Home>diy>Building & Construction>What Is Cash Flow In Construction

Building & Construction

What Is Cash Flow In Construction

Modified: January 6, 2024

Learn about cash flow in building construction and how it impacts a construction project's financial health. Understand the importance of managing cash flow for successful construction projects.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of construction, where buildings and structures come to life. In the realm of construction projects, there is a crucial element that keeps everything flowing smoothly – cash flow. Whether you’re a seasoned professional or a curious individual interested in the construction industry, understanding the concept of cash flow is vital.

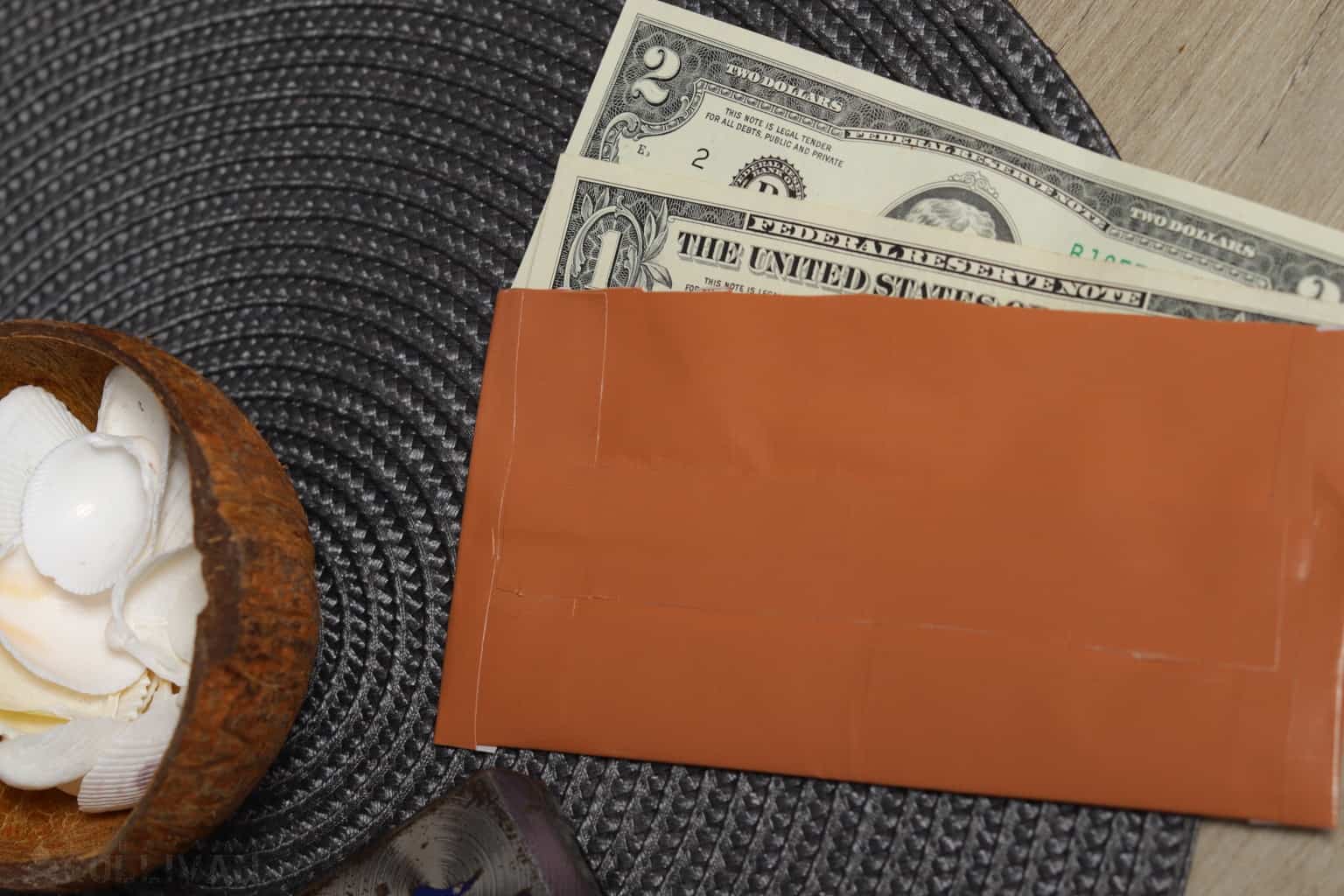

Cash flow refers to the movement of money in and out of a construction project. It is the lifeline that keeps the project running, ensuring that expenses are covered, suppliers and subcontractors are paid, and profits are generated. Managing cash flow effectively is a fundamental aspect of any construction project, as failing to do so can lead to financial challenges and even project disruptions.

