Home>Home Security and Surveillance>How Much Does Mortgage Home Protection Insurance Cost

Home Security and Surveillance

How Much Does Mortgage Home Protection Insurance Cost

Modified: March 6, 2024

Get peace of mind with mortgage home protection insurance. Find out the cost of home security and surveillance to protect your investment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of home security and surveillance! In this comprehensive guide, we will explore everything you need to know about protecting your home and loved ones. From the latest technology trends to essential tips and best practices, we’ve got you covered.

Whether you’re a homeowner, renter, or someone simply looking to improve security measures, having a solid home security system is crucial. With advancements in technology, there are now a wide range of options available to suit every budget and lifestyle. We’ll dive deep into the world of home security and surveillance to help you make the best choices for your specific needs.

Home security and surveillance systems offer peace of mind by providing an added layer of protection against potential threats. They not only deter burglars but also provide invaluable evidence in case of any incident. With the rise in smart home technology, these systems have become smarter, more efficient, and more user-friendly than ever before.

In this guide, we will cover various aspects of home security and surveillance, starting with the basics. We’ll discuss the different types of security systems available, including alarms, cameras, doorbell cameras, and smart locks. We will also delve into the features and benefits of each type, helping you choose the right ones for your home.

Additionally, we will explore the importance of professional monitoring services and the benefits they bring to your security setup. We’ll discuss how these services work and why they are integral to ensuring quick response times in case of emergencies.

Furthermore, we will address the issue of privacy concerns associated with home security and surveillance. We understand the importance of maintaining your privacy while enjoying the benefits of a secure home. We will provide tips and guidelines on how to strike the right balance between security and privacy.

Lastly, we’ll share expert tips on how to optimize your home security system and make it even more effective. From strategic camera placement to implementing smart home integrations, we’ll provide actionable advice that can enhance the overall security of your home.

So whether you’re a tech enthusiast looking to stay updated on the latest security innovations or a homeowner seeking to protect your loved ones and valuable assets, this guide is for you. Let’s embark on this journey together and create a safer and more secure home environment for all!

Key Takeaways:

- Mortgage Home Protection Insurance provides financial security for homeowners facing unforeseen circumstances, covering mortgage payments and reducing the risk of property repossession.

- Factors affecting the cost of Mortgage Home Protection Insurance include age, health, waiting period, coverage amount, and policy length. Shopping around and adjusting deductibles can help lower premiums.

Read more: What Are Insurance Home Protection Plans

What is Mortgage Home Protection Insurance?

Mortgage Home Protection Insurance, also known as Mortgage Payment Protection Insurance (MPPI), is a type of insurance that provides financial protection to homeowners in the event that they are unable to meet their mortgage payments due to unforeseen circumstances. It acts as a safety net, helping homeowners avoid the risk of falling into arrears and potentially facing repossession of their property.

This type of insurance typically covers mortgage repayments in case of involuntary unemployment, sickness, or injury that prevents the insured from working and earning an income. Depending on the policy, it may also provide coverage in the event of death, critical illness, or disability.

Mortgage Home Protection Insurance offers homeowners financial peace of mind by ensuring that their mortgage obligations can be fulfilled even in challenging times. By providing a temporary income replacement or covering the mortgage payments directly, this insurance allows homeowners to maintain the stability of their home during periods of unexpected hardship.

While Mortgage Home Protection Insurance is not mandatory, it is worth considering for homeowners who want to safeguard their largest investment and protect their family’s financial security. It can offer valuable support during difficult circumstances, providing a financial safety net when it is needed most.

It is important to note that Mortgage Home Protection Insurance should not be confused with Mortgage Life Insurance. While Mortgage Home Protection Insurance covers the mortgage payments in case of unforeseen circumstances, Mortgage Life Insurance pays off the remaining mortgage balance in the event of the homeowner’s death.

When considering Mortgage Home Protection Insurance, it is essential to carefully review the policy details, including the coverage period, waiting period (the duration before the insurance kicks in), and any exclusions or limitations. Each policy may differ in terms of the specific events it covers and the extent of coverage provided.

Keep in mind that Mortgage Home Protection Insurance may not be suitable for everyone. Factors such as employment stability, existing savings or emergency funds, and other sources of income and support should be considered when determining the necessity and affordability of this insurance.

