loan approval process. Your credit score serves as a key indicator of your financial responsibility and reliability, influencing the terms and conditions of the loan you can obtain. In this comprehensive guide, we'll delve into the significance of credit scores for home improvement loans, the minimum credit score requirements, and actionable steps to enhance your credit score to secure the best possible loan for your renovation project. Let's embark on this enlightening journey to unlock the secrets of obtaining a home improvement loan that aligns with your aspirations.

**

Key Takeaways:

- Maintaining a good credit score is crucial for getting a favorable home improvement loan. By paying bills on time and managing credit wisely, you can access better loan options and lower interest rates.

- Understanding credit scores and taking steps to improve them can help you secure the funds needed for your home renovation. By reviewing your credit report and seeking professional guidance, you can enhance your creditworthiness.

Understanding Credit Scores

**

Before delving into the specifics of credit scores for home improvement loans, it's essential to grasp the fundamental concept of credit scores. Your credit score is a numerical representation of your creditworthiness, serving as a reflection of your financial behavior and history. It is a three-digit number, typically ranging from 300 to 850, with higher scores indicating a lower credit risk and greater financial reliability.

Several factors contribute to the calculation of your credit score, including your payment history, credit utilization, length of credit history, types of credit used, and new credit accounts. Payment history holds significant weight in determining your credit score, emphasizing the importance of making timely payments on credit accounts, loans, and other financial obligations.

Understanding the components that influence your credit score empowers you to make informed decisions to maintain or improve it. By managing your finances prudently and adhering to responsible credit practices, you can cultivate a favorable credit score that enhances your financial prospects, including the ability to secure favorable terms for a home improvement loan.

**

Importance of Credit Scores for Home Improvement Loans

**

When seeking a home improvement loan, your credit score holds immense significance as it directly influences the loan approval process and the terms offered by lenders. A high credit score not only increases the likelihood of loan approval but also enables you to access loans with lower interest rates and more favorable terms, ultimately reducing the overall cost of your home renovation project.

Lenders use credit scores as a pivotal factor in assessing the risk associated with extending a loan to an individual. A higher credit score indicates a lower credit risk, portraying you as a reliable borrower with a history of managing credit responsibly. This instills confidence in lenders, leading to more competitive loan offers, including higher loan amounts and lower interest rates.

Conversely, a lower credit score may limit your options and result in higher interest rates or less favorable loan terms. It’s essential to recognize the impact of your credit score on the potential loan options available to you, underscoring the significance of maintaining a healthy credit profile when embarking on a home improvement project.

By comprehending the pivotal role of credit scores in securing favorable home improvement loans, you can proactively take steps to enhance your creditworthiness, thereby positioning yourself to access the most advantageous loan products for your renovation endeavors.

**

Aim for a credit score of 620 or higher to qualify for a home improvement loan. A higher score will give you better interest rates and loan options.

Minimum Credit Score Requirements for Home Improvement Loans

**

Home improvement loans encompass a diverse array of financing options, each with its own set of minimum credit score requirements. While specific requirements vary among lenders and loan types, understanding the general guidelines can provide valuable insights into the credit scores necessary to secure different types of home improvement loans.

For conventional home improvement loans, which may include personal loans or home equity loans, lenders typically seek credit scores in the good to excellent range. This often translates to credit scores of 680 and above for personal loans, while home equity loans may necessitate scores in the range of 720 or higher to access the most favorable terms.

FHA Title 1 loans, a popular choice for home improvements, are more accessible to individuals with lower credit scores. While FHA itself does not set a minimum credit score requirement, lenders offering FHA Title 1 loans may impose their own credit score criteria, often accommodating individuals with fair credit scores, typically starting from 580.

It’s important to note that while these are general guidelines, individual lenders may have varying criteria based on their risk assessment and lending policies. Additionally, the specific loan amount and the overall financial profile of the borrower may influence the credit score requirements set forth by lenders.

By familiarizing yourself with the minimum credit score requirements for various home improvement loans, you can assess your eligibility for different financing options and strategize to enhance your credit score if necessary, ensuring that you can access the most suitable loan for your renovation project.

**

How to Improve Your Credit Score for a Home Improvement Loan

**

Enhancing your credit score is an empowering endeavor that can significantly bolster your financial prospects, particularly when seeking a home improvement loan. By implementing strategic measures, you can elevate your credit score, thereby expanding your access to favorable loan options and more attractive terms. Here are actionable steps to improve your credit score:

- Review Your Credit Report: Obtain a copy of your credit report from major credit bureaus and meticulously review it for inaccuracies, discrepancies, or unauthorized accounts. Disputing any errors can rectify inaccuracies that may be negatively impacting your credit score.

- Timely Payments: Consistently making on-time payments for credit cards, loans, and other financial obligations is pivotal for enhancing your credit score. Setting up automatic payments or reminders can help ensure punctual payments.

- Credit Utilization: Aim to maintain a low credit utilization ratio by effectively managing your credit card balances. Keeping your credit utilization below 30% of your available credit limit can positively influence your credit score.

- Diversify Your Credit Mix: Having a diverse array of credit accounts, such as credit cards, installment loans, and a mortgage, can contribute positively to your credit score. However, it’s important to manage these accounts responsibly.

- Avoid Opening New Accounts: While establishing new credit accounts can diversify your credit mix, excessive new credit applications within a short timeframe can lower your credit score. Exercise caution when applying for new credit.

- Maintain Long-Term Accounts: Long-standing credit accounts reflect stability and responsible credit management. Keeping older accounts open and in good standing can bolster your credit score.

- Seek Professional Guidance: If you encounter challenges in improving your credit score, consulting with a reputable credit counselor or financial advisor can provide valuable insights and personalized strategies to enhance your creditworthiness.

By diligently implementing these measures and exercising financial prudence, you can proactively elevate your credit score, positioning yourself to secure an advantageous home improvement loan that aligns with your renovation aspirations.

**

Conclusion

**

Embarking on a home improvement project is an exciting endeavor, allowing you to transform your living space to better reflect your lifestyle and preferences. However, securing the necessary funds through a home improvement loan necessitates a comprehensive understanding of the role of credit scores in the loan approval process.

By comprehending the significance of credit scores for home improvement loans and the minimum credit score requirements associated with various loan options, you can strategically position yourself to access the most advantageous financing for your renovation project. Furthermore, by proactively enhancing your credit score through prudent financial management and targeted actions, you can expand your access to favorable loan terms and lower interest rates, ultimately reducing the overall cost of your home improvement endeavors.

As you navigate the landscape of home improvement loans, remember that your credit score is not a static metric; it is a reflection of your financial habits and can be improved through informed and disciplined practices. By reviewing your credit report, maintaining timely payments, managing credit utilization, and seeking professional guidance when needed, you can elevate your credit score, unlocking a world of financing opportunities for your home renovation aspirations.

Armed with the knowledge and strategies outlined in this guide, you are poised to embark on your home improvement journey with confidence, knowing that you can navigate the realm of home improvement loans with astuteness and foresight. Your dream of a revitalized living space is within reach, and with a fortified credit score, you can access the ideal financing to turn your renovation visions into reality.

Frequently Asked Questions about What Kind Of Credit Score To Get A Home Improvement Loan

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “What Kind Of Credit Score To Get A Home Improvement Loan”