In this article, we will delve deeper into the concept of cash flow in construction, its importance, factors that affect cash flow, strategies for managing and improving cash flow, and common challenges in cash flow management. We will also discuss key performance indicators (KPIs) that can be used to monitor and evaluate cash flow in construction projects.

By exploring these aspects, you will gain a comprehensive understanding of cash flow in construction and be better equipped to ensure the financial health and success of your construction projects.

So, let’s embark on this journey and uncover the significance of cash flow in the dynamic world of construction!

Key Takeaways:

- Cash flow is the financial heartbeat of construction projects, crucial for timely payments, risk management, and profitability. Proactive management and monitoring of cash flow are essential for project success.

- Effective cash flow management involves understanding, addressing, and mitigating common challenges such as delayed payments, unanticipated expenses, and project delays. Monitoring key performance indicators (KPIs) provides valuable insights for improving financial management.

Read more: What Is A Showerhead Flow Regulator

Definition of Cash Flow in Construction

Cash flow in construction refers to the movement of money within a construction project, including the inflow and outflow of funds. It is the financial heartbeat of the project, indicating the availability of cash to meet various financial obligations and sustain the project’s progress.

In simple terms, cash flow in construction is the difference between the money received from clients, sponsors, or financing sources, and the money spent on project-related expenses, such as materials, labor, overhead costs, and subcontractor payments.

A positive cash flow occurs when the money coming into the project exceeds the money going out, resulting in a surplus. This surplus can be used to cover future expenses, reinvest in the project, or generate profits. On the other hand, a negative cash flow arises when the outflow of funds surpasses the inflow, creating a deficit. Negative cash flow can lead to financial strain and hinder the project’s progress unless addressed effectively.

It is essential to distinguish between cash flow and profitability in construction. While profitability measures the project’s ability to generate profits, cash flow focuses on the availability and movement of money. A project can be profitable on paper but experience cash flow challenges due to delays in payments, unexpected expenses, or poor financial management.

Managing cash flow in construction requires careful planning, monitoring, and control of financial activities to maintain a healthy financial position throughout the project’s duration. By keeping a close eye on cash flow, project managers can anticipate potential cash gaps or surpluses and take proactive measures to address them.

Now that we have a clear understanding of what cash flow in construction entails, let’s explore why it is of paramount importance in construction projects.

Importance of Cash Flow in Construction Projects

Cash flow is a critical aspect of construction projects, playing a pivotal role in ensuring their success and continuity. Let’s explore the key reasons why cash flow is of paramount importance in construction:

- Timely Payment of Expenses: Construction projects involve various expenses, such as purchasing materials, paying labor costs, and meeting subcontractor obligations. A positive cash flow enables the timely payment of these expenses, ensuring the smooth progress of the project. It prevents delays, interruptions, and potential legal disputes, as contractors and suppliers are paid promptly.

- Managing Project Risks: Construction projects are inherently subject to risks, such as unforeseen delays, changes in scope, or unexpected cost overruns. A robust cash flow management system allows project managers to mitigate these risks by maintaining adequate funds to address unforeseen circumstances. It provides the project with financial resilience to navigate challenges and maintain momentum.

- Building Strong Relationships: Cash flow management fosters healthy relationships with suppliers, subcontractors, and other stakeholders involved in the construction process. When payments are made promptly, contractors and suppliers are more likely to provide preferential treatment, better pricing, and reliable services. Strong relationships built on mutual trust can lead to smoother project execution and improved project outcomes.

- Leveraging Financing Opportunities: Construction projects often require financing to cover upfront costs or bridge cash gaps between payments received and expenses incurred. A positive and consistent cash flow enhances the project’s credibility, making it more attractive to lenders and investors. It increases the likelihood of securing favorable financing terms, such as lower interest rates and extended repayment periods.

- Maximizing Profitability: Effective cash flow management contributes to the overall profitability of construction projects. By ensuring a healthy cash flow, project managers can identify opportunities to optimize costs, negotiate better deals, and allocate resources efficiently. A positive cash flow allows for the reinvestment of surplus funds into the project, leading to increased profitability and potential growth.

