Articles

How To Store Cash Safely At Home

Modified: February 22, 2024

Learn effective strategies for safely storing your cash at home with these informative articles. Protect your assets and gain peace of mind.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

When it comes to keeping your hard-earned cash safe, you might automatically think of utilizing a bank or financial institution. However, there are situations where storing your cash at home can be a more convenient option. Whether it’s for emergencies, upcoming expenses, or simply a personal preference, safely storing cash at home is a topic of crucial importance.

The purpose of this article is to guide you through the process of storing cash securely within the confines of your own home. We will explore the various methods available to you, weigh the risks involved, and provide tips to ensure the safety and accessibility of your cash.

Before delving deeper into the different storage options, it’s essential to understand the importance of safely storing cash at home.

Key Takeaways:

- Safely storing cash at home requires assessing risks, considering security, and avoiding common mistakes. Choose the most suitable method to protect your funds from theft, fire, and unexpected events.

- Diversify storage locations, maintain secrecy, and utilize alarm systems to safeguard your cash effectively. Regularly review and maintain your security measures to ensure the accessibility and security of your funds.

Read more: How To Store Cash In A Safe

Importance of Safely Storing Cash at Home

Keeping your cash safe at home is essential for several reasons. Firstly, it provides a sense of security and peace of mind, knowing that you have a stash of emergency funds readily accessible. Unexpected expenses or emergencies can arise at any time, and having cash on hand can help you navigate through challenging situations without relying solely on credit or external financial resources.

In addition, storing cash at home can be advantageous in scenarios where access to a bank or ATM is limited. For example, during natural disasters or power outages, these services may be temporarily unavailable. Having cash readily available can help you purchase essential supplies or services when electronic payment systems are down.

Moreover, storing cash at home allows you to maintain a level of financial privacy. While banks follow strict privacy policies, some individuals prefer to keep their financial transactions and holdings confidential. Storing cash at home enables you to maintain control over your financial information and keep it away from prying eyes.

However, it’s important to note that keeping large sums of cash at home also comes with inherent risks. Factors such as theft, fire, or natural disasters can put your cash at risk. Therefore, understanding and assessing these risks is crucial in determining the most suitable method of storing cash at home.

Assessing the Risks

Before deciding on a method to safely store cash at home, it’s crucial to assess the risks involved. By understanding the potential threats, you can make an informed decision and implement appropriate measures to mitigate these risks.

Theft is a significant risk when it comes to storing cash at home. Whether it’s a break-in, burglary, or a targeted theft, criminals may be enticed by the thought of finding a stash of cash. Consider the security of your home, the neighborhood you live in, and any previous incidents of theft in your area.

Another risk is the possibility of fire or water damage. Accidents happen, and natural disasters can strike unexpectedly. Ensure that your chosen storage method provides adequate protection against these elements to safeguard your cash.

Additionally, consider the risks associated with the storage method itself. For example, if you opt for a home safe, assess its durability, lock mechanisms, and resistance to tampering. If you choose to create hidden compartments, ensure they are well-concealed and not easily detectable. Each storage method comes with its own set of risks, so evaluate them carefully.

Furthermore, don’t forget to consider the risk of losing or misplacing your cash. It’s essential to have a reliable system in place that allows you to keep track of your stored cash, ensuring you can access it when needed.

By thoroughly assessing these risks, you can determine the most suitable storage method and take the necessary precautions to mitigate potential threats to your cash.

Factors to Consider Before Choosing a Storage Method

When it comes to safely storing cash at home, there are several factors to consider before choosing a storage method. By carefully evaluating these factors, you can make an informed decision that suits your specific needs and mitigates potential risks.

1. Security: The primary factor to consider is the level of security provided by the storage method. Look for options that offer robust security features such as sturdy construction, reliable locking mechanisms, and resistance to tampering. Assess the overall durability and strength of the storage method to ensure it can withstand potential threats.

2. Accessibility: Determine how easily you can access your stored cash when needed. Consider factors such as convenience, ease of retrieval, and the ability to quickly add or remove cash from the storage method. Strike a balance between security and accessibility to ensure your cash is both secure and readily accessible in times of need.

3. Discretion: For individuals who prioritize privacy, discretion is a crucial factor. Choose a storage method that can keep your cash hidden or inconspicuous, such as a hidden compartment or diversion safe. Ensuring that your cash is not easily detectable adds an extra layer of protection against theft or unauthorized access.

