Home>Renovation & DIY>Home Renovation Guides>What Is Home Improvement Accounting

Home Renovation Guides

What Is Home Improvement Accounting

Published: December 22, 2023

Learn the ins and outs of home improvement accounting with our comprehensive guides. Manage your finances effectively for successful renovations. Explore now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of home improvement accounting, where financial management meets the art of transforming living spaces. As homeowners embark on the journey of enhancing their homes, accounting plays a pivotal role in ensuring the success and sustainability of these endeavors. Home improvement accounting encompasses a range of financial practices tailored to the unique needs of renovation projects, offering valuable insights into the fiscal aspects of enhancing and maintaining residential properties.

Whether you’re a seasoned DIY enthusiast or a homeowner seeking professional renovation services, understanding the fundamentals of home improvement accounting can empower you to make informed financial decisions, optimize resource allocation, and achieve your desired home transformation within budgetary constraints. In this comprehensive guide, we will delve into the importance, types, key components, challenges, and best practices of home improvement accounting, equipping you with the knowledge to navigate the financial landscape of home enhancement with confidence and proficiency.

Key Takeaways:

- Home improvement accounting is crucial for managing renovation finances, ensuring transparency, budget discipline, and resource optimization. It empowers homeowners and professionals to make informed financial decisions and achieve successful home transformations within budgetary constraints.

- Understanding the types of home improvement accounting and embracing best practices empowers stakeholders to navigate the financial landscape with precision, strategic acumen, and confidence. It fosters financial stability, risk mitigation, and project success in residential renovation endeavors.

Read more: What Is Home Improvements?

Importance of Home Improvement Accounting

Home improvement accounting holds immense significance in the realm of residential renovation and maintenance. It serves as the financial compass that guides homeowners, contractors, and renovation professionals through the intricate landscape of budgeting, expenditure tracking, and resource management. Let’s explore the key reasons why home improvement accounting is crucial:

- Financial Transparency: Effective accounting practices provide transparency into the financial aspects of home improvement projects. By maintaining accurate records of expenses, income, and cash flow, homeowners and contractors gain insight into the financial health of the project, enabling informed decision-making and proactive budget adjustments.

- Budget Management: Home improvement accounting facilitates meticulous budget planning and monitoring. It empowers homeowners to set realistic budgets, allocate funds to different aspects of the project, and track expenditures to ensure adherence to financial goals. This proactive approach helps prevent overspending and enables adjustments to be made in real time, fostering financial discipline throughout the renovation process.

- Resource Optimization: By analyzing financial data, home improvement accounting allows for the optimization of resources such as materials, labor, and equipment. It helps identify cost-efficient suppliers, streamline procurement processes, and minimize wastage, ultimately maximizing the value derived from the allocated budget.

- Project Viability Assessment: Sound accounting practices aid in assessing the financial feasibility of home improvement projects. Through cost-benefit analysis, cash flow projections, and financial forecasting, stakeholders can evaluate the viability of proposed renovations, ensuring that the anticipated benefits outweigh the associated costs.

- Compliance and Tax Obligations: Proper accounting in home improvement projects ensures compliance with tax regulations and financial reporting requirements. It facilitates the documentation of expenses, income, and tax-deductible items, simplifying the process of filing taxes and minimizing the risk of non-compliance.

By embracing robust accounting principles tailored to the unique dynamics of home improvement, individuals and professionals involved in renovation endeavors can foster financial stability, mitigate risks, and enhance the overall success and sustainability of residential enhancement projects.

Types of Home Improvement Accounting

Home improvement accounting encompasses various specialized approaches tailored to address the specific financial needs and complexities inherent in renovation projects. Understanding the different types of home improvement accounting is essential for effectively managing financial resources and ensuring the fiscal viability of renovation endeavors. Let’s explore some key types of home improvement accounting:

- Project-Based Accounting: This type of accounting focuses on individual renovation projects, tracking the financial inflows and outflows associated with each undertaking. It involves creating project-specific budgets, monitoring expenses, and analyzing the financial performance of each project independently. Project-based accounting enables stakeholders to evaluate the profitability and efficiency of individual renovations, facilitating data-driven decision-making and resource allocation.

