Home>Renovation & DIY>Home Renovation Guides>What Kind Of Home Improvement Can I Claim On My Taxes

Home Renovation Guides

What Kind Of Home Improvement Can I Claim On My Taxes

Published: December 22, 2023

Learn about the tax benefits of home improvement projects and find out which renovations you can claim on your taxes with our comprehensive home renovation guides. Discover how to maximize your tax savings today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Embarking on home improvement projects not only enhances the aesthetic appeal and functionality of your living space but can also yield potential tax benefits. Understanding the nuances of home improvement tax deductions can empower homeowners to make informed decisions and optimize their financial strategies. By delving into the eligibility criteria for claiming such deductions and the specific expenses that qualify, you can leverage these insights to maximize your tax benefits while investing in your home.

Navigating the realm of tax deductions for home improvements requires a comprehensive understanding of the permissible expenses and the proper procedures for claiming them. This guide aims to demystify the intricacies of home improvement tax deductions, shedding light on eligible and ineligible expenses, and providing clarity on the process of claiming these deductions on your taxes. Whether you're contemplating a renovation, remodeling, or repair project, grasping the tax implications can significantly impact your financial outlook and overall investment strategy.

Let's delve into the realm of home improvement tax deductions, unraveling the potential financial advantages that await homeowners who embark on these transformative endeavors. Understanding the tax implications of home improvements can empower you to make informed decisions, optimize your budget, and ultimately enhance the value and comfort of your living space.

Key Takeaways:

- Home improvements like energy-efficient upgrades and accessibility modifications can potentially qualify for tax deductions, reducing the financial burden and enhancing your living space.

- Keep detailed records, understand eligibility criteria, and seek professional guidance to maximize potential tax benefits when claiming home improvement expenses on your taxes.

Understanding Home Improvement Tax Deductions

Home improvement tax deductions are designed to provide homeowners with financial incentives for investing in the enhancement, maintenance, and energy efficiency of their properties. These deductions can potentially offset the costs associated with qualifying home improvement expenses, thereby reducing the homeowner’s taxable income and overall tax liability. By leveraging these deductions, homeowners can mitigate the financial burden of renovation projects and foster a more favorable environment for property investment.

It’s essential to recognize that home improvement tax deductions are subject to specific eligibility criteria and limitations. Understanding the nuances of these deductions is crucial for maximizing their potential benefits while ensuring compliance with tax regulations.

When contemplating home improvement projects, it’s prudent to consider the tax implications of your endeavors. By aligning your renovation plans with the criteria for eligible expenses, you can strategically leverage tax deductions to optimize your financial outcomes. Whether you’re enhancing your property’s energy efficiency, making structural improvements, or undertaking repairs, being cognizant of the tax implications can inform your decision-making process and financial planning.

By gaining a comprehensive understanding of home improvement tax deductions, homeowners can navigate the complexities of tax regulations and capitalize on opportunities to minimize their tax burden. This knowledge empowers individuals to make informed choices regarding home improvements, ensuring that their investments yield not only aesthetic and functional enhancements but also potential tax advantages.

As we delve deeper into the realm of home improvement tax deductions, we’ll explore the specific expenses that qualify for deductions, as well as those that are ineligible. By discerning the distinction between eligible and ineligible expenses, homeowners can confidently pursue their renovation and maintenance projects while optimizing their tax strategies.

Eligible Home Improvement Expenses

When it comes to home improvement tax deductions, certain expenses are deemed eligible for potential tax benefits. Understanding which costs qualify for deductions is paramount for homeowners seeking to leverage these financial incentives. Eligible home improvement expenses typically encompass a range of projects and upgrades that contribute to the property’s improvement, energy efficiency, and maintenance.

1. Energy-Efficient Upgrades: Expenses incurred for installing energy-efficient systems, such as solar panels, energy-efficient windows, doors, and insulation, may qualify for tax deductions. These upgrades not only contribute to environmental sustainability but also offer homeowners the potential for substantial tax benefits.

2. Home Accessibility Modifications: Renovations aimed at enhancing home accessibility for individuals with disabilities, such as installing wheelchair ramps, widening doorways, and modifying bathrooms, may be eligible for tax deductions. These modifications contribute to the safety and comfort of the home while potentially yielding tax advantages for the homeowner.

3. Home Office Renovations: Expenses related to renovating or improving a home office space, provided it is used exclusively and regularly for business purposes, may qualify for tax deductions. This includes costs associated with structural modifications, insulation, and utilities directly attributable to the home office.

4. Repairs and Maintenance: Certain repair and maintenance expenses, such as fixing a leaky roof, repairing plumbing, or maintaining the HVAC system, may be eligible for tax deductions if they contribute to the overall improvement and preservation of the property.