4. Capacity: Assess the storage capacity of your chosen method. Consider the amount of cash you plan to store and whether the storage option can accommodate your needs. It’s essential to have enough space to organize and keep track of your cash effectively.

5. Protection against environmental factors: Evaluate the storage method’s ability to safeguard your cash from potential risks such as fire, water damage, or extreme temperatures. Look for options that provide adequate protection against these elements to preserve the quality and value of your cash.

6. Cost: Consider the cost of the storage method and weigh it against the level of security and features it offers. Remember to factor in any additional expenses such as installation, maintenance, or insurance. Choose an option that provides a reasonable balance between affordability and effectiveness.

By carefully considering these factors, you can select a storage method that aligns with your needs and provides a secure and accessible way to store your cash at home.

Common Mistakes to Avoid

When it comes to safely storing cash at home, it’s important to be aware of common mistakes that can compromise the security and accessibility of your funds. By avoiding these pitfalls, you can ensure the effectiveness and longevity of your chosen storage method. Here are some common mistakes to steer clear of:

1. Lack of proper documentation: Failing to keep a record of the amount and location of your stored cash can lead to confusion and difficulty in accessing it when needed. Maintaining clear documentation will help you stay organized and ensure you can easily track and retrieve your funds.

2. Storing all cash in one place: Putting all your cash in a single storage location can be risky. If that location is compromised, you stand to lose all your funds. Instead, consider diversifying your storage methods and distributing cash in different secure locations within your home.

3. Neglecting to secure valuable items: If you choose to store cash in a home safe, ensure you also secure other valuable items in it. Tucking cash away in a safe while leaving valuable items unprotected can be counterproductive and increase the risk of theft.

4. Overlooking preventive measures: Along with a reliable storage method, it’s essential to implement additional preventive measures. This could include having a security system installed, reinforcing doors and windows, and ensuring proper lighting around your home’s perimeter. Taking these precautions can deter potential burglars and enhance the security of your cash.

5. Failing to regularly review and update storage methods: Circumstances change over time, and so should your approach to storing cash at home. Regularly evaluate and update your storage methods based on any changes in your living situation, security concerns, or advancements in technology. Stay proactive to ensure your cash remains safe and accessible.

6. Not considering insurance options: It’s important to evaluate insurance options to protect your stored cash in case of theft, fire, or other unforeseen events. Consult with your insurance provider to understand what coverage options are available to you and determine if it’s a suitable investment for your specific circumstances.

By avoiding these common mistakes and staying vigilant in your approach to storing cash at home, you can minimize risks and ensure the safety and accessibility of your funds.

