Home>Home Maintenance>How To Find Out Property Assessment In New Jersey

Home Maintenance

How To Find Out Property Assessment In New Jersey

Modified: March 6, 2024

Easily find out the property assessment for your home in New Jersey with our step-by-step guide. Stay informed about the value of your property for effective home maintenance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Owning a property is a significant financial investment, and it is essential to have an accurate understanding of its value. In New Jersey, property assessments play a crucial role in determining the property’s value for taxation purposes. Understanding how to find out the property assessment in New Jersey is important for homeowners, potential buyers, and investors.

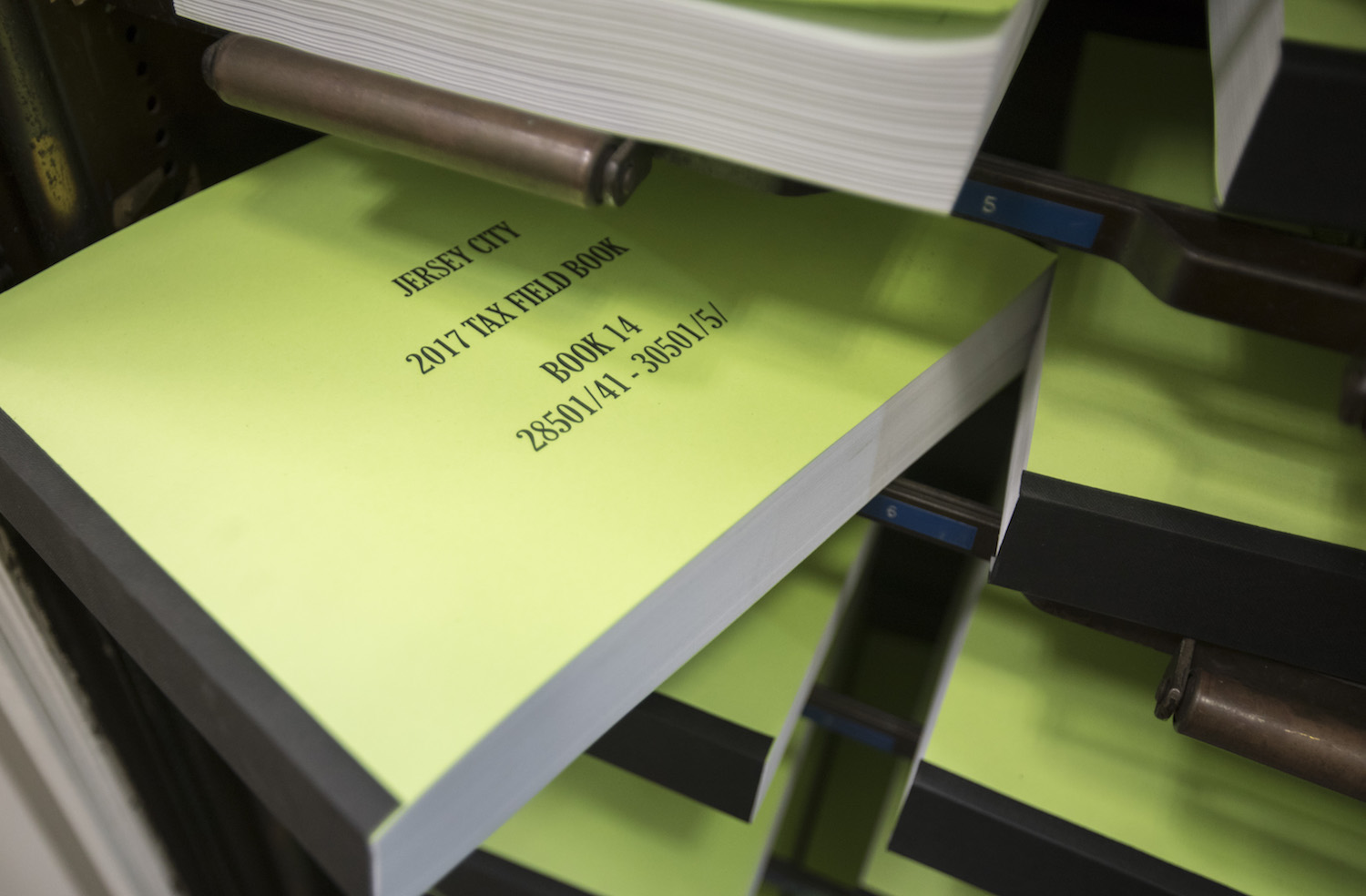

A property assessment is the estimated value of a property carried out by the local tax assessor’s office. It serves as the basis for calculating property taxes. The assessment is typically conducted annually or at set intervals to reflect changes in the real estate market. Property assessments in New Jersey are subject to review and potential appeals, making it essential for property owners to be familiar with the process.

In this article, we will explore the different methods to find out property assessments in New Jersey. We will discuss contacting the local tax assessor’s office, utilizing online databases, reviewing assessment notices and tax bills, and hiring a licensed appraiser. Additionally, we will explore the various factors that influence property assessments and how to appeal an inaccurate assessment.

Understanding property assessments can help homeowners understand their tax liabilities, make informed decisions when buying or selling a property, and potentially save money through the appeal process. By diving into the intricacies of property assessments in New Jersey, you will gain valuable insights into this crucial aspect of property ownership.

So, let’s delve into the world of property assessments in New Jersey and discover the methods, factors, and strategies involved in finding out and appealing property assessments. By the end of this article, you will have a comprehensive understanding of property assessments in New Jersey and be equipped to navigate this important aspect of property ownership.

Key Takeaways:

- Understanding property assessments in New Jersey is crucial for homeowners. Methods to find out assessments include contacting the tax assessor’s office, searching online databases, reviewing assessment notices, and hiring a licensed appraiser.

- Factors like location, property size, recent sales, and improvements influence property assessments. Property owners can appeal assessments by gathering evidence, filing an appeal, and presenting their case professionally.

