Home>Home Maintenance>Who Is Liable For Damage To Home During Home Inspection By Buyer’s Agent?

Home Maintenance

Who Is Liable For Damage To Home During Home Inspection By Buyer’s Agent?

Modified: March 6, 2024

Discover who is responsible for any damage caused to a home during a buyer's agent's home inspection. Learn more about home maintenance and liability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

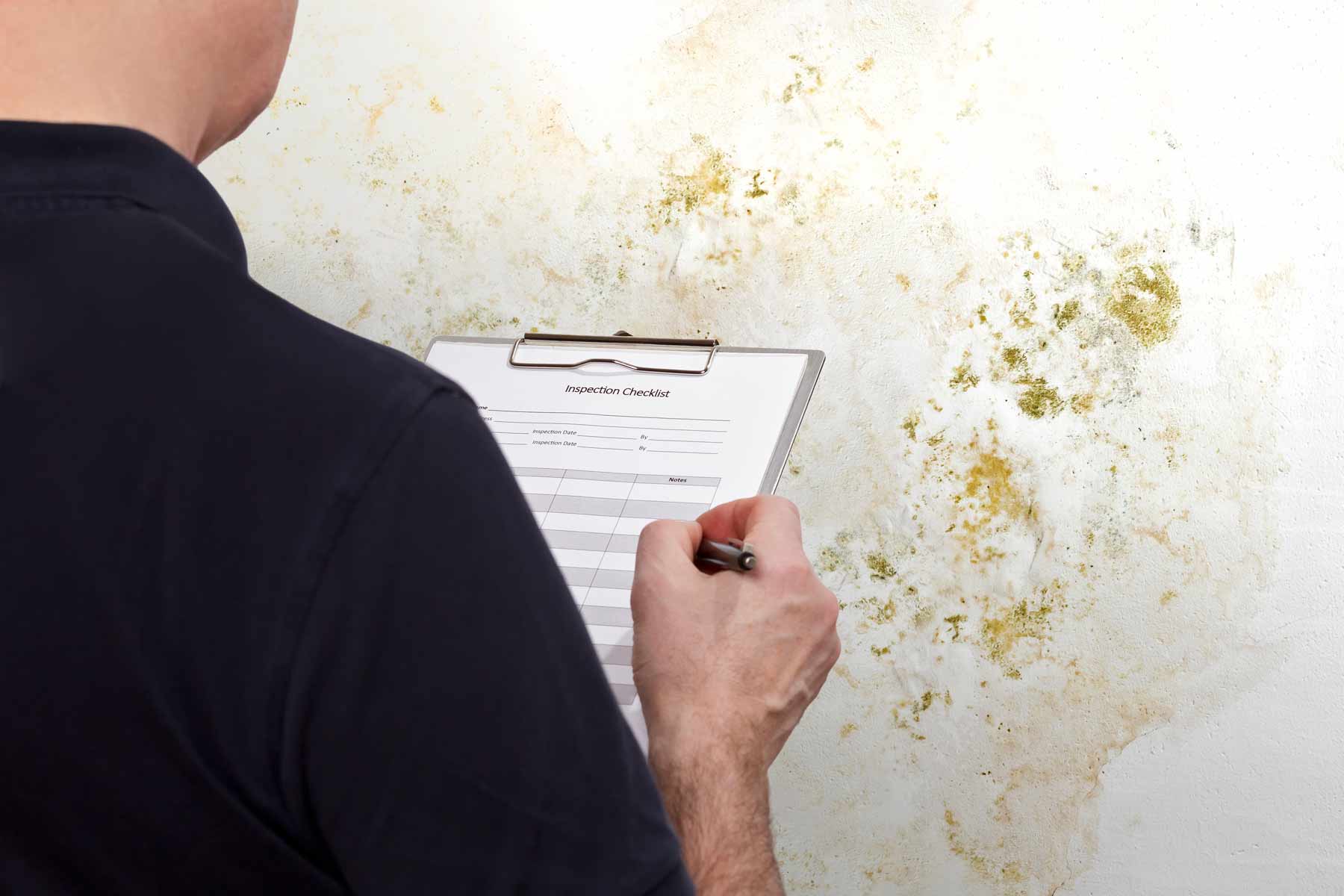

When it comes to purchasing a home, a thorough home inspection is an essential step in ensuring the property is in good condition and free from any hidden issues. A home inspection is typically conducted by a qualified professional who thoroughly examines the various components and systems of the home, from the foundation to the roof.

