Articles

How To Store Receipts

Modified: January 8, 2024

Discover effective methods and strategies for storing receipts with our informative articles. Simplify your record-keeping process and stay organized with our expert tips.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Receipts – those small slips of paper that we often toss aside after a purchase. They may seem insignificant, but keeping track of and organizing receipts can be extremely valuable. Whether you’re an individual trying to manage personal expenses or a business owner needing to track expenses for tax purposes, storing receipts properly is crucial.

In today’s digital age, the process of storing receipts has become more streamlined and efficient. There are both physical and digital storage options available, each with their own advantages. Regardless of the method you choose, organizing receipts can save you time, money, and hassle down the line.

In this article, we’ll delve into the reasons why it is important to store receipts, provide tips for organizing them effectively, explore different storage options, discuss essential information to include on a receipt, and consider how long you should keep receipts. By the end, you’ll have a clear understanding of the benefits of organizing and storing your receipts.

Key Takeaways:

- Organizing and storing receipts is crucial for proof of purchase, tax deductions, budgeting, insurance claims, and legal compliance. It offers peace of mind and financial clarity, leading to informed financial decisions.

- Implementing efficient receipt organization and storage systems, whether physical or digital, can save time, reduce stress, and provide valuable insights into spending habits and financial health.

Read more: How To Store Receipts For Taxes

Why is it important to store receipts?

Storing receipts may seem like a tedious task, but it holds great importance for individuals and businesses alike. Here are some key reasons why it is crucial to store receipts:

- Proof of purchase: Receipts serve as concrete proof that a transaction has taken place. They provide evidence of what was bought, when it was purchased, and the amount paid. This proof of purchase is particularly important for returns, exchanges, or warranty claims. Without a receipt, it can be challenging to validate a purchase and resolve any issues that may arise.

- Tax deductions and refunds: For businesses and individuals, receipts play a vital role in calculating accurate tax deductions and refunds. By maintaining organized receipts, you have tangible evidence of business expenses or qualifying deductions that can reduce your tax liability. Without proper documentation, you may miss out on valuable deductions and substantially increase your tax burden.

- Budgeting and financial tracking: Receipts can be valuable tools for budgeting and tracking your expenses. By organizing and categorizing receipts, you can gain insights into your spending habits, identify areas where you can cut back, and effectively manage your finances. This visibility allows you to make informed decisions about your budget and financial goals.

- Insurance claims: In the unfortunate event of a theft, damage, or loss, receipts become essential for insurance claims. They provide evidence of the value of your possessions and can streamline the claims process. Without receipts, it can be challenging to prove ownership or the cost of items, resulting in potential delays or denials in insurance reimbursements.

- Legal requirements and audits: In some cases, you may be legally required to retain certain receipts for a specific period of time. This is particularly true for businesses that need to comply with tax regulations, audits, or government requirements. Failing to store receipts as required may lead to penalties, fines, or legal complications.

Overall, storing receipts is essential for maintaining financial records, ensuring accurate tax filings, facilitating returns or warranty claims, and providing evidence in case of insurance claims or legal requirements. It is a small investment of time and effort that can yield significant benefits in the long run.

Tips for organizing receipts

Keeping your receipts organized is key to maximizing their usefulness. Here are some helpful tips to keep your receipts in order:

- Create a dedicated system: Establish a system for organizing your receipts that works for you. It could be a physical folder, an accordion file, or a digital spreadsheet. Find a method that is easy to maintain and suits your lifestyle.

- Sort receipts by category: Categorize your receipts to make them easier to find. Common categories include groceries, utilities, transportation, and entertainment. If you’re a small business owner, you may want to categorize by expenses like office supplies, travel, or advertising.

- Use labeling or color-coding: Label your physical receipt storage containers or folders with the relevant categories. Consider using different colors for different types of expenses to visually distinguish them. In a digital system, use clear file names or tags to easily search and retrieve receipts.

- Record information promptly: Don’t procrastinate when it comes to recording receipt details. Note down any necessary information such as the date, amount, vendor, and purpose of the purchase as soon as possible. This ensures accuracy and saves you time later when you need to refer to the receipts.

- Digitize your receipts: Consider going paperless by using a scanner or mobile app to digitize your receipts. This not only reduces clutter but also makes it easier to search and store them electronically. Many apps even have features that extract key information from receipts, saving you time on data entry.

- Backup your digital receipts: If you opt for digital storage, make sure to have a backup system in place. Store copies of your receipts on a cloud storage platform or an external hard drive to protect against data loss.

