Home>Renovation & DIY>Home Renovation Guides>How To Find Out If A Home Improvement Will Raise Property Tax

Home Renovation Guides

How To Find Out If A Home Improvement Will Raise Property Tax

Published: December 21, 2023

Learn how to determine if a home improvement project will impact your property taxes with our comprehensive home renovation guide. Discover the factors that can influence property tax assessments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

**

Introduction

**

Are you considering making improvements to your home but worried about potential increases in property taxes? It's a common concern among homeowners, as property taxes can significantly impact the overall cost of homeownership. However, understanding how home improvements can affect property taxes is essential for making informed decisions about your living space. In this comprehensive guide, we'll delve into the intricacies of property taxes, the factors that influence them, and how home improvements can impact these taxes. By the end, you'll have a clear understanding of how to determine if a home improvement will raise your property taxes, empowering you to make informed decisions about your home renovation projects.

**

Key Takeaways:

- Home improvements can raise property taxes by increasing the assessed value of a home. Factors like size, location, and market conditions can impact tax obligations.

- Research local tax regulations and consult with assessors to understand how specific home improvements may affect property taxes. Consider potential tax incentives and market conditions.

Understanding Property Taxes

**

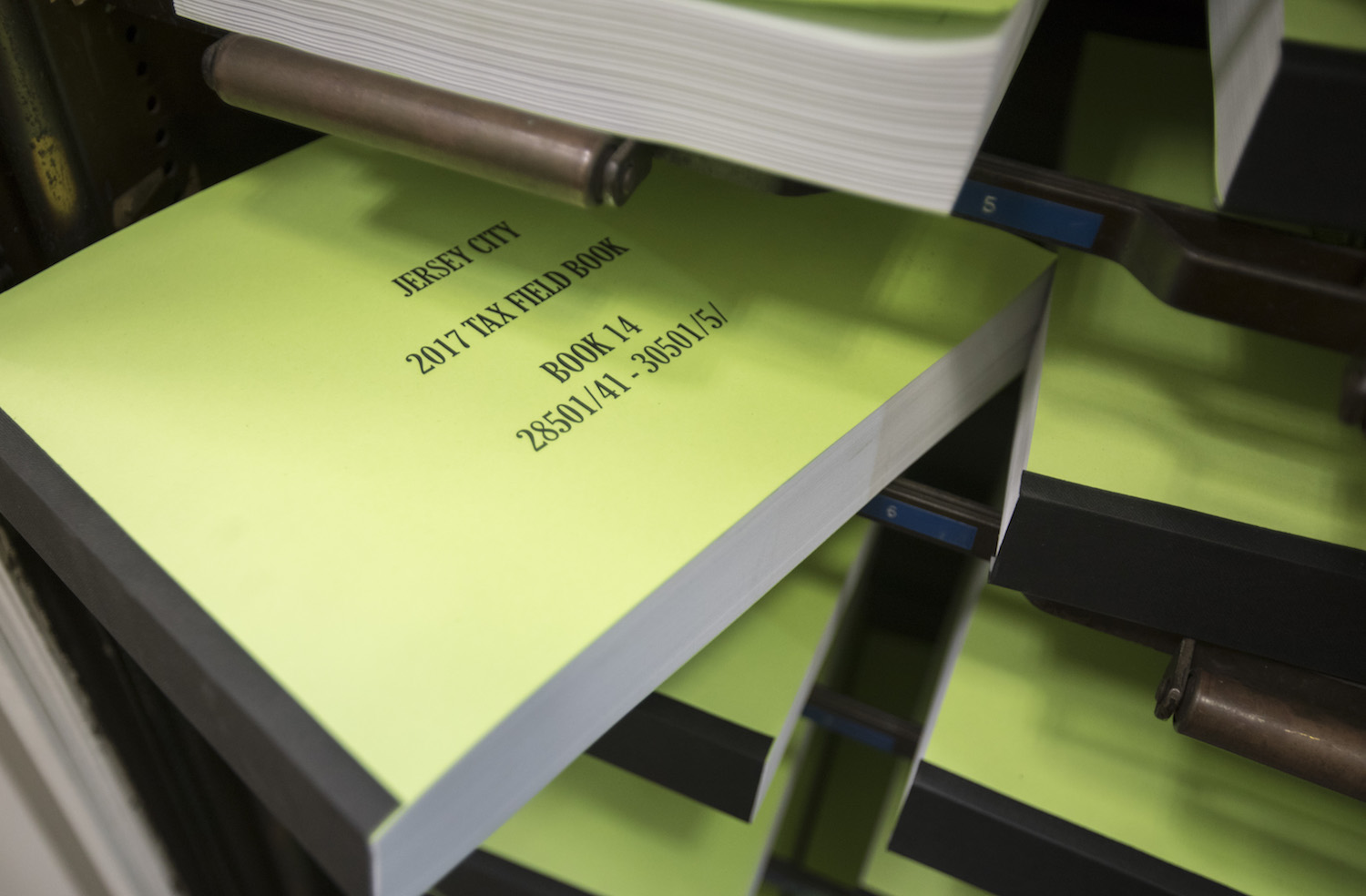

Property taxes are a primary source of revenue for local governments, funding essential services such as schools, public safety, infrastructure, and more. These taxes are calculated based on the assessed value of a property, with the revenue collected used to support the community as a whole. The assessed value of a property is determined by local tax assessors and is typically based on factors such as the property’s size, location, and overall market value.

Property tax rates can vary significantly from one location to another, as they are determined by local governments and can be influenced by factors such as budgetary needs and the overall property value within a specific area. It’s important to note that property taxes are recurring expenses that homeowners must consider when budgeting for homeownership costs.

Understanding how property taxes are calculated is crucial for homeowners. Typically, the tax rate is applied to the assessed value of the property, resulting in the annual property tax bill. While property tax rates and assessment methods vary by location, gaining insight into these calculations can help homeowners anticipate and plan for their property tax obligations.

