Home>diy>Planning & Engineering>Under Which Business Organization Does A Landscape Architect Fall?

Planning & Engineering

Under Which Business Organization Does A Landscape Architect Fall?

Modified: August 16, 2024

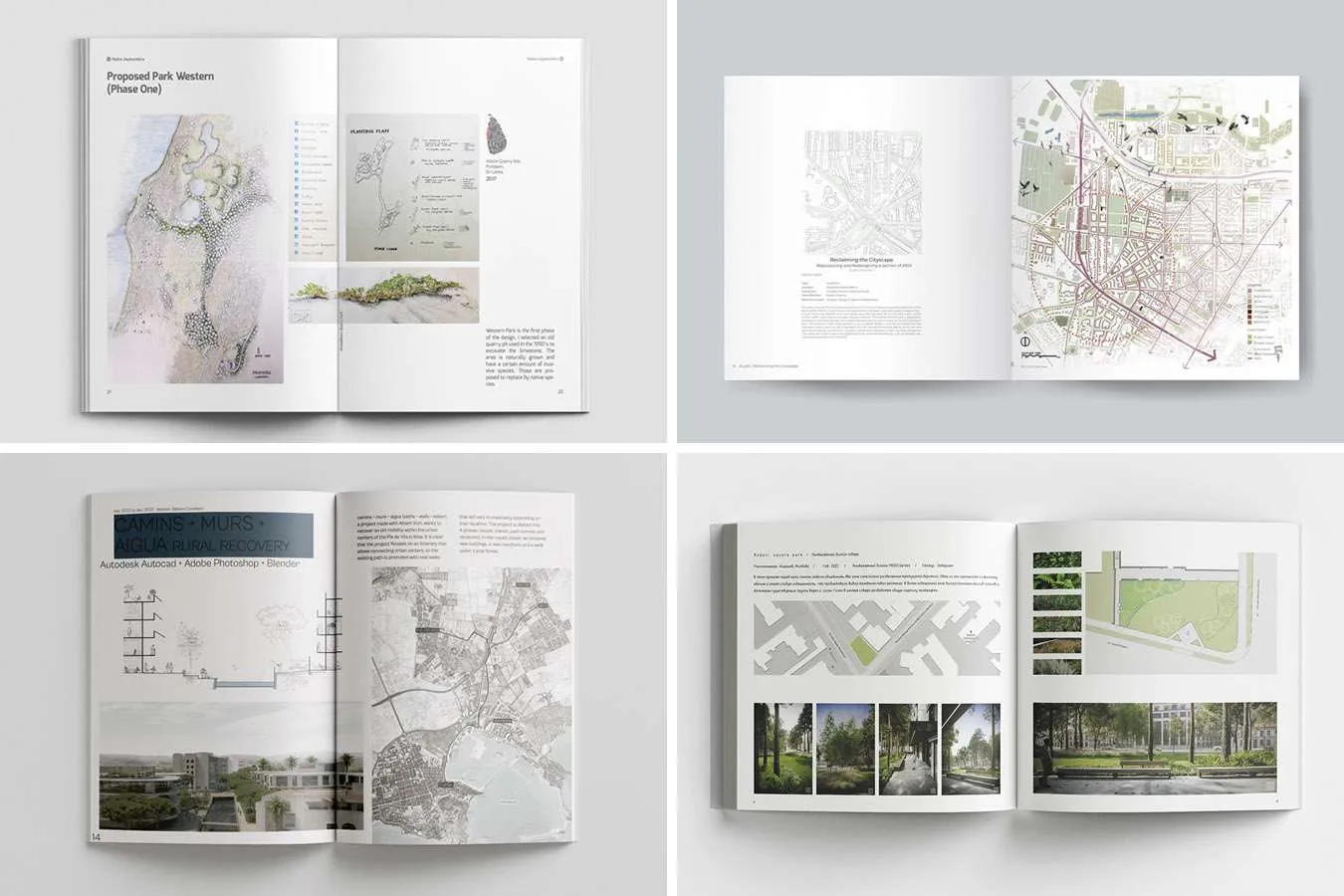

Discover which business organization landscape architects fall under and how planning engineering plays a crucial role in their work. Gain insights and explore career opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