- Review and purge regularly: Regularly review your receipts to keep your system current and organized. Dispose of receipts that are no longer needed once you have properly recorded them. Keeping only necessary receipts will ensure your storage space remains clutter-free.

- Consider using expense management apps: There are numerous expense management apps available that can help you track and organize your receipts. These apps often have features that automatically categorize expenses and generate reports for easier financial management.

By implementing these tips, you can create an efficient and organized system for storing and managing your receipts. Not only will it save you time and stress, but it will also provide you with a clear overview of your finances.

Sorting and categorizing receipts

Sorting and categorizing receipts is crucial for easy retrieval and effective organization. Here are some strategies to help you sort and categorize your receipts:

- Date-based sorting: Sort your receipts chronologically according to the purchase date. This allows for easy tracking of expenses over time and ensures that you can easily locate specific receipts when needed.

- Categorize by expense type: Create categories based on the type of expense, such as groceries, utilities, dining, or travel. By allocating receipts into specific expense categories, you can quickly assess and analyze your spending habits in different areas.

- Separate personal and business receipts: If you are a small business owner or self-employed, it’s crucial to keep personal and business expenses separate. Maintain separate folders or files for personal and business receipts to streamline tax reporting and avoid any confusion or mix-ups.

- Organize by vendor or store: Another way to sort and categorize receipts is by organizing them based on the vendor or store where the purchase was made. This can be useful when you want to track expenses from a particular merchant or compare prices between different retailers.

- Use color-coded labels or tags: Consider using color-coded labels or tags to visually distinguish different categories or types of receipts. For example, you could assign green labels to receipts for household expenses and blue labels for receipts related to transportation. This method helps you easily identify and locate specific receipts.

- Utilize digital search and tagging features: If you use a digital storage system, take advantage of search and tagging features to quickly find relevant receipts. Tagging receipts with keywords or categories can make it much easier to locate specific transactions when needed.

- Create separate folders for recurring expenses: If you have recurring expenses, such as monthly subscriptions or recurring bills, consider creating dedicated folders for these receipts. This allows for easy access and ensures that you don’t miss any payments or overlook any important documentation.

- Consider creating a summary sheet: For larger expense categories or projects, create a summary sheet that lists the related receipts and provides a brief description or explanation. This summary sheet can serve as a quick reference guide when you need to review or analyze a specific set of expenses.

Remember, the key to effective sorting and categorizing is to find a method that works best for you. Choose a system that is easy to maintain and aligns with your organizational preferences. By implementing these strategies, you’ll have a well-organized repository of receipts that can be easily accessed and analyzed to gain valuable insights into your spending habits and financial health.

Physical storage options

While digital storage has become increasingly popular, physical storage options for receipts are still relevant and useful. Here are some physical storage options to consider for organizing and storing your receipts:

