Home>Renovation & DIY>Home Renovation Guides>How To Get Cash For Home Upgrades

Home Renovation Guides

How To Get Cash For Home Upgrades

Modified: January 6, 2024

Discover expert tips and strategies for financing your home renovation projects. Learn how to get cash for home upgrades with our comprehensive guides.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the exciting world of home renovation! Whether you’re looking to spruce up your living space, increase your property value, or simply enhance the comfort and functionality of your home, embarking on a renovation journey can be both thrilling and rewarding. However, one common challenge that many homeowners face is finding the necessary funds to bring their renovation dreams to life. In this comprehensive guide, we will explore various strategies to help you secure the cash needed to turn your home upgrade aspirations into reality.

From assessing your home’s current condition to devising a realistic budget and exploring creative ways to fund your renovation project, we will cover everything you need to know to make informed decisions and achieve your desired results. So, let’s dive in and discover the secrets to obtaining the cash you need for your home upgrades!

Key Takeaways:

- Secure the necessary funds for home upgrades by assessing your home, creating a realistic budget, and exploring diverse financing options. Selling your home for cash can also provide a streamlined pathway to access renovation funds.

- Embark on a transformative renovation journey by leveraging home equity, exploring financing options, and considering cost-saving measures. Selling your home for cash presents a compelling alternative for homeowners seeking a fresh start.

Read more: How To Deduct Home Upgrades

Assessing Your Home

Before diving into the realm of home upgrades, it’s crucial to conduct a thorough assessment of your property. Start by evaluating the current condition of your home, identifying areas that require attention, and envisioning the desired improvements. This initial assessment will serve as the foundation for your renovation plans and help you prioritize the areas that need the most urgent attention.

Consider the age and structural integrity of key components such as the roof, plumbing, electrical systems, and HVAC (heating, ventilation, and air conditioning) units. Inspect the condition of walls, flooring, and windows to identify any signs of wear and tear. Additionally, assess the functionality and aesthetics of spaces such as the kitchen, bathrooms, and outdoor areas to pinpoint potential areas for enhancement.

Engage in a critical examination of your home’s layout and flow to determine if any modifications could optimize the use of space and improve the overall livability of your residence. By taking the time to thoroughly assess your home, you can gain valuable insights that will inform your renovation priorities and help you allocate your budget more effectively.

Furthermore, consider consulting with a professional home inspector or contractor to obtain expert guidance on identifying hidden issues and understanding the feasibility of your renovation ideas. Their expertise can provide invaluable clarity and prevent unforeseen challenges as you progress with your upgrade plans.

Remember, the more comprehensive your assessment, the better equipped you’ll be to make informed decisions and embark on a renovation journey that aligns with your vision and budget.

Budgeting for Upgrades

Creating a realistic budget is an essential step in the home renovation process. Once you’ve assessed your home and identified the areas that require attention, it’s time to determine how much you can afford to invest in your upgrades. Establishing a clear budget will help you prioritize your renovation goals, make informed choices, and avoid overspending.

Start by outlining the specific upgrades you wish to undertake, whether it’s remodeling a kitchen, renovating a bathroom, or enhancing your outdoor living space. Research the average costs associated with similar projects to gain a realistic understanding of the financial commitment required for each upgrade. Consider factors such as materials, labor, permits, and potential unforeseen expenses to create a comprehensive budget that accommodates all necessary aspects of your renovation.

When budgeting for your upgrades, it’s crucial to build in a contingency fund to account for unexpected costs that may arise during the renovation process. Typically, setting aside 10-20% of your total budget for contingencies can provide a safety net and alleviate the stress of unforeseen expenses.

Additionally, explore financing options if your renovation budget exceeds your current financial resources. Whether it’s through personal savings, home equity loans, or renovation-specific loans, understanding your financing options will empower you to make informed decisions and proceed with your upgrades confidently.

Remember that a well-defined budget serves as a guiding framework throughout your renovation journey, enabling you to make choices that align with your financial capabilities and renovation priorities. By establishing a clear budget and considering potential financing avenues, you can embark on your home upgrades with a solid financial plan in place.

Consider applying for a home improvement loan or a home equity line of credit to get cash for upgrades. These options can provide the funds you need to make improvements and increase the value of your home.