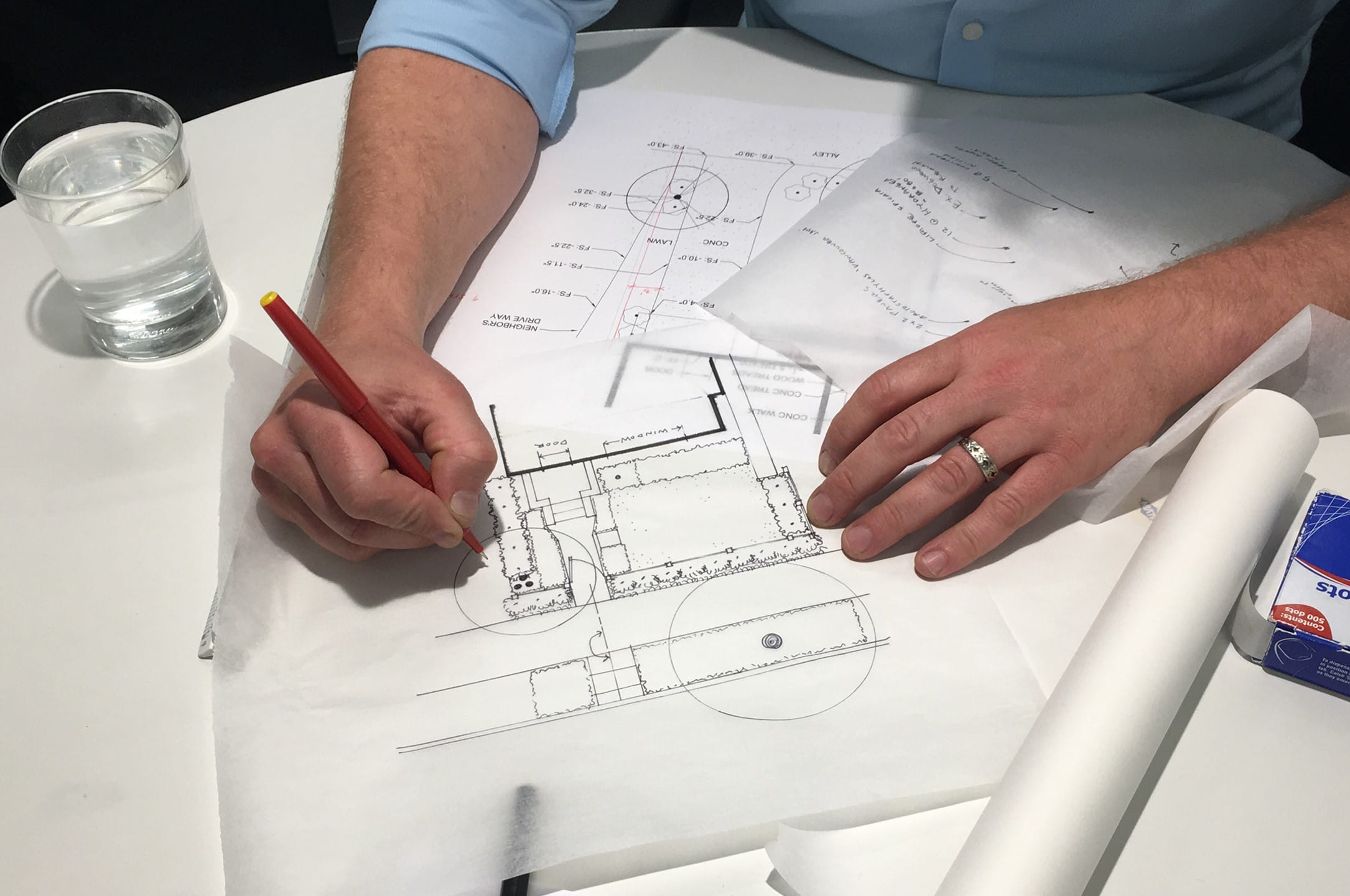

When it comes to operating a landscape architecture business, there are several different business organization structures to consider. The choice of business organization can have significant implications for the legal and financial aspects of the company, as well as the overall management and decision-making processes.