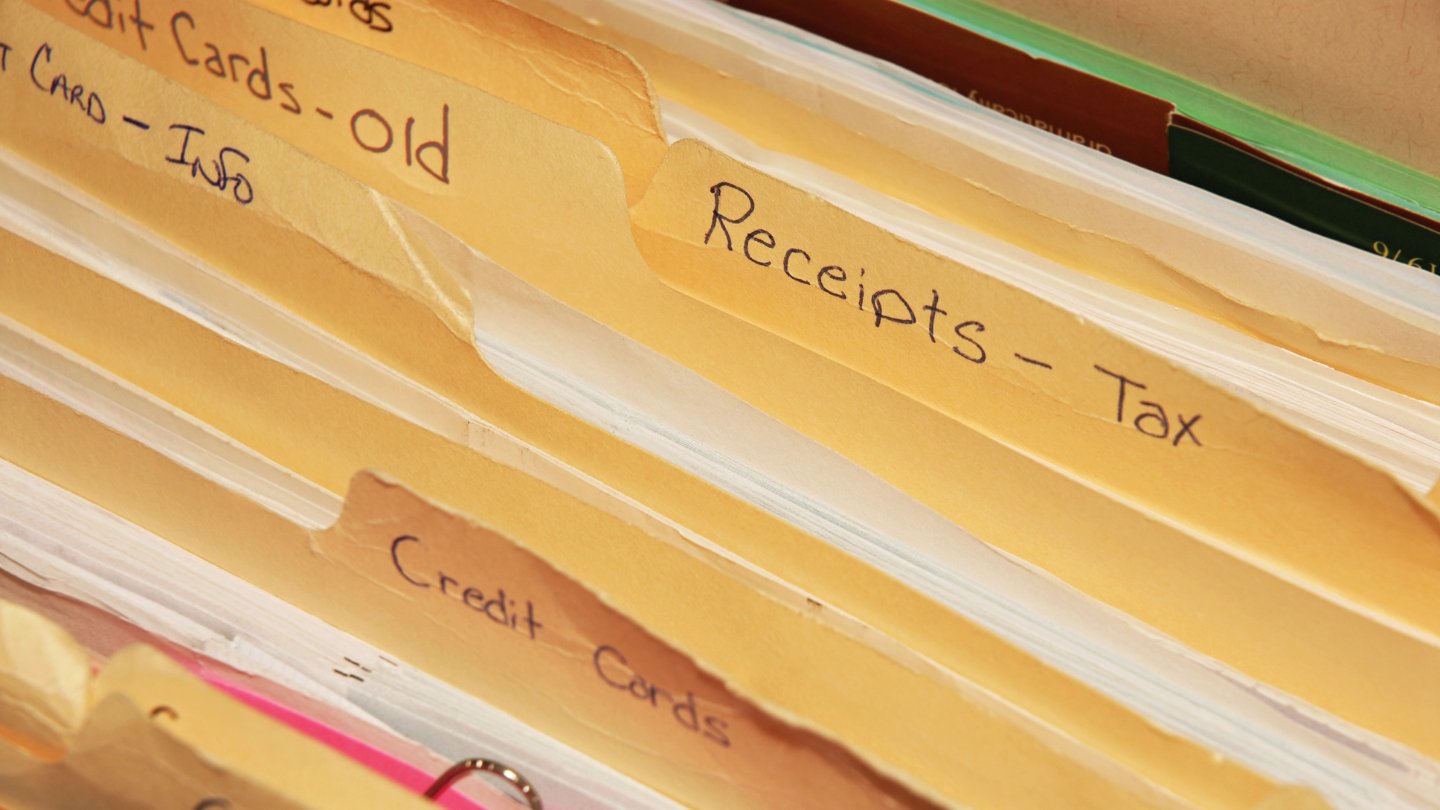

- Expandable file folders: Expandable file folders or accordion files are convenient for organizing receipts. With multiple pockets or sections, these folders allow you to categorize your receipts by expense type or date. They are portable and can be easily stored in a filing cabinet or shelf.

- Binders with sheet protectors: Using binders with sheet protectors is an effective way to keep your receipts organized and accessible. Insert receipts into the sheet protectors and organize them by category or date. This method allows you to flip through the binder to quickly locate specific receipts.

- Envelope system: The envelope system is a simple and cost-effective option for storing receipts. Label envelopes with different expense categories and place receipts accordingly. This option works well for individuals who have fewer receipts to store and prefer a more tactile approach to organization.

- Portable file boxes: Portable file boxes are ideal for individuals or small businesses that handle a larger volume of receipts. These boxes have multiple compartments or hanging files that allow for easy organization and access to stored receipts. They can be stored on a shelf or under a desk for quick retrieval.

- File cabinets: File cabinets are a classic choice for physical document storage, including receipts. They provide ample space for categorizing and organizing your receipts in file folders or envelopes. Label each drawer or section accordingly, making it easy to find specific receipts.

- Plastic storage containers: Use plastic storage containers with dividers to sort and store receipts. These containers are stackable, making them a space-efficient option. Label each divider with the appropriate expense categories to ensure easy identification.

- Receipt organizers or wallets: Smaller receipt organizers or wallets are suitable for individuals who only need to store a small number of receipts. These portable options often have separate compartments or pockets to help you categorize receipts. They are great for those who frequently need to access receipts on the go.

When choosing a physical storage option, consider factors such as the volume of receipts you need to store, available space, accessibility, and your preferred method of organization. Remember to regularly review and update your physical storage system to ensure it remains organized and clutter-free.

While physical storage options are reliable, it’s worth considering digital alternatives as well. Digital storage provides convenience, accessibility, and the ability to easily search and analyze receipts. Combining physical and digital storage methods can offer the best of both worlds, providing you with a comprehensive and organized system for storing your receipts.

Scan and save your receipts digitally using a mobile app or scanner. Organize them in folders by month or category to easily access when needed.

Read more: How To Store Receipts For Business

Digital storage options

In today’s digital age, storing receipts electronically has become increasingly popular. Digital storage offers convenience, accessibility, and the ability to easily search and organize receipts. Here are some digital storage options to consider for organizing and storing your receipts:

- Scan and store on your computer: Scan your paper receipts using a scanner or smartphone app, and then save the scanned images on your computer. Create organized folders within your computer’s file system to categorize and store the scanned receipts. This method allows for easy access and eliminates the need for physical storage space.