In summary, cash flow is crucial for the successful execution of construction projects. It enables the timely payment of expenses, manages project risks, builds strong relationships, leverages financing opportunities, and maximizes profitability. With a firm grasp of the importance of cash flow, we will now delve into the factors that can affect cash flow in construction.

Factors Affecting Cash Flow in Construction

Managing cash flow effectively in construction requires an understanding of the factors that can impact the inflow and outflow of funds. Let’s explore the key factors that can influence cash flow in construction:

- Payment Terms: The payment terms agreed upon with clients or sponsors can significantly impact cash flow. Longer payment terms can lead to delayed cash inflows, while shorter payment terms ensure a more consistent and timely cash flow.

- Project Delays: Delays in project completion can have a direct impact on cash flow. When projects are delayed, expenses continue to accumulate while expected payments may be postponed. These delays can disrupt cash flow and lead to financial challenges.

- Change Orders: Changes in project scope or design can affect cash flow. Additional work due to change orders may require additional resources and expenses, potentially impacting cash flow if not adequately accounted for and managed.

- Supplier and Subcontractor Payments: Timely payment to suppliers and subcontractors is crucial to maintain healthy relationships and ensure the smooth flow of materials and labor. Delayed payments can strain relationships and potentially lead to disruptions in the project’s progress.

- Unforeseen Costs: Construction projects can encounter unforeseen costs such as material price increases, regulatory changes, or unexpected repairs. These costs can impact cash flow if not anticipated and budgeted accordingly.

- Cash Reserves: The availability of cash reserves plays a vital role in managing cash flow. Having adequate reserves can help bridge cash gaps during periods of slow payments or unexpected expenses.

- Subcontractor Performance: The performance of subcontractors can impact cash flow. Delays or quality issues caused by subcontractors can lead to unexpected costs or project delays, affecting cash flow in the process.

- Payment Collection: Efficient payment collection processes are essential for maintaining a healthy cash flow. Ineffective collection practices can result in delayed payments, impacting the project’s financial stability.

By being aware of these factors and their potential impact, construction professionals can proactively address them and implement strategies to mitigate the negative effects on cash flow. In the next section, we will explore ways to manage and improve cash flow in construction projects.

Managing and Improving Cash Flow in Construction Projects

Effective management of cash flow is crucial for the success and sustainability of construction projects. By implementing proactive strategies, construction professionals can ensure the availability of funds to meet financial obligations and mitigate potential cash flow challenges. Let’s explore some key approaches to managing and improving cash flow in construction:

- Accurate Cost Estimation: Starting with an accurate and detailed cost estimation is essential. This ensures that all project expenses are considered and included in the project budget. It helps prevent surprises and allows for better planning and cash flow management.

- Timely Invoicing and Payment Collection: Promptly invoicing clients and sponsors for completed milestones or project stages is crucial. Establishing clear payment terms and following up on outstanding invoices can help expedite payment collection and maintain a steady cash inflow.

- Streamlined Procurement Processes: Optimizing procurement processes helps manage the flow of materials and supplies more efficiently. This includes negotiating favorable terms with suppliers, centralizing purchasing, and maintaining good relationships with reliable vendors.

- Effective Subcontractor Management: Ensuring the timely completion and performance of subcontractors is essential for cash flow management. Clear communication, regular progress monitoring, and enforcing penalties for delays or poor performance can help mitigate risks and keep the project on track.

- Monitoring and Control of Expenses: Regular monitoring of project expenses is crucial to identify cost overruns or unexpected expenses. Implementing effective expense control measures, such as tracking costs against the budget and seeking cost-saving opportunities, can help maintain a healthy cash flow.

- Establishing Contingency Funds: Allocating funds for contingencies is a prudent approach to manage unforeseen expenses or events that may impact cash flow. Having a contingency plan and reserves in place provides financial stability and reduces the risk of cash flow disruption.

- Negotiating Favorable Payment Terms: Negotiating payment terms with clients, customers, or sponsors can impact cash flow. Strive for shorter payment terms to ensure a more consistent and timely cash inflow, reducing the risk of cash flow gaps.