Understanding Property Assessments in New Jersey

Property assessments in New Jersey are a vital component of the taxation system. They determine the value of a property for tax purposes and play a significant role in calculating property taxes. Understanding the process of property assessments in New Jersey is crucial for homeowners to ensure the accuracy of their assessments and assess the fairness of their tax liabilities.

In New Jersey, property assessments are conducted by the local tax assessor’s office. The assessor typically assesses the value of a property based on factors such as its location, size, condition, and recent sales data of similar properties in the area. These assessments are performed on a regular basis, often annually or once every few years, to account for changes in the real estate market.

The assessed value of a property is an estimation of its market value, which is the price it would sell for in an open market. It is important to note that the assessed value may not necessarily represent the current market value of the property as assessments are conducted periodically and might not capture real-time fluctuations in the market.

The primary purpose of property assessments is to determine the property tax amount that homeowners are required to pay. Property taxes are a significant source of revenue for local municipalities and fund various community services and infrastructure projects. The tax rate is calculated based on the assessed value of the property and the applicable tax rates set by local government authorities.

It is important to understand that property assessments are not fixed and can be subject to change. Property owners should be aware of the factors that may influence their assessments and ensure that they are accurately reflected. Factors such as location, neighborhood, property size, condition, recent sales and market trends, and improvements or renovations made to the property can all impact the assessed value.

In the next section, we will explore the various methods to find out property assessments in New Jersey. By being familiar with these methods, homeowners can easily access their property assessments and verify their accuracy. Additionally, this knowledge will enable homeowners to make informed decisions when it comes to buying or selling a property, as well as understanding their tax obligations accurately.

Methods to Find Out Property Assessment in New Jersey

Finding out the property assessment in New Jersey is essential for property owners to have a clear understanding of their property’s value and tax obligations. There are several methods available to access property assessments in the state. Let’s explore these methods in detail:

1. Contacting the Local Tax Assessor’s Office: One of the most straightforward ways to find out your property assessment is by contacting the local tax assessor’s office in the municipality where your property is located. The tax assessor’s office maintains records of property assessments and can provide you with the assessed value of your property upon request. You can find the contact information for the tax assessor’s office on your municipality’s website or by contacting the local government office.

2. Searching Online Databases: Many counties in New Jersey offer online databases where property owners can access property assessment information. These databases are usually accessible through the county’s official website and allow users to search for property assessments by address, owner’s name, or tax ID number. By entering the relevant details, property owners can quickly obtain their property’s assessed value.