- Cloud storage platforms: Cloud storage platforms like Google Drive, Dropbox, or OneDrive offer a secure and accessible way to store your receipts. Simply scan your receipts and upload them to your preferred cloud storage platform. Organize them using folders and subfolders according to your preferred categorization method. Cloud storage also provides the advantage of automatic backups, ensuring your receipts are safe from loss or damage.

- Expense management apps: There are numerous expense management apps available that allow you to capture and store receipts digitally. These apps often have features that allow you to categorize receipts, extract key information, and generate expense reports. Some popular options include Expensify, Shoeboxed, and Wave.

- Email or digital receipts: Instead of receiving paper receipts, opt for email or digital receipts whenever possible. Keep a dedicated folder in your email inbox for these receipts or download them and store them in appropriately labeled folders on your computer or cloud storage platform. This method eliminates the need for physical receipts altogether.

- Receipt organization software: There are specialized receipt organization software options available that help you manage and store your receipts in an organized manner. These software programs often come with features like receipt scanning, automatic categorization, and reporting functionalities.

- Mobile apps: Several mobile apps are designed specifically for receipt organization and storage. Scan your receipts using the app, and it will categorize, tag, and store them electronically. These apps often offer additional features like expense tracking, budgeting, and integration with other financial tools.

When choosing a digital storage option, consider factors such as security, ease of use, compatibility with other tools or software you use, and the ability to search and retrieve receipts efficiently. It’s important to back up your digital receipts regularly to mitigate the risk of data loss.

Combining digital storage with physical storage methods can be a smart approach. It allows for easy access to receipts on the go while providing the added security and accessibility of digital storage. Find the digital storage option that best suits your needs and preferences to maintain an organized and efficient system for storing and managing your receipts.

Essential information to include on a receipt

A well-structured and informative receipt is essential for accurate record-keeping and easy reference. Including the following information on your receipts ensures that they serve their purpose effectively:

- Date and time: The date and time of the transaction should be clearly indicated on the receipt. This information helps in tracking and organizing receipts chronologically.

- Vendor details: Include the name and contact information of the vendor or business where the purchase was made. This could be the store name, address, phone number, and website if applicable. It helps identify where the transaction took place for future reference.

- Itemized list of products or services: Provide a detailed list of items or services purchased, including quantities and individual prices. If applicable, include any relevant details such as size, color, or specifications. An itemized list ensures clarity and is crucial for returns, exchanges, or warranty claims.

- Total amount: Clearly state the total amount paid for the transaction, including any applicable taxes or fees. This information is important for budgeting, expense tracking, and tax purposes.

- Payment method: Indicate how the purchase was paid for, whether it was by cash, credit card, debit card, or any other payment method accepted by the vendor. This helps reconcile payments and provides a detailed record of your transactions.

- Transaction number or receipt number: Assign a unique identifier to each receipt. This can be a transaction number or a receipt number. It helps in referencing and retrieving specific receipts when needed.

- Return policy: Include information about the vendor’s return policy or any applicable warranties. This helps in understanding the terms and conditions for returning or exchanging items, ensuring a smooth process if necessary.

- Additional details: Depending on the nature of the purchase, include any additional information that may be relevant. For example, if it’s a service, note the date or duration of service provided. If it’s a subscription, mention the start and end dates. These details provide comprehensive information about the transaction.

Ensuring these essential details are present on your receipts helps maintain accurate financial records, simplifies expense tracking, facilitates returns or exchanges, and provides documentation for tax purposes. It is also a good practice to keep all associated receipts together, especially if you have multiple receipts for a particular transaction, as it helps provide a complete picture and eliminates any confusion.

How long to keep receipts

Knowing how long to keep receipts is essential for maintaining organized financial records while avoiding unnecessary clutter. While specific retention periods may vary based on personal or business circumstances, here are some general guidelines to consider:

- Short-term receipts: Receipts for everyday expenses, such as groceries, dining out, or personal purchases, can generally be safely discarded once you have verified the transaction and reconciled it with your bank or credit card statement. Holding on to these receipts for a few weeks or until the month-end is usually sufficient.

- Medium-term receipts: Receipts for larger purchases or expenses with warranty or return periods may need to be kept for a longer duration. This includes items like electronics, appliances, or furniture. Hold on to these receipts for at least the duration of the warranty or return period, in case you need to exercise any consumer rights or file warranty claims.

- Long-term receipts: Some receipts should be kept for an extended period of time, especially those related to tax deductions, insurance claims, or legal requirements. As a general rule of thumb, keep these receipts for at least 3 to 7 years. Examples include receipts for business expenses, medical expenses, charitable donations, major home repairs or improvements, and insurance policies.

