Articles

How To Store Business Receipts

Modified: December 7, 2023

Learn effective techniques for storing and organizing your business receipts with our insightful articles. Simplify your record-keeping and stay organized.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

As a business owner, keeping track of your expenses is crucial for various reasons, including tax deductions, financial reporting, and auditing. One essential aspect of managing your expenses is storing business receipts properly. Adequate receipt storage not only ensures compliance with legal requirements but also enables efficient record-keeping and facilitates the analysis of your business’s financial health.

In this article, we will explore the importance of storing business receipts, provide essential information on business receipts, discuss different methods of storing receipts, offer tips on choosing the right storage system, and share best practices for organizing and sorting your receipts.

Whether you’re a seasoned entrepreneur or just starting your journey as a business owner, understanding how to store business receipts effectively is paramount. By implementing a solid receipt storage system, you can save yourself time, money, and potential headaches down the line.

Key Takeaways:

- Properly storing business receipts is essential for tax compliance, financial reporting, and auditing. It also aids in insurance claims, expense tracking, and legal compliance, contributing to overall business organization and success.

- Choosing the right storage system, organizing receipts effectively, and leveraging digital storage solutions are key to streamlining receipt management. Following best practices and avoiding common mistakes ensures organized, accessible, and compliant receipt storage.

Read more: How To Organize Receipts For Business

Importance of Storing Business Receipts

Storing business receipts is not just a mundane administrative task; it is a critical practice that bears significant importance for businesses of all sizes. Here are some reasons why storing business receipts is essential:

- Tax Compliance: Storing business receipts allows you to accurately report your expenses and claim eligible deductions when filing your taxes. The Internal Revenue Service (IRS) requires businesses to retain receipts as supporting documents for tax deductions. Without proper receipt storage, you may risk losing out on valuable deductions or face scrutiny during tax audits.

- Financial Reporting: Receipts serve as concrete evidence of your business transactions. By storing and organizing receipts, you can easily track your income and expenses, making financial reporting and analysis more accurate. This, in turn, enables you to make informed decisions regarding budgeting, cash flow management, and business growth.

- Auditing Purposes: In the event of an audit, either by tax authorities or potential investors, having well-organized receipts provides transparency and credibility. It allows auditors to verify the legitimacy of your expenses and ensures that your financial records match the transactions recorded.

- Insurance Claims: Storing receipts becomes crucial when filing insurance claims for damaged or stolen business property. Receipts serve as proof of ownership and the value of the items, making the claims process smoother and increasing the chances of reimbursement.

- Documenting Business Expenses: Business receipts help in tracking and categorizing your expenses accurately. By storing receipts, you can identify areas where you can cut costs, optimize spending, or negotiate better deals with vendors.

- Legal Compliance: Different jurisdictions have varying regulations regarding record-keeping and document retention for businesses. Storing receipts ensures that you remain compliant with local laws, avoiding potential penalties and legal troubles.

Overall, storing business receipts not only helps you stay organized but also provides financial, legal, and operational benefits for your business. It is an essential practice that should not be overlooked, regardless of the size or nature of your business.

Essential Information on Business Receipts

Before diving into the various storage methods and best practices, it’s important to understand the key information that should be present on business receipts. Here are the essential details that should be included on your business receipts:

- Date and Time: The date and time of the transaction should be clearly stated on the receipt. This allows for accurate record-keeping and ensures that the receipt is associated with the correct financial period.

- Merchant Details: The name and contact information of the merchant or business should be provided on the receipt. This includes the business name, address, and contact information.

- Transaction Description: A brief description of the goods or services purchased should be included on the receipt. This description helps in identifying the nature of the expense during record-keeping and makes it easier to categorize the expenses for financial reporting.

- Price and Currency: The total price paid, including taxes, should be clearly mentioned on the receipt. It is essential to have the currency stated, especially if you conduct business internationally or deal with multiple currencies.

- Payment Method: Indicate the method of payment used for the transaction, whether it was cash, credit card, check, or any other form of payment. This information helps in reconciling the transaction with your financial statements.

- Receipt Number: Each receipt should have a unique identification number or reference, allowing for easy referencing and tracking in your records.

- Tax Information: If applicable, ensure that any applicable tax information, such as the sales tax or VAT amount, is clearly indicated on the receipt.

- Customer Information: If your business caters to individual customers, it may be beneficial to include the customer’s name or a customer identifier on the receipt for tracking and customer relationship purposes.