However, during the home inspection process, it is not uncommon for accidental damage to occur. Whether it’s a scratched floor, a broken window, or a damaged wall, these incidents can leave the homeowner wondering who is liable for the repairs and whether they are covered by insurance.

In this article, we will delve into the responsibilities of the buyer’s agent during a home inspection, the potential damage that can occur, and who is liable for the repairs. We will also touch upon the role of homeowner’s insurance in these situations and how to resolve any disputes or claims that may arise.

Buying a home is a significant investment, and understanding the complexities of home inspections and liabilities is crucial for both buyers and sellers. Let’s explore this topic further to provide you with the knowledge you need to navigate this process with confidence.

Key Takeaways:

- Accidental damage during a home inspection can lead to liabilities for both buyers and sellers. It’s crucial to communicate, negotiate, and understand insurance coverage to resolve disputes effectively.

- Buyer’s agents play a vital role in guiding buyers through the inspection process, from recommending inspectors to negotiating repairs. Open communication and professional guidance are key to a successful home inspection.

Understanding Home Inspections

A home inspection is a critical part of the home buying process, as it allows potential buyers to assess the condition of the property they are interested in. During a home inspection, a qualified professional, usually hired by the buyer, thoroughly evaluates the different components of the home, including the structure, plumbing, electrical systems, HVAC, and more.

The purpose of a home inspection is to identify any existing or potential issues with the property. This includes structural problems, safety hazards, code violations, and any necessary repairs or maintenance. The inspector will typically provide a detailed report outlining their findings, which can be used by both the buyer and seller to negotiate repairs or adjust the purchase price.

Home inspections typically cover both the interior and exterior of the property. The inspector will examine areas such as the roof, walls, windows, doors, foundation, basement, attic, crawl spaces, and major systems like heating, cooling, and plumbing. They will also check for the presence of pests, mold, and other environmental hazards.

It’s important to note that a home inspection is not a guarantee of perfection. The inspector’s role is to identify visible issues and potential problems based on their visual assessment. They may also recommend further evaluation by specialists, such as electricians or structural engineers, for more in-depth analysis.

Buyers should attend the home inspection to gain firsthand knowledge of the property’s condition and ask any questions they may have. This can provide valuable insights into the home’s maintenance needs and help the buyer make an informed decision.

Overall, a home inspection serves to protect the buyer’s interests and ensure they are aware of any significant issues that could affect the home’s value or pose safety concerns. It is an essential step in the home buying process that helps buyers make informed decisions and negotiate repairs or adjustments before finalizing the purchase.

Buyer’s Agent Responsibilities

A buyer’s agent plays a vital role in representing the interests of the homebuyer throughout the purchasing process. Their responsibilities include guiding the buyer, providing market insights, negotiating offers, and assisting with various paperwork and transactions. When it comes to home inspections, buyer’s agents have specific obligations to ensure the process goes smoothly.

One of the primary responsibilities of a buyer’s agent is to help the buyer find a qualified and reputable home inspector. They should have a network of trusted professionals or be knowledgeable enough to recommend reliable inspectors. The agent can also assist in scheduling the inspection and coordinating the logistics between the inspector, buyer, and seller.

During the home inspection, the buyer’s agent should accompany the buyer to provide support and address any concerns or questions that may arise. Their presence shows that they are actively representing the buyer’s interests and having their best interests in mind throughout the inspection process.

Buyer’s agents should encourage their clients to thoroughly review the home inspection report and help them understand its contents. They should be able to explain the findings, any potential issues identified, and their implications on the purchase. This allows the buyer to make an informed decision on whether to proceed with the transaction, negotiate repairs, or adjust the purchase price accordingly.

Additionally, buyer’s agents should advise their clients on the appropriate course of action if significant issues are uncovered during the home inspection. They may recommend bringing in specialists or contractors to provide estimates for repair costs. This information can then be used to negotiate with the seller for repairs, credits, or a price reduction.

Buyer’s agents must also ensure that all agreed-upon repairs or adjustments are properly documented and included in the purchase agreement. They should review the terms to verify that the necessary repairs will be completed before closing, giving the buyer peace of mind and assurance that the property will be in the desired condition.

