Articles

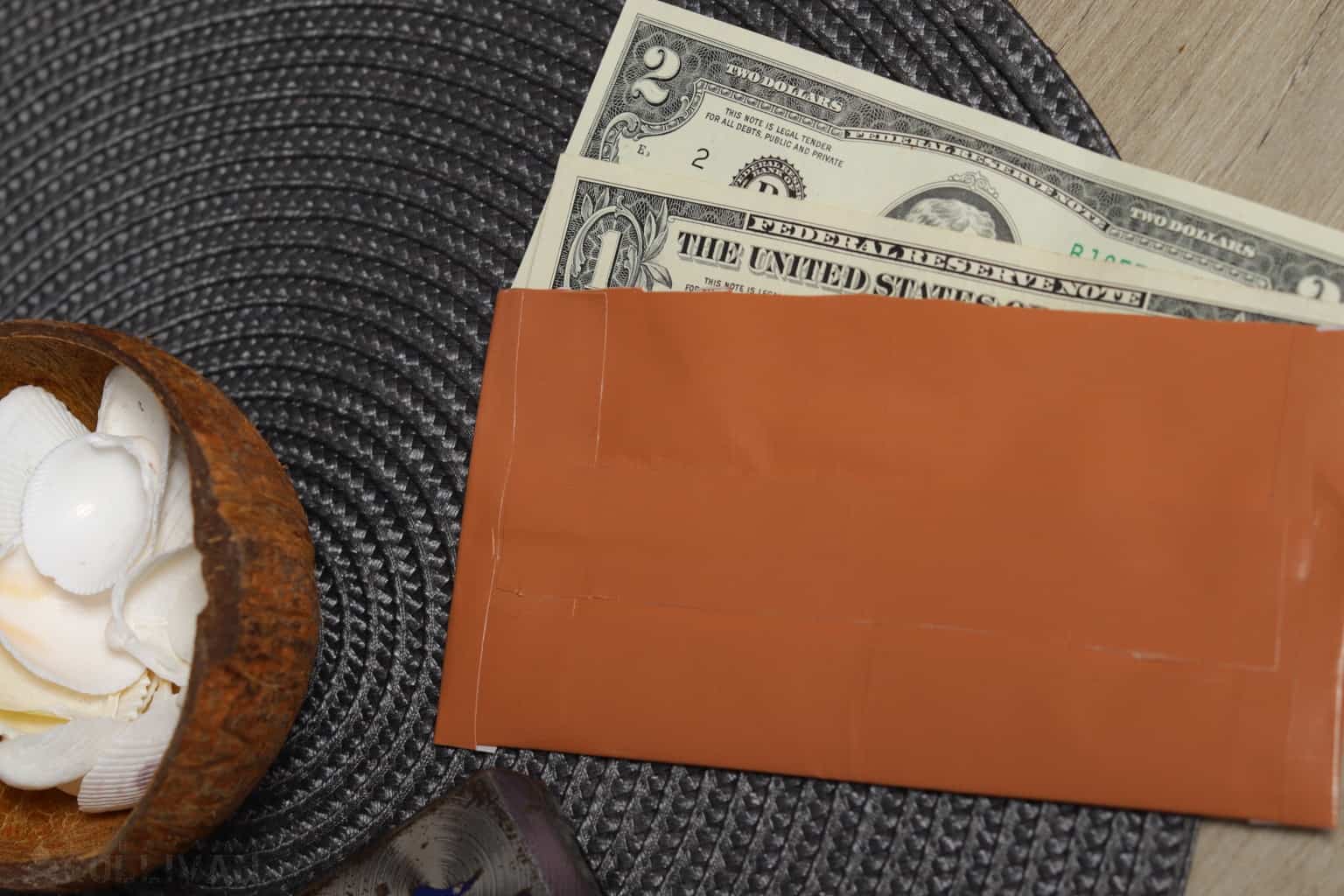

How To Store Cash

Modified: January 20, 2024

Learn effective methods for storing cash securely with our informative articles. Discover tips and techniques to protect your money and ensure its safety.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of cash storage! Whether you’re looking for a safe and convenient way to store your savings at home, keep your money secure while traveling, or simply need a reliable solution for keeping your emergency cash accessible, this article will guide you through the process of cash storage.

Having a reliable method for storing your cash is essential in today’s fast-paced world. While digital payment methods are gaining popularity, cash still holds its value and is widely used for various transactions. However, it’s important to ensure that your cash is stored safely to prevent loss or theft.

In this article, we will explore different cash storage options, discuss the importance of safety considerations, and provide tips and guidelines for storing cash in various scenarios.