- Important documents: Certain receipts should be kept indefinitely for legal or sentimental reasons. These include receipts for major assets like a home or vehicle purchase, receipts for valuable assets and jewelry, and receipts for important documents like passports or birth certificates. Keeping these receipts in a safe and secure place is crucial for proof of ownership.

It’s important to note that the retention periods mentioned above are general recommendations and may vary depending on your specific jurisdiction and circumstances. Consult with a tax advisor or legal professional to determine the appropriate retention periods for your specific situation.

When storing receipts, consider organizing them by the year or category to make retrieval and purging easier. Digital storage can also be a convenient option for retaining receipts, as it eliminates physical clutter and provides easy search and retrieval capabilities.

Regularly review your receipts to identify those that are no longer necessary to keep. Safely dispose of old receipts by shredding or securely disposing of them to protect your personal information.

By following these guidelines and maintaining an organized system for storing receipts, you can strike the right balance between clutter-free records and retaining essential documentation for the necessary duration.

Benefits of organizing and storing receipts

Organizing and storing receipts may require some effort initially, but it offers several significant benefits in the long run. Here are some key advantages of keeping your receipts organized:

- Accurate financial records: By organizing your receipts, you can maintain accurate financial records. Receipts provide evidence of your purchases and expenses, allowing you to track and review your spending habits over time. This helps you develop a clearer understanding of your financial health and make more informed decisions about your budget.

- Easier expense tracking: Organized receipts make it easier to track your expenses. Categorized receipts allow you to quickly identify specific spending patterns or areas where you may be overspending. This knowledge empowers you to make adjustments to your budget and manage your finances more effectively.

- Efficient tax preparation: When tax season arrives, organized receipts can be a lifesaver. Receipts serve as valuable supporting documentation for deductions and credits, ensuring that you don’t miss out on any eligible tax benefits. By having all your receipts organized and easily accessible, you can streamline the tax preparation process and potentially reduce your tax liability.

- Evidence for returns and warranties: Keeping receipts can prove invaluable when it comes to returning or exchanging items. Many stores require proof of purchase for returns or warranty claims. By organizing your receipts, you can easily locate the necessary document to facilitate a smooth return process and avoid potential hassles.

- Insurance claims: In the event of loss, damage, or theft, receipts become crucial for insurance purposes. Receipts provide proof of ownership and the value of your possessions, assisting in filing accurate insurance claims. This ensures a smoother claims process and increases the likelihood of receiving adequate reimbursements.

- Legal compliance: Certain types of businesses and individuals may have legal requirements to retain receipts for a specific period. Compliance with these regulations helps avoid legal complications or penalties in the event of an audit or investigation. By organizing and storing receipts appropriately, you can ensure compliance and mitigate potential risks.

- Budget accountability: Organized receipts create a sense of accountability for your spending. As you review your receipts, you can better understand where your money is going, identify areas for improvement, and maintain a disciplined approach to your finances. The act of organizing and storing receipts itself encourages responsible financial practices.

Ultimately, organizing and storing receipts offers peace of mind, financial clarity, and the ability to make informed decisions about your money. By investing the time and effort to establish an organized system, you can reap the numerous benefits that organized receipts provide in both the short and long term.

Read more: How To Store Receipts Digitally

Conclusion

Organizing and storing receipts may initially seem like a mundane task, but its importance cannot be understated. From proof of purchase to efficient tax preparation, the benefits of maintaining organized receipts are numerous. By following the tips provided and utilizing physical and digital storage options, you can create an effective system for managing your receipts.

Properly sorting and categorizing receipts allows for easy retrieval and analysis, helping you track expenses, budget effectively, and make informed financial decisions. Whether you choose physical storage options like expandable file folders or embrace digital storage through scanning and using expense management apps, find a system that suits your lifestyle and preferences.

Don’t underestimate the power of well-organized receipts when it comes to tax deductions, insurance claims, or warranty returns. By keeping receipts for the recommended durations, you can ensure compliance with legal requirements and protect yourself in case of audits or investigations.

The benefits of organizing and storing receipts extend beyond mere financial tracking. It instills a sense of accountability, enables budget management, and contributes to overall financial well-being. Moreover, neatly organized receipts bring peace of mind and eliminate the stress of searching for important documents when needed.

In conclusion, embracing the practice of organizing and storing receipts is a valuable investment in your personal or business financial management. By establishing good habits, utilizing technology, and staying consistent, you can enjoy the benefits of easy access, accurate records, and financial peace of mind. So, start organizing your receipts today and reap the rewards that come with a well-organized financial system.

Frequently Asked Questions about How To Store Receipts

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Store Receipts”