In this article, we will explore the various business organization options available to landscape architects, including sole proprietorship, partnership, limited liability company (LLC), corporation, professional corporation (PC), and non-profit organization. By understanding the different structures, landscape architects can make an informed decision that aligns with their specific goals, requirements, and legal obligations.

Let’s dive into each of these options to gain a clearer understanding of how a landscape architect can structure their business effectively. It’s important to note that while this article provides general information, it is always advisable to consult with a legal professional or accountant to determine the most suitable business organization for your specific circumstances.

Key Takeaways:

- Choose the right business organization structure for your landscape architecture business to align with your goals, protect personal assets, and navigate legal and financial complexities. Seek professional guidance for informed decisions.

- Consider the advantages and considerations of sole proprietorship, partnership, LLC, corporation, PC, and non-profit organization to make a positive impact, raise capital, and ensure compliance. Tailor your business structure to your vision and growth strategy.

Sole Proprietorship

A sole proprietorship is the simplest and most common form of business organization. In this structure, the landscape architect operates the business as an individual and is personally responsible for all aspects of the company, including its debts and liabilities.

One of the main advantages of a sole proprietorship is the ease of setup and operation. There are no formal legal requirements or formalities to follow, making it a cost-effective option for small-scale operations. Additionally, the landscape architect has complete control and flexibility over business decisions and operations.

However, it’s important to note that with a sole proprietorship, the landscape architect’s personal assets are not protected from business liabilities. This means that if the business incurs debts or legal issues, the landscape architect’s personal assets, such as their home or savings, may be at risk.

From a tax perspective, a sole proprietorship is relatively straightforward. The landscape architect reports business income and expenses on their personal tax return and is subject to individual income tax rates. Additionally, the landscape architect may be eligible for certain tax deductions related to their business expenses.

One key consideration when operating as a sole proprietorship is the ability to raise capital and secure funding. Since the landscape architect is personally liable for the business, it may be challenging to attract investors or obtain significant financing. Consequently, sole proprietorships are often suitable for small-scale ventures with limited financial needs.

In summary, a sole proprietorship offers simplicity, low setup costs, and complete control for landscape architects. However, it also comes with unlimited personal liability and limitations on raising capital. It is important to carefully assess the business’s risk factors and consult with legal and financial professionals when considering a sole proprietorship as a business structure.

Partnership

A partnership is a business organization structure in which two or more individuals or entities come together to operate a landscape architecture business. Partnerships can take the form of general partnerships or limited partnerships.

In a general partnership, all partners share equal responsibility for the business’s operations, profits, and debts. Each partner contributes to the business’s success and is equally liable for any legal or financial obligations. General partnerships are relatively simple to set up and operate, as they do not require formal legal documentation. However, it is advisable to have a partnership agreement in place to ensure clarity on roles, responsibilities, profit sharing, and dispute resolution.

On the other hand, a limited partnership consists of general partners and limited partners. General partners have unlimited liability and actively participate in the business’s operations, while limited partners have limited liability and contribute capital but do not participate in day-to-day decision-making. Limited partnerships are more suitable for situations where certain partners want to invest in the business without assuming significant management responsibility.

One of the key advantages of a partnership is the ability to combine resources, knowledge, and skills. Partners can contribute capital, expertise, and industry connections, which can help grow the business more effectively than a sole proprietorship. Additionally, the workload can be shared among partners, allowing for greater efficiency and specialization.