Factors That Affect Property Taxes

**

Several key factors can influence the amount of property taxes a homeowner is required to pay. Understanding these factors is essential for gaining insight into the dynamics of property tax calculations. Here are some of the primary factors that can affect property taxes:

- Assessed Property Value: The assessed value of a property serves as the foundation for property tax calculations. This value is determined by local tax assessors and is based on various factors, including the property’s size, location, and market value. As the assessed value of a property increases, so too can the property tax obligation.

- Local Tax Rates: Property tax rates can vary significantly from one location to another. Local governments set these rates based on budgetary needs and other financial considerations. Higher tax rates can result in increased property tax obligations for homeowners.

- Exemptions and Deductions: Some jurisdictions offer property tax exemptions or deductions for certain property types or individuals, such as senior citizens or veterans. Understanding the availability of these exemptions and deductions can impact a homeowner’s overall property tax burden.

- Improvements and Additions: Making improvements or additions to a property can also affect property taxes. These changes can increase the assessed value of the property, leading to higher property tax obligations.

- Market Conditions: Fluctuations in the real estate market can impact property values, subsequently influencing property tax assessments. In areas experiencing rapid appreciation, property tax obligations may increase accordingly.

By considering these factors, homeowners can gain a clearer understanding of the elements that contribute to their property tax obligations. Being aware of these dynamics is crucial when assessing the potential impact of home improvements on property taxes.

Check with your local assessor’s office to see if the home improvement will increase your property’s assessed value. They can provide information on how improvements may impact your property taxes.

Impact of Home Improvements on Property Taxes

**

Home improvements have the potential to impact property taxes, as they can influence the assessed value of a property. When homeowners invest in renovations, additions, or upgrades, the overall value of their property may increase, leading to a higher assessed value and potentially higher property tax obligations. It’s important to recognize that not all home improvements will automatically result in significant property tax increases, but understanding the potential impact is essential for informed decision-making.