Before purchasing a policy, it is advisable to consult with an insurance professional who can provide guidance tailored to your individual circumstances. They can help you understand the terms and conditions of various policies, compare quotes from different providers, and make informed decisions about the coverage that best suits your needs.

Remember, Mortgage Home Protection Insurance is designed to provide a safety net during challenging times, offering peace of mind and financial security to homeowners. It is an important consideration for those who want to protect their investment and ensure they can continue to meet their mortgage obligations even in unforeseen circumstances.

Factors Affecting the Cost of Mortgage Home Protection Insurance

The cost of Mortgage Home Protection Insurance can vary depending on several factors. Understanding these factors can help you assess the affordability of the insurance and make informed decisions when selecting a policy. Here are some key factors that can influence the cost of Mortgage Home Protection Insurance:

1. Age and Health: Your age and health are important factors that insurance providers consider when determining the cost of coverage. Generally, younger and healthier individuals may qualify for lower premiums as they are deemed to have a lower risk of experiencing health-related issues or becoming unemployed.

2. Occupation and Income: The nature of your occupation and the level of income you earn can impact the cost of Mortgage Home Protection Insurance. Certain occupations that are considered high-risk or vulnerable to fluctuations in employment may result in higher premiums.

3. Waiting Period: The waiting period refers to the time between when you become unemployed or incapacitated and when insurance coverage begins. A shorter waiting period typically results in higher premiums as it reduces the risk exposure for insurance providers.

4. Coverage Amount: The amount of coverage you choose will directly affect the cost of Mortgage Home Protection Insurance. Higher coverage amounts will generally result in higher premiums. It is important to strike a balance between adequate coverage and affordability.

5. Policy Length: The duration of the policy can impact the cost of insurance. Longer policy terms may have higher premiums due to the extended coverage period.

6. Additional Coverages: Some Mortgage Home Protection Insurance policies offer additional coverages, such as critical illness or disability coverage. Adding these optional coverages can increase the cost of insurance but provide added protection in case of unforeseen events.

7. Exclusions and Limitations: Each policy may have specific exclusions or limitations that can affect the cost. It is crucial to review and understand these details to ensure that the coverage meets your specific needs.

8. Insurance Provider: Different insurance providers may offer varying rates and pricing structures for Mortgage Home Protection Insurance. It is advisable to compare quotes from multiple providers to ensure you are getting the most competitive rates.

9. Policy Deductibles: Deductibles are the amount you are responsible for paying before the insurance coverage kicks in. Choosing a higher deductible can lower the premium cost but will require you to pay a larger portion of the claim out of pocket.

10. Location: The location of your property can also impact the cost of insurance. Areas prone to natural disasters or with higher crime rates may result in higher premiums as the risk of property damage or loss increases.

It is important to note that the cost of Mortgage Home Protection Insurance may vary based on individual circumstances and the specific details of the policy. It is advisable to consult with an insurance professional to assess your needs accurately, compare options, and select the policy that provides the desired coverage at a reasonable cost.

The cost of mortgage home protection insurance can vary depending on factors such as the value of your home, the coverage amount, and your location. It’s important to shop around and compare quotes from different insurance providers to find the best rate for your specific needs.

Average Cost of Mortgage Home Protection Insurance

The cost of Mortgage Home Protection Insurance can vary depending on several factors, including the amount of coverage, the policy duration, the waiting period, and your individual circumstances. While these factors contribute to the overall cost, it is helpful to have a general idea of the average costs associated with this type of insurance.

On average, Mortgage Home Protection Insurance can range from 0.3% to 0.6% of the mortgage principal per month. For example, if your mortgage principal is $200,000, the monthly cost of insurance could range from $600 to $1,200 per year. However, it’s important to note that these figures are estimates, and the actual cost can vary based on your specific circumstances.

Keep in mind that this percentage can differ based on various factors like your age, health, occupation, and the insurance provider you choose. Younger individuals and those who are in good health may receive more favorable rates compared to older individuals or those with pre-existing medical conditions.

The waiting period, which is the time between the claim and the start of the coverage, also affects the cost. Generally, a shorter waiting period leads to higher premiums. A waiting period of 30 days is common, but some policies may have longer waiting periods, such as 60 or 90 days, to reduce costs.