So, whether you’re a homeowner looking for the best way to safeguard your cash, a frequent traveler who wants to keep your money secure while on-the-go, or someone who wants to explore off-site cash storage options, read on to discover the best strategies for storing cash.

Key Takeaways:

- Prioritize safety and privacy when storing cash at home or while traveling. Choose secure containers, split storage locations, and be discreet to protect your funds from loss or theft.

- Consider off-site storage options like safe deposit boxes or private vaults for added security. When traveling, use concealment accessories and hotel safes to keep your cash secure and accessible.

Read more: How To Store Cash At Home

Importance of Cash Storage

Ensuring the safety and security of your cash is crucial for multiple reasons. Whether you have a stash of emergency funds, savings for future purchases, or simply want to keep your day-to-day cash secure, understanding the importance of proper cash storage is essential.

First and foremost, cash is a physical form of currency that holds tangible value. Unlike digital transactions, which can sometimes be reversed or disputed, once cash is lost or stolen, it’s gone for good. Therefore, having a reliable system in place to store your cash is vital to prevent any potential loss.

Cash storage is especially important in the event of emergencies. Having a designated cash reserve at home can be a lifesaver during natural disasters, power outages, or other unforeseen circumstances where electronic payment methods may not be accessible. It provides a sense of security, knowing you have immediate access to funds when needed.

Another key reason for cash storage is privacy. While banking systems offer convenient ways to manage and track your money, there may be times when you prefer to keep your financial transactions discreet. By storing cash securely at home or using off-site storage options, you have more control over your privacy and financial matters.

Furthermore, keeping significant amounts of cash in plain sight or in loosely secured locations can make you vulnerable to theft. Cash is a tempting target for burglars, and without proper storage measures, you run the risk of becoming a victim of theft. Taking the necessary precautions to store your cash securely can help deter potential thieves and protect your hard-earned money.

Lastly, efficient cash storage ensures easy access and organization. When you have a designated place for your cash, whether it’s at home or through a third-party service, you can quickly retrieve and manage your funds. This saves time and eliminates the stress of searching for misplaced cash or dealing with disorganized financial matters.

Overall, understanding the importance of cash storage allows you to protect your money, maintain privacy, and ensure preparedness for emergencies. By implementing the right cash storage solutions, you can have peace of mind knowing that your funds are secure and easily accessible when you need them.

Safety Considerations

When it comes to cash storage, prioritizing safety is of utmost importance. Following these safety considerations will help safeguard your money and minimize the risk of loss or theft.

1. Secure Storage Location: Choose a secure and inconspicuous location to store your cash. Consider using a locked drawer or cabinet that is not easily accessible to others. Avoid storing cash in obvious places such as under your mattress or in your sock drawer, as these are common targets for thieves.

2. Concealment: Keep your cash out of sight by using a concealment device or container. There are various options available, such as diversion safes that look like ordinary household items or specially designed cash storage containers that blend in with other belongings.

3. Avoid Overexposure: Limit the number of people who are aware of your cash storage arrangements. Sharing this information can increase the risk of theft or unauthorized access. Only disclose this information to individuals you trust implicitly.

4. Regular Auditing: Periodically audit your cash storage to ensure that the amount is accurate and accounted for. This will help identify any discrepancies or potential issues early on.

5. Diversify Storage Locations: Consider splitting your cash storage across multiple locations. For example, you might keep a portion of your cash at home and store the rest in a safe deposit box or with a reputable off-site storage provider. By diversifying your storage locations, you reduce the risk of losing all your cash in a single event.

6. Use Depository Institutions: Consider utilizing the services of established financial institutions such as banks or credit unions. They offer secure options for cash storage, including safe deposit boxes. These boxes are typically located within the bank vault and offer an added layer of protection against theft and damage.

7. Insure Your Cash: Depending on the amount of cash you have, it may be worth considering cash insurance. This can protect you against loss and theft, providing financial compensation in the event of an unforeseen incident. Be sure to check with your insurance provider for details on coverage and options available.

8. Be Cautious with Sharing: Be mindful of who you share information about your cash storage with. Avoid discussing it openly in public or on social media platforms. Remember that the fewer people who know about your cash storage arrangements, the lower the risk of it falling into the wrong hands.

By following these safety considerations, you can significantly reduce the risk of theft or loss of your cash. Remember, it’s better to be proactive and take precautionary measures than to face the consequences of inadequate cash storage practices.