Overall, buyer’s agents have a fiduciary duty to their clients and must act in their best interests. This includes advocating for a thorough home inspection, assisting with the interpretation of the report, and helping negotiate repair requests. Their expertise and guidance can significantly contribute to a successful home inspection and a successful home purchase.

Liabilities during Home Inspections

During a home inspection, various liabilities can arise, both for the buyer and the seller. It’s essential to understand these potential liabilities to navigate the inspection process effectively and mitigate any risks.

For the buyer, liabilities during a home inspection typically revolve around identifying existing or potential issues with the property. If the inspector discovers significant problems or safety hazards, the buyer may face the following liabilities:

- Repair Costs: If the home inspection uncovers significant issues, the buyer may be responsible for the cost of repairs. Depending on the nature and extent of the repairs needed, these costs can range from minor fixes to major renovations.

- Health and Safety Risks: If the inspection reveals potential health or safety hazards, the buyer may need to address these issues to ensure the property is safe to occupy. This could involve measures such as removing mold, addressing lead paint, or upgrading electrical systems.

- Future Maintenance and Upkeep: The inspection report may highlight areas that require regular maintenance or attention in the future. Buyers should be aware of these ongoing responsibilities to plan for the upkeep of the property.

On the other hand, sellers also have liabilities during a home inspection. If the inspection identifies any issues, sellers may face the following liabilities:

- Disclosure Obligations: Sellers must disclose any known defects or issues with the property. If the inspection uncovers undisclosed problems, sellers may be held liable for not providing accurate information about the condition of the home.

- Repair Negotiations: If the inspection report reveals issues that need repair, it is customary for the buyer to request these repairs or negotiate for a price reduction. Sellers may be liable for addressing these repair requests or negotiating an agreement with the buyer.

- Potential Legal Consequences: If a seller intentionally conceals a significant issue that later becomes apparent during the home inspection, they may face legal action and potential financial liabilities.

It is worth noting that liabilities during a home inspection can vary depending on local laws and contractual agreements between the buyer and seller. Buyers and sellers should consult with their real estate agents, attorneys, or local authorities to fully understand their specific liabilities and obligations during the inspection process.

By understanding these potential liabilities, buyers and sellers can better prepare themselves for the outcome of a home inspection and make informed decisions about the purchase or sale of a property.

Potential Damage to Home

While a home inspection is essential for assessing the condition of a property, it is possible for accidental damage to occur during the inspection process. The following are some examples of potential damage that can happen to a home:

- Scratches and Scuffs: During a home inspection, the inspector may need to access tight spaces or move furniture, which can result in scratches or scuffs on walls, floors, or furniture.

- Broken Fixtures: Inspectors may inadvertently break fixtures such as light switches, doorknobs, or cabinet handles while conducting their assessments.

- Water Damage: Inspections often involve testing plumbing systems, such as running faucets or flushing toilets. In rare cases, water damage can occur if there is a leak or if the plumbing system is not properly functioning.

- Electrical Issues: Testing electrical outlets and switches may lead to short circuits or blown fuses, potentially causing damage to electrical systems.

- Roof Damage: Inspectors may need to access the roof to examine its condition. During this process, tiles or shingles could be dislodged or damaged.

It’s important to note that most professional home inspectors take great care to minimize the risk of damage during the inspection. They are trained to be thorough while being mindful of the homeowner’s property. However, accidents can still happen, especially in older or more fragile homes.

If damage occurs during the inspection, it should be documented in the inspection report. Both the buyer and the seller should review the report and address any concerns regarding the damage. In some cases, repairs or compensation may be necessary to rectify the situation.

Furthermore, homeowners should understand that some wear and tear or minor damages may be inevitable during the inspection process. Preparing the home for inspection by decluttering, securing loose items, and addressing any known issues beforehand can help minimize the risk of additional damage.

If homeowners have concerns about potential damage during the inspection, they should communicate their worries to the buyer’s agent and the inspector before the inspection begins. Open and clear communication can help ensure both parties are aware of each other’s expectations and can work together to minimize any potential damage.

By being aware of the potential damage that can occur during a home inspection, homeowners can make informed decisions about their property and address any issues that may arise during the process.

The liability for damage to a home during a home inspection by the buyer’s agent typically falls on the buyer or their agent. It’s important to discuss liability and potential damages with your real estate agent before the inspection.