Read more: How To Store Cash Safely

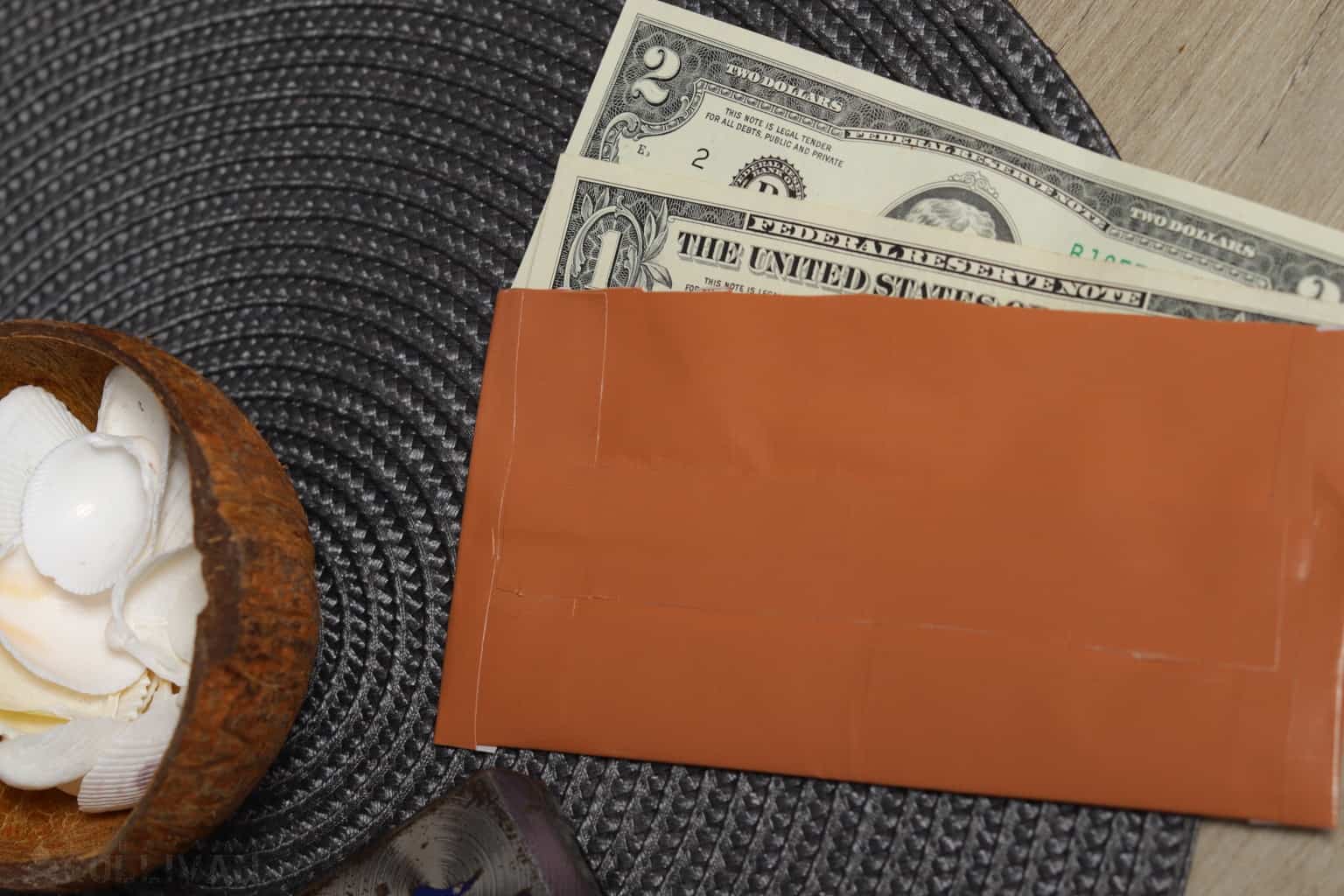

Different Options for Safely Storing Cash at Home

There are several options to consider when it comes to safely storing cash at home. Each option offers its own set of benefits and considerations, so it’s important to choose the method that best suits your needs. Here are five common options:

- 1. Home Safes: Home safes provide a high level of security for storing cash. They are typically made of sturdy materials and come with advanced locking mechanisms. Home safes can be fireproof and waterproof, providing additional protection for your cash. Depending on your needs, you can choose from different sizes and types of safes, including floor safes, wall safes, or portable safes.

- 2. Hidden Compartments: Concealing cash in hidden compartments offers a discreet and inconspicuous storage solution. These hidden compartments can be installed in various household items such as furniture, walls, or even ordinary objects like books or cans. Creating hidden compartments requires some DIY skills or professional help to ensure proper installation and concealment.

- 3. Diversion Safes: Diversion safes, also known as decoy safes, are designed to mimic ordinary household items. These safes are disguised as objects such as a soda can, a book, or a cleaning product. Diversion safes offer a blend of security and camouflage, as potential thieves are unlikely to suspect that these innocuous items contain valuable cash.

- 4. Safety Deposit Boxes: Safety deposit boxes are an option provided by banks or financial institutions. These boxes are securely stored within the bank’s vault, offering a high level of security. Renting a safety deposit box allows you to keep your cash and other valuable items in a protected environment. However, it’s important to note that access to the box may be limited during the bank’s operating hours.

- 5. Secure Vaults: For those with substantial cash holdings, a secure vault can be a reliable option. Vault systems offer maximum security, combining advanced technology, multiple layers of authentication, and around-the-clock monitoring. These vaults can be installed within your home or in a separate location like a dedicated vault facility. Secure vaults provide enhanced protection against theft, fire, and natural disasters.

When selecting a storage method, consider factors such as security, convenience, discretion, capacity, and cost. Assess your needs and priorities to determine which option aligns best with your requirements and provides optimal security for your cash.

Home Safes

Home safes are a popular and effective option for safely storing cash at home. They offer a high level of security and protection against theft, fire, and other unforeseen events. Home safes come in various sizes, styles, and levels of security, allowing you to choose the one that best suits your needs and budget.