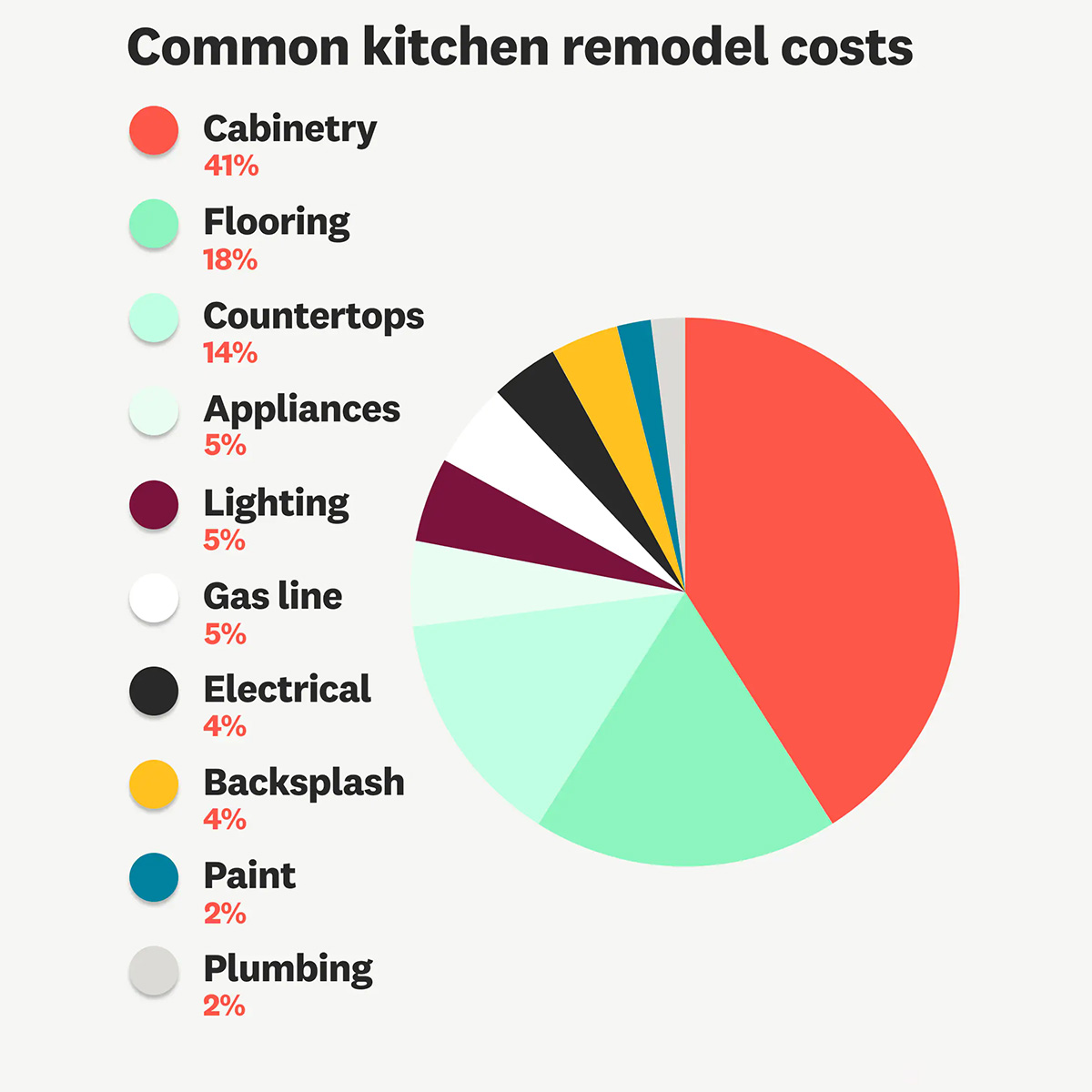

5. Capital Improvements: Investments in significant improvements that increase the value of the property, such as adding a room, remodeling a kitchen, or installing a swimming pool, may potentially qualify for tax benefits. It’s important to differentiate capital improvements from regular repairs and maintenance, as the former may offer tax advantages while the latter typically does not.

Understanding the spectrum of eligible home improvement expenses empowers homeowners to strategically plan and execute their renovation projects while capitalizing on potential tax benefits. By aligning their home improvement endeavors with the criteria for eligible expenses, homeowners can optimize their financial outcomes and foster a more rewarding investment experience.

You can typically claim home improvements that increase the energy efficiency of your home, such as installing solar panels or energy-efficient windows. Always consult a tax professional for specific advice.

Ineligible Home Improvement Expenses

While there are numerous eligible home improvement expenses that may qualify for tax deductions, it’s equally important to recognize the expenses that do not meet the criteria for such benefits. Understanding which costs are deemed ineligible for tax deductions can help homeowners navigate their renovation projects with clarity and financial prudence.

1. Normal Repairs and Maintenance: Routine repairs and maintenance, such as painting, fixing minor leaks, and replacing broken fixtures, typically do not qualify for tax deductions. While these upkeep activities are essential for property maintenance, they are not considered eligible expenses for tax benefits.

2. Cosmetic Enhancements: Expenses related to purely cosmetic enhancements, such as redecorating, landscaping for aesthetic purposes, or installing luxury amenities, are generally ineligible for tax deductions. While these improvements contribute to the visual appeal of the property, they do not typically align with the criteria for tax-deductible expenses.