Buyer’s Agent’s Liability

When it comes to liability during a home inspection, the buyer’s agent has a unique role and set of responsibilities. While the buyer’s agent is not directly conducting the inspection, they have certain obligations that can impact their liability in the process.

It’s important to note that the liability of a buyer’s agent varies depending on the specific circumstances of the inspection and the contractual agreements in place. However, here are some general considerations regarding a buyer’s agent’s liability:

Selection of Home Inspector: One of the buyer’s agent’s responsibilities is to help the buyer find a qualified and reputable home inspector. The agent should exercise due diligence in recommending a reliable inspector. If the recommended inspector turns out to be negligent or fails to identify significant issues during the inspection, the buyer’s agent could potentially be held liable for their recommendation.

Accompanying the Buyer During the Inspection: The buyer’s agent should attend the home inspection to provide support and address any questions or concerns the buyer may have. By being present during the inspection, the buyer’s agent can actively advocate for the buyer’s interests. If the agent fails to attend the inspection without a valid reason or if their absence negatively impacts the buyer’s ability to address issues, their liability may be questioned.

Communication and Disclosure: Buyer’s agents have a duty to keep the buyer informed throughout the home inspection process. This includes disclosing any known issues or material facts about the property to the inspector and ensuring the inspector is aware of the buyer’s concerns. Failing to communicate relevant information or concerns may lead to liability if it results in significant consequences for the buyer.

Negotiation and Documentation: During the inspection, the buyer’s agent plays a crucial role in negotiating repairs or adjustments with the seller. They should ensure that all agreed-upon repairs or adjustments are documented in writing and incorporated into the purchase agreement. If the agent fails to adequately negotiate repairs or secure proper documentation, they may be held liable if issues arise after the closing.

It’s important for buyer’s agents to stay up-to-date on local laws, regulations, and best practices concerning home inspections. By staying informed and acting diligently, buyer’s agents can minimize their liability and provide the necessary support to protect their clients’ interests.

Although a buyer’s agent’s liability during a home inspection may not be as extensive as that of the inspector or the seller, they still have a responsibility to act professionally and advocate for the buyer throughout the process. Open communication, competence, and attentiveness are key factors in reducing potential liability and ensuring a successful home inspection for the buyer.

Homeowner’s Insurance Coverage

When it comes to potential damage during a home inspection, homeowners may wonder if their homeowner’s insurance will cover any repairs or claims. The coverage provided by homeowner’s insurance can vary depending on the policy and the specific circumstances. Let’s explore homeowner’s insurance coverage in relation to home inspection-related damage:

Accidental Damage: Most homeowner’s insurance policies provide coverage for accidental damage to the property. If the inspector accidentally causes damage during the inspection, such as breaking a window or damaging a wall, the homeowner’s insurance policy may cover the cost of repairs. It’s important to review the insurance policy and speak with the insurance provider to understand the specific coverage and deductible amounts.

Pre-existing Conditions and Wear and Tear: Homeowner’s insurance typically does not cover pre-existing conditions or wear and tear on the property. If the damage discovered during the inspection is a result of long-term wear and tear or a pre-existing condition, it is unlikely to be covered by homeowner’s insurance. It is important to distinguish between accidental damage during the inspection and pre-existing issues when filing an insurance claim.

Policy Exclusions: Homeowner’s insurance policies often have exclusions for certain types of damage, such as damage caused by pests, mold, or other environmental factors. It’s essential to review the policy carefully and understand any specific exclusions that may impact coverage for damage discovered during the inspection.

Liability Coverage for Accidents: Homeowner’s insurance policies typically include liability coverage, which protects the homeowner if someone is injured on the property. If the inspector or any other party involved in the inspection process sustains an injury during the inspection, the homeowner’s liability coverage may come into play. This coverage can help cover medical expenses or legal costs in case of a liability claim.

Professional Liability Insurance for Inspectors: Home inspectors usually carry professional liability insurance, also known as errors and omissions insurance. This coverage protects the inspector if a mistake or oversight during the inspection leads to financial loss or damage for the homeowner. If the inspector’s actions result in significant damage, homeowners can seek compensation through the inspector’s professional liability insurance.

It’s important for homeowners to review their homeowner’s insurance policy, understand the coverage limits, deductibles, and exclusions, and consult with their insurance provider as necessary. Additionally, homeowners may want to inquire about the inspector’s professional liability insurance to ensure they have adequate coverage in case of significant damage resulting from the inspection.

