Articles

How To Store Money At Home

Modified: January 18, 2024

Discover effective articles on how to store money safely at home. Find tips, tricks, and expert advice to keep your cash secure.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Protecting our financial assets is a top priority for many individuals. While most people trust banks and other financial institutions to keep their money safe, some prefer the peace of mind of having cash readily available at home. Storing money at home can provide a sense of security and convenience, but it also comes with certain risks and considerations.

In this article, we will explore the various aspects of storing money at home, including safety considerations, choosing a secure location, investing in a safe, dividing and hiding your cash, utilizing home security systems, and alternatives to storing cash at home.

It is important to note that storing large sums of money at home may not be advisable for everyone. The inherent risks, such as theft, fire, and damage, should be carefully evaluated. It is always recommended to consult with a financial advisor before making any decisions regarding the storage of your money.

Now, let’s dive deeper into the world of storing money at home, and learn how to ensure its safety and security.

Key Takeaways:

- Storing money at home requires careful consideration of safety, location, and security measures. It’s essential to prioritize protection while finding a method that suits individual needs and goals.

- While home storage offers convenience, alternative options like bank accounts, investments, and digital wallets provide secure and potentially more beneficial ways to manage and grow your money. Regular review and updates are crucial.

Read more: How To Store Money In A Safe

Safety Considerations

When it comes to storing money at home, safety should be your top priority. Here are some important safety considerations to keep in mind:

- Secrecy: Keep your decision to store money at home private. Avoid discussing it with others or sharing the information with anyone outside your immediate family.

- Amount: Consider how much money you plan to store at home. Storing large sums of cash increases the risk of theft and other safety hazards. It is advisable to keep only a reasonable amount of cash on hand for immediate needs.

- Legal restrictions: Check local laws and regulations regarding the amount of cash you are legally allowed to store at home. Some jurisdictions may have limitations or reporting requirements for large cash holdings.

- Insurance: Review your homeowner’s or renter’s insurance policy to understand the coverage it provides for cash stored at home. You may need to purchase additional coverage to protect your money adequately.

- Regular inspection: Regularly inspect your storage area and take note of any security vulnerabilities. Look for signs of damage, potential entry points, or weak spots that could compromise the safety of your money.

By considering these safety factors and taking necessary precautions, you can minimize the risks associated with storing money at home and ensure the protection of your financial assets.

Choosing a Secure Location

When it comes to storing money at home, selecting the right location is crucial for ensuring its safety. Here are some tips for choosing a secure location:

- Hidden and inconspicuous: Choose a location that is hidden and not easily noticeable. Avoid obvious places like bedroom drawers or closets. Consider more unconventional spots, such as a disguised safe or a secret compartment.

- Secure room: If possible, dedicate a secure room for storing your money. This could be a home office, a walk-in closet, or a basement. Ensure that the room has a lockable door and proper security measures in place.

- Fireproof and waterproof: Opt for a location that is fireproof and waterproof to protect your cash from potential disasters. Look for safes or storage boxes that offer these features.

- Access control: Consider adding an extra layer of security with access control measures, such as a combination lock, biometric authentication, or even a hidden keypad.

- Avoid common areas: Avoid storing money in areas that are commonly targeted by thieves, such as master bedrooms or living room areas. Instead, choose less predictable spaces.

It’s essential to choose a location that fits your specific needs and provides maximum security for storing your money at home. Remember, the goal is to make it as difficult as possible for potential thieves to discover and access your cash.

Investing in a Safe

One of the most effective ways to secure your money at home is by investing in a reliable and high-quality safe. Here are some factors to consider when choosing a safe:

- Type of safe: Determine the type of safe that best suits your needs. There are various options available, including floor safes, wall safes, and portable safes. Consider the size, weight, and installation requirements of each type.

- Security features: Look for safes with advanced security features, such as burglary-resistant construction, heavy-duty locks, and reinforced hinges. Ideally, choose a safe that is certified to meet industry standards for security, such as Underwriters Laboratories (UL) ratings.

- Fire protection: Opt for a safe with fire-resistant properties. Safes with fire ratings will provide a specified level of protection against fire and heat. Look for safes that have been tested and certified to meet fire protection standards.

- Size and capacity: Consider the size and capacity of the safe based on the amount of cash you plan to store. Ensure that the safe has enough room for your cash as well as any other valuables you may want to secure.

- Placement: Choose a secure and discreet location to install the safe. Ensure that it is properly bolted down or secured to prevent easy removal by potential thieves.

