Home>Articles>How Long To Depreciate HVAC Unit For Rental Property

Articles

How Long To Depreciate HVAC Unit For Rental Property

Modified: December 7, 2023

Looking for information on how long to depreciate an HVAC unit for a rental property? Our articles provide valuable insights and guidelines for landlords.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of real estate investing! If you’re a landlord or aspiring to become one, you know that owning rental properties can prove to be a lucrative business venture. However, it’s essential to understand the financial aspects involved, such as depreciation.

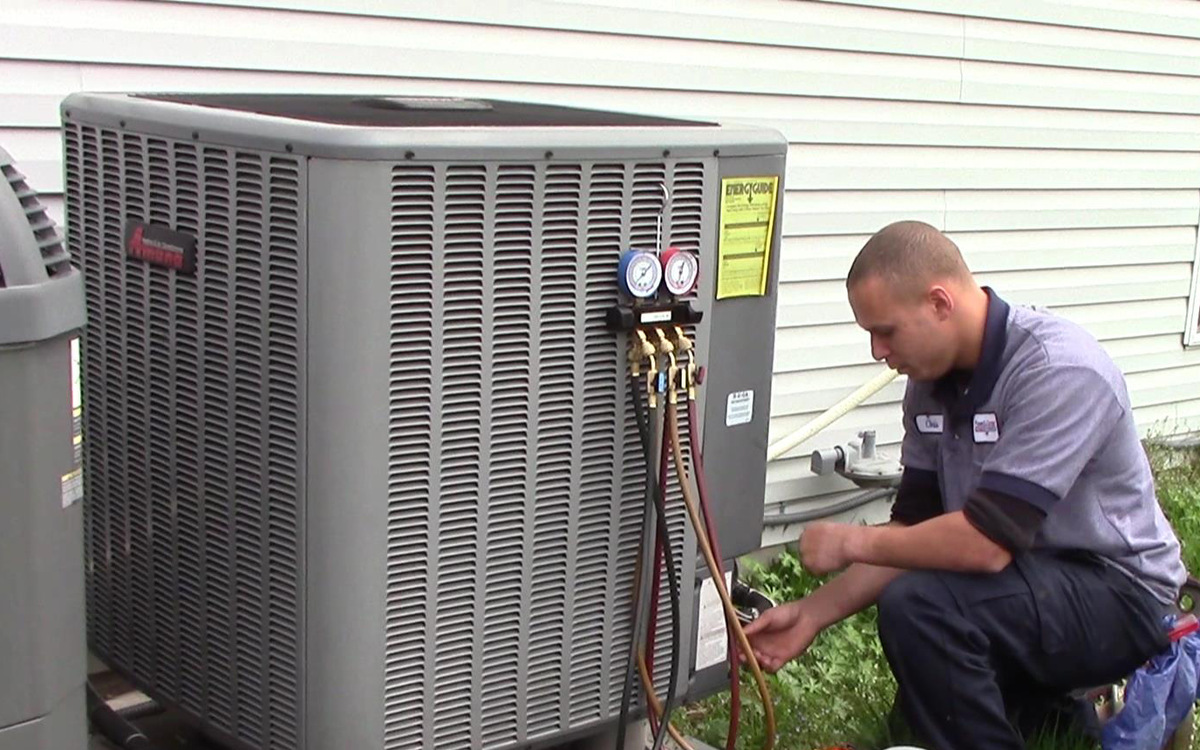

In this article, we will specifically address depreciation of HVAC units for rental properties. HVAC stands for Heating, Ventilation, and Air Conditioning, which plays a crucial role in ensuring the comfort and well-being of tenants. As an investor, knowing how to properly depreciate this significant asset can have a direct impact on your taxes and overall profitability.

But first, let’s briefly discuss what depreciation actually means in relation to rental properties.

Key Takeaways:

- Depreciating HVAC units for rental properties is a crucial financial strategy for landlords, allowing them to reduce tax liability and allocate funds for future replacements or repairs.

- Factors such as age, technology advancements, regional climate, and market demand can influence the depreciation of HVAC units, impacting landlords’ financial planning and profitability.

Read more: How To Depreciate Rental Home Improvements?

What is Depreciation?

Depreciation is a financial concept that refers to the decrease in value or usefulness of an asset over time. In the context of real estate, depreciation allows landlords to deduct the cost of certain assets from their taxable income, thereby reducing their overall tax liability.

While land itself does not depreciate, other components of a rental property, such as buildings, appliances, and HVAC units, do have a finite lifespan and lose value over time. Depreciation is a way to account for this gradual wear and tear and the eventual need for replacement or repairs.

By recognizing depreciation as an expense, landlords can spread out the cost of acquiring and maintaining rental property assets over their useful lifespan. This helps to ensure that the financial impact of these expenses is more accurately reflected in the tax reporting and accounting of the property.

It’s important to note that the Internal Revenue Service (IRS) provides guidelines and rules regarding depreciation for rental property assets. The IRS classifies different assets into specific categories known as “recovery periods” or “useful lives.” These recovery periods determine the length of time over which an asset can be depreciated.