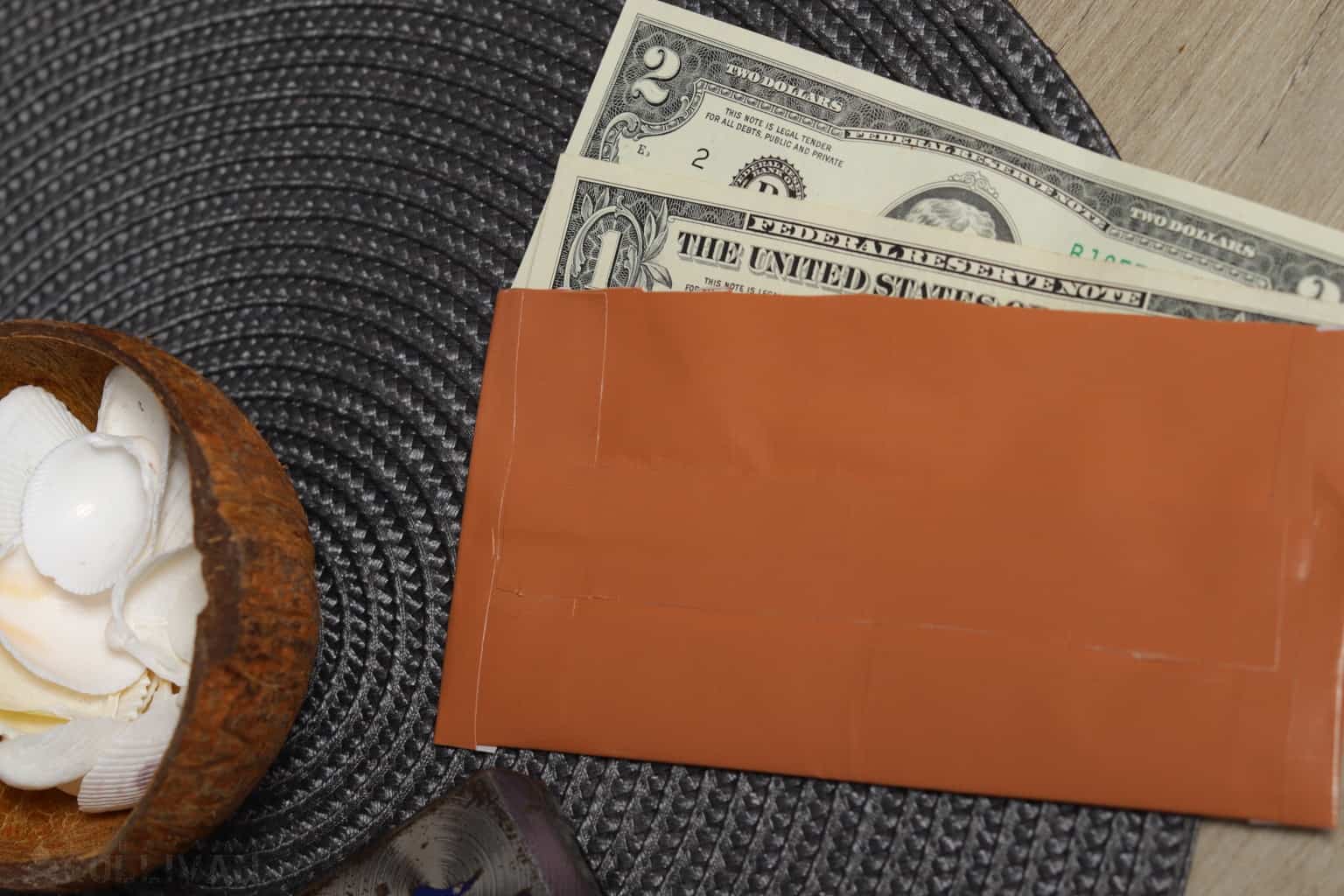

Finding Cash for Home Upgrades

Securing the necessary funds for your home upgrades may seem like a daunting task, but with strategic planning and resourceful approaches, you can explore various avenues to finance your renovation project.

One effective strategy is to leverage your existing home equity. If you’ve built up equity in your home over time, tapping into this asset through a home equity loan or a home equity line of credit (HELOC) can provide the financial resources needed for your upgrades. These options allow you to borrow against the value of your home, providing access to substantial funds with favorable interest rates.

Another avenue to consider is refinancing your mortgage. By refinancing at a lower interest rate or extending the loan term, you may free up additional cash that can be allocated towards your renovation goals. It’s important to carefully evaluate the terms and potential savings associated with refinancing to ensure it aligns with your long-term financial objectives.

Exploring personal loans and credit options can also provide the flexibility and immediate access to funds needed for your home upgrades. Whether through traditional banks, credit unions, or online lenders, comparing loan terms and interest rates can help you secure a financing solution that suits your needs.