Choosing the Right Cash Storage Container

When it comes to cash storage, having the right container is essential for ensuring security and easy access to your funds. Here are some factors to consider when choosing the right cash storage container:

1. Size and Capacity: Determine the amount of cash you need to store and choose a container that can accommodate it. Consider both the physical dimensions and the capacity in terms of volume or weight. Remember to consider potential future needs to ensure that the container can grow with your cash storage requirements.

2. Durability: Look for a cash storage container that is made of strong and durable materials. Opt for containers made of metal, such as steel, as they offer better protection against forced entry and damage. Avoid containers that are easily breakable or can be easily tampered with.

3. Locking Mechanism: Ensure that the cash storage container has a robust locking mechanism. Look for containers that feature advanced lock systems like combination locks, digital locks, or biometric locks for added security. The locking mechanism should be resistant to picking or tampering.

4. Portability: Consider whether you need a portable cash storage container. If you plan to travel frequently, having a container that is lightweight and easy to transport will be beneficial. Look for options with features like carrying handles or straps for added convenience.

5. Concealment Features: If you prefer an extra layer of security, consider containers that offer concealment features. Some containers are designed to look like everyday objects, such as books, cans, or household items. These hidden compartments provide an added level of discretion and make it difficult for thieves to identify your cash storage.

6. Fire and Water Resistance: It’s important to protect your cash from potential hazards like fires and water damage. Look for cash storage containers that have fire-resistant and waterproof features. These containers will help safeguard your cash in the event of a fire or flood.

7. Accessibility: Consider how easily and quickly you need to access your cash. Look for containers that provide easy access without compromising security. Options with features like quick-access compartments or combination locks with easy-to-remember codes can be beneficial.

8. Reviews and Ratings: Before finalizing your choice, research and read reviews of different cash storage containers. Pay attention to ratings, customer feedback, and recommendations from trusted sources. This will give you insights into the reliability, durability, and security features of the containers you are considering.

Remember, choosing the right cash storage container is a crucial step in ensuring the security and accessibility of your funds. Consider your specific needs, the level of security required, and the features that align with your preferences. By selecting the appropriate container, you can have peace of mind knowing that your cash is well-protected.

Home Cash Storage Options

When it comes to storing cash at home, there are several options to consider. The choice depends on your security needs, the amount of cash you have, and your personal preferences. Here are some home cash storage options to consider:

1. Home Safes: A home safe is a popular and effective option for cash storage. These safes come in various sizes and can be fireproof and waterproof. Look for safes with high-security ratings and durable construction. Consider where to install the safe in your home, choosing a discreet location that is not easily visible or accessible to potential intruders.

2. Diversion Safes: Diversion safes are ordinary-looking objects that have a hidden compartment inside to store cash. These can be in the form of everyday items such as books, soda cans, or household products. Diversion safes provide an added layer of disguise and make it difficult for thieves to identify your cash stash.

3. Secure Lockboxes: A secure lockbox is a portable option for home cash storage. These lockboxes are typically made of sturdy materials like steel and feature a locking mechanism. They are suitable for smaller amounts of cash and provide portability if you need to move your cash around or access it while on the go.

4. DIY Solutions: If you prefer a more discreet and budget-friendly option, you can create your own cash storage solutions. Use your imagination and ingenuity to find hidden spots in your home, such as within walls or behind false panels, to keep your money secure. However, be mindful of potential damage to your home’s structure and ensure the hiding spot is easily accessible to you.

5. Locked Drawers or Cabinets: If you have limited cash to store, locking drawers or cabinets can be a simple and effective option. Install a lock on an existing drawer or cabinet to restrict access to your cash. Choose a secure lock that cannot be easily picked or tampered with.

When storing cash at home, it’s important to remember to keep your storage method concealed and limit access to trusted individuals. Avoid discussing cash storage openly or leaving clues that could lead to discovery by unauthorized individuals.

Additionally, consider maintaining a record of the cash you have stored at home. Keep track of the amount and periodically audit it to ensure that it matches your records. This will help detect any discrepancies or potential issues.

Remember that home cash storage is just one option, and there are other alternatives available depending on your preferences and needs. Consider the specific security requirements and convenience factors when selecting the best home cash storage option for you.

Consider storing cash in a fireproof and waterproof safe or lockbox, preferably in a secure location such as a hidden spot in your home. Avoid keeping large amounts of cash on hand and consider using a bank account for long-term storage.