Another benefit of a partnership is the potential tax advantages. Partnerships are “pass-through” entities, meaning that the profits and losses of the business are passed through to the partners, who report them on their personal tax returns. This avoids double taxation at both the corporate and individual levels, providing potential tax savings for partners.

Like any business structure, partnerships also have their considerations and challenges. The most significant concern is the potential for personal liability. Each partner is personally liable for the partnership’s debts and obligations, which means that a partner’s personal assets may be at risk in the event of legal issues or financial difficulties.

Communication, cooperation, and mutual trust are essential for successful partnerships. Open and transparent communication, clear roles and responsibilities, and a shared vision are critical to avoid conflicts and ensure the smooth operation of the business.

Overall, a partnership offers the advantages of shared resources, expertise, and tax benefits, but it also comes with the risk of personal liability and the need for effective communication and collaboration. It is crucial to have a well-defined partnership agreement and seek legal guidance when establishing a partnership for a landscape architecture business.

Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a popular business organization structure for landscape architects. An LLC provides a balance between the simplicity of a sole proprietorship and the liability protection of a corporation.

One of the main advantages of an LLC is the limited liability protection it offers to its owners, known as “members.” In an LLC, the members’ personal assets are generally protected from the company’s debts and liabilities. This means that if the business faces legal issues or financial difficulties, the members’ personal assets, such as their homes or savings, are not at risk.

Setting up an LLC involves filing the necessary paperwork with the state and paying the required fees. The process typically includes drafting an operating agreement that outlines the LLC’s internal management structure, decision-making processes, and profit distribution among the members. While an operating agreement is not required in all jurisdictions, it is highly recommended to establish clear guidelines and expectations.

Another advantage of an LLC is its flexibility in terms of management and taxation. LLCs can be managed by the members themselves or appoint managers to handle day-to-day operations. This flexibility allows members to choose the management structure that best suits their needs and experience.

From a tax perspective, an LLC can choose its tax classification. By default, an LLC with multiple members is taxed as a partnership, where the company’s income and expenses flow through to the members’ personal tax returns. This avoids double taxation at the corporate level. However, an LLC can also elect to be taxed as a corporation, providing potential tax planning opportunities for the members.

It’s important to note that while an LLC provides liability protection, members may still be held personally responsible for their own professional malpractice or negligence. In such cases, professional liability insurance is strongly recommended to mitigate potential risks.

Operating as an LLC also enhances the company’s credibility and professionalism in the eyes of clients, contractors, and lenders. The structure conveys a sense of stability and establishes a formalized business entity that can inspire confidence and facilitate business relationships.

In summary, an LLC offers the benefits of limited liability protection, flexibility in management, and potential tax advantages. It is a preferred choice for landscape architects who seek legal protection for their personal assets while maintaining a manageable and tax-efficient business structure. Consulting with a legal professional or accountant is advisable to ensure compliance with state regulations and to maximize the benefits of operating as an LLC.

A landscape architect typically falls under the category of a professional service business organization, often operating as a sole proprietorship, partnership, or limited liability company (LLC).

Corporation

A corporation is a legal entity that is separate from its owners, known as shareholders. It is a more complex and formal business organization structure often chosen by larger landscape architecture firms or those planning for significant growth and expansion.

One of the main advantages of a corporation is the limited liability protection it affords to its shareholders. In a corporation, the shareholders’ personal assets are typically shielded from the company’s debts and legal liabilities. This means that in the event of financial difficulties or legal issues, the shareholders’ personal assets are generally safeguarded.

Establishing a corporation involves more formalities and legal requirements than other business structures. It typically involves filing articles of incorporation with the state, drafting corporate bylaws that outline the company’s internal operating procedures, and issuing shares of stock to the shareholders. Shareholders have ownership rights and elect a board of directors responsible for overseeing the company’s strategic decisions and appointing officers who handle day-to-day operations.