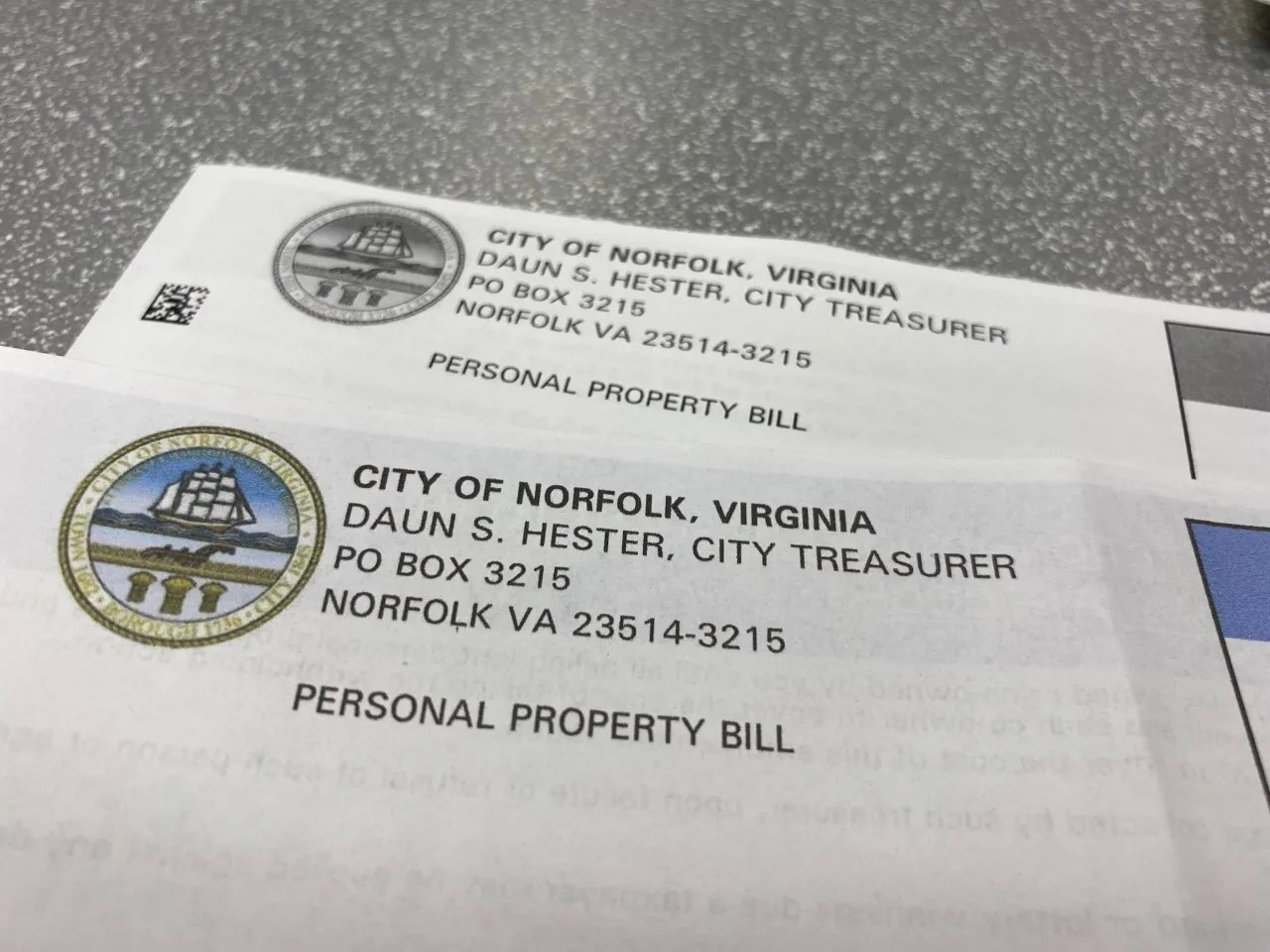

3. Reviewing Assessment Notices and Tax Bills: Property owners in New Jersey receive annual assessment notices and tax bills that provide information about their property assessments. Assessment notices are typically mailed out by the local tax assessor’s office and include important details such as the assessed value of the property and any changes from the previous assessment. Tax bills, on the other hand, provide information about the property tax amount due based on the assessed value. Reviewing these notices and bills can give property owners a clear understanding of their property’s assessment.

4. Hiring a Licensed Appraiser: If you require a professional and independent assessment of your property, you may consider hiring a licensed appraiser. Appraisers are trained professionals who have expertise in evaluating property values. They can conduct a thorough assessment of your property using various methods and provide you with an accurate valuation. Keep in mind that hiring an appraiser may come with a cost, but it can be beneficial if you are looking for a detailed and impartial assessment.

It is important to note that property assessments can be subject to change over time due to market fluctuations or property improvements. It is recommended to regularly check your property assessment to ensure its accuracy and address any discrepancies promptly.

In the next section, we will explore the factors that can influence property assessments in New Jersey. Understanding these factors will provide insight into how property assessments are determined and why assessments may vary between properties.

Contacting the Local Tax Assessor’s Office

One of the most direct and reliable methods to find out the property assessment in New Jersey is by contacting the local tax assessor’s office. The tax assessor’s office is responsible for assessing the value of properties within their jurisdiction for taxation purposes. They maintain records of property assessments and can provide property owners with the assessed value of their specific property upon request.

To contact the local tax assessor’s office, you can start by visiting the municipality’s official website. Most municipalities have an online presence where they provide contact information for various departments, including the tax assessor’s office. Alternatively, you can reach out to the local government office and ask for the contact details of the tax assessor’s office.

When contacting the tax assessor’s office, it is helpful to have the property’s address, owner’s name, or tax parcel ID number handy. Providing this information will assist the office in locating the correct property and retrieving the relevant assessment details.

The staff at the tax assessor’s office can provide you with a wide range of information related to your property assessment, including the assessed value, any recent changes or updates, and the methodology used to determine the assessment. They can also inform you about any upcoming revaluation or reassessment activity that may affect the assessed value of your property.

Furthermore, the tax assessor’s office is a valuable resource for understanding the local property tax regulations and procedures. They can provide guidance on how to interpret your property assessment and how it corresponds to your tax obligations. If you have any questions or concerns about your property assessment, the staff at the tax assessor’s office will be able to address them and provide clarifications.

It is important to note that due to the workload and availability of resources, it may take some time to obtain the requested information from the tax assessor’s office. Therefore, it is advisable to contact them well in advance if you need the information by a specific deadline.

In addition to accessing property assessments, the tax assessor’s office can also help with other property-related inquiries, such as understanding tax rates, exemptions, and filing for tax appeals if necessary. Their expertise and knowledge make them an essential point of contact for property owners seeking information about their property assessments.

Overall, contacting the local tax assessor’s office is a reliable and convenient method to find out the property assessment in New Jersey. By taking advantage of this resource, property owners can gain a comprehensive understanding of their property’s assessed value and ensure the accuracy of their tax obligations.

Searching Online Databases

In today’s digital age, accessing information has become easier than ever. When it comes to finding out property assessments in New Jersey, one method that provides convenience and efficiency is searching online databases. Many counties in New Jersey offer online databases that allow property owners to access property assessment information with a few clicks.

To begin your search, you can visit the official website of the county where your property is located. Most county websites have a dedicated section or webpage for property assessments. Look for options like “Property Records” or “Property Assessments” on the website’s menu or search bar. Once you access the property assessment section, you may be prompted to enter specific details about your property, such as the address, owner’s name, or tax ID number.

By entering the relevant information, you can retrieve the assessed value of your property and additional details related to your assessment. These details may include the property’s dimensions, recent sale information, tax history, and any exemptions or deductions applied. The online database allows you to access this information at any time, making it a convenient option for property owners who prefer a self-service approach.

Using online databases to find property assessments has several advantages. First, it is accessible 24/7, eliminating the need to wait for business hours or rely on external parties for the information. Second, it provides a quick and efficient way to retrieve property assessment details, saving you time and effort. Additionally, online databases often offer additional features like property tax calculators or assessment history, giving you a comprehensive overview of your property’s assessment journey.

While online databases are a valuable tool, it’s important to note that they may vary in functionality and accessibility from county to county. Some counties may require registration or login to access property assessment information, while others may offer a more user-friendly and transparent interface. It’s recommended to explore the available options on the county’s website and familiarize yourself with the database’s features and search capabilities.

It’s worth mentioning that despite the convenience of online databases, they may not always provide the most up-to-date information. Property assessments can change periodically, and online databases may not reflect real-time updates. Therefore, if you suspect any discrepancies or have concerns about the accuracy of the assessment, it’s advisable to contact the local tax assessor’s office for the most accurate and recent information.

Searching online databases is a practical and efficient method to find out property assessments in New Jersey. It empowers property owners to access their property information at their convenience and gain insights into their tax obligations. By leveraging online resources, property owners can stay informed about their property assessments and make informed decisions about their property.