- Regular Cash Flow Forecasting: Monitoring and forecasting cash flow is vital for proactive decision-making. By projecting future cash inflows and outflows, construction professionals can anticipate potential cash flow issues and take corrective measures in advance.

Implementing these strategies requires effective communication, coordination, and financial management skills. By paying attention to cash flow and actively managing it throughout the project, construction professionals can enhance financial stability, minimize risks, and increase the chances of project success.

Now let’s address some common challenges that arise in cash flow management in construction projects.

Tip: Cash flow in construction refers to the movement of money in and out of a construction project. It’s important to monitor and manage cash flow to ensure that there is enough money to cover expenses and keep the project on track.

Read more: How To Store Cash At Home

Strategies for Effective Cash Flow Management in Construction

Cash flow management is a crucial aspect of construction projects, and implementing effective strategies is key to maintaining a healthy financial position. Let’s explore some strategies that can help construction professionals manage cash flow effectively:

- Create a Detailed Cash Flow Projection: Develop a comprehensive cash flow projection that outlines expected inflows and outflows of funds throughout the project. This projection provides visibility into the future cash needs of the project and allows for proactive management.

- Establish Clear Payment Terms: Clearly define payment terms with clients and subcontractors. Ensure payment milestones are clearly communicated and agreed upon upfront to avoid disputes and ensure timely payments.

- Monitor and Follow up on Outstanding Invoices: Keep track of outstanding invoices and implement a systematic follow-up process to ensure timely payment collection. Regularly communicate with clients to resolve any payment issues promptly.

- Negotiate Favorable Financing Terms: When seeking financing for the project, negotiate favorable terms, such as extended repayment periods or lower interest rates. This helps manage the cash outflow and reduces the financial burden on the project.

- Minimize Inventory and Just-In-Time Practices: Embrace just-in-time practices to minimize inventory holding costs. By ordering materials and supplies only when needed, excess inventory and the associated carrying costs can be reduced, improving cash flow.

- Optimize Expense Management: Regularly review expenses and identify cost-saving opportunities. Explore alternative suppliers, negotiate better pricing, and eliminate unnecessary expenses to improve cash flow.

- Utilize Technology: Leverage construction project management software or accounting systems to streamline financial processes, automate invoicing, and manage payment tracking. This helps improve accuracy, efficiency, and transparency in cash flow management.

- Maintain Strong Relationships: Foster strong relationships with clients, subcontractors, suppliers, and financiers. Good relationships can lead to prompt payments, favorable terms, and better support during times of financial need.

- Regularly Review and Adjust Cash Flow Projection: Continuously monitor the actual cash flow against the projected cash flow and make adjustments as needed. This allows for adaptive financial management and helps identify potential cash flow gaps in advance.

- Anticipate and Plan for Risks: Identify potential risks that may impact cash flow and develop contingency plans. Be prepared for delays, scope changes, or unforeseen expenses by setting aside reserves and establishing alternative financing options if necessary.

Implementing these strategies requires proactive planning, effective communication, and regular monitoring. By adopting these measures, construction professionals can navigate cash flow challenges, optimize financial resources, and ensure the financial health of their projects.

Now let’s explore some common challenges that arise in cash flow management in construction projects.

Common Challenges in Cash Flow Management in Construction

While effective cash flow management is crucial for the success of construction projects, several challenges can impact the financial stability of a project. Being aware of these challenges is essential for proactive financial planning and risk mitigation. Let’s explore some common challenges in cash flow management in construction:

- Delayed Payments: Delays in payment from clients or sponsors can significantly impact cash flow. Unforeseen circumstances, disputes, or administrative delays can result in late payments, causing strain on the project’s financial health.

- Unanticipated Expenses: Construction projects can encounter unexpected expenses that were not accounted for in the initial budget. These expenses can arise from scope changes, site conditions, or regulatory requirements. Failure to anticipate and budget for these costs can lead to cash flow gaps.

- Project Delays: Delays in project completion directly impact cash flow. Project delays can slow down or halt the inflow of payments, while expenses such as labor, equipment, and overhead costs continue to accrue. Managing and minimizing project delays is essential to maintain a healthy cash flow.

- Poor Financial Planning: Inaccurate cost estimations, insufficient budgeting, or inadequate cash flow projections can lead to cash flow challenges. It is crucial to have a thorough understanding of project costs and anticipate potential cash flow gaps to ensure adequate financial planning.

