Home>Renovation & DIY>Home Renovation Guides>What Home Improvements Count As Home Acquisition Debt?

Home Renovation Guides

What Home Improvements Count As Home Acquisition Debt?

Modified: January 4, 2024

Discover which home improvements qualify as home acquisition debt and learn how to maximize tax benefits. Get expert guidance on home renovation with our comprehensive guides.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Understanding Home Acquisition Debt

When it comes to renovating your home, the costs can quickly add up. However, did you know that certain home improvements can actually count as home acquisition debt? Understanding this concept is crucial for homeowners looking to maximize their tax benefits while enhancing their living space. In this comprehensive guide, we will delve into the intricacies of home acquisition debt and shed light on which home improvements fall under this category. By the end of this article, you will have a clear understanding of how to leverage home renovations to qualify for valuable tax deductions.

Understanding Home Acquisition Debt

Home acquisition debt refers to the funds borrowed to acquire, build, or substantially improve a qualified residence. This type of debt is typically secured by the home itself. The IRS defines a qualified residence as the taxpayer’s primary residence or a second home, such as a vacation property. Understanding the concept of home acquisition debt is essential for homeowners who want to make the most of their tax benefits.

One key aspect of home acquisition debt is that it must be used to improve the taxpayer’s principal or secondary residence. This distinguishes it from other types of debt, such as home equity loans or personal loans, which may not necessarily be tied to home improvement activities.

It’s important to note that there are limits to the amount of home acquisition debt that can be used to calculate the mortgage interest deduction. As of 2021, the maximum amount of debt eligible for the mortgage interest deduction is $750,000 for married couples filing jointly, and $375,000 for married couples filing separately or individual taxpayers. Any debt beyond these limits may not qualify for the deduction.

Furthermore, the IRS imposes certain requirements for home improvements to be considered as home acquisition debt. To qualify, the improvements must add value to the home, prolong its useful life, or adapt it to new uses. This means that routine repairs or maintenance, such as painting or fixing leaks, may not meet the criteria unless they are part of a larger, qualified home improvement project.

By understanding the nuances of home acquisition debt, homeowners can make informed decisions about their renovation projects and leverage tax benefits to offset some of the costs. With this foundation in place, let’s explore the specific home improvements that qualify as home acquisition debt.

Home Improvements that Count as Home Acquisition Debt

When it comes to home improvements that qualify as home acquisition debt, the key criterion is whether the project substantially enhances the value, longevity, or functionality of the residence. This typically involves renovations that go beyond basic repairs or maintenance and result in a tangible increase in the home’s worth or utility.

Some common examples of home improvements that may qualify as home acquisition debt include:

- Adding a new room or expanding an existing one

- Remodeling the kitchen or bathrooms

- Upgrading the HVAC system or installing central air conditioning

- Replacing the roof, windows, or doors

- Adding a deck, patio, or porch

- Finishing or renovating the basement or attic

- Installing a new security system or home automation features

- Upgrading the electrical or plumbing systems

- Landscaping or adding outdoor amenities

It’s important to keep in mind that the IRS has specific guidelines regarding the nature and scope of these improvements. Generally, the work must substantially add value to the home or extend its useful life. Cosmetic enhancements, such as painting or wallpapering, are unlikely to meet the criteria unless they are part of a more extensive renovation project.

Additionally, the IRS may require homeowners to maintain records and receipts related to the home improvements to substantiate their eligibility for the mortgage interest deduction. This underscores the importance of proper documentation and adherence to IRS guidelines when considering home renovations as part of home acquisition debt.

By understanding which home improvements qualify as home acquisition debt, homeowners can strategically plan their renovation projects to maximize tax benefits and long-term value. With these insights in mind, let’s explore specific examples of home improvements that fall under this category.

Examples of Home Improvements that Count as Home Acquisition Debt

Let’s delve into specific examples of home improvements that qualify as home acquisition debt, shedding light on how these projects can enhance the value and functionality of a residence while potentially providing tax benefits for homeowners.

