Home>Renovation & DIY>Home Renovation Guides>What Home Improvements Increase Property Taxes In New Jersey?

Home Renovation Guides

What Home Improvements Increase Property Taxes In New Jersey?

Modified: January 4, 2024

Discover which home improvements can potentially increase your property taxes in New Jersey with our comprehensive home renovation guide. Maximize your investment and avoid unexpected tax hikes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

When it comes to renovating your home in New Jersey, it's essential to consider the potential impact on your property taxes. Home improvements can significantly affect the assessed value of your property, which in turn may lead to an increase in property taxes. Understanding which renovations can impact your property taxes is crucial for homeowners looking to enhance their living spaces while managing their overall housing costs.

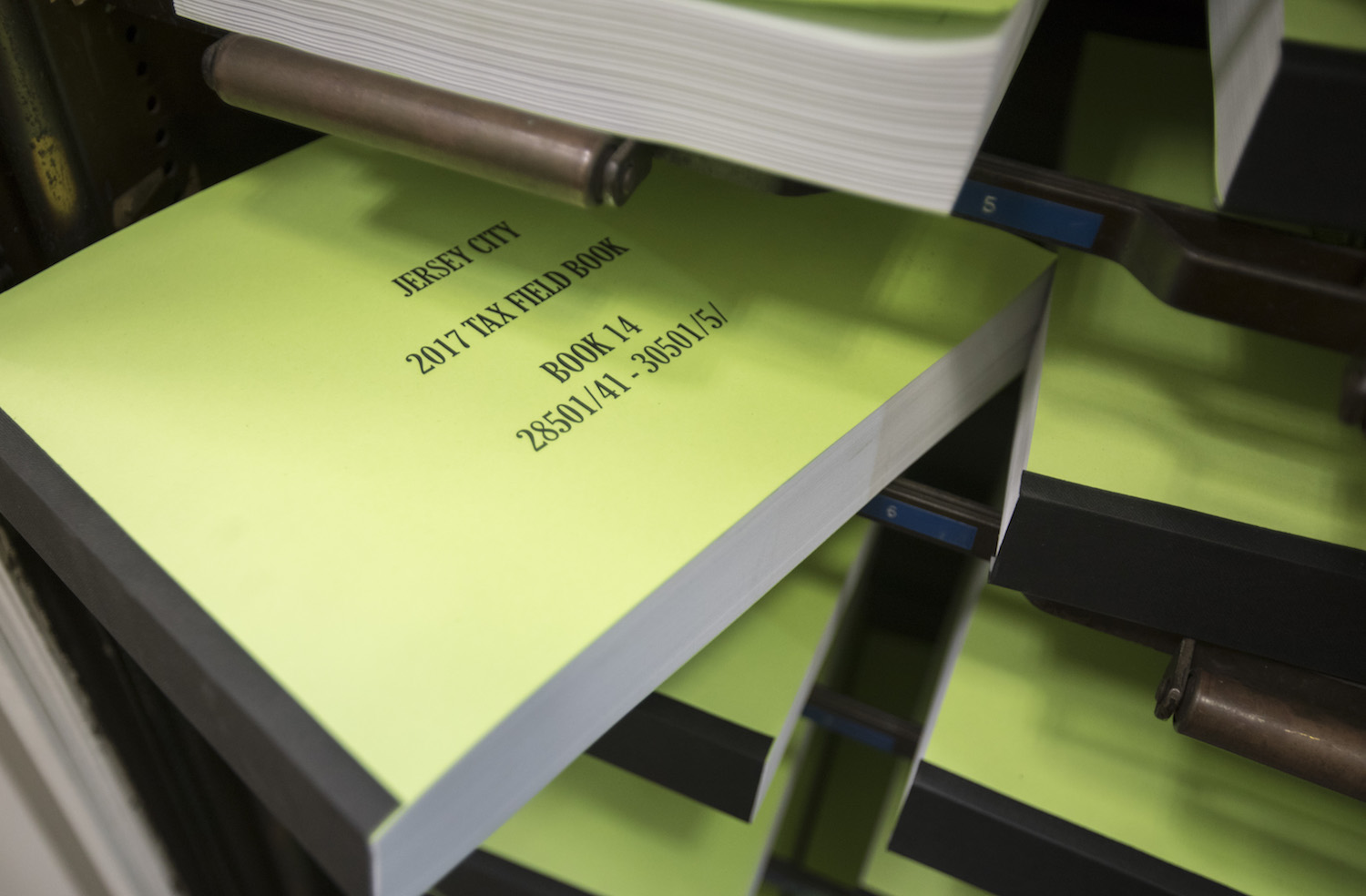

In New Jersey, property taxes are a vital source of revenue for local governments, funding essential services such as public schools, infrastructure maintenance, and public safety. The property tax system in the state is based on the assessed value of the property, and any changes to this value can directly influence the amount of property taxes owed. Therefore, it's important for homeowners to be aware of how specific home improvements can impact their property taxes.