Furthermore, investigate government incentive programs and energy-efficient home improvement grants that may offer financial assistance for specific types of upgrades, such as energy-efficient appliance installations or sustainable home enhancements. These programs can not only provide financial support but also contribute to the long-term sustainability and efficiency of your home.

Lastly, consider the potential for cost-saving measures within your renovation plans. Exploring DIY (do-it-yourself) options for certain upgrades or sourcing materials from budget-friendly suppliers can help stretch your renovation budget and reduce the need for substantial external financing.

By exploring these diverse avenues for funding, you can identify the most suitable financial approach to support your home upgrades, empowering you to embark on your renovation journey with confidence and financial clarity.

Selling Your Home for Cash

For homeowners considering major renovations or seeking a fresh start in a new property, selling your current home can present a viable opportunity to obtain the cash needed for your upgrade endeavors. The process of selling your home for cash offers a streamlined and efficient way to access funds and transition to a new living space.

One compelling option is to explore the possibility of selling your home directly to cash buyers or real estate investment companies. These entities often specialize in purchasing properties quickly and with minimal hassle, providing homeowners with a straightforward and expedited sale process. By selling your home for cash, you can swiftly unlock the equity tied up in your property, enabling you to fund your renovation project or transition to a new home without the delays often associated with traditional real estate transactions.

Additionally, engaging with real estate agents who specialize in cash sales and have a network of potential buyers can facilitate a smooth and efficient selling process. These professionals can provide valuable guidance on pricing your home competitively and connecting you with qualified cash buyers, streamlining the path to securing the funds needed for your home upgrades.

Furthermore, if you’re considering a move to a new location or downsizing to a more manageable living space, selling your home for cash can provide the financial resources necessary to make a seamless transition. The proceeds from the sale can be allocated towards your renovation budget or serve as a down payment for your new home, offering a convenient pathway to realizing your housing aspirations.

Before embarking on the journey of selling your home for cash, it’s essential to conduct thorough research, seek professional guidance, and carefully evaluate the potential benefits and considerations associated with this approach. By weighing the advantages of accessing immediate cash against the implications of parting with your current property, you can make an informed decision that aligns with your long-term goals and renovation aspirations.

Ultimately, selling your home for cash presents a compelling avenue to obtain the financial resources needed for your home upgrades or transition to a new living space, offering a streamlined and efficient pathway to realizing your housing aspirations.

Read more: How To Upgrade Google Home Firmware

Conclusion

Congratulations on embarking on the journey to enhance your living space through thoughtful home upgrades! As you’ve discovered, securing the necessary funds for your renovation project involves a blend of strategic planning, financial acumen, and creative resourcefulness. By assessing your home, devising a realistic budget, and exploring diverse avenues to fund your upgrades, you’ve equipped yourself with the knowledge and insights needed to make informed decisions and achieve your renovation goals.

Remember that a comprehensive assessment of your home’s condition forms the bedrock of your renovation journey, enabling you to prioritize areas for improvement and envision the potential enhancements that will elevate your living experience. Building a clear and realistic budget empowers you to make informed choices and navigate the financial landscape with confidence, ensuring that your renovation plans align with your resources and priorities.

Exploring diverse avenues to secure the necessary funds for your home upgrades, whether through leveraging home equity, exploring financing options, or considering the potential for cost-saving measures, provides a spectrum of opportunities to realize your renovation aspirations. Additionally, the prospect of selling your home for cash presents a streamlined pathway to access the financial resources needed for your upgrades or transition to a new living space, offering a compelling alternative for homeowners seeking a fresh start.

As you venture into the realm of home upgrades, remember that each decision you make is an investment in the comfort, functionality, and long-term value of your home. Whether you’re revamping a kitchen, transforming a bathroom, or enhancing your outdoor living space, every upgrade contributes to the creation of a living environment that reflects your vision and lifestyle.

With careful planning, financial prudence, and a clear vision for your renovation goals, you’re well-positioned to embark on a transformative renovation journey that brings your home upgrade dreams to life. By leveraging the insights and strategies outlined in this guide, you can navigate the process of securing the necessary funds for your upgrades with confidence and embark on a renovation journey that aligns with your vision and aspirations.

Now, armed with a wealth of knowledge and a clear roadmap for securing the cash you need for your home upgrades, you’re ready to take the next steps toward creating a living space that reflects your unique style, comfort, and aspirations. Here’s to the exciting adventure of transforming your home and embracing the endless possibilities that come with thoughtful and inspired renovations!

Frequently Asked Questions about How To Get Cash For Home Upgrades

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Get Cash For Home Upgrades”