Additionally, the length of the policy can influence the cost. Common policy terms range from one year to five years. Longer-term policies may have higher premiums due to the extended coverage period and increased risk exposures for the insurance provider.

The specific coverage amount you choose will also impact the cost of Mortgage Home Protection Insurance. Higher coverage amounts will typically result in higher premiums. It’s essential to strike a balance between adequate coverage and affordability to find a policy that suits your needs and budget.

While these average costs provide a guideline, it is crucial to remember that they can vary based on your circumstances and the policy details. It is advisable to obtain quotes from multiple insurance providers to compare prices and coverage options. Consulting with an insurance professional can also help you navigate through the process and find the best policy that meets your specific requirements.

Remember, Mortgage Home Protection Insurance is an investment in the security and stability of your home. By providing financial protection in times of unexpected circumstances, it offers peace of mind and helps ensure that your mortgage obligations are met, reducing the risk of losing your property. Take the time to research, understand the policy terms, and compare prices to make an informed decision about this important form of insurance.

How to Lower the Cost of Mortgage Home Protection Insurance

Mortgage Home Protection Insurance is an important safeguard that provides financial security in challenging times. However, the cost of insurance can add up over time, so it’s essential to explore ways to lower the premiums while maintaining adequate coverage. Here are some tips to help you reduce the cost of Mortgage Home Protection Insurance:

1. Shop Around for the Best Rates: Don’t settle for the first insurance quote you receive. Take the time to research and compare rates from multiple insurance providers. Each provider may have different pricing structures, so getting multiple quotes will help you find the most competitive rates.

2. Review Coverage Needs: Evaluate your coverage needs to ensure you are not overpaying for unnecessary coverage. Consider your specific circumstances and assess if additional coverage options, such as critical illness or disability coverage, are essential for your situation.

3. Opt for a Longer Waiting Period: The waiting period is the time between the claim and when the coverage begins. Opting for a longer waiting period, such as 60 or 90 days, can lower your premiums. However, ensure that you have enough savings or emergency funds to cover mortgage payments during the waiting period.

4. Maintain a Healthy Lifestyle: Your health plays a crucial role in determining the cost of insurance. Adopting a healthy lifestyle, including regular exercise, a balanced diet, and avoiding tobacco or excessive alcohol use, may qualify you for lower premiums.

5. Consider Increasing Deductibles: Higher deductibles can lower your premiums. Consult with your insurance provider to determine if increasing deductibles is a viable option for you.

6. Bundle Insurance Policies: Inquire about potential discounts for bundling your Mortgage Home Protection Insurance with other insurance policies, such as auto or homeowner’s insurance. Insurance companies often offer discounts when you have multiple policies with them.