Read more: How To Find Property Assessment Value

Reviewing Assessment Notices and Tax Bills

When it comes to finding out the property assessment in New Jersey, reviewing assessment notices and tax bills is another valuable method. Property owners in New Jersey receive annual assessment notices and tax bills, which provide essential information about their property assessments and tax obligations.

Assessment notices are typically sent out by the local tax assessor’s office to property owners each year. These notices include important details such as the assessed value of the property and any changes from the previous assessment. They serve as official documentation of the property’s assessed value and provide a basis for calculating property taxes.

Tax bills, on the other hand, are statements that property owners receive, usually on a quarterly or annual basis, indicating the amount of property tax due. The tax bill is calculated based on the assessed value of the property and the applicable tax rates set by local government authorities.

By reviewing assessment notices and tax bills, property owners can gain valuable insights into their property assessments. They can verify the accuracy of the assessed value, identify any changes or updates made to the assessment, and understand how it corresponds to their tax obligations.

To access your assessment notices and tax bills, you can typically find them in your mailbox or online through the municipality’s official website. If you do not receive them or misplace them, you can contact the local tax assessor’s office or the municipality’s tax collector’s office to request copies.

When reviewing assessment notices, pay close attention to any changes made to the assessed value of your property. The notice should clearly state the previous assessment value and the current assessed value, allowing you to compare and understand any adjustments. It’s important to note that property assessments can fluctuate due to factors such as market trends, property improvements, or changes in the neighborhood.

Similarly, when examining tax bills, ensure that the assessed value used to calculate the property tax amount is accurate and consistent with your assessment notice. Check for any exemptions or deductions applied that may impact your tax obligations.

If, upon reviewing your assessment notice and tax bill, you believe that there is an error or discrepancy in the assessed value or tax calculation, you should contact the local tax assessor’s office or the tax collector’s office. They can provide clarification on the assessment and assist in resolving any issues or concerns.

Reviewing assessment notices and tax bills is an effective method to find out property assessments in New Jersey. It allows property owners to stay informed about their property’s assessed value and ensures the accuracy of their tax obligations. By actively reviewing these documents, property owners can detect any potential errors or discrepancies and address them promptly.

Hiring a Licensed Appraiser

When it comes to finding out the property assessment in New Jersey, hiring a licensed appraiser is another option that property owners can consider. Appraisers are trained professionals who specialize in evaluating property values and can provide an independent assessment of your property’s worth.

Hiring a licensed appraiser offers several advantages. First and foremost, appraisers have expertise in property valuation and are knowledgeable about the factors that influence property assessments. They utilize various methods, including analyzing market data, conducting property inspections, and considering recent sales of comparable properties, to determine an accurate assessment.

Appraisers provide a detailed and impartial evaluation of your property’s value, taking into account its specific characteristics, location, condition, and recent market trends. Their professional opinion can be particularly useful in situations where property owners are uncertain about the accuracy or fairness of their property assessment.

Furthermore, the appraisal report produced by the licensed appraiser can serve as valuable documentation when challenging an inaccurate assessment. The report provides a comprehensive analysis of your property’s value and can be used as supporting evidence during the assessment appeals process.

When hiring a licensed appraiser, it is important to ensure that they are qualified and accredited professionals. Look for appraisers who hold certifications from reputable organizations such as the Appraisal Institute (AI) or the American Society of Appraisers (ASA). These certifications indicate that the appraiser has met specific requirements, including education, experience, and ethical standards.

To find a licensed appraiser, you can search online directories or contact professional appraisal associations in New Jersey. These resources can provide a list of accredited appraisers who specialize in residential or commercial properties within your area.

Before engaging an appraiser, it is advisable to request information about their experience, credentials, and fee structure. You may also want to inquire if they have familiarity with properties in your specific location or neighborhood. This information will help you make an informed decision and ensure that the appraiser is a good fit for your specific needs.

It’s important to note that hiring a licensed appraiser typically comes with a cost. The fee for an appraisal varies depending on various factors such as the type and complexity of the property, the scope of the assignment, and the appraiser’s experience. Property owners should consider the potential benefits of obtaining an independent assessment in their decision-making process.

Overall, hiring a licensed appraiser can be a valuable method to find out the property assessment in New Jersey. They bring expertise, objectivity, and professional judgment to the evaluation process. By working with a licensed appraiser, property owners can ensure an accurate assessment of their property value and have the necessary documentation to support their case if challenging an inaccurate assessment.

Factors Affecting Property Assessments

Property assessments in New Jersey are influenced by various factors that determine the value of a property for tax purposes. Understanding these factors is crucial for property owners to gain insights into how their assessments are determined and why assessments may vary between properties. Here are some key factors that can affect property assessments:

1. Location and Neighborhood: The location of a property is a significant factor in determining its assessed value. Properties located in desirable neighborhoods, close to amenities, good schools, and transportation hubs tend to have higher assessed values. On the other hand, properties in less desirable or economically-depressed areas may have lower assessed values.

2. Property Size and Condition: The size and condition of a property also play a role in determining its assessed value. Generally, larger properties with more square footage tend to have higher assessments. Similarly, well-maintained properties in good condition are likely to have higher assessed values compared to properties in poor condition or in need of repairs.

3. Recent Sales and Market Trends: Recent sales data of similar properties in the area are often taken into consideration when assessing a property. If there have been recent sales of comparable properties at higher values, it can influence the assessed value of neighboring properties. Additionally, market trends, such as increasing property values in a particular area, can impact assessments.

4. Improvements and Renovations: Improvements and renovations made to a property can affect its assessed value. Major upgrades, such as adding an additional room, renovating the kitchen or bathroom, or installing energy-efficient features, can increase the assessed value of a property. Property owners should keep a record of all improvements and provide this information to the local tax assessor’s office to ensure that the assessment accurately reflects the property’s value.

5. Property Use and Zoning: The use and zoning of a property can influence its assessed value. Properties used for commercial purposes or located in areas with higher zoning restrictions may have higher assessed values compared to residential properties. The potential income-generating capacity of a property, such as rental or commercial income, can also impact its assessed value.