3. Home Improvement for Rental Properties: Renovations and improvements made to a property that is used for rental purposes may not qualify for tax deductions in the same manner as those made to a primary residence. The tax treatment of home improvements for rental properties is subject to distinct regulations and considerations.

4. Expenses Incurred for Personal Use Portion of the Property: If a home improvement project encompasses an area of the property used for both personal and business purposes, the expenses attributed to the personal use portion may not be eligible for tax deductions. It’s crucial to differentiate between the business-related and personal-use components of the property to determine the tax-deductible portion of the expenses.

5. Improvements Not Adding to Property Value: Certain improvements that do not substantially increase the property’s value or contribute to its long-term enhancement may not qualify for tax deductions. It’s important to discern between investments that yield enduring benefits for the property and those that are purely superficial or fleeting in nature.

By understanding the categories of ineligible home improvement expenses, homeowners can make informed decisions regarding their renovation projects while managing their financial expectations. While these expenses may not yield tax benefits, they remain integral to the overall maintenance and enjoyment of the property, contributing to its long-term appeal and functionality.

How to Claim Home Improvement Expenses on Your Taxes

Claiming home improvement expenses on your taxes involves a systematic approach to ensure compliance with tax regulations and maximize the potential benefits of eligible expenses. By following the appropriate procedures and documentation requirements, homeowners can navigate the process of claiming these expenses with confidence and precision.

1. Maintain Detailed Records: Keeping meticulous records of all expenses related to home improvements is paramount. This includes invoices, receipts, contracts, and any documentation substantiating the costs incurred. Organizing and retaining these records is essential for accurately reporting the expenses when filing your taxes.

2. Determine Eligibility of Expenses: It’s crucial to discern which home improvement expenses qualify for tax deductions based on the specific criteria outlined by the tax authorities. Consulting with a tax professional or utilizing reliable resources can help homeowners ascertain the eligibility of their expenses and make informed decisions regarding the deductibility of each cost.

3. Understand Tax Deduction Limits: Familiarize yourself with the limitations and restrictions associated with home improvement tax deductions. Certain expenses may be subject to maximum deduction limits or phased-out benefits based on your income level. Being cognizant of these constraints can inform your tax planning and financial projections.

4. Utilize Applicable Tax Forms: When filing your taxes, ensure that you utilize the appropriate tax forms and schedules for reporting home improvement expenses. Depending on the nature of the expenses and the type of deduction sought, specific forms, such as Schedule A (Form 1040) for itemized deductions, may be required to accurately report these costs.

5. Seek Professional Guidance: Given the complexities of tax regulations and the nuances of home improvement deductions, seeking guidance from a qualified tax professional can provide invaluable support. A tax advisor can offer personalized insights, optimize your tax strategy, and ensure compliance with the latest tax laws and regulations.

6. Review Applicable Tax Credits: In addition to deductions, explore potential tax credits related to energy-efficient home improvements and renewable energy installations. Certain upgrades, such as solar panels and energy-efficient HVAC systems, may qualify for tax credits, offering a dollar-for-dollar reduction in your tax liability.

By adhering to these guidelines and best practices, homeowners can streamline the process of claiming home improvement expenses on their taxes while maximizing the potential tax benefits. Navigating the complexities of tax deductions for home improvements requires diligence, attention to detail, and a proactive approach to tax planning and compliance.

Conclusion

Embarking on home improvement projects presents an opportunity for homeowners to not only enhance their living environment but also potentially benefit from tax incentives. By understanding the intricacies of home improvement tax deductions, individuals can strategically plan their renovation endeavors, optimize their financial outcomes, and foster a more rewarding investment experience.

Grasping the distinction between eligible and ineligible home improvement expenses is essential for making informed decisions and aligning renovation projects with the criteria for potential tax benefits. From energy-efficient upgrades and accessibility modifications to home office renovations and capital improvements, the spectrum of eligible expenses offers homeowners a pathway to leverage tax deductions while investing in their properties.

Conversely, recognizing the expenses that do not qualify for tax deductions, such as routine maintenance, cosmetic enhancements, and improvements for rental properties, provides clarity and financial prudence in navigating home improvement projects.

When it comes to claiming home improvement expenses on your taxes, meticulous record-keeping, a thorough understanding of eligibility criteria, and compliance with tax regulations are paramount. By maintaining detailed records, discerning the deductibility of expenses, and seeking professional guidance when necessary, homeowners can navigate the process with precision and confidence.

Ultimately, the intersection of home improvements and tax deductions underscores the broader significance of strategic financial planning and prudent investment decisions. By leveraging the potential tax benefits of eligible home improvement expenses, homeowners can optimize their financial well-being, enhance the value of their properties, and contribute to a more sustainable and comfortable living environment.

As you embark on your home improvement journey, consider the multifaceted rewards that extend beyond the aesthetic and functional enhancements. With a keen understanding of home improvement tax deductions, you can infuse your renovation projects with financial prudence, long-term value, and the potential for tax advantages, ultimately enriching your homeownership experience.

Frequently Asked Questions about What Kind Of Home Improvement Can I Claim On My Taxes

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “What Kind Of Home Improvement Can I Claim On My Taxes”