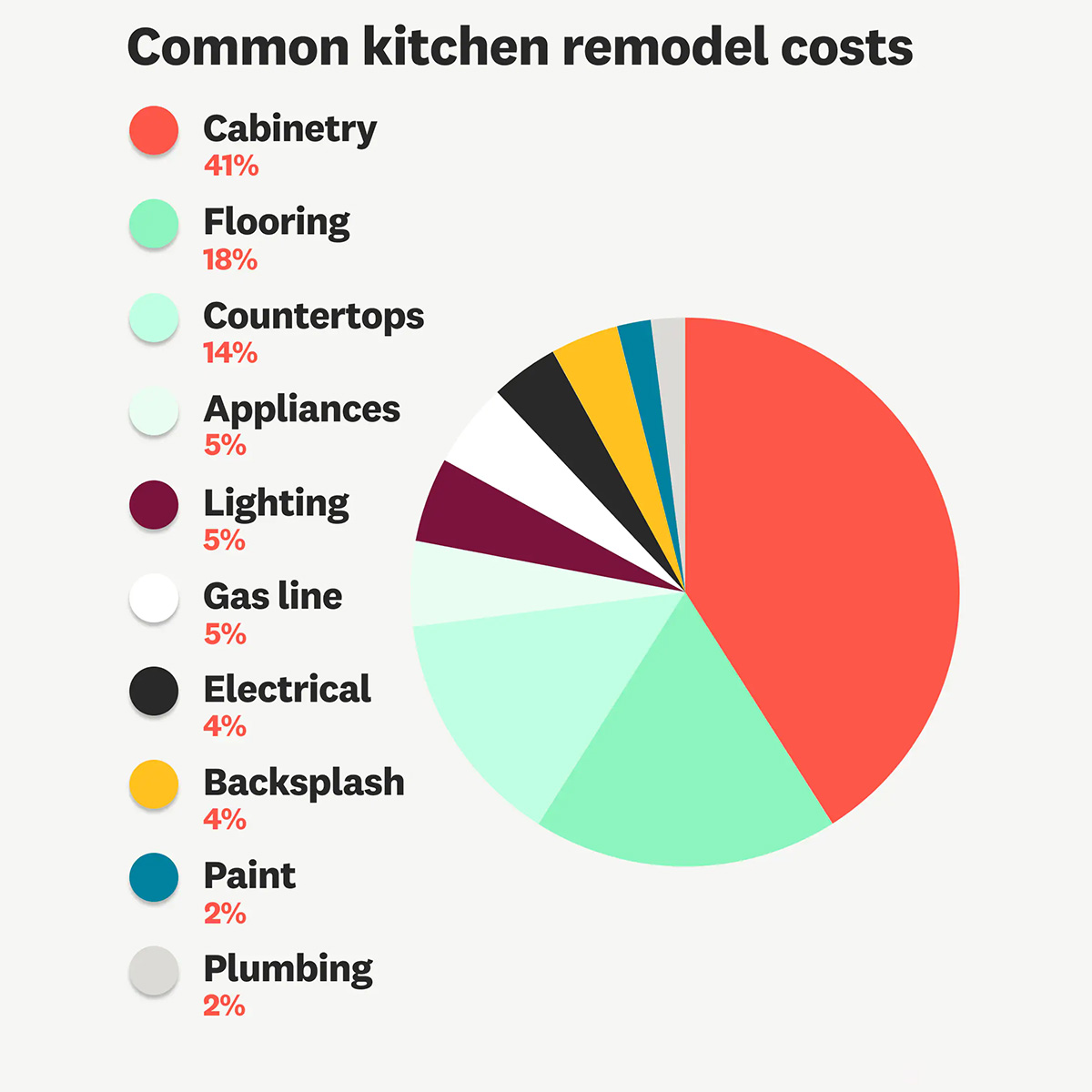

- Cost Accounting: Cost accounting in home improvement involves the detailed analysis and allocation of costs related to materials, labor, equipment, and overhead expenses. By categorizing and tracking costs associated with specific aspects of a renovation project, such as kitchen remodeling or bathroom upgrades, stakeholders can gain insights into cost efficiencies, identify areas for cost reduction, and optimize resource allocation to maximize the value derived from the allocated budget.

- Asset Management Accounting: This type of accounting focuses on the financial management of assets involved in home improvement projects, including inventory management, depreciation tracking, and asset valuation. By effectively managing and accounting for assets such as building materials, tools, and equipment, stakeholders can optimize inventory levels, minimize asset depreciation, and enhance overall project efficiency.

- Contractor Accounting: Contractor accounting pertains to the financial management practices adopted by renovation professionals and contracting firms. It involves tracking project-specific revenues, expenses, and profit margins, as well as managing subcontractor payments, invoicing, and financial reporting. Contractor accounting plays a crucial role in ensuring the financial health and sustainability of renovation businesses, fostering profitability and operational efficiency.