6. Exemptions and Tax Incentives: Certain exemptions and tax incentives provided by local or state governments can affect property assessments. For instance, properties designated as historic landmarks or owned by senior citizens may qualify for exemptions that reduce their assessed value. It is important to understand the eligibility criteria for exemptions and incentives and apply for them if applicable.

It’s important to note that property assessments in New Jersey can change over time due to various factors. Assessments are typically conducted periodically, and adjustments may be made to reflect changes in the real estate market. Property owners should review their assessments periodically to ensure their accuracy and address any concerns or discrepancies through the appropriate channels.

By understanding the factors that influence property assessments, property owners can gain insights into their property’s assessed value and make informed decisions regarding their taxes and overall property management. Additionally, knowledge of these factors can be helpful when appealing an inaccurate assessment or seeking a reassessment of the property value.

Location and Neighborhood

Location and neighborhood are key factors that significantly influence property assessments in New Jersey. The location of a property plays a vital role in its desirability and, ultimately, its assessed value. Here are some important aspects to consider:

Desirable Neighborhoods: Properties located in desirable neighborhoods tend to have higher assessed values. Factors such as low crime rates, good schools, proximity to amenities like parks, shopping centers, and restaurants, and access to transportation contribute to the desirability of a neighborhood. These neighborhoods often attract buyers and investors, leading to higher property values and assessments.

Proximity to Employment Opportunities: Properties located close to job centers, business districts, and major employment hubs tend to have higher assessed values. The convenience of a shorter commute and access to employment opportunities make properties in these areas more attractive to potential buyers, resulting in higher demand and increased assessments.

Views and Scenic Surroundings: Properties with desirable views, such as waterfront locations or views of parks and natural landscapes, can have higher assessed values. The aesthetic appeal and tranquility provided by scenic surroundings can significantly impact property values, making them more sought after and leading to higher assessments.

Access to Transportation: Properties located near public transportation options, such as train stations, bus stops, or major highways, typically have higher assessed values. Easy access to transportation not only enhances convenience for residents but also increases the appeal of a neighborhood, contributing to higher property values.

Property Location within the Neighborhood: Even within a neighborhood, the specific location of a property can influence its assessed value. Factors such as proximity to amenities, schools, parks, and roads can affect assessments. Properties located on main streets or in prime locations within the neighborhood may command higher assessed values due to increased visibility and convenience.

It is important to note that property assessments take into consideration the average value of similar properties within the neighborhood. While a property may be located in a desirable neighborhood, other factors such as property size, condition, and recent sales of comparable properties also influence its assessed value. Consequently, individual assessments within the same neighborhood may vary depending on these additional factors.

To find out how location and neighborhood impact your property assessment, you can contact the local tax assessor’s office or explore online databases. Understanding the role of location and neighborhood in property assessments can help property owners make more informed decisions, such as pricing their property for sale, assessing their tax obligations accurately, or determining the potential returns on investment.

In the next sections, we will explore additional factors that affect property assessments in New Jersey, including property size and condition, recent sales and market trends, improvements and renovations, and exemptions and tax incentives. By understanding these factors, property owners can enhance their understanding of property assessments and how they relate to the overall value of their property.

You can find property assessments in New Jersey by visiting the local tax assessor’s office or searching online through the county’s property tax website.

Read more: How To Find Property Assessment In Arizona

Property Size and Condition

Property size and condition are crucial factors that significantly impact property assessments in New Jersey. Assessors take into account the size and condition of a property to determine its assessed value. Here’s a closer look at how these factors influence property assessments:

Property Size: The size of a property is an essential consideration when assessing its value. Larger properties typically have higher assessed values compared to smaller ones. Assessors take into account the total square footage of the property, including the indoor living space, lot size, and any additional structures or improvements on the property, such as garages or sheds. The size of the property is a direct indicator of its market value and has a direct impact on the assessment.

Property Condition: The condition of a property also plays a significant role in property assessments. Assessors consider the overall state of the property, including its structural integrity, maintenance, and any necessary repairs or renovations. Well-maintained properties with modern updates and a high level of upkeep are likely to have higher assessed values. On the other hand, properties in poor condition or in need of significant repairs may have lower assessed values.

Assessors usually rely on visual inspections to evaluate the condition of a property. They assess factors such as the roof, foundation, plumbing, electrical systems, and overall structural integrity. The overall condition of the property affects its marketability and perceived value, leading to adjustments in the assessed value.

It’s important to note that property assessments consider the condition of the property as it stands on the assessment date, rather than potential improvements or upgrades that may have been made after the assessment. Any renovations or improvements should be properly documented and shared with the local tax assessor’s office to ensure that the assessment accurately reflects the property’s condition.

Property owners can positively influence their property assessments by maintaining and improving their properties. Keeping up with regular maintenance, addressing repairs promptly, and making upgrades can enhance the overall condition of the property, potentially resulting in a higher assessed value.

When it comes to property size and condition, it’s essential to remember that these factors interact with other elements like location, recent sales, and market trends. Assessors consider a combination of factors to arrive at an accurate assessment that reflects the property’s overall value.

To find out how property size and condition impact your property assessment, you can review your assessment notice or tax bill, or contact the local tax assessor’s office for more information. The assessed value will be determined based on an evaluation of these factors, aiming to provide a fair and accurate reflection of your property’s value.

By understanding the role of property size and condition in property assessments, homeowners can focus on maintaining and improving their properties, ensuring the accuracy of their assessments and potentially increasing the value of their investment.