Read more: How To Store Cash Safely

Safe Deposit Box Storage

If you’re looking for an extra layer of security and peace of mind, safe deposit box storage at a bank or financial institution is a reliable option for storing your cash. Safe deposit boxes offer a secure and protected environment for safeguarding your valuables, including cash. Here’s what you need to know about safe deposit box storage:

1. Secured Environment: Safe deposit boxes are typically located within the vault of a bank or financial institution. These vaults are designed to withstand various threats such as theft, fire, and natural disasters. The secure environment ensures that your cash is protected from potential risks.

2. Added Security Measures: Financial institutions have strict security measures in place to safeguard the contents of safe deposit boxes. These may include surveillance cameras, alarm systems, controlled access, and security personnel. The combination of these measures offers an additional layer of protection for your cash.

3. Various Sizes Available: Safe deposit boxes come in a range of sizes to accommodate different storage needs. You can choose a size that suits the amount of cash you want to store. Along with cash, safe deposit boxes can also hold other valuables such as important documents, jewelry, or collectibles.

4. Privacy and Confidentiality: Safe deposit boxes provide an added level of privacy and confidentiality. The contents of your box are known only to you and authorized personnel. This ensures that your cash and other valuables remain confidential and cannot be accessed by anyone without your permission.

5. Access Control: Only authorized individuals, usually the box owner or authorized persons listed on the account, have access to the safe deposit box. To access your box, you will typically need to provide identification and a key or passcode. This ensures that your cash is in the hands of trusted individuals.

6. Limitations and Restrictions: It’s essential to be aware of any limitations or restrictions imposed by the financial institution regarding safe deposit box usage. These may include restricted access hours, limitations on storing certain items, or specific regulations regarding box rental fees. Familiarize yourself with these policies to ensure a smooth and hassle-free storage experience.

7. Insurance Considerations: Check with your bank or financial institution to understand if their safe deposit box storage offers any insurance coverage for the contents. Some institutions may offer limited insurance coverage, but it’s usually limited to protecting against bank negligence rather than covering the actual value of your cash. You may need to obtain separate insurance to cover the full value of your cash.

Safe deposit box storage offers an excellent solution for those who prioritize high-security storage options. However, keep in mind that accessing your cash at any time may be slightly inconvenient, as it requires visiting the bank during their operating hours. It’s advisable to weigh the benefits of added security against the accessibility factor to determine if safe deposit box storage is the right choice for your cash storage needs.

Off-site Cash Storage Options

If you’re seeking alternatives to storing your cash at home or in a safe deposit box, off-site cash storage options provide an additional layer of security and convenience. These options allow you to keep your cash in a trusted and secure location outside of your immediate premises. Here are some off-site cash storage options to consider:

1. Private Vault Storage: Private vault companies offer secure storage facilities specifically designed for storing valuable items, including cash. These facilities utilize advanced security systems, 24/7 surveillance, and access control measures. Private vault storage provides a high level of security and peace of mind for storing your cash off-site.

2. Managed Off-site Storage: Certain companies specialize in providing managed cash storage services. They handle the storage and management of cash on your behalf. These services often include secure transportation of your cash, secure storage facilities, and detailed inventory and reporting systems. Managed off-site storage is a convenient option for large amounts of cash or for businesses that deal with significant amounts of cash regularly.

3. Precious Metals or Bullion Storage: Some individuals choose to convert their cash into precious metals like gold or silver and store them off-site in secure vaults or facilities specifically designed for precious metal storage. These vaults offer high-security measures and protection against theft or damage. However, it’s important to weigh the risks and benefits of converting cash into precious metals, as their value can fluctuate.

4. Cryptocurrency Wallets: For those who prefer digital forms of currency, storing cash in a cryptocurrency wallet can provide an off-site storage solution. Cryptocurrency wallets use secure encryption and decentralized ledger technology to protect your digital cash. While this option is not physical, it offers a secure and easily accessible way to store cash electronically.

5. Third-Party Storage Services (e.g., Banks): Some banks and financial institutions offer off-site cash storage services as an alternative to safe deposit boxes. These services typically involve storing cash in highly secure vaults at their designated locations. While this option may require additional fees or have certain limitations, it provides the peace of mind of having your cash stored in a trusted and reputable facility.

When considering off-site cash storage options, it is crucial to research and select reputable service providers with a proven track record of security and reliability. Look for companies that maintain stringent security protocols, insurance coverage for stored assets, and positive customer reviews.

Additionally, remember to assess the accessibility factor when choosing an off-site storage option. Determine whether you need regular access to your cash or if it’s intended for long-term storage. Consider factors such as operating hours, transportation logistics, and the ease of retrieving your cash when needed.