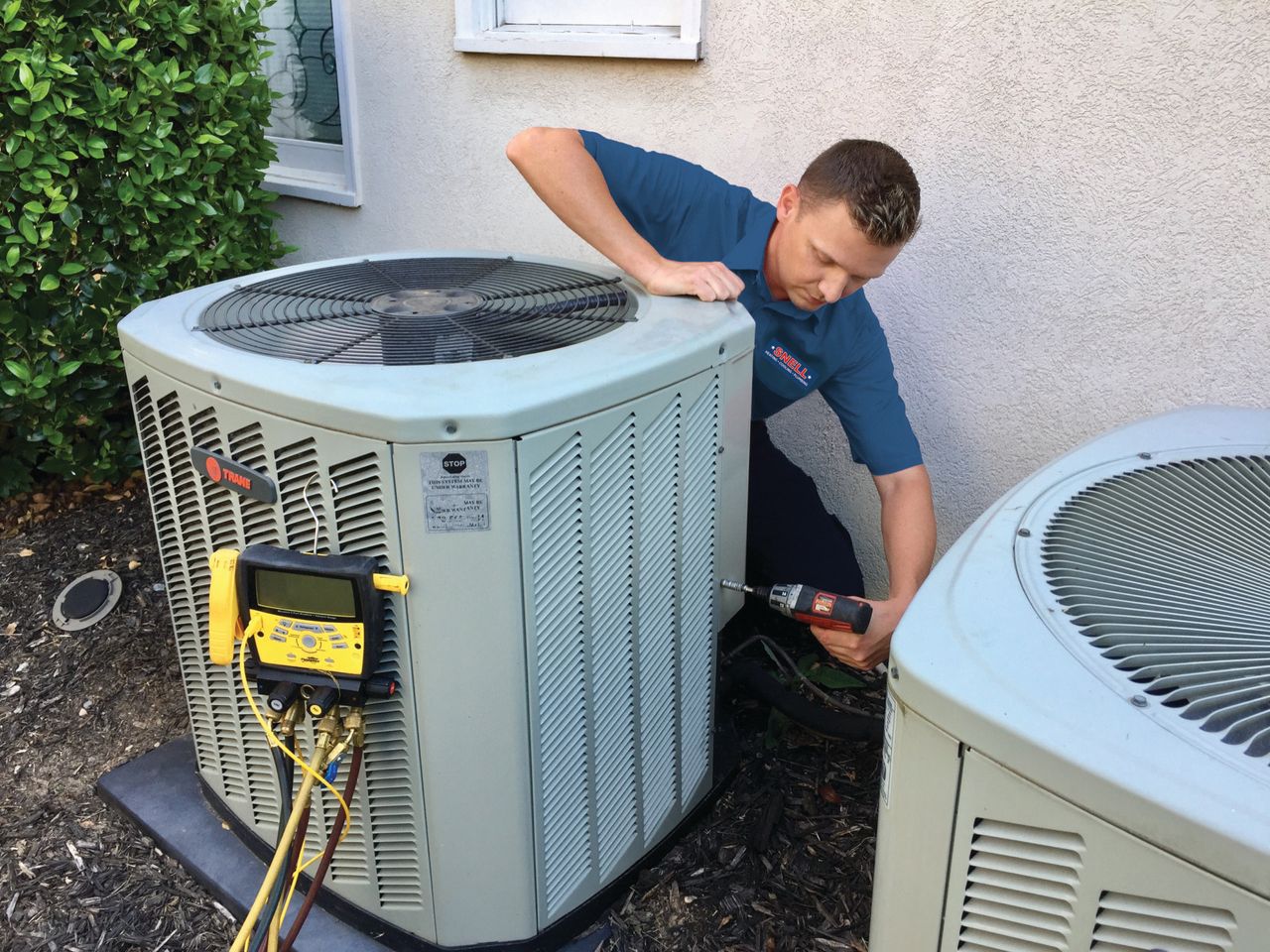

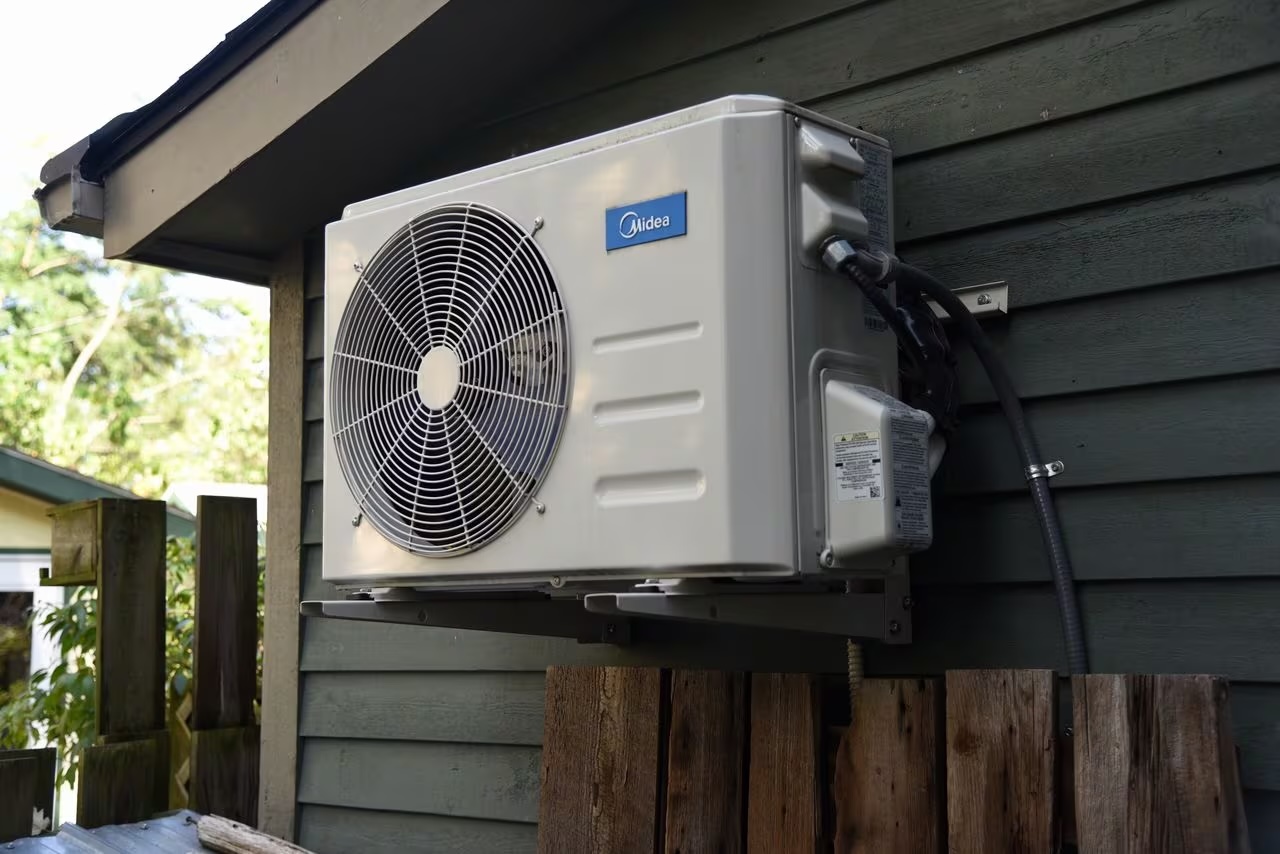

7. Improve Home Security: Enhancing your home’s security measures can demonstrate to insurance providers that your property is less susceptible to risks. Install burglar alarms, smoke detectors, and deadbolt locks. Additionally, consider adding security cameras or a monitored security system for added protection.

8. Maintain Good Credit: A good credit score shows financial responsibility and may result in lower insurance premiums. Pay your bills on time, reduce your debt, and monitor your credit report regularly.

9. Regularly Review and Update Your Policy: As your circumstances change, review your policy periodically to ensure you have the appropriate coverage. If you have paid down a significant portion of your mortgage, you may be able to lower your coverage amount accordingly.

10. Seek Professional Advice: Consult with an experienced insurance professional who can guide you through the process. They can analyze your specific needs, compare policies, and provide personalized recommendations to help you find the most cost-effective coverage.

Remember, while it’s essential to reduce costs, be vigilant not to compromise on coverage. The goal is to strike a balance between affordable premiums and adequate protection for your home and loved ones. By implementing these strategies and exploring all available options, you can lower the cost of Mortgage Home Protection Insurance without sacrificing peace of mind and financial security.

Conclusion

Home security and surveillance are paramount concerns for homeowners and renters alike. Investing in a robust home security system can provide the peace of mind and protection needed to safeguard your property and loved ones.