When selecting a home safe, consider the following factors:

Security: Look for a safe made of durable materials such as steel, with a solid construction that is resistant to tampering and break-ins. Choose a safe with a reliable locking mechanism, such as a combination lock, digital keypad, or biometric fingerprint scanner.

Fire Resistance: Fireproof safes are designed to withstand high temperatures and protect the contents inside. Look for safes with a high fire rating, indicating the duration and temperature they can withstand without damaging the contents.

Size and Capacity: Consider the amount of cash you plan to store and choose a safe with adequate capacity. It’s important to have enough room for your cash while leaving space for other valuable items or documents.

Installation: Home safes can be installed in various ways, depending on your preference and the design of your home. They can be bolted to the floor, wall-mounted, or hidden in a secure location. Proper installation ensures the safe is securely anchored and less susceptible to theft.

Accessibility: Choose a safe that is easily accessible to you while maintaining security. Consider the convenience of opening and closing the safe, as well as the ease of adding or removing cash as needed.

Remember to regularly maintain and inspect your home safe to ensure it remains in good working condition. Check the locking mechanisms, hinges, and insulation periodically to prevent any potential issues.

It’s important to communicate the existence of the safe to trusted individuals, such as family members or legal representatives, in case of an emergency or if someone needs access to your cash on your behalf.

Ultimately, investing in a home safe provides a secure and reliable method of storing cash at home. Properly chosen and maintained, a home safe offers peace of mind knowing that your cash is protected from theft and unexpected events.

Consider investing in a fireproof and waterproof safe to store cash safely at home. Make sure to securely bolt the safe to the floor or wall to prevent theft.

Hidden Compartments

Hidden compartments offer a discreet and inconspicuous solution for storing cash at home. By creating hidden compartments within ordinary household items or structures, you can effectively hide and protect your cash from potential theft.

Here are some considerations when utilizing hidden compartments:

Concealment: Hidden compartments can be created within various household items such as furniture, walls, floors, or even everyday objects like books or cans. Ensure that the hidden compartment is well-concealed and not easily detectable by potential intruders.

Design and Construction: To create hidden compartments, you may need to rely on DIY techniques or seek professional help. Carefully plan the design and construction of the compartment, considering factors such as accessibility, stability, and ease of concealment.

Camouflage: Consider using items that blend naturally with their surroundings to serve as the disguise for the hidden compartment. For example, a bookshelf with a secret compartment behind a book or a custom-built drawer hidden within the structure of a piece of furniture. The more inconspicuous the item, the more difficult it is for intruders to find the hidden cash.

Accessibility: Ensure that the hidden compartment is easily accessible to you while maintaining security. This could involve using a hidden latch or mechanism that only you are aware of, or utilizing a key or combination lock to access the compartment. Plan ahead to ensure smooth and efficient access to your cash whenever needed.

Secrecy: It’s crucial to maintain secrecy about the existence of hidden compartments. Only inform trusted individuals about their presence, such as family members or individuals who would need access in case of an emergency. Keeping the knowledge limited reduces the chances of inadvertently revealing the hiding spots.

Creating hidden compartments requires careful planning and implementation. Be mindful of any potential damage to the existing structure of your home when installing hidden compartments. It’s also important to regularly inspect and maintain the compartments to ensure they remain hidden and secure over time.

Hidden compartments provide an extra layer of security, as potential thieves are unlikely to suspect the presence of hidden cash. However, it’s important to remember that no hiding method is foolproof. With this in mind, it’s ideal to combine hidden compartments with other security measures for optimal protection.

Diversion Safes

Diversion safes, also known as decoy safes, are an innovative and clever way to store cash at home. These safes are designed to mimic ordinary household items, thereby diverting attention from the valuable contents they hold.

Here are some key aspects to consider when using diversion safes:

Disguise: Diversion safes are designed to resemble everyday objects such as soda cans, books, cleaning products, or even electrical outlets. The goal is to make these safes look indistinguishable from their non-security counterparts. The more convincingly the diversion safe mimics the original item, the more effective it will be in diverting attention.

Camouflage: Place the diversion safe among other similar items in their natural environment. For example, if using a book safe, ensure it blends seamlessly with other books on a bookshelf. The goal is to make the safe inconspicuous and blend in with its surroundings.