Renovations that add square footage, such as room additions or expanded living spaces, can directly impact the assessed value of a property. Similarly, significant upgrades to kitchens, bathrooms, or other key areas of the home can enhance overall property value. Additionally, improvements that enhance curb appeal, energy efficiency, or structural integrity can also contribute to a higher assessed value.

It’s worth noting that some home improvements, particularly those focused on energy efficiency or sustainable practices, may qualify for tax incentives or exemptions, potentially offsetting any increases in property tax obligations. Understanding the potential financial benefits and drawbacks of specific home improvements is essential for homeowners seeking to enhance their living spaces while managing their long-term financial commitments.

Ultimately, the impact of home improvements on property taxes is contingent on various factors, including the scope and scale of the renovations, local property tax regulations, and market conditions. By recognizing the potential influence of home improvements on property taxes, homeowners can make informed decisions about their renovation projects and anticipate any associated financial implications.

How to Determine if a Home Improvement Will Raise Property Taxes

**

When considering home improvements and their potential impact on property taxes, homeowners can take proactive steps to assess the potential financial implications before moving forward with renovation projects. Here are key considerations for determining if a home improvement will raise property taxes:

- Research Local Property Tax Regulations: Understanding local property tax regulations and assessment practices is crucial for homeowners. Researching how property assessments are conducted in your area, including the criteria used to determine assessed property values, can provide valuable insight into how home improvements may impact property taxes.

- Consult with Local Tax Assessors: Engaging in discussions with local tax assessors can yield valuable information about how specific home improvements may influence property tax assessments. Assessors can provide guidance on the potential impact of renovations and additions, helping homeowners make informed decisions.

- Consider the Scope of the Improvement: Assessing the scale and nature of the planned home improvement is essential. Major renovations, additions, or upgrades that significantly enhance the property’s value are more likely to impact property taxes compared to minor cosmetic changes or routine maintenance.

- Evaluate Potential Tax Incentives: Some home improvements, particularly those focused on energy efficiency or sustainability, may qualify for tax incentives, exemptions, or credits. Understanding the availability of these incentives can help homeowners offset potential increases in property tax obligations.

- Assess Market Conditions: Considering the current real estate market conditions in your area is important. Rapidly appreciating markets may lead to higher property tax assessments following home improvements, while stable or declining markets may yield less significant impacts.

By carefully evaluating these factors and seeking relevant information, homeowners can make informed assessments of how a specific home improvement may impact their property taxes. This proactive approach empowers homeowners to weigh the potential benefits and drawbacks of renovations while considering their long-term financial commitments.

Conclusion

**

Understanding the relationship between home improvements and property taxes is essential for homeowners seeking to enhance their living spaces while managing their financial obligations. Property taxes play a significant role in the overall cost of homeownership, and the potential impact of home improvements on these taxes warrants careful consideration.

By comprehending the factors that influence property taxes, including assessed property value, local tax rates, exemptions, and market conditions, homeowners can gain insight into the dynamics of property tax calculations. This knowledge empowers them to anticipate and plan for their property tax obligations, particularly when contemplating home improvements.

Recognizing the potential impact of home improvements on property taxes allows homeowners to make informed decisions about renovation projects. By researching local property tax regulations, consulting with tax assessors, and evaluating the scope of planned improvements, homeowners can proactively assess the potential financial implications. Additionally, considering potential tax incentives and market conditions provides a comprehensive understanding of how specific renovations may affect property taxes.

Ultimately, the decision to pursue home improvements should be an informed one, taking into account both the desired enhancements to the living space and the potential financial ramifications, including property tax obligations. By leveraging knowledge and proactive assessment, homeowners can navigate the complexities of property taxes and make strategic choices regarding their home renovation projects.

Empowered with a comprehensive understanding of property taxes and the potential impact of home improvements, homeowners can embark on renovation endeavors with confidence, knowing that they have considered the financial implications and are well-equipped to make informed decisions about enhancing their living spaces.

**

Frequently Asked Questions about How To Find Out If A Home Improvement Will Raise Property Tax

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Find Out If A Home Improvement Will Raise Property Tax”