Recent Sales and Market Trends

Recent sales and market trends are significant factors that influence property assessments in New Jersey. These factors reflect the state of the real estate market and help assessors determine the value of a property. Here’s an overview of how recent sales and market trends affect property assessments:

Comparable Sales: Assessors analyze recent sales of similar properties in the area to determine the assessed value of a property. They look for properties with similar characteristics, such as size, location, condition, and features, that have been sold within a specific time frame. These comparable sales provide valuable data on current market prices and serve as benchmarks for property assessments. If there have been recent sales of similar properties at higher prices, it can influence the assessed value of neighboring properties and potentially lead to an increase in assessments.

Market Conditions: Assessors consider the prevailing market conditions when assessing a property. This includes factors such as supply and demand, interest rates, economic conditions, and other market indicators. In a seller’s market where demand exceeds supply, property values tend to rise, resulting in higher assessments. Conversely, during a buyer’s market where supply outpaces demand, property values may stagnate or decrease, potentially leading to lower assessments. Assessors continuously monitor market conditions to ensure assessments reflect the current real estate landscape.

Real Estate Market Fluctuations: Property assessments take into account fluctuations in the real estate market. Assessors consider trends and changes in property values over time. They analyze historical sales data, including sales and assessment ratios, to identify patterns and fluctuations in property values within specific neighborhoods or market segments. Adjustments may be made to property assessments to align with these market fluctuations, ensuring assessments reflect the current value of the property.

It is important to note that assessments do not necessarily reflect real-time market values. Assessors work within assessment cycles, reassessing properties periodically rather than in response to immediate market changes. This means that assessments may not always capture the very latest market trends or fluctuations. However, assessors strive to ensure assessments are fair and consistent based on available market data.

Property owners can access information about recent sales and market trends through various resources. Local real estate agencies, online platforms, or public records can provide data on recent property sales, which can be helpful in understanding market trends and supporting your understanding of your property assessment. However, for the most accurate and up-to-date market information, consulting with a licensed real estate agent or appraiser can provide valuable insights into the current state of the market in your specific area.

By understanding the impact of recent sales and market trends on property assessments, homeowners can gain a better understanding of how assessors arrive at the assessed value of their properties. Staying aware of market conditions and recent sales can also help property owners make informed decisions regarding their property, such as pricing it for sale or evaluating its investment potential.

In the next section, we will explore the influence of property improvements and renovations on property assessments. Understanding these factors can provide insights into how upgrades and renovations can impact the assessed value of a property.

Improvements and Renovations

Improvements and renovations made to a property can significantly impact property assessments in New Jersey. Assessors take into account upgrades and changes that enhance the value of a property when determining its assessed value. Let’s explore how improvements and renovations affect property assessments:

Increased Property Value: Property improvements and renovations that increase the overall value of a property can lead to higher assessments. Upgrades such as adding an extra bedroom or bathroom, renovating the kitchen or bathroom, installing new flooring, or updating the HVAC system can enhance the functionality and appeal of a property. These improvements are likely to result in a higher assessed value as they contribute to the overall market value of the property.

Quality of Materials and Workmanship: Assessors also take into consideration the quality of materials and workmanship in property assessments. The use of high-quality materials and professional craftsmanship in renovations can positively impact the assessed value. Assessors may consider the durability, longevity, and overall design of the improvements when determining the assessment. Properties with superior quality upgrades are often assessed at a higher value compared to those with cheaper or subpar renovations.

Energy Efficiency Upgrades: Energy-efficient upgrades, such as the installation of solar panels, energy-efficient windows, or insulation, can also influence property assessments. These types of improvements are not only environmentally friendly but can also result in long-term cost savings for homeowners. Assessors often take into account the energy efficiency of a property when determining its assessed value, as it adds to the overall desirability and perceived value of the property.

Permitting and Documentation: To ensure that improvements and renovations are properly accounted for during property assessments, it is crucial to obtain the necessary permits and documentation. Proper documentation helps assessors understand the scope and quality of the work done on the property. It is advisable to keep records of permits, receipts, and invoices related to the improvements, as they can serve as valuable supporting documents if any discrepancies arise during the assessment process.

It’s important to note that assessors assess a property based on its condition as of a specific assessment date. Therefore, any improvements or renovations made after the assessment date may not be reflected in the current assessment until the next assessment cycle.

To ensure that improvements and renovations are accurately reflected in the property assessment, property owners should keep detailed records of the work done and provide this information to the local tax assessor’s office. Providing proper documentation of upgrades and renovations can help ensure a fair and accurate assessment of the property’s value.

Understanding the impact of improvements and renovations on property assessments allows homeowners to make informed decisions when investing in their properties. By focusing on upgrades that enhance the value and functionality of the property, homeowners can increase their property’s overall market value and potentially see a positive impact on their property assessments.

In the next section, we will explore the process of appealing property assessments in New Jersey. Understanding the assessment appeal process can be helpful if property owners believe their assessments are inaccurate or unfair.

Appealing Property Assessments in New Jersey

If property owners in New Jersey believe that their property assessments are inaccurate or unfair, they have the right to appeal the assessment. The assessment appeal process provides an opportunity to present evidence and arguments to challenge the assessed value of a property. Here’s an overview of the assessment appeal process in New Jersey:

Understanding the Assessment Appeal Process: The assessment appeal process in New Jersey consists of several steps. Property owners must first file an appeal with the County Board of Taxation within a specified timeframe, typically 30 days from the date of the assessment notice or the mailing of the annual tax bill. After filing the appeal, property owners may need to attend a hearing before the County Tax Board to present their case.

Gathering Supporting Evidence: To support an appeal, property owners should gather relevant evidence that supports their argument for a lower assessed value. This may include recent sales data of comparable properties, appraisals, photographs, and documentation of property defects or unfavorable conditions. It’s essential to compile a strong case with credible evidence to demonstrate why the assessment is inaccurate.

Filing an Appeal: Property owners can file an appeal by completing the appropriate forms provided by the County Board of Taxation. These forms typically require information about the property, the reasons for the appeal, and supporting evidence. Filing fees may apply, and it’s important to adhere to the specified deadline for filing the appeal.