Each type of home improvement accounting serves as a valuable tool for managing the financial intricacies of renovation projects, offering insights and control over budgeting, cost management, asset utilization, and revenue optimization. By leveraging the appropriate accounting practices, homeowners and renovation professionals can navigate the financial landscape of home improvement with precision and strategic acumen.

Key Components of Home Improvement Accounting

Home improvement accounting comprises several essential components that form the foundation of sound financial management within the context of renovation projects. Understanding these key components is instrumental in establishing robust accounting practices tailored to the unique dynamics of home enhancement endeavors. Let’s explore the fundamental components of home improvement accounting:

- Budget Development and Monitoring: The process of creating a comprehensive budget tailored to the specific requirements of a home improvement project is a critical component of home improvement accounting. This involves estimating costs, allocating funds to different project aspects, and continuously monitoring expenditures to ensure adherence to the established budgetary constraints.

- Expense Tracking and Categorization: Accurate and detailed tracking of expenses related to materials, labor, permits, and other project costs is essential for effective home improvement accounting. Expenses should be categorized and documented systematically to provide clarity on where the funds are being allocated and to identify areas for potential cost optimization.

- Revenue and Income Management: Managing project-related revenue, income, and cash flow is a vital aspect of home improvement accounting. This includes tracking payments from clients, managing invoicing and receivables, and ensuring timely income recognition to maintain healthy project cash flow.

- Financial Reporting and Analysis: Generating regular financial reports and conducting in-depth analysis of financial data are integral components of home improvement accounting. These reports provide insights into project profitability, cost efficiencies, and overall financial performance, enabling stakeholders to make informed decisions and adjustments as needed.

- Compliance and Tax Management: Ensuring compliance with tax regulations, documenting tax-deductible expenses, and managing tax obligations are crucial components of home improvement accounting. Adhering to tax requirements and maintaining accurate records of tax-related transactions is essential for financial transparency and regulatory compliance.

- Risk Assessment and Mitigation: Assessing financial risks associated with home improvement projects and implementing strategies to mitigate these risks form an integral part of home improvement accounting. This includes identifying potential cost overruns, supply chain disruptions, and other financial risks, and developing contingency plans to address these challenges proactively.

By integrating these key components into their accounting practices, homeowners, contractors, and renovation professionals can establish a solid financial framework that supports effective budgeting, expense management, revenue optimization, and regulatory compliance within the context of home improvement projects.

Keep detailed records of all expenses and income related to home improvement projects. Use accounting software to track costs, manage budgets, and analyze the financial performance of each project.

Common Challenges in Home Improvement Accounting

While home improvement accounting is essential for effective financial management in renovation projects, it is not without its challenges. Understanding and addressing these common challenges is crucial for maintaining financial stability and ensuring the success of home enhancement endeavors. Let’s explore some of the prevalent challenges encountered in home improvement accounting:

- Complex Cost Structures: Home improvement projects often involve complex cost structures, including material costs, labor expenses, subcontractor fees, and overhead expenditures. Managing and categorizing these diverse costs can pose challenges in accurate expense tracking and cost allocation.

- Variable Project Timelines: The unpredictable nature of renovation timelines can complicate accounting processes, as expenses and revenues may fluctuate based on project progress. Adapting accounting practices to accommodate variable project timelines and cash flow fluctuations is essential for accurate financial management.

- Regulatory Compliance: Navigating the regulatory landscape, including building codes, permits, and tax obligations, presents a significant challenge in home improvement accounting. Ensuring compliance with diverse regulations and documentation requirements demands meticulous attention to detail and a thorough understanding of relevant legal and financial frameworks.

- Cash Flow Management: Maintaining healthy project cash flow amidst fluctuating expenses and income streams is a common challenge in home improvement accounting. Balancing cash inflows and outflows, managing receivables, and optimizing payment schedules are essential for sustaining project momentum and financial stability.

- Resource Allocation: Optimizing the allocation of resources, such as materials and labor, while adhering to budgetary constraints can be a daunting challenge in home improvement accounting. Efficiently managing resource procurement, minimizing waste, and maximizing resource utilization require strategic planning and meticulous execution.

- Project Scope Changes: Adaptation to evolving project scopes and client preferences can impact accounting processes, as changes may necessitate adjustments in budgeting, expense tracking, and financial reporting. Flexibility in accounting practices is essential to accommodate dynamic project requirements.