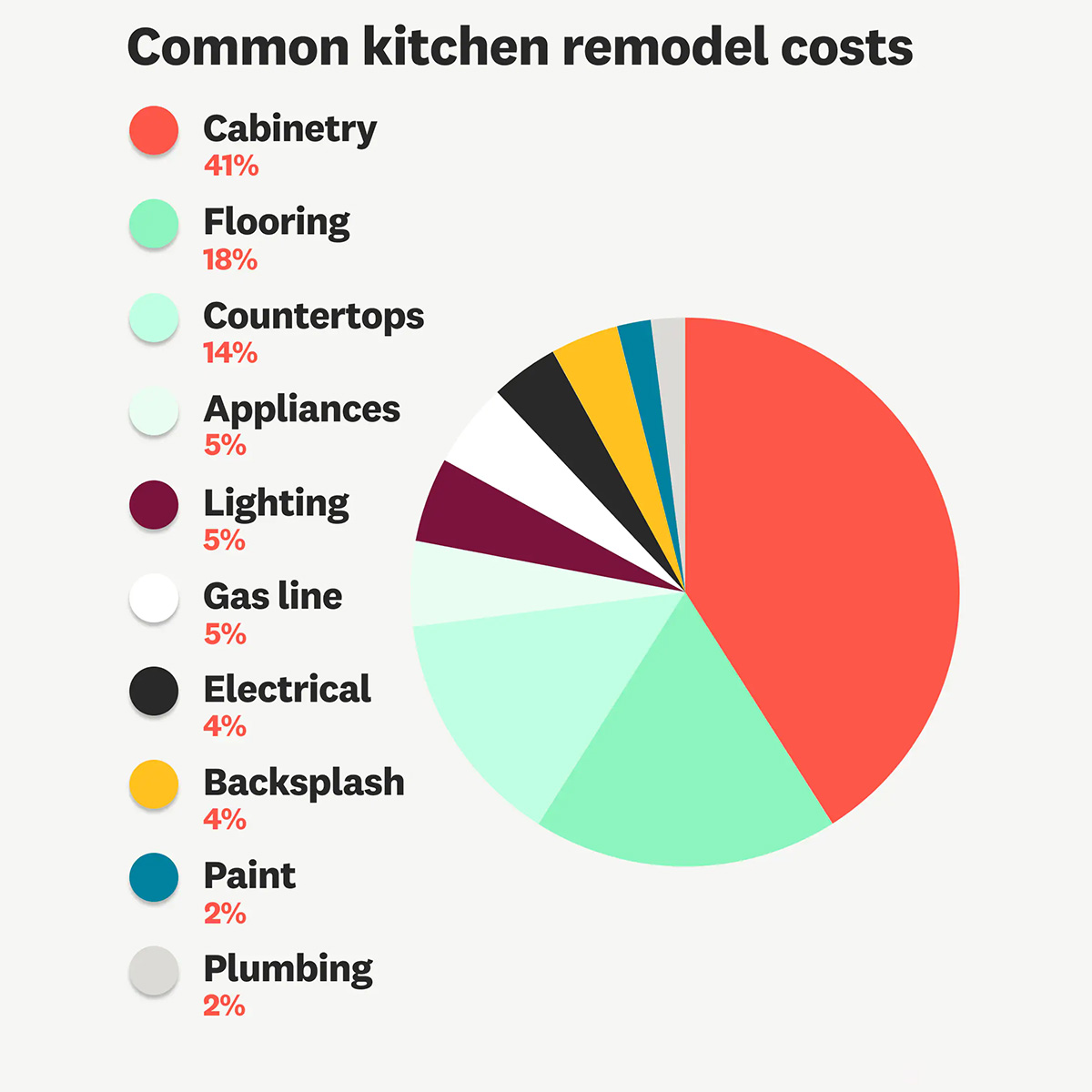

1. Kitchen Remodel

Updating a kitchen with new appliances, cabinets, countertops, and flooring can significantly increase the value of a home while modernizing its appeal. A well-executed kitchen remodel not only enhances the living experience but also aligns with the criteria for home acquisition debt, making it a strategic investment for homeowners.

2. Bathroom Renovation

Renovating a bathroom by installing new fixtures, tiles, vanities, and enhancing the overall aesthetics and functionality can qualify as home acquisition debt. Improving the quality and appeal of bathrooms can contribute to the overall value of the home, aligning with the IRS guidelines for eligible home improvements.

3. Room Addition

Adding a new room, such as a bedroom, home office, or entertainment space, expands the usable square footage of the home and enhances its versatility. This type of substantial improvement often meets the criteria for home acquisition debt, especially when it contributes to increasing the home’s market value.

4. Roof Replacement

Replacing an aging or damaged roof not only safeguards the home but also adds to its structural integrity and longevity. Since a new roof is a fundamental component of the home, its replacement can be considered a qualifying improvement under home acquisition debt guidelines.

Read more: What Is Home Improvements?

5. Energy-Efficient Upgrades

Investing in energy-efficient upgrades, such as installing solar panels, upgrading insulation, or replacing windows and doors with energy-efficient models, can enhance the home’s sustainability and reduce utility costs. These improvements align with the IRS criteria for home acquisition debt, especially as they contribute to the long-term value and efficiency of the residence.

By considering these examples and understanding how they align with the concept of home acquisition debt, homeowners can make informed decisions about their renovation projects while potentially capitalizing on valuable tax benefits. With a clear understanding of the eligible improvements, homeowners can embark on renovation endeavors that not only enhance their living space but also contribute to their long-term financial well-being.

Conclusion

As homeowners embark on renovation projects to enhance their residences, understanding the concept of home acquisition debt and its implications for tax benefits is paramount. By recognizing which home improvements qualify as home acquisition debt, homeowners can strategically plan their renovations to maximize the long-term value of their properties while potentially benefiting from valuable tax deductions.

From kitchen remodels and bathroom renovations to energy-efficient upgrades and room additions, a wide range of home improvements can align with the IRS guidelines for home acquisition debt. These projects not only enhance the aesthetic appeal and functionality of a home but also contribute to its overall value, making them strategic investments for homeowners seeking to leverage tax benefits.

It’s important for homeowners to maintain proper documentation and adhere to IRS guidelines when considering home improvements as part of home acquisition debt. Keeping detailed records and receipts related to the renovation projects can substantiate the eligibility for the mortgage interest deduction, providing peace of mind and financial benefits in the long run.

By integrating these insights into their renovation plans, homeowners can navigate the complexities of home acquisition debt and make informed decisions about their home improvement projects. Whether it’s a kitchen remodel, bathroom renovation, room addition, or energy-efficient upgrade, each improvement represents an opportunity to enhance the living experience while potentially unlocking tax advantages.

Ultimately, by understanding which home improvements count as home acquisition debt, homeowners can transform their residences into personalized havens while optimizing their financial well-being. This comprehensive understanding empowers homeowners to embark on renovation journeys with clarity and purpose, leveraging the potential tax benefits to create homes that are not only beautiful and functional but also financially rewarding.

Frequently Asked Questions about What Home Improvements Count As Home Acquisition Debt?

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “What Home Improvements Count As Home Acquisition Debt?”