In this comprehensive guide, we will explore the relationship between home improvements and property taxes in New Jersey. We'll delve into the types of renovations that can potentially lead to an increase in property taxes, as well as those that may have a minimal impact or even result in tax savings. By gaining a clear understanding of these dynamics, homeowners can make informed decisions about their home improvement projects, ensuring that they align with their financial goals and overall property investment strategy.

Whether you're considering a kitchen remodel, a new addition, or other significant upgrades to your home, this guide will provide valuable insights into the potential tax implications. By the end of this article, you'll have a well-rounded understanding of how various home improvements can affect your property taxes in the Garden State, empowering you to plan and execute your home renovation projects with confidence. Let's dive into the details of property taxes and home improvements in New Jersey to equip you with the knowledge needed to make informed decisions about enhancing your home.

Key Takeaways:

- Renovations like major additions, extensive renovations, and energy-efficient upgrades can increase property taxes in New Jersey, impacting homeowners’ overall housing costs.

- On the other hand, basic upgrades, cosmetic enhancements, and energy-efficient incentives may have minimal impact on property taxes or even result in tax savings for homeowners, providing opportunities to improve living spaces while managing housing costs effectively.

Understanding Property Taxes in New Jersey

Before delving into the specific types of home improvements that can impact property taxes in New Jersey, it’s essential to grasp the fundamental aspects of the state’s property tax system. Property taxes in New Jersey play a critical role in funding local government services, including schools, infrastructure, and public safety initiatives. The amount of property tax owed by homeowners is determined by the assessed value of their properties, which is established by local tax assessors.

New Jersey utilizes an ad valorem property tax system, meaning that taxes are based on the value of the property. The assessed value of a property is a key factor in determining property taxes, and it reflects the market value of the property as determined by the local tax assessor’s office. This assessed value serves as the basis for calculating property taxes, with homeowners being responsible for paying taxes based on this valuation.

It’s important to note that property taxes in New Jersey can vary widely depending on the municipality in which a property is located. Different towns and cities may have distinct tax rates and assessment practices, leading to variations in property tax burdens for homeowners across the state. Additionally, New Jersey’s property tax system is known for its complexity, with factors such as tax appeals, exemptions, and deductions further influencing the overall tax liabilities of property owners.

Understanding the relationship between home improvements and property taxes is crucial within this context. Certain renovations and upgrades can increase the assessed value of a property, potentially leading to higher property taxes for homeowners. On the other hand, some home improvements may have minimal impact on property taxes or even result in tax savings, making it important for homeowners to be aware of these dynamics as they plan and execute their renovation projects.

By gaining a solid understanding of how property taxes are calculated and the factors that can influence them, homeowners in New Jersey can make informed decisions about their home improvement endeavors. With this foundational knowledge in place, let’s explore the specific types of home improvements that can impact property taxes in the Garden State, shedding light on the potential tax implications of various renovation projects.

Home Improvements That Increase Property Taxes

When considering home improvements in New Jersey, it’s important to be aware of the renovations that can potentially lead to an increase in property taxes. Certain upgrades and additions have the potential to raise the assessed value of a property, thereby impacting the amount of property taxes owed by homeowners. Understanding which home improvements fall into this category is essential for homeowners seeking to manage their overall housing costs effectively.

1. Major Additions: Constructing significant additions to a home, such as adding a new bedroom, expanding the living space, or building a detached structure like a garage or a guest house, can substantially increase the assessed value of the property. These types of additions often result in a higher property tax burden due to the augmented value of the home.

2. Extensive Renovations: Extensive renovations that significantly enhance the quality and functionality of a property, such as a full kitchen remodel, a luxurious bathroom upgrade, or the installation of high-end fixtures and finishes, can contribute to an increase in the assessed value of the home. As a result, homeowners may experience a corresponding rise in their property taxes.

3. Outdoor Improvements: Landscaping upgrades, the installation of a pool, a new deck, or a patio can add to the curb appeal and overall value of a property. While these outdoor improvements can enhance the enjoyment of a home, they may also lead to an increase in property taxes due to the augmented assessed value resulting from these enhancements.

4. Energy-Efficient Upgrades: While energy-efficient upgrades, such as installing solar panels, energy-efficient windows, or a geothermal heating and cooling system, can yield long-term cost savings and environmental benefits, they may also lead to an increase in property taxes. The added value attributed to these sustainable features can impact the assessed value of the property and, consequently, the property tax obligations.

5. Structural Improvements: Making structural improvements to a property, such as reinforcing the foundation, replacing the roof, or upgrading the HVAC system, can contribute to an increase in the assessed value of the home. These essential structural enhancements may result in a higher property tax assessment due to the improved overall condition and functionality of the property.