One key advantage of a corporation is its ability to sell shares of stock to raise capital. This makes it an attractive option for landscape architecture firms seeking substantial funding for expansion or investment in new projects. Corporations also have the potential to attract investors and issue different classes of stock, allowing for flexibility in ownership and management structures.

Another advantage of a corporation is its longevity and continuity. Unlike other business structures that may dissolve or undergo significant changes if an owner leaves or passes away, a corporation can exist indefinitely. The company continues to operate and maintain its corporate identity regardless of changes in ownership or management.

From a taxation perspective, corporations are subject to double taxation. The corporation itself is taxed on its profits at the corporate tax rate, and then the shareholders are taxed on the dividends they receive from the corporation. However, certain tax planning strategies can help mitigate the impact of double taxation, such as reinvesting profits back into the business or utilizing tax deductions and credits available to corporations.

Operating as a corporation also adds a layer of credibility and professionalism to a landscape architecture firm. It can enhance the company’s reputation among clients, lenders, and business partners. Additionally, a corporation may have more opportunities for growth and expansion, including potential mergers and acquisitions.

In summary, a corporation offers the benefits of limited liability protection, the ability to raise capital through stock sales, longevity, and a professional image. However, the formalities, greater regulatory compliance, and potential double taxation are important considerations. Landscape architecture firms considering a corporation as their business structure should seek guidance from legal and financial professionals to ensure compliance and maximize the advantages of operating as a corporation.

Professional Corporation (PC)

A Professional Corporation (PC), also known as a Professional Service Corporation, is a specialized form of business organization specifically designed for licensed professionals, including landscape architects. The PC structure combines the benefits of a corporation with the professional regulations and requirements imposed on certain occupations.

One of the main advantages of a PC is the limited liability protection it provides to its shareholders. Similar to a regular corporation, the PC structure separates the personal assets of the shareholders from the company’s debts and legal liabilities. This means that the personal assets of the shareholders, such as their homes and savings, are generally protected in the event of financial difficulties or legal issues.

Setting up a PC involves filing the necessary paperwork, such as articles of incorporation, with the state licensing board and meeting specific professional regulations and requirements. These requirements may vary depending on the jurisdiction and the industry in which the professionals operate. It is essential to consult with the appropriate licensing board and legal professionals to ensure compliance with all necessary regulations.

One of the primary requirements of a PC is that the shareholders must be licensed professionals in the field of practice. In the case of landscape architects, all shareholders of the PC must hold valid licenses in landscape architecture. This restriction ensures that the corporation is operated by professionals who have the necessary skills, expertise, and qualifications.

Another advantage of a PC is its ability to generate credibility and trust among clients and industry peers. Being recognized as a professional entity can enhance the reputation and distinction of the landscape architecture firm. Clients often feel more confident working with a PC because they know that the professionals within the corporation are bound by ethical and professional standards.

From a taxation perspective, PC’s are typically treated as regular corporations, subject to double taxation. The corporation itself is taxed on its profits at the corporate tax rate, and then shareholders are taxed on any dividends received. However, some jurisdictions may provide tax advantages or exemptions for certain professional services corporations, so it’s important to consult with tax professionals familiar with local regulations.

Operating as a PC can also provide certain benefits regarding succession planning. A PC can facilitate the transfer of ownership interests and ensure the continued operation of the firm even in the event of retirement, disability, or death of shareholders. This allows the firm to maintain its client relationships and reputation by smoothly transitioning ownership to other licensed professionals.

In summary, a Professional Corporation offers limited liability protection, credibility, and specialized compliance with professional regulations. It is a suitable business organization structure for licensed professionals, including landscape architects, who want to protect their personal assets, operate within their professional guidelines, and enhance their reputation within their industry. Consultation with both legal and licensing professionals is crucial to ensure compliance with all necessary regulations when establishing a Professional Corporation.