Security: Despite their disguised appearance, diversion safes should still provide a reasonable level of security. Look for safes with a hidden compartment that can securely hold your cash. Some diversion safes have locking mechanisms, such as a combination lock or a key lock, to provide an additional layer of security.

Accessibility: Choose a diversion safe that allows you easy and convenient access to your cash. Avoid safes that are difficult to open or require complex mechanisms, as this could lead to frustration and potential mishandling of the contents.

Placement: Strategic placement of the diversion safe is important. Consider locations where the disguised object would naturally belong, such as in a pantry, bathroom, or living room. Avoid placing it in obvious locations or areas that may raise suspicions.

Secrecy and Awareness: Only inform trusted individuals about the existence and location of your diversion safe. This reduces the risk of accidental discovery by unauthorized individuals. Remember to stay vigilant and periodically assess the effectiveness of the deception.

Diversion safes offer a creative way to conceal your cash in plain sight. However, it’s important to note that these safes may not offer the same level of security as traditional safes. They primarily rely on deception and diversion rather than impenetrable construction. Therefore, it’s advisable to combine the use of diversion safes with other security measures for optimal protection.

Read more: How To Store Cash At Home

Safety Deposit Boxes

Safety deposit boxes are a popular option for storing cash and valuable items securely. These boxes are typically offered by banks or financial institutions and are located within the vaults of the respective institutions.

Here are some important considerations when utilizing safety deposit boxes:

Security: Safety deposit boxes offer a high level of security. They are typically stored within a bank’s vault, which is equipped with advanced security systems, surveillance cameras, and round-the-clock monitoring. The vaults themselves are constructed to withstand various threats such as theft, fire, and natural disasters.

Access Control: Access to safety deposit boxes is typically restricted and closely monitored. Only authorized individuals, typically the renter and trusted key holders, will have access to the box. Banks may require proper identification and authentication before granting access to the vault area.

Privacy and Confidentiality: Banks are required by law to maintain the privacy and confidentiality of safety deposit box holders. This ensures that your cash and valuable items are protected and kept private from unauthorized individuals.

Storage Capacity: Safety deposit boxes come in various sizes, allowing you to choose the one that suits your storage needs. Assess the amount of cash you plan to store and any other valuable items you may want to keep together with your cash.

Limitations: Keep in mind that safety deposit boxes have some limitations. They are only accessible during the bank’s operating hours, and you need to physically visit the bank to access your items. Additionally, banks may have restrictions on the types of items that can be stored in the box.

Rental Costs: Safety deposit boxes are typically rented for a monthly or annual fee. The rental cost will depend on the size of the box and the policies of the bank. Evaluate the cost of renting a safety deposit box to ensure it aligns with your budget and the value of the items you plan to store.

Safety deposit boxes offer a secure and reliable option for storing cash and valuable items outside the home. They provide peace of mind, knowing that your cash is stored in a highly secure environment. However, it’s important to assess your access needs and consider the limitations and costs associated with using a safety deposit box before making a decision.

Secure Vaults

For individuals with substantial cash holdings and a higher level of security requirements, secure vaults offer the utmost protection for storing cash at home. These are highly secure storage facilities specifically designed to safeguard valuable assets, including cash, jewelry, important documents, and more.

Here are key aspects to consider when using secure vaults:

Advanced Security Measures: Secure vaults employ advanced security measures to protect stored items. These can include multi-level authentication systems, biometric access control, 24/7 surveillance, and alarm systems. The facilities are built to withstand various threats such as theft, fire, flood, and even natural disasters.

Customizable Storage Options: Secure vaults provide customizable storage options, allowing you to select the size and configuration that best meets your needs. They offer specialized storage compartments or lockable boxes within the vault, providing a secure and organized way to store your cash.

Location: Secure vaults can be located within your home or in a separate facility. Some may prefer to have the vault integrated into their home’s architecture, while others may opt for an off-site location. Choose a location that offers the desired level of security and convenience for accessing your cash.

Insurance Options: Before storing cash in a secure vault, consider obtaining appropriate insurance coverage. Consult with insurance providers to understand the coverage options and ensure you have adequate financial protection for your stored cash.

Accessibility: Determine the level of accessibility you require for your stored cash. Some secure vaults offer 24/7 access, while others may have specific operating hours. Consider your access needs and choose a facility that aligns with your requirements.