By being mindful of the potential impact of these home improvements on property taxes, homeowners can make informed decisions about their renovation projects. While these upgrades can enhance the comfort, functionality, and value of a home, it’s important to consider the potential tax implications and plan accordingly to manage overall housing costs effectively.

Adding a new bathroom or bedroom, installing a swimming pool, or making significant structural changes can increase property taxes in New Jersey. Always check with your local tax assessor before making major home improvements.

Home Improvements That Do Not Increase Property Taxes

Amidst the landscape of home improvements in New Jersey, there are certain renovations and upgrades that may have minimal impact on property taxes or even result in tax savings for homeowners. Understanding which home improvements fall into this category is essential for those seeking to enhance their living spaces while managing their overall housing costs effectively.

1. Maintenance and Repairs: Routine maintenance and essential repairs, such as fixing a leaky roof, repairing plumbing or electrical systems, or addressing structural issues, typically do not lead to a significant increase in property taxes. These types of repairs are essential for preserving the integrity and safety of a home and are unlikely to substantially impact the assessed value of the property.

2. Cosmetic Enhancements: Cosmetic upgrades, such as repainting the interior or exterior of a home, replacing flooring, updating light fixtures, or refreshing the landscaping, are generally considered to have minimal impact on property taxes. While these enhancements can enhance the aesthetics and appeal of a property, they are less likely to substantially increase the assessed value and, consequently, the property tax obligations.

3. Accessibility Features: Adding accessibility features to a home, such as installing ramps, handrails, or other modifications to improve accessibility for individuals with disabilities or mobility challenges, may not significantly impact property taxes. These types of improvements are focused on enhancing the functionality and inclusivity of a home and are less likely to lead to a substantial increase in property tax assessments.

4. Basic Upgrades: Basic upgrades that do not significantly alter the overall size or functionality of a property, such as replacing outdated appliances, upgrading standard fixtures, or making minor improvements to the interior or exterior, are unlikely to lead to a substantial increase in property taxes. These types of upgrades are considered to have minimal impact on the assessed value of the property.

5. Energy-Efficient Rebates and Incentives: In some cases, energy-efficient upgrades that qualify for rebates, incentives, or tax credits may not result in a significant increase in property taxes. Homeowners who take advantage of these programs to make energy-efficient improvements, such as installing insulation, energy-efficient heating and cooling systems, or efficient lighting, may benefit from reduced tax liabilities or incentives that offset potential tax impacts.

By understanding the potential tax implications of these home improvements, homeowners can make informed decisions about their renovation projects. While these upgrades may enhance the comfort, functionality, and efficiency of a home, they are less likely to lead to substantial increases in property taxes, providing homeowners with opportunities to improve their living spaces while managing their overall housing costs effectively.

Conclusion

As homeowners in New Jersey embark on home improvement projects to enhance their living spaces, it’s crucial to consider the potential impact of these renovations on property taxes. The relationship between home improvements and property taxes is a significant factor in managing overall housing costs and maximizing the value of property investments. By understanding which renovations can lead to increased property taxes and which may have minimal impact or even result in tax savings, homeowners can make informed decisions about their home improvement endeavors.

Throughout this guide, we’ve explored the dynamics of property taxes in New Jersey and how specific home improvements can influence the assessed value of a property. Major additions, extensive renovations, outdoor enhancements, energy-efficient upgrades, and structural improvements are among the renovations that can potentially lead to higher property tax obligations. Conversely, maintenance and repairs, cosmetic enhancements, accessibility features, basic upgrades, and energy-efficient incentives are examples of home improvements that may have minimal impact on property taxes or even result in tax savings for homeowners.

By being mindful of the potential tax implications of various home improvements, homeowners can align their renovation projects with their financial goals and overall property investment strategy. Planning and executing renovations with an understanding of their potential impact on property taxes can help homeowners manage their housing costs effectively while enhancing the comfort, functionality, and value of their homes.

Ultimately, the relationship between home improvements and property taxes underscores the importance of informed decision-making and strategic planning. Whether it’s creating additional living space, upgrading energy efficiency, or enhancing the aesthetics of a home, homeowners can leverage their understanding of potential tax implications to make the most of their home improvement projects in New Jersey. By balancing their vision for their living spaces with a clear awareness of the tax considerations, homeowners can navigate the renovation process with confidence, ensuring that their homes reflect their aspirations while aligning with their financial objectives.

Armed with the insights provided in this guide, homeowners in New Jersey are well-equipped to approach their home improvement endeavors with a comprehensive understanding of the potential impact on property taxes. By leveraging this knowledge, homeowners can embark on renovation projects that not only elevate their living spaces but also contribute to their long-term financial well-being and property investment strategies in the Garden State.

Frequently Asked Questions about What Home Improvements Increase Property Taxes In New Jersey?

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “What Home Improvements Increase Property Taxes In New Jersey?”