By ensuring that the above information is present on your business receipts, you can effectively track and categorize expenses, maintain accurate financial records, and facilitate easy access and retrieval when needed.

Different Methods of Storing Business Receipts

There are various methods and systems available for storing business receipts. The choice of storage method depends on factors such as the volume of receipts, the level of organization needed, and the preferences of the business owner. Here are a few common methods of storing business receipts:

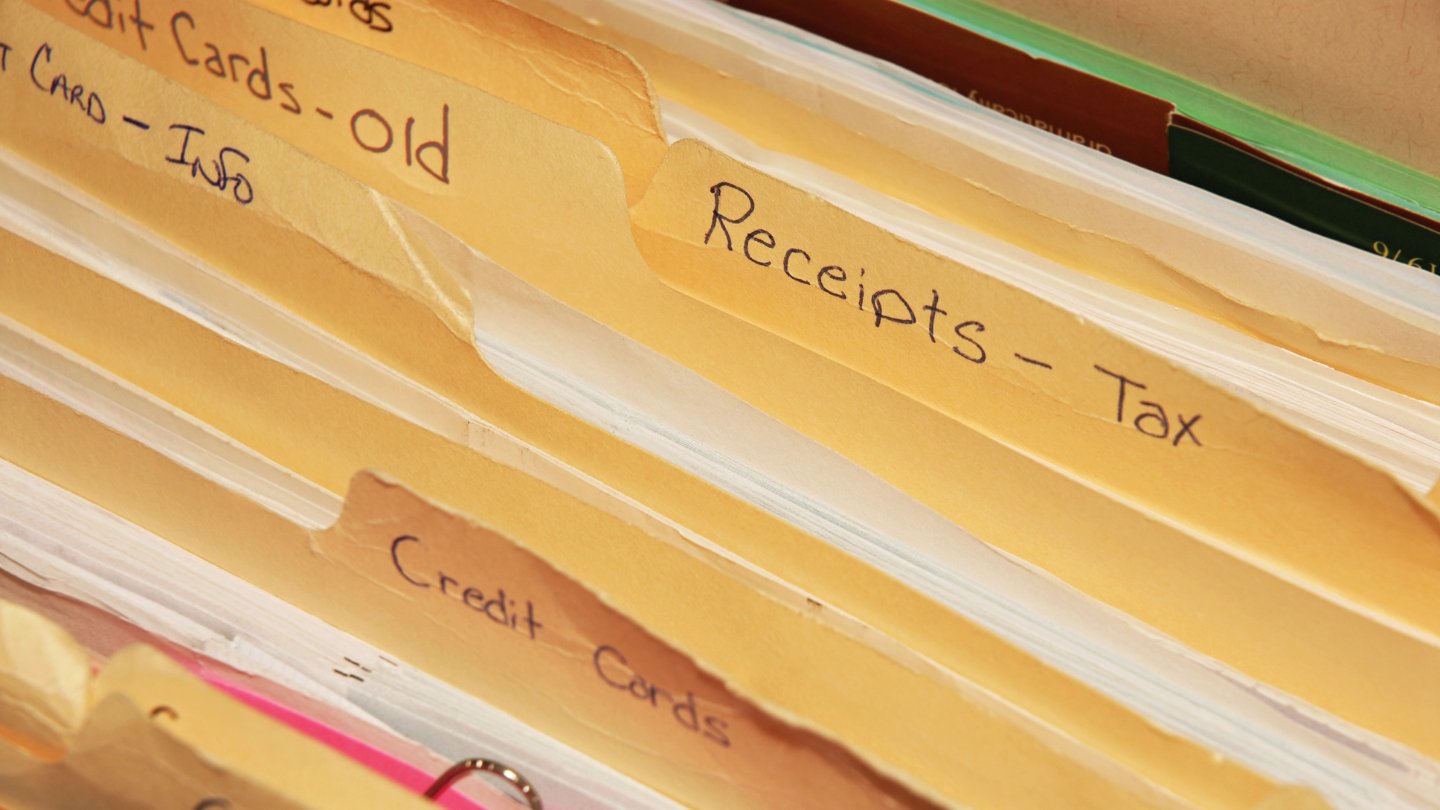

- Physical Filing Folders: This traditional method involves organizing and storing receipts in physical filing folders. You can label folders by year, month, or expense category for easy retrieval. Consider using separate folders for different types of receipts, such as office supplies, utilities, or travel expenses.

- Envelopes or Ziplock Bags: If you have a smaller volume of receipts, you can use envelopes or ziplock bags to store and categorize them. This method is cost-effective and easy to implement, but it may not be suitable for long-term storage or larger businesses with high receipt volumes.