Addressing these common challenges requires a proactive and adaptive approach to home improvement accounting. By leveraging robust accounting tools, maintaining meticulous records, and staying attuned to the dynamic nature of renovation projects, stakeholders can navigate these challenges effectively, fostering financial stability and project success.

Read more: What Is A Home Improvement

Best Practices in Home Improvement Accounting

Implementing best practices in home improvement accounting is essential for fostering financial discipline, optimizing resource utilization, and ensuring the fiscal viability of renovation projects. By embracing proven accounting methodologies tailored to the unique dynamics of home enhancement endeavors, stakeholders can navigate the financial landscape with precision and strategic acumen. Let’s explore some key best practices in home improvement accounting:

- Comprehensive Budgeting: Develop detailed and realistic budgets for each home improvement project, considering all relevant expenses, contingencies, and potential scope changes. Regularly monitor budget performance and make adjustments as needed to maintain financial discipline.

- Accurate Expense Tracking: Maintain meticulous records of all project-related expenses, categorizing costs effectively to gain insights into the allocation of funds across different aspects of the renovation. Utilize accounting software or tools to streamline expense tracking and ensure accuracy.

- Timely Invoicing and Receivables Management: Implement efficient invoicing processes to ensure timely recognition of project income. Proactively manage receivables and follow up on outstanding payments to maintain healthy project cash flow.

- Regular Financial Reporting: Generate regular financial reports to analyze project performance, profitability, and cost efficiencies. Utilize financial analysis to make data-driven decisions and identify areas for improvement.

- Adherence to Regulatory Requirements: Stay informed about relevant building codes, permits, and tax obligations, ensuring strict compliance with regulatory and legal frameworks. Maintain accurate documentation to support regulatory compliance and minimize the risk of penalties or delays.

- Transparent Communication: Foster open communication with clients, subcontractors, and project stakeholders regarding financial aspects of the renovation. Transparent communication builds trust and facilitates collaborative decision-making.

- Risk Management and Contingency Planning: Identify potential financial risks associated with the project and develop contingency plans to mitigate these risks. Proactively address challenges such as cost overruns, supply chain disruptions, and scope changes.

- Utilization of Accounting Software: Leverage specialized accounting software tailored to construction and home improvement projects to streamline financial management processes, automate tasks, and enhance accuracy and efficiency.

By embracing these best practices, stakeholders involved in home improvement projects can establish a robust financial framework that supports effective budgeting, expense management, revenue optimization, and regulatory compliance. Implementing these practices fosters financial stability, mitigates risks, and enhances the overall success and sustainability of residential renovation endeavors.

Conclusion

Home improvement accounting serves as the cornerstone of financial management in the dynamic realm of residential renovation and enhancement. By navigating the intricacies of budgeting, expense tracking, revenue management, and regulatory compliance, stakeholders can foster financial stability, optimize resource utilization, and ensure the success and sustainability of home improvement projects. As homeowners, contractors, and renovation professionals embark on the journey of transforming living spaces, embracing the best practices and principles of home improvement accounting is essential for making informed financial decisions and achieving desired outcomes within budgetary constraints.

From comprehensive budget development to accurate expense tracking, from transparent communication to proactive risk management, the integration of robust accounting practices tailored to the unique dynamics of home improvement projects empowers stakeholders to navigate the financial landscape with precision and strategic acumen. By leveraging specialized accounting software, staying attuned to regulatory requirements, and fostering transparent communication, individuals and professionals involved in renovation endeavors can establish a solid financial framework that supports effective budgeting, expense management, revenue optimization, and regulatory compliance.

While challenges such as complex cost structures, variable project timelines, and regulatory compliance may present hurdles in home improvement accounting, proactive adaptation, meticulous record-keeping, and strategic planning enable stakeholders to navigate these challenges effectively, fostering financial stability and project success. By integrating the key components of home improvement accounting, understanding the types of specialized accounting approaches, and embracing best practices, stakeholders can embark on home improvement projects with confidence, financial acumen, and a clear roadmap for success.

As the art of home enhancement continues to evolve, home improvement accounting remains a steadfast compass, guiding stakeholders through the financial intricacies of renovation, empowering them to achieve their vision for transformed living spaces while maintaining fiscal discipline and sustainability.

Frequently Asked Questions about What Is Home Improvement Accounting

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “What Is Home Improvement Accounting”