In this comprehensive guide, we’ve explored the world of home security and surveillance, delving into the different types of security systems, the importance of professional monitoring services, privacy concerns, and expert tips to optimize your system. We’ve also discussed Mortgage Home Protection Insurance, how it works, factors affecting its cost, and tips to lower the premiums.

By understanding the various aspects of home security, including alarm systems, cameras, doorbell cameras, and smart locks, you can make informed decisions to tailor your security setup to your specific needs and budget. Professional monitoring services ensure rapid response and offer additional layers of protection, while privacy considerations help strike a balance between security and maintaining personal privacy.

Mortgage Home Protection Insurance provides financial security by covering mortgage payments in case of unforeseen circumstances. Understanding the factors that influence its cost and exploring ways to reduce premiums, such as shopping around for the best rates and adjusting deductibles and waiting periods, can help homeowners find the most affordable coverage.

In conclusion, home security and surveillance are essential for creating a safe and secure living environment. Investing in a reliable security system and considering Mortgage Home Protection Insurance can provide valuable peace of mind and financial protection during unexpected events.

Remember to evaluate your specific needs, compare quotes from multiple insurance providers, and seek professional advice to make informed decisions. By implementing the tips and advice shared in this guide, you can create a comprehensive home security and surveillance solution that meets your needs, protects your home, and ensures the well-being of your loved ones.

Stay proactive, stay informed, and stay safe!

Frequently Asked Questions about How Much Does Mortgage Home Protection Insurance Cost

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.