- Expanding Files: Expanding files are portable accordion-style organizers that have various sections or pockets. They allow you to sort receipts by month, expense category, or vendor. They are compact and convenient for businesses on the go.

- Binders or Notebooks: Using binders or notebooks with clear plastic sleeves allows you to insert receipts and organize them in a systematic manner. This method provides flexibility in arranging and rearranging receipts as needed.

- Receipt Scanner Software: Receipt scanner software enables you to digitize and store your receipts electronically. You can use a dedicated receipt scanner or smartphone apps that allow you to capture and store images of your receipts. This method saves physical space and provides easy access to your receipts.

- Cloud Storage Services: Cloud storage services such as Google Drive, Dropbox, or OneDrive offer secure online storage for your digital receipts. You can scan receipts or save them as PDF files and upload them to the cloud for easy organization, access, and retrieval from anywhere.

It’s important to choose a storage method that works best for your business needs, taking into consideration factors such as volume, accessibility, portability, and ease of organization. Remember to keep the receipts in a safe and secure place to protect sensitive financial information.

Choosing the Right Storage System for Business Receipts

Choosing the right storage system for your business receipts is vital for effective organization and easy retrieval. Consider the following factors when selecting a storage system:

- Volume of Receipts: Evaluate the volume of receipts your business generates on a regular basis. If you have a high volume, consider a digital storage solution to minimize physical storage requirements.

- Accessibility and Retrieval: Determine how frequently you need to access your receipts. If you frequently refer back to them or require quick retrieval for financial reporting or audits, opt for a storage system that allows for easy and fast access.

- Organization and Categorization: Assess the level of organization and categorization you need for your receipts. If you have a large number of receipts and require in-depth categorization, consider digital storage systems that allow you to easily tag and search for receipts based on criteria such as date, vendor, or expense category.

- Security and Data Protection: Take into account the security and protection of your receipt data. If you opt for a digital solution, ensure that you choose a secure platform or cloud storage service that encrypts your data and provides password protection.

- Integration with Other Systems: Consider whether you need your storage system to integrate with other software or applications you use for accounting, bookkeeping, or expense tracking. Seamless integration can streamline your workflow and simplify data management.

- Portability: Determine if you need a storage system that allows you to access and manage your receipts on the go. Digital solutions and cloud-based storage provide the advantage of accessing your receipts from any device with an internet connection.

- Long-Term Storage: If you need to retain your receipts for several years for legal or auditing purposes, choose a storage method that ensures the longevity and preservation of your physical or digital receipts.

By carefully considering these factors, you can select a storage system that aligns with your business needs and requirements. It’s important to regularly evaluate your storage system and make adjustments as your business evolves or as new technologies and solutions become available.

Scan and digitize your business receipts to reduce paper clutter and make it easier to store and organize them electronically. This will also make it easier to access and search for specific receipts when needed.

Read more: How To Store Business Cards Digitally

Organizing and Sorting Business Receipts

Once you have chosen a storage system for your business receipts, it’s important to establish a solid organizational structure that allows for easy retrieval and efficient record-keeping. Here are some tips for organizing and sorting your business receipts:

- Sort by Date: Arrange your receipts in chronological order based on the date of the transaction. This helps you easily track and reconcile expenses, especially when it comes to financial reporting.

- Categorize by Expense Type: Create expense categories that align with your business needs, such as office supplies, utilities, travel expenses, or marketing costs. Categorize receipts accordingly to quickly identify and analyze your expenses.

- Label Clearly: Label your storage containers, folders, or digital folders with clear and descriptive names. This makes it easier to locate specific receipts when needed.

- Create Subcategories: If you have a large volume of receipts within a particular expense category, consider further organizing them into subcategories. For example, within the “Travel Expenses” category, you can create subcategories for flights, accommodation, and meals.

- Use Color-Coded Labels or Folders: Assign different colors to various expense categories or subcategories to visually differentiate them. This can make it quicker to locate specific types of receipts at a glance.

- Implement a Digital Document Management System: If you opt for digital receipt storage, utilize features such as tagging or keyword search to quickly locate receipts based on specific criteria such as vendor name or expense amount.

- Regularly Review and Purge: Set aside time periodically to review your receipts and eliminate any unnecessary ones. This ensures that your storage system remains organized and clutter-free.

- Digitize Physical Receipts: Consider digitizing paper receipts by scanning or taking photos of them. This not only reduces physical storage requirements but also provides easy access and protects against loss or damage.