Now that we have a basic understanding of depreciation let’s take a closer look at HVAC units and how they are related to rental property depreciation.

Understanding HVAC Units

Before diving into the depreciation of HVAC units for rental properties, let’s have a clear understanding of what HVAC units actually are and their importance in rental properties.

HVAC stands for Heating, Ventilation, and Air Conditioning. HVAC systems are designed to regulate the temperature, humidity, and air quality within buildings. They play a crucial role in ensuring the comfort and well-being of tenants by providing a controlled and healthy indoor environment.

HVAC units typically consist of various components, including a furnace or boiler for heating, a central air conditioner or heat pump for cooling, and a ventilation system for circulating fresh air. These systems can be complex and require professional installation and maintenance to operate efficiently.

In rental properties, HVAC units are considered a major asset and a significant investment. They not only contribute to tenants’ comfort but also enhance the property’s value and marketability. Having a reliable and well-functioning HVAC system can attract and retain tenants, leading to higher rental income and greater tenant satisfaction.

However, like any other mechanical system, HVAC units have a limited lifespan and will eventually need replacement or major repairs. This is where depreciation comes into play. Depreciating HVAC units allows landlords to account for their declining value over time and allocate funds for future replacements or repairs.

Now that we have a solid understanding of HVAC units, let’s explore how depreciation works for these assets in the context of rental properties.

Depreciating HVAC Units for Rental Properties

Depreciating HVAC units for rental properties involves allocating a portion of the asset’s value as an expense over its useful life. By doing so, landlords can deduct this depreciation expense from their taxable income, reducing their overall tax liability.

The first step in depreciating an HVAC unit is determining its cost basis. This includes the purchase price of the unit, installation costs, and any other related expenses. The cost basis becomes the starting point for calculating depreciation.

The IRS categorizes HVAC units as “residential rental property” and assigns them a recovery period of 27.5 years. This means that landlords can divide the cost basis of the HVAC unit by 27.5 and deduct that amount each year as a depreciation expense on their taxes.

It’s important to note that the depreciation expense can only be claimed for the portion of the HVAC unit that is used for the rental property. If the rental property is only part of a larger building, the depreciation should be calculated based on the percentage of floor space occupied by the rental unit.

Another aspect to consider is the concept of “bonus depreciation.” Under certain circumstances, landlords may be eligible to take advantage of bonus depreciation, which allows for a larger deduction in the year the HVAC unit is placed in service. This can potentially provide greater tax benefits and help offset the initial investment cost.

Depreciating HVAC units not only helps landlords reduce their tax liability but also provides a way to account for the inevitable wear and tear that these assets will experience. By setting aside funds through depreciation, landlords can better prepare for future replacement or repair expenses and ensure the long-term viability of their rental properties.

Now that we understand the concept of depreciation and how it applies to HVAC units for rental properties, let’s delve into the factors that can affect the depreciation period.

The IRS considers HVAC units as residential rental property, so they should be depreciated over 27.5 years for tax purposes. Keep detailed records for accurate depreciation.

Factors Affecting HVAC Unit Depreciation

When it comes to depreciating HVAC units for rental properties, several factors can influence the depreciation period and the overall value decline of the asset. Understanding these factors can help landlords estimate the depreciation expenses and plan for future replacements or repairs.

1. Age and Condition: The age and condition of an HVAC unit play a significant role in determining its depreciation. Older units or those in poor condition may depreciate more quickly, as they are more likely to require frequent repairs or replacement. Regular maintenance and upkeep can help prolong the lifespan of an HVAC unit and slow down its depreciation.

2. Technology Advancements: The HVAC industry is continuously evolving, with new technologies emerging that improve energy efficiency and performance. As newer, more advanced HVAC units enter the market, older units may become less valuable and depreciate at a faster rate. Keeping up with industry advancements can help landlords understand when it’s time to consider upgrading their HVAC systems.

3. Regional Climate and Usage: The climate and usage patterns in the rental property’s location can also affect HVAC unit depreciation. In regions with extreme weather conditions, such as hot summers or cold winters, HVAC units may experience more significant wear and tear, leading to faster depreciation. Similarly, properties with high occupancy rates or frequent tenant turnover may put additional strain on the HVAC system.

4. Quality of Installation and Maintenance: Proper installation and regular maintenance are vital for the longevity and performance of an HVAC unit. If an HVAC system is incorrectly installed or not adequately maintained, it may depreciate more rapidly due to increased wear and potential breakdowns. Landlords should ensure that professional installation and routine maintenance are conducted to maximize the lifespan of the HVAC unit.

5. Market Demand and Economic Factors: The value of an HVAC unit may also be influenced by market demand and economic factors. If there is a high demand for rental properties with modern and efficient HVAC systems, landlords may be able to charge higher rents, which can offset the depreciation expenses. Economic downturns or shifts in the real estate market can also impact the value and depreciation of HVAC units.