Presenting Your Case: Once the appeal is filed, property owners may be required to attend a hearing before the County Tax Board. At the hearing, property owners can present their case, including the evidence they have gathered, to argue for a lower assessed value. It is advisable to be prepared with organized documentation and clear arguments to effectively communicate your position.

During the hearing, property owners may have the opportunity to present their evidence, respond to questions from the Tax Board members, and provide additional information to support their appeal. The County Tax Board will consider the evidence presented by both the property owner and the assessor’s office before making a decision.

Decisions and Further Appeals: After the hearing, the County Tax Board will issue a decision regarding the property assessment. If property owners are unsatisfied with the outcome, they may have the option to further appeal the decision to the New Jersey Tax Court or the County Superior Court. It is important to consult with a qualified attorney to understand the process and requirements for further appeals.

It’s worth noting that the assessment appeal process can be complex, and it is advisable to seek professional advice if you decide to appeal your property assessment. Consulting with a licensed appraiser or a real estate attorney who specializes in property tax matters can provide guidance and support throughout the appeal process.

In summary, the assessment appeal process in New Jersey allows property owners to challenge the accuracy or fairness of their property assessments. By understanding the steps involved in appealing assessments and gathering strong supporting evidence, property owners can work towards achieving a fair and accurate assessment of their property’s value.

Understanding the Assessment Appeal Process

The assessment appeal process in New Jersey provides property owners with the opportunity to challenge the accuracy or fairness of their property assessments. This process allows property owners to present their case, provide evidence, and seek a reassessment of their property’s value. Understanding the assessment appeal process is crucial for property owners who believe their assessments are incorrect or unjust. Here is an overview of the assessment appeal process in New Jersey:

Timing and Deadlines: Property owners must file an appeal within the specified timeframe, typically 30 days from the date of the assessment notice or the mailing of the annual tax bill. It is essential to adhere to these deadlines to ensure that the appeal is considered valid. Failing to meet the deadlines may result in the forfeiture of the right to appeal for that tax year.

Filing the Appeal: To initiate the assessment appeal process, property owners must complete the necessary forms provided by the County Board of Taxation. These forms require relevant information about the property, the reasons for the appeal, and any supporting evidence. It is important to provide accurate and detailed information to strengthen your case.

Gathering Supporting Evidence: Property owners must gather supporting evidence to present during the appeal process. This evidence may include recent sales data of similar properties, appraisals, photographs, or documentation of property defects or unfavorable conditions. The goal is to demonstrate that the assessed value is inaccurate or unfair. It’s crucial to compile and organize strong evidence to effectively support your appeal.

Hearing before the County Tax Board: Once the appeal is filed, property owners may be required to attend a hearing before the County Tax Board. The purpose of the hearing is to present your case and provide evidence to support your argument for a lower assessed value. It is advisable to be prepared with organized documentation, clear arguments, and persuasive presentation skills.

During the hearing, property owners may have the opportunity to present their evidence, respond to questions from the Tax Board members, and provide additional information to support their appeal. The County Tax Board will carefully consider the evidence presented by both the property owner and the assessor’s office before making a decision.

Decision and Finalizing the Assessment: Once the hearing is complete, the County Tax Board will issue a decision regarding the property assessment. The decision may involve a reduction, no change, or an adjustment to the assessed value. It’s important to carefully review the decision and understand its implications on your property’s assessment.

If property owners are dissatisfied with the decision made by the County Tax Board, they have the option to further appeal to the New Jersey Tax Court or the County Superior Court. It is advisable to consult with a qualified attorney who specializes in property tax matters to guide you through the additional appeals process if necessary.

Understanding the assessment appeal process is crucial for property owners who believe their assessments are inaccurate or unjust. By adhering to the specified deadlines, gathering strong supporting evidence, and presenting a compelling case during the hearing, property owners can work towards achieving a fair reassessment of their property’s value. Consulting with professionals who specialize in property tax matters can provide valuable guidance and support throughout the assessment appeal process.

Gathering Supporting Evidence

Gathering supporting evidence is a critical step in the assessment appeal process in New Jersey. Strong evidence strengthens your case and supports your argument for a lower assessed value. Collecting relevant and persuasive evidence helps demonstrate that the current assessment is inaccurate or unfair. Here are some key considerations for gathering supporting evidence:

Recent Sales Data: Collect recent sales data of comparable properties in your area. Look for properties with similar characteristics, such as size, location, condition, and features. A comparison of recent sales prices can highlight discrepancies between your property’s assessment and the market value of similar properties. This data supports the argument that your property’s assessed value should be adjusted accordingly.

Appraisals and Property Valuations: Obtain a professional appraisal or property valuation report from a licensed appraiser. Appraisals provide an expert and unbiased assessment of your property’s value. These reports take into account various factors such as the property’s size, condition, location, and recent market trends. A comprehensive appraisal report can carry significant weight in supporting your appeal.

Photographs and Documentation: Take detailed photographs of your property, both inside and outside. Capture any relevant features, conditions, or defects that may affect its value. Additionally, gather any supporting documents, such as repair invoices, maintenance records, or inspection reports, that demonstrate the property’s condition or any issues that may impact the assessed value. Clear visual evidence and documentation provide tangible support for your case.

Property Defects or Unfavorable Conditions: Identify any defects or unfavorable conditions that may lower the assessed value of your property. This can include structural issues, outdated systems, or damages that significantly affect the property’s value. Obtain expert opinions or estimates regarding the cost of repairs or improvements needed to rectify these defects. Such evidence highlights the need for a reassessment based on the actual condition of the property.

Market Analysis and Trends: Conduct research and gather data on the current real estate market trends in your area. This can include information on sales activity, price fluctuations, or changes in market demand. Highlight any significant shifts or developments that may have affected property values since the assessment was conducted. This evidence helps demonstrate that the current assessment does not align with market realities.