Cost: Secure vaults involve ongoing costs, including rental fees and possible insurance premiums. Evaluate the cost of renting a secure vault and compare it to the value and security it provides for your cash. It’s important to strike a balance between the cost and the peace of mind that a secure facility offers.

Secure vaults provide an unparalleled level of security for storing cash at home. They are the ideal choice for individuals with high-value cash holdings, significant security requirements, or those who prioritize maximum protection for their assets. However, it’s essential to carefully consider the access, location, cost, and insurance aspects before opting for a secure vault.

Tips for Successful Cash Storage at Home

When storing cash at home, it’s important to implement appropriate measures to ensure its security and accessibility. Here are some essential tips to consider for successful cash storage:

- Diversify Storage Locations: Rather than storing all your cash in one place, consider diversifying your storage locations. Spread your cash across multiple secure methods such as home safes, hidden compartments, or diversion safes. This reduces the risk of losing all your funds in case of theft or unexpected events.

- Maintain Secrecy: Keep the existence and location of your cash storage methods confidential. Only inform trusted individuals who need to know about it, such as family members or legal representatives. Minimizing the number of people who are aware of your cash storage decreases the likelihood of it being compromised.

- Regularly Review Security Measures: Periodically assess the effectiveness of your security measures. Check the condition of your home safes, hidden compartments, or diversion safes. Ensure that locks are functioning properly, and make any necessary repairs or upgrades to maintain the highest level of security.

- Utilize Alarm Systems: Consider installing a comprehensive home security system, including alarms and surveillance cameras, to protect your cash. Alarm systems act as deterrents to potential thieves and can alert you and the authorities if there is an attempted break-in.

- Document and Track: Keep a record of the amount of cash you have stored and its location. It’s advisable to maintain a detailed inventory of your stored cash, including date, denomination, and any additional information you find relevant. Regularly update this documentation to track the status of your cash effectively.

- Regular Maintenance: Maintain your storage methods regularly. Inspect and clean home safes, hidden compartments, and diversion safes to ensure they remain in good working condition. Regular maintenance helps prevent malfunctions and ensures the long-term effectiveness of your cash storage methods.

- Consider Insurance: Evaluate insurance options to provide financial protection for your stored cash and other valuable items. Consult with insurance providers to understand coverage options and determine if additional coverage is necessary to safeguard your assets adequately.

- Communication and Preparation: Communicate your cash storage arrangements to trusted individuals in case of emergencies or unforeseen circumstances. Ensure that family members or authorized individuals know how to access the stored cash in your absence.

- Be Mindful of Cash Handling: When handling cash at home, be discreet and mindful of who may be observing. Avoid discussing or displaying large amounts of cash in public or around individuals who do not need to know about your financial resources.

- Educate Yourself: Stay informed about current security practices and methods. Stay updated on the latest security technologies and techniques to continually improve your cash storage arrangements.

By following these tips, you can establish successful cash storage practices at home, ensuring the security and accessibility of your funds when you need them most.

Conclusion

Safely storing cash at home requires careful consideration and implementation of robust security measures. Whether you choose to use home safes, hidden compartments, diversion safes, safety deposit boxes, or secure vaults, the goal is to protect your hard-earned cash from potential theft, fire, or other unexpected events.

Assessing the risks, considering factors like security, accessibility, capacity, and cost, and avoiding common mistakes are essential steps to successfully store cash at home. By evaluating these factors, you can select the most suitable storage method that aligns with your needs and provides optimal security for your cash.

Remember to maintain secrecy, regularly review and maintain your storage methods, and utilize additional security measures such as alarm systems to enhance the protection of your cash. Keeping a detailed inventory and communicating your arrangements to trusted individuals will aid in keeping track of your funds and ensuring their accessibility in case of emergencies or absences.

While storing cash at home can offer convenience and peace of mind, it’s crucial to continually stay informed about the latest security practices and technologies. Regularly reassess your storage methods and make necessary upgrades to keep up with evolving threats and safeguard your cash effectively.

By following these tips and best practices, you can establish a secure and successful system for storing cash at home. Remember to strike a balance between security and accessibility, customize your approach to fit your needs, and maintain a vigilant mindset to protect your cash and financial well-being.

Frequently Asked Questions about How To Store Cash Safely At Home

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Store Cash Safely At Home”