- Backup Digital Receipts: Regularly back up your digital receipts to prevent loss of data due to hardware failure or accidental deletion. Store backups in a separate location or utilize cloud storage services for added security.

- Keep Business and Personal Receipts Separate: It’s essential to maintain a clear separation between your business and personal receipts. This ensures accurate financial reporting and simplifies the process of identifying eligible business expenses.

By implementing an organized system and following these tips, you can streamline the management and retrieval of your business receipts. This organization not only saves you time but also contributes to the overall financial health and success of your business.

Digital Storage Solutions for Business Receipts

In today’s digital age, storing business receipts electronically offers numerous advantages over traditional paper-based methods. Digital storage solutions not only save physical storage space but also provide easy access, organization, and enhanced security for your business receipts. Here are some popular digital storage options:

- Cloud Storage: Cloud storage services like Google Drive, Dropbox, or OneDrive offer secure online storage for your digital receipts. You can upload scanned images or PDF files of your receipts to the cloud and access them from any device with an internet connection. Cloud storage provides convenient backup and synchronization features, ensuring your receipts are safely stored and accessible from anywhere.

- Receipt Management Software: There are various receipt management software applications available that offer dedicated features for organizing and storing business receipts. These applications typically allow you to scan or upload receipts, categorize them, add notes or tags, and generate expense reports. Some popular receipt management software options include Expensify, Shoeboxed, and Evernote.

- Accounting Software Integration: Many accounting software platforms, such as QuickBooks or Xero, offer receipt storage and management features. These platforms often allow you to upload receipts, link them to specific transactions, and automatically extract key information, eliminating the need for manual data entry.

- Mobile Apps: Various mobile apps are designed specifically for receipt storage and management. These apps utilize the camera on your smartphone to capture and digitize receipts on the go. They often include features such as expense categorization, receipt search, and integration with other software or platforms. Examples of popular receipt management apps include Wave Receipts, Receipt Bank, and Foreceipt.

- Email or Document Management: If your business relies heavily on email communication, you can create a dedicated email folder to store digital receipts received via email. Alternatively, you can utilize document management systems like SharePoint or Google Docs to organize and store digital receipts in a centralized location.

When using digital storage for business receipts, it’s important to consider security measures to protect sensitive financial information. This may include using strong passwords, enabling two-factor authentication, encrypting files, and regularly updating your software and systems to ensure they are protected against potential cyber threats.

Digital storage solutions offer a more streamlined and efficient way to store and manage your business receipts. By leveraging technology, you can save time, reduce clutter, and easily access and organize your receipts, ultimately improving your overall financial record-keeping process.

Best Practices for Storing Business Receipts

To ensure the effectiveness and integrity of your business receipt storage system, it’s important to follow best practices that promote organization, accessibility, and compliance. Here are some key best practices for storing business receipts:

- Consistent and Timely Storage: Make it a habit to store receipts immediately after each transaction. This reduces the chances of receipts being misplaced and ensures accurate record-keeping.

- Labeling and Organizing: Clearly label storage containers, folders, or digital folders with descriptive names, and organize receipts in a logical and consistent manner. This allows for easy retrieval and efficient record-keeping.

- Separate Business and Personal Receipts: Keep personal and business receipts separate to avoid confusion and ensure accurate financial reporting. Maintaining a clear distinction simplifies the process of identifying and tracking eligible business expenses.

- Regular Review and Purging: Regularly review your receipts and eliminate any unnecessary ones. This helps keep your storage system organized and prevents clutter and unnecessary storage costs.

- Backup and Data Protection: For digital storage solutions, implement regular backups of your receipt data to prevent loss due to hardware failure or accidental deletion. Store backups in a separate location or utilize cloud storage services for added security.

- Document Retention and Compliance: Familiarize yourself with the legal requirements for document retention in your jurisdiction. Understand how long you should retain business receipts and ensure compliance with local laws and regulations.

- Data Security: Implement security measures to protect your receipt data, especially if you opt for digital storage solutions. Utilize strong passwords, enable two-factor authentication, and keep software and systems updated to guard against potential cyber threats.

- Digitize Paper Receipts: Consider digitizing paper receipts by scanning or photographing them. This reduces physical storage requirements and provides enhanced accessibility and protection against loss or damage.

- Consistent Naming and File Organization: If you store digital receipts, establish a consistent naming convention and folder structure to keep your data organized. This simplifies searching and retrieval when needed.