By considering these factors, landlords can gain a better understanding of how HVAC unit depreciation plays a role in their overall rental property strategy. Calculating the depreciation period accurately is essential for determining the financial impact and making informed decisions about maintenance, repairs, and potential upgrades.

Next, let’s explore the methods for calculating the depreciation period for HVAC units in rental properties.

Calculating the Depreciation Period

Calculating the depreciation period for HVAC units in rental properties requires determining the useful life of the asset. The Internal Revenue Service (IRS) provides guidelines for different types of assets, including residential rental property. In the case of HVAC units, the recovery period is set at 27.5 years.

To calculate the annual depreciation expense, landlords divide the cost basis of the HVAC unit by the recovery period. The cost basis includes the purchase price of the unit, installation costs, and any other related expenses. Here’s a simplified example:

Let’s say the cost basis of the HVAC unit is $5,000. Dividing that by the recovery period of 27.5 years gives us an annual depreciation expense of approximately $182.

Since depreciation is an annual expense, landlords can deduct $182 each year for tax purposes. This reduces their taxable income and, therefore, their overall tax liability.

It’s important to note that the depreciation period starts from the time the HVAC unit is placed in service or ready for use in the rental property. So, if the unit was installed halfway through the tax year, only half of the annual depreciation expense can be claimed for that year.

Furthermore, it’s crucial to maintain accurate records of the depreciation expenses and relevant documentation, such as receipts and invoices. These records will come in handy during tax filing and if there is a need to prove the depreciation calculations.

Now that we’ve covered how to calculate the depreciation period, let’s explore some examples to better understand the concept in practice.

Examples of HVAC Unit Depreciation Calculation

To illustrate how HVAC unit depreciation is calculated, let’s consider a few examples:

Example 1:

You purchased an HVAC unit for $4,000 and installed it in your rental property. The recovery period for HVAC units is 27.5 years, as per the IRS guidelines.

To calculate the annual depreciation expense, divide the cost basis ($4,000) by the recovery period (27.5 years).

Annual depreciation expense = $4,000 / 27.5 = $145.45

So, each year, you can deduct approximately $145.45 as the depreciation expense for the HVAC unit.

Example 2:

In this scenario, you purchased an HVAC unit for $7,500 and installed it in your rental property. However, the unit was installed halfway through the tax year.

The recovery period for HVAC units remains 27.5 years, but you will only be able to claim half of the annual depreciation expense for the first year.

To calculate the annual depreciation expense, divide the cost basis ($7,500) by the recovery period (27.5 years).

Annual depreciation expense = $7,500 / 27.5 = $272.73

Since the unit was installed halfway through the tax year, you can claim half of the annual depreciation expense:

Depreciation expense for the first year = $272.73 / 2 = $136.36

For subsequent years, you will be able to claim the full annual depreciation expense of approximately $272.73.

Although these examples provide a basic understanding of HVAC unit depreciation calculations, it’s important to consult with a tax professional or accountant to ensure accurate depreciation reporting and compliance with IRS regulations.

Now that we have explored examples of HVAC unit depreciation calculations, let’s wrap up our discussion.

Conclusion

Depreciating HVAC units in rental properties is a crucial aspect of real estate investing. Understanding how to properly account for the declining value of these assets can have significant financial implications for landlords. By depreciating HVAC units, landlords can reduce their tax liability and allocate funds for future replacements or repairs.

We’ve learned that depreciation is the process of recognizing the decrease in value or usefulness of an asset over time. While land itself does not depreciate, components of rental properties, such as HVAC units, do have a finite lifespan and lose value.

HVAC units, which encompass heating, ventilation, and air conditioning systems, are essential for providing comfortable and healthy environments for tenants. Depreciating HVAC units involves determining their cost basis and dividing it by the recovery period set by the IRS, which for HVAC units is 27.5 years for residential rental properties.

Factors that affect HVAC unit depreciation include age and condition, technology advancements, regional climate and usage, quality of installation and maintenance, as well as market demand and economic factors. Understanding these factors can help landlords estimate depreciation expenses and plan accordingly.

To calculate the depreciation period, landlords divide the cost basis of the HVAC unit by the recovery period. The resulting annual depreciation expense can be deducted from taxable income, reducing overall tax liability. It’s important to keep accurate records and consult with a tax professional or accountant to ensure compliance with IRS regulations.

In conclusion, correctly depreciating HVAC units for rental properties is essential for financial planning and maximizing profitability. By understanding the concept of depreciation, considering relevant factors, and accurately calculating the depreciation period, landlords can effectively manage the financial aspects of their rental properties and ensure long-term success.

So, whether you’re a seasoned landlord or just starting in the real estate investment realm, grasp the concept of HVAC unit depreciation and harness its benefits to make informed financial decisions for your rental property portfolio.

Frequently Asked Questions about How Long To Depreciate HVAC Unit For Rental Property

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How Long To Depreciate HVAC Unit For Rental Property”