Non-profit Organization

A non-profit organization is a business organization structure established for a specific purpose or cause, rather than for generating profits. Non-profit organizations, including those in the field of landscape architecture, are focused on serving the community, advancing a cause, or providing a public benefit.

One of the main characteristics of a non-profit organization is that it operates for a specified mission or purpose, rather than for the financial gain of its members or shareholders. Non-profit organizations often work towards addressing social, cultural, educational, or environmental issues. In the case of landscape architecture, non-profit organizations may focus on promoting sustainable design practices, community engagement, or conservation efforts.

Non-profit organizations are governed by a board of directors, which is responsible for making strategic decisions and overseeing the organization’s activities. The board members are typically volunteers who serve in a fiduciary capacity to ensure the organization is fulfilling its mission and handling its funds and resources responsibly.

In terms of financial structure, non-profit organizations rely on various sources of funding, including donations, grants, sponsorships, and fundraising activities. These funds are used to support the organization’s programs, projects, and operational expenses. Non-profit organizations are required to file annual financial reports to maintain transparency and accountability.

One of the key benefits of a non-profit organization is the ability to receive tax-exempt status. Eligible non-profit organizations are exempt from paying federal income tax on their earnings and may also be exempt from certain state and local taxes. Additionally, individuals and businesses that donate to non-profit organizations may be eligible for tax deductions, incentivizing charitable giving.

Non-profit organizations play a crucial role in advocating for social and environmental causes. They often collaborate with other organizations, government entities, and community stakeholders to promote positive change. Non-profit organizations in the field of landscape architecture can make a significant impact by implementing sustainable design practices, promoting public awareness, and engaging local communities in the decision-making process.

It’s important to note that operating a non-profit organization requires careful planning and compliance with legal and regulatory requirements. Non-profit organizations must adhere to specific laws and regulations pertaining to tax-exempt status, financial reporting, and governance, among others. Consulting with legal, financial, and accounting professionals with expertise in non-profit organizations is essential to ensure compliance and responsible management.

In summary, a non-profit organization offers landscape architects a platform to make a positive impact, serve their community, and advance their mission. It provides a structure to rally support, generate funding, and collaborate with stakeholders to address social and environmental issues. Establishing and operating a non-profit organization requires careful planning, adherence to legal requirements, and the dedication of passionate individuals committed to making a difference.

Conclusion

Choosing the right business organization structure is a critical decision for landscape architects and can have a significant impact on the success and sustainability of their business. Each business organization option, from sole proprietorship to corporation, offers unique advantages and considerations depending on the specific goals, needs, and resources of the landscape architect.

A sole proprietorship provides simplicity and complete control over the business, but it also comes with unlimited personal liability. Partnerships allow for shared resources and expertise, but effective communication and mutual trust are essential. Limited liability companies (LLCs) combine liability protection with flexibility in management and taxation options.

Corporations offer limited liability protection, the ability to raise capital through stock sales, and a professional image. Professional corporations (PCs) cater specifically to licensed professionals, providing credibility and compliance with professional regulations. Non-profit organizations allow landscape architects to make a positive impact on their community and address social or environmental causes.

Throughout the decision-making process, landscape architects should consider their short-term and long-term business goals, financial resources, legal obligations, and personal aspirations. Seeking advice and guidance from legal professionals, accountants, and licensing boards can help navigate the complexities of business organization structures and ensure compliance with regulations that govern the field.

Ultimately, the choice of business organization structure should align with the landscape architect’s vision, brand, values, and growth strategy. By selecting the most suitable business organization, landscape architects can position themselves for success, protect their personal assets, and effectively operate their businesses in the ever-evolving landscape architecture industry.

Remember, the information provided in this article serves as a general guide and does not replace personalized advice from professionals. Take the time to assess your specific circumstances and consult with experts to make an informed decision that will set a strong foundation for your landscape architecture business.

Frequently Asked Questions about Under Which Business Organization Does A Landscape Architect Fall?

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “Under Which Business Organization Does A Landscape Architect Fall?”