Investing in a high-quality safe is a worthwhile investment for protecting your money at home. Remember to regularly maintain and inspect the safe to ensure its continued functionality and security.

Consider using a fireproof and waterproof safe to store money at home. Place the safe in a secure, hidden location and avoid telling others about its existence.

Dividing and Hiding Your Cash

Dividing and hiding your cash can add an extra layer of security when storing money at home. Here are some strategies to consider:

- Divide into smaller amounts: Rather than storing all your cash in one place, divide it into smaller amounts and distribute it across different hiding spots. This way, even if one hiding spot is compromised, you won’t lose all your money.

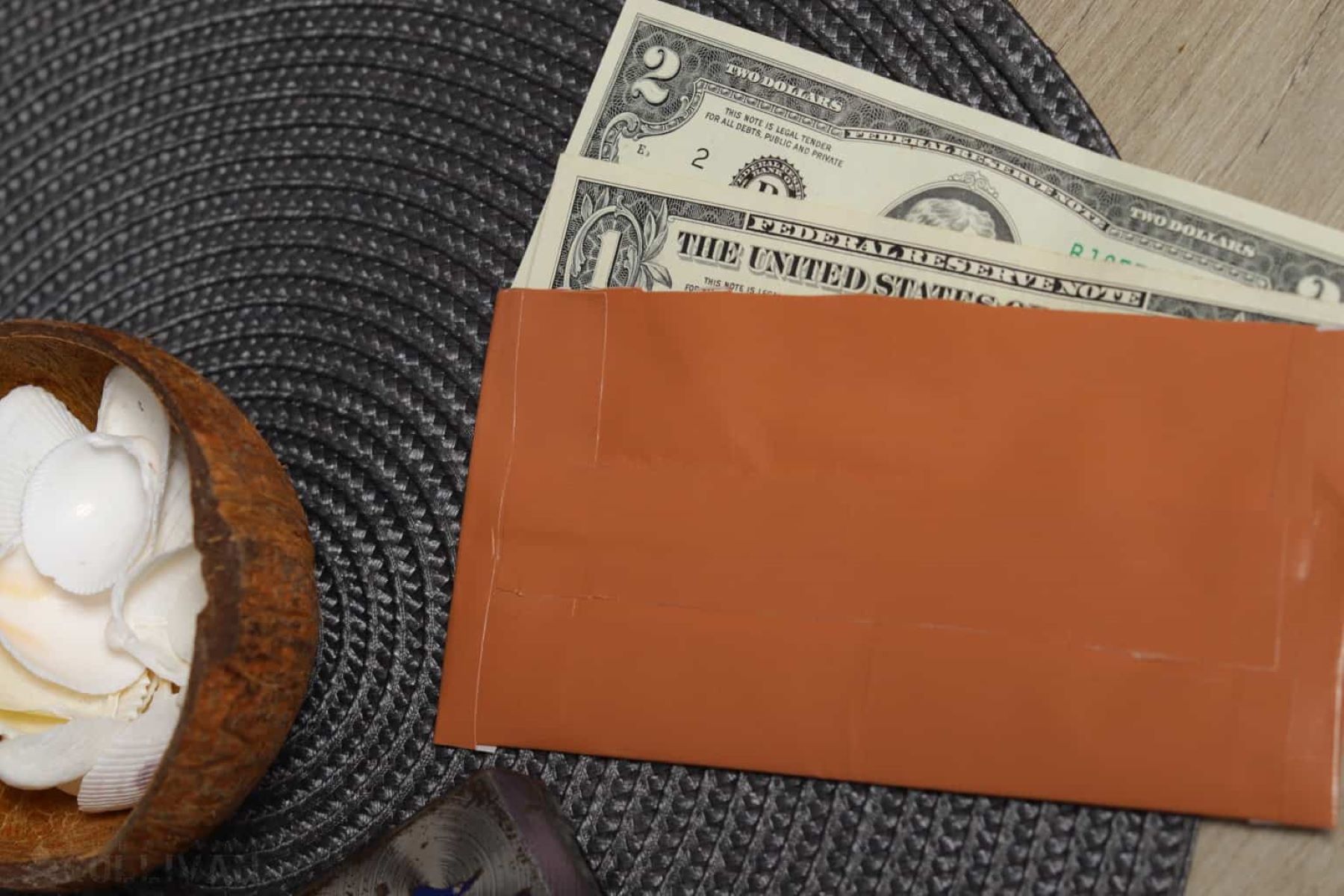

- Use decoy items: Consider using decoy items or false containers to divert attention from your cash. For example, you could place some cash in a well-marked envelope or a container disguised as something mundane.