Ultimately, every homeowner’s insurance policy is unique, and coverage can vary. Reviewing the policy and discussing it with the insurance provider will provide homeowners with a clear understanding of their coverage and any potential claims related to damage during a home inspection.

Resolving Disputes and Claims

During a home inspection, disputes and claims can arise between buyers, sellers, and other involved parties. It’s important to have a clear understanding of the steps to take when trying to resolve these disputes and claims. Here are some useful guidelines:

1. Communicate and Seek Clarification: If any issues or disagreements arise during the home inspection, it’s essential to communicate with the other party involved. Clearly express your concerns and seek clarification on any points of contention. Open and honest communication can often help resolve disputes amicably.

2. Review the Inspection Report: Thoroughly review the home inspection report and discuss its findings with the other party. It’s important to understand the extent of any identified issues, their potential impact, and the recommended actions for resolution.

3. Consult with Professionals: If necessary, seek advice from professionals such as real estate agents, attorneys, or contractors specializing in the specific areas of concern. Their expertise can provide insights into the best course of action and help navigate any legal or contractual complexities.

4. Negotiate Repairs or Adjustments: When addressing repair requests, negotiate with the other party to find a mutually agreeable solution. This may involve requesting repairs, a reduction in the purchase price, or a credit towards future repairs. It’s important to document any agreed-upon repairs or adjustments in writing to ensure both parties are held accountable.

5. Mediation or Arbitration: If negotiations reach an impasse, consider involving a neutral third party, such as a mediator or arbitrator. These professionals can assist in facilitating resolution discussions and finding a fair compromise that satisfies both parties.

6. Insurance Claims: If damage occurs during the inspection or if disputes arise that are covered by insurance, initiate the claims process with the appropriate insurance provider. Provide all necessary documentation, including the inspection report, supporting evidence, and any relevant communication related to the claim.

7. Legal Remedies: In rare cases where disputes cannot be resolved through negotiation, mediation, or insurance claims, you may need to pursue legal remedies. Consult with an attorney specializing in real estate law to discuss your options and determine the best course of action.

Remember, resolving disputes and claims related to a home inspection requires patience, open-mindedness, and a willingness to find solutions that are fair to both parties. By maintaining open lines of communication and seeking professional guidance when necessary, you can navigate through these challenges and achieve a satisfactory resolution.

Conclusion

A thorough home inspection is a crucial step in the home buying process, providing buyers with insights into the condition of the property they intend to purchase. However, during the inspection, accidental damage can occur, raising questions about liability and insurance coverage.

In this article, we have explored various aspects of home inspections, including the responsibilities of the buyer’s agent, potential liabilities, and coverage provided by homeowner’s insurance. It’s important for buyers, sellers, and agents to understand their roles and obligations to ensure a smooth and successful home inspection process.

Buyer’s agents play a critical role in guiding buyers through the inspection process, from recommending qualified inspectors to negotiating repairs or adjustments. Their liability, while secondary to that of the inspector or seller, involves ensuring they act in the best interests of their clients and communicate effectively throughout the inspection process.

Homeowner’s insurance coverage can vary, but generally, it may provide protection for accidental damage caused during the inspection. However, coverage for pre-existing conditions, wear and tear, or specific exclusions should be reviewed carefully to manage expectations accurately.

Disputes and claims that may arise during a home inspection can often be resolved through open communication, negotiation, and seeking professional guidance when necessary. By effectively addressing concerns and documenting all agreements, buyers and sellers can work towards a satisfactory resolution that protects their respective interests.

Ultimately, a successful home inspection is essential for buyers to make informed decisions and sellers to provide an accurate representation of their property. Being aware of responsibilities, liabilities, and available insurance coverage helps create a smoother inspection process and reduces potential conflicts.

As buyers and sellers navigate the home inspection process, it’s important to remember that the ultimate goal is to ensure an honest transaction and a home that meets the buyer’s expectations. With proper communication, due diligence, and an understanding of the processes involved, both parties can move forward confidently in their real estate journey.

Frequently Asked Questions about Who Is Liable For Damage To Home During Home Inspection By Buyer's Agent?

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “Who Is Liable For Damage To Home During Home Inspection By Buyer’s Agent?”