Comparable Case Precedence: Research and gather information on similar assessment appeal cases that have been successful. Identify cases where properties with similar characteristics or circumstances achieved a lower assessed value. These precedents provide additional support to your argument that a reassessment is warranted.

When presenting your evidence, it is crucial to organize it in a clear and concise manner. Create a comprehensive file containing all relevant documentation, photographs, reports, and supporting materials. Consider creating a summary or cover letter that outlines the key points of your appeal. A well-organized and thorough presentation of evidence will strengthen your case during the appeal process.

Remember to review and adhere to the guidelines and requirements set by the County Board of Taxation for submitting evidence. Each county may have specific rules and deadlines for the submission of evidence during the appeal process.

Consulting with professionals, such as licensed appraisers or attorneys specializing in property tax matters, can provide valuable guidance and assistance in gathering and presenting supporting evidence. Their expertise can help ensure that your evidence is robust, relevant, and compelling, increasing your chances of a successful assessment appeal.

By gathering strong supporting evidence, property owners can build a convincing case to challenge their property assessment and work towards achieving a fair and accurate reassessment of their property’s value.

Filing an Appeal and Presenting Your Case

Filing an appeal and presenting your case effectively are critical steps in the assessment appeal process in New Jersey. A well-prepared and persuasive presentation can significantly increase your chances of a successful reassessment. Here are important considerations for filing an appeal and presenting your case:

File the Appeal: To initiate the appeal process, file the appropriate forms provided by the County Board of Taxation within the specified timeframe, typically 30 days from the date of the assessment notice or the mailing of the annual tax bill. Complete the forms accurately, including all required information such as property details, reasons for the appeal, and supporting evidence. Be sure to adhere to the deadline and include any filing fees, if applicable.

Understand the Regulations and Process: Familiarize yourself with the regulations and requirements of the assessment appeal process in your county. Each county may have specific procedures, rules, and deadlines that must be followed. Understanding these details will ensure that your appeal is filed correctly and that you are prepared for each step in the process.

Organize Your Evidence: Gather and organize all supporting evidence for your case. Arrange the evidence in a clear and logical manner. Label and index documents, photographs, and other materials to present them coherently during the appeal process. A well-organized presentation of evidence will help you present a strong and coherent argument for a lower assessed value.

Prepare an Opening Statement: Craft a concise and impactful opening statement to introduce your case. Clearly state the reasons for your appeal and provide a brief overview of the evidence you will present. The opening statement should be clear, logical, and persuasive, capturing the attention of the County Tax Board members and summarizing the key points of your case.

Present Your Evidence: During the hearing before the County Tax Board, present your evidence in a methodical and well-structured manner. Begin with a clear overview of the evidence you will present and its relevance to your appeal. Present each piece of evidence systematically, referring to specific documents, photographs, or reports as necessary. Be prepared to discuss and explain the significance of the evidence in relation to your case.

Be Professional and Respectful: Maintain a professional and respectful demeanor throughout the appeal process. Address the County Tax Board members and other participants with courtesy and professionalism. Stay focused, articulate your points clearly, and respond to questions or comments with clarity and confidence. Remember that the objective is to present a compelling case rather than engaging in personal arguments or confrontations.

Consider Seeking Professional Advice: Depending on the complexity of the case, consider consulting with a real estate attorney or a licensed appraiser specializing in property tax matters. Their expertise can provide valuable guidance and support in preparing and presenting your case, ensuring that your arguments are effectively presented and supported by sound legal and appraisal principles.

The assessment appeal process can be complex, and each case is unique. It is important to tailor your presentation to the specific circumstances of your property and the evidence you have gathered. Be prepared for questions and critiques from the County Tax Board members, and respond thoughtfully and respectfully.

After presenting your case, you will need to await the decision of the County Tax Board regarding the reassessment of your property. If the decision is not in your favor, consult with a real estate attorney to discuss the possibility of further appeals to the New Jersey Tax Court or the County Superior Court.

By filing an appeal and presenting your case diligently and persuasively, you maximize your chances of achieving a fair reassessment of your property’s value. Proper preparation, effective organization of evidence, and a professional presentation are key to a successful outcome in the assessment appeal process.

Conclusion

Navigating the world of property assessments in New Jersey can be complex, but with the right knowledge and understanding, property owners can ensure that their assessments accurately reflect the value of their properties. In this comprehensive guide, we have explored the methods to find out property assessments in New Jersey, including contacting the local tax assessor’s office, searching online databases, reviewing assessment notices and tax bills, and hiring a licensed appraiser.

We have also discussed the factors that can influence property assessments, such as location and neighborhood, property size and condition, recent sales and market trends, improvements and renovations, and exemptions and tax incentives. Understanding these factors equips property owners with the insights needed to assess the fairness and accuracy of their property assessments.

Additionally, we have provided an overview of the assessment appeal process in New Jersey, emphasizing the importance of gathering supporting evidence, filing an appeal within designated timelines, and presenting a compelling case before the County Tax Board.

Throughout this guide, we have stressed the significance of seeking professional advice when necessary. Consulting with a licensed appraiser or real estate attorney who specializes in property tax matters can provide valuable guidance and support to navigate the complexities of property assessments and the assessment appeals process.

In conclusion, staying informed about property assessments is an essential part of property ownership in New Jersey. By understanding the methods to find property assessments, the factors that influence assessments, and the process of appealing assessments, property owners can ensure that their assessments accurately reflect the value of their properties for taxation purposes.

Remember, property assessments may change periodically due to market fluctuations and property improvements. It is important to regularly review your assessments, gather supporting evidence, and, if necessary, file an appeal to challenge any inaccuracies or unfair assessments.

By actively engaging in the assessment process and being proactive in managing your property assessments, you can ensure that you are accurately assessed and fulfill your tax obligations with confidence.

Frequently Asked Questions about How To Find Out Property Assessment In New Jersey

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Find Out Property Assessment In New Jersey”