- Utilize everyday objects: Hide your cash within ordinary objects that won’t draw suspicion. This could include books with secret compartments, hollowed-out household items, or even inside a carefully sealed food container in the pantry.

- Camouflage: Blend your hiding spots with their surroundings to make them less noticeable. For example, store cash in a well-sealed envelope in a stack of papers or in a locked cash box inside an inconspicuous drawer.

- Remember your hiding spots: Make sure you remember the locations of your hidden cash. Keep a record or create a mental map to avoid forgetting where you’ve hidden your money.

By dividing and hiding your cash effectively, you can minimize the risk of losing all your money in the event of theft or other unfortunate circumstances.

Read more: How To Get Money For Home Improvement

Using Home Security Systems

Implementing a reliable home security system can provide an extra layer of protection when storing money at home. Here are some components and features to consider:

- Alarm system: Install a robust alarm system that includes sensors on doors and windows. This will alert you and potentially scare off intruders if any unauthorized access is detected.

- Surveillance cameras: Set up surveillance cameras around your property, focusing on points of entry and areas where you store your money. They can act as a deterrent and provide valuable evidence in the event of a break-in.

- Motion sensors: Utilize motion sensors inside your home, especially in areas where your money is stored. These sensors can detect any movement and trigger an alarm if necessary.

- Smart home technology: Consider integrating your security system with smart home technology. This allows you to monitor and control your security system remotely through your smartphone, providing real-time alerts and access to video feeds.

- 24/7 monitoring: Subscribe to a professional monitoring service that provides round-the-clock surveillance of your home. In case of an alarm trigger, the monitoring service will alert local authorities, ensuring a swift response.

Remember to regularly test and maintain your security system to ensure its optimal functionality. Additionally, display signs or stickers indicating that your home is protected by a security system, as this can serve as a deterrent to potential thieves.

While a home security system cannot guarantee complete security, it acts as a valuable deterrent and aids in providing peace of mind when it comes to storing money at home.

Alternatives to Storing Cash at Home

While storing cash at home may provide a sense of control and accessibility, there are alternative options to consider. Here are some alternatives to storing cash at home:

- Bank accounts: Utilize bank accounts to securely store your money. Banks offer various types of accounts, such as checking and savings accounts, which provide a safe and regulated environment for your funds. Additionally, you can earn interest on your savings and enjoy the convenience of online banking.

- Certificates of deposit (CDs): Consider investing your money in CDs, which are time deposits offered by banks. CDs offer a fixed interest rate over a specific period, providing a safe and potentially higher return on your funds compared to traditional savings accounts.

- Investments: Explore investment opportunities such as stocks, bonds, or mutual funds. While these carry a level of risk, they offer the potential for long-term growth and income. Consult with a financial advisor to determine the best investment options for your financial goals.

- Digital wallets: Embrace digital payment platforms and digital wallets, which provide secure storage and accessibility for your money. These platforms offer encryption and other security measures to protect your funds, and you can easily make online purchases or transfer money.

- Safe deposit boxes: Rent a safe deposit box at your local bank to securely store important documents and valuable items. While it may not be suitable for large amounts of cash, it provides an added layer of protection against theft, fire, or other hazards.

Consider the advantages and disadvantages of each alternative and choose the option that aligns with your financial goals, risk tolerance, and convenience.

Remember to regularly review and evaluate your financial strategies to ensure your money is working for you and being stored in the most secure and appropriate manner.

Conclusion

Storing money at home can offer a sense of security and convenience, but it is crucial to approach it with caution and take necessary precautions. By considering safety considerations, choosing a secure location, investing in a safe, dividing and hiding your cash, and utilizing home security systems, you can enhance the safety and protection of your stored money.

However, it is essential to recognize that storing large sums of cash at home may not be suitable or advisable for everyone. The risks of theft, fire, and other hazards should be carefully evaluated, and it is recommended to consult with a financial advisor before making any decisions.

Additionally, alternative options such as bank accounts, certificates of deposit, investments, digital wallets, and safe deposit boxes provide secure alternatives for storing and growing your money. Consider the advantages and disadvantages of each option to make an informed decision.

Ultimately, the key is to prioritize safety and security while finding a storage method that aligns with your individual needs and goals. Regularly review and update your strategies to ensure your money is protected and working for you.

Remember, protecting your financial assets is a continuous effort, and staying proactive is paramount to safeguarding your hard-earned money.

Frequently Asked Questions about How To Store Money At Home

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Store Money At Home”