- Document Audit Trail: Maintain an audit trail for your receipts, tracking any changes or updates made to the receipt files or metadata. This ensures the integrity and credibility of your receipt records.

By implementing these best practices, you can optimize your receipt storage system and ensure that your business receipts are well-organized, easily accessible, and compliant with legal requirements.

Common Mistakes to Avoid when Storing Business Receipts

Effective receipt storage is crucial for maintaining accurate financial records and ensuring compliance with legal requirements. However, there are common mistakes that business owners often make when storing their receipts. Being aware of these mistakes can help you avoid unnecessary challenges and complications. Here are some common mistakes to avoid when storing business receipts:

- Not Collecting Receipts: One of the most significant mistakes is not collecting receipts in the first place. Make it a habit to request and keep receipts for all business-related expenses, as they serve as crucial documentation for financial reporting and tax purposes.

- Delaying Storage: Waiting too long to store receipts can lead to misplaced or lost documents. It’s best to store receipts immediately after each transaction to ensure accurate record-keeping and to reduce the risk of losing important receipts.

- Disorganized Filing Systems: Failing to establish a consistent and organized filing system can lead to confusion and difficulty in finding specific receipts when needed. Invest the time to set up a logical and structured filing system that suits your business needs.

- Mixing Personal and Business Receipts: Blurring the lines between personal and business receipts can complicate financial reporting and may lead to inaccurate expense tracking. Keep personal and business receipts separate to ensure clarity and compliance.

- Poor Labeling and Documentation: Inadequate labeling and poor documentation of receipts can make it challenging to identify and track expenses. It’s essential to clearly label receipts with relevant details such as the date, vendor name, and expense category.

- Lack of Backups: Failing to regularly backup your digital receipts poses a significant risk of data loss. Ensure you have backup copies of your digital receipts, stored in a separate location, to avoid losing important financial records.

- Ignoring Data Security: Proper data security measures are essential when storing digital receipts. Neglecting to implement strong passwords, encryption, and other security measures can expose sensitive financial information to potential breaches or data loss.

- Failure to Update Systems: Neglecting to update your digital storage systems or software can leave you vulnerable to security risks and compatibility issues. Regularly update your storage systems and software to ensure optimal functionality and protection.

- Not Retaining Receipts for the Required Duration: Different jurisdictions have varying laws and regulations regarding how long business receipts should be retained. Failure to comply with these requirements can result in legal and financial consequences. Familiarize yourself with the document retention guidelines specific to your location.

- Disregarding Audit Trails: Neglecting to maintain audit trails documenting any changes or updates made to digital receipt files can lead to credibility issues during audits or financial reviews. Keep a record of any modifications to your receipt files to ensure transparency and accuracy.

By avoiding these common mistakes and implementing good practices for storing business receipts, you can maintain organized and reliable financial records, simplify tax reporting, and ensure compliance with regulatory requirements.

Read more: Which Receipts To Keep For Home Improvements

Conclusion

Properly storing your business receipts is crucial for maintaining organized financial records, ensuring compliance with tax regulations, and facilitating efficient expense management. By implementing effective storage methods and following best practices, you can streamline your record-keeping processes, save time and effort, and minimize the risk of lost or misplaced receipts.

Throughout this article, we have explored the importance of storing business receipts, discussed essential information to include on receipts, examined different methods of storage, and provided guidance on choosing the right storage system. We have also shared tips for organizing and sorting receipts, highlighted digital storage solutions, and outlined best practices to follow when storing business receipts.

Remember, storing business receipts is not just about adhering to legal requirements; it is an opportunity to gain valuable insights into your business’s financial health and make informed decisions. By properly organizing and categorizing your receipts, you can identify spending patterns, optimize expenses, and ultimately improve your bottom line.

Avoid common mistakes such as neglecting to collect receipts, disorganized filing, and mixing personal and business receipts. Instead, establish a consistent routine of timely receipt storage, implement a well-structured filing system, and keep personal and business expenses separate. Embrace digital storage solutions, leverage cloud storage services or receipt management software, and prioritize data security to protect your sensitive financial information.

By adhering to these practices, you can ensure that your business receipts are organized, accessible, and compliant. This will make tax season less stressful, facilitate financial reporting, and help you stay prepared for potential audits or reviews.

Investing time and effort in proper receipt storage is an investment in the long-term success and growth of your business. So, implement these practices today and enjoy the benefits of organized, efficient, and compliant record-keeping for your business receipts.

Frequently Asked Questions about How To Store Business Receipts

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Store Business Receipts”