Off-site cash storage options provide peace of mind knowing that your cash is secure in trusted facilities outside of your immediate premises. Consider your specific needs, security requirements, and convenience factors when selecting the best off-site storage option for your cash.

Travel Cash Storage Tips

Traveling can present unique challenges when it comes to cash storage. Whether you’re going on a vacation or a business trip, it’s essential to have a plan in place to keep your cash secure while on the move. Follow these travel cash storage tips to ensure the safety of your funds:

1. Use a Travel Wallet: Invest in a secure travel wallet designed specifically for carrying cash and cards. Look for a wallet with RFID-blocking technology to prevent unauthorized scanning of your cards. Choose one that has multiple compartments to separate different currencies and denominations.

2. Split Your Cash: Avoid keeping all your cash in one place while traveling. Split your money into multiple locations, such as different pockets, bags, or pieces of travel gear. This way, even if one location is compromised, you won’t lose all your cash.

3. Utilize a Money Belt: Money belts are worn around your waist and can be hidden under your clothing. They provide a discreet and secure way to store your cash, credit cards, and important documents. Ensure the money belt you choose is comfortable, lightweight, and made with secure closures.

4. Concealment Accessories: Consider using concealment accessories such as hidden pockets, pouches, or socks with secret compartments. These accessories provide covert storage for your cash, preventing it from being easily visible or accessible to potential thieves.

5. Avoid Flashy Displays: Be discreet when handling your cash in public. Avoid openly displaying large amounts of cash, as it can attract unwanted attention. It’s best to only take out the cash you need for immediate transactions and keep the rest securely tucked away.

6. Keep Emergency Cash Separated: Set aside a separate emergency cash stash that you keep in a hidden location, such as a secret pocket on your clothing or a hidden compartment in your luggage. This cash should only be accessed in dire situations, providing you with a fallback option if needed.

7. Use Hotel Safes: Take advantage of the in-room safes provided by hotels to store your cash when you’re not carrying it with you. Ensure the safe has a secure locking mechanism and keep a record of the cash you store inside.

8. Avoid Obvious Hiding Places: Criminals are often aware of common hiding places for cash. Avoid storing your cash in obvious locations such as back pockets, backpacks, or easily accessible compartments. Opt for less predictable locations to diminish the risk of theft.

9. Be Mindful of Withdrawals: When withdrawing cash from an ATM, choose reputable and secure locations. Avoid using ATMs in secluded or poorly lit areas where the risk of theft is higher. Cover the keypad when entering your PIN to prevent anyone from seeing it.

10. Keep a Record: Make a note of the serial numbers of high denomination bills or any valuable foreign currency you have. This will be helpful in case of loss or theft, as it can aid in reporting and recovery efforts.

Remember, safety should always be your top priority when traveling with cash. By following these tips and staying vigilant, you can enjoy your trip with peace of mind, knowing that your cash is secure and accessible when you need it.

Conclusion

Proper cash storage is crucial for protecting your funds and maintaining financial security. Whether you’re storing cash at home, utilizing a safe deposit box, exploring off-site options, or securing cash while traveling, understanding the importance of cash storage and implementing effective strategies is essential.

By choosing the right cash storage container, you can ensure the security and accessibility of your money. Consider factors such as size, durability, locking mechanisms, and portability when selecting a container that meets your specific needs.

Various options are available for cash storage at home, including safes, lockboxes, diversion safes, and locked drawers or cabinets. Evaluate the pros and cons of each option and choose the one that offers the highest level of security and convenience for your circumstances.

If you prefer additional security, safe deposit box storage at a bank or financial institution is a reliable choice. With a secured environment, access control, and added privacy, safe deposit boxes offer peace of mind for protecting your cash and other valuables.

Off-site cash storage options, such as private vault storage, managed storage services, or even cryptocurrency wallets, provide an extra layer of security beyond traditional storage methods. Research reputable providers with strict security measures to find the option that best meets your needs.

When traveling, employing smart cash storage practices is essential. Utilize travel wallets, money belts, and concealment accessories to keep your cash discreet and secure. Split your cash, avoid flashy displays, and utilize hotel safes to protect your funds while on the move.

In conclusion, remember that safety should always be your top priority when it comes to cash storage. Implementing proper storage measures, being mindful of safety considerations, and staying informed about available options will help safeguard your money and give you peace of mind.

So, whether you’re storing cash for emergencies, future savings, or travel purposes, take the necessary steps to protect your hard-earned funds. By prioritizing security and employing the strategies outlined in this article, you can ensure the safety, accessibility, and longevity of your cash storage arrangements.

Frequently Asked Questions about How To Store Cash

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Store Cash”