- Inefficient Payment Collection: Ineffective payment collection processes can disrupt cash flow. Late or missed payments can strain the project’s finances, leading to difficulties in meeting financial obligations and impacting subcontractor and supplier relationships.

- Lack of Communication: Poor communication among project stakeholders, including clients, subcontractors, and suppliers, can exacerbate cash flow challenges. Misunderstandings, delays in approvals, or failure to communicate payment terms effectively can hinder the smooth flow of funds.

- Uncertain Market Conditions: Economic fluctuations, changes in market demand, or industry-specific challenges can impact the cash flow of construction projects. Adapting to market conditions and adjusting financial strategies accordingly is crucial in mitigating these risks.

- Underestimating Project Costs: Insufficiently accounting for the true costs of a project can strain cash flow. Failure to consider all project expenses, including indirect costs, can lead to budget shortfalls and cash flow challenges.

- Poor Cash Flow Monitoring: Inadequate monitoring and lack of timely financial information can hinder effective cash flow management. Regularly tracking and reviewing cash flow allows for proactive decision-making and swift implementation of corrective measures.

- Dependency on Single Clients or Projects: Overreliance on a single client or project can pose cash flow risks. If there are delays or issues with that particular client or project, it can significantly impact cash flow. Diversifying the client portfolio and securing multiple projects helps mitigate this risk.

Addressing these challenges requires proactive financial planning, effective communication, and robust risk management. By understanding and proactively managing these common cash flow challenges, construction professionals can navigate potential pitfalls and maintain a healthy financial position for their projects.

Now, let’s explore some key performance indicators that can help monitor cash flow in construction projects.

Key Performance Indicators for Monitoring Cash Flow in Construction

Monitoring cash flow performance is crucial to ensure the financial health and success of construction projects. Key performance indicators (KPIs) provide valuable insights into the project’s cash flow and help identify areas for improvement. Here are some essential KPIs for monitoring cash flow in construction:

- Cash Flow Ratio: This KPI measures the ratio between the cash inflows and outflows during a specific period. A ratio above 1 indicates a positive cash flow, while a ratio below 1 signifies a negative cash flow.

- Days Sales Outstanding (DSO): DSO measures the average number of days it takes to collect payment from clients or sponsors. A decrease in DSO indicates faster payment collection and improved cash flow.

- Working Capital: This KPI represents the project’s ability to meet short-term financial obligations. It is calculated by subtracting current liabilities from current assets. Positive working capital indicates a healthy cash flow position.

- Cash Conversion Cycle (CCC): CCC measures the time it takes to convert investments in inventory and other resources into cash inflows. It includes the average time for inventory turnover, accounts receivable collection, and accounts payable payment. A shorter CCC indicates a better cash flow position.

- Profitability versus Cash Flow: Comparing profitability metrics, such as gross profit margin or net income, with cash flow metrics provides insights into the project’s financial health. A high profitability but poor cash flow may indicate cash flow management issues.

- Projected versus Actual Cash Flow: Regularly comparing projected cash flow with actual cash flow helps evaluate the accuracy of cash flow projections. Significant variances can suggest the need for adjustments in financial planning and management.

- Payable and Receivable Aging: Tracking the aging of payables and receivables provides visibility into the timeliness of payments. Analyzing patterns and identifying late payments or delays aids in proactive measures to improve cash flow.

- Financial Ratios: Various financial ratios can be used to assess the health of cash flow, such as the current ratio (current assets divided by current liabilities) and the quick ratio (excluding inventory from current assets). These ratios help evaluate the project’s ability to cover its short-term obligations.

- Cost-to-Complete Analysis: Analyzing the cost-to-complete for ongoing projects helps identify potential cost overruns and budget issues. Early detection allows for necessary adjustments to prevent cash flow gaps caused by unexpected expenses.

- Operating Cash Flow: Monitoring the operating cash flow, which reflects the cash generated from day-to-day operations, provides insights into the project’s financial sustainability. Consistent positive operating cash flow is essential for meeting financial obligations.

By monitoring these key performance indicators, construction professionals can gain a better understanding of their project’s cash flow position and take proactive measures to enhance financial management. Regular analysis of these metrics enables early identification of cash flow issues and the implementation of appropriate strategies to maintain a healthy cash flow.

Now that we have explored the key KPIs, let’s conclude our discussion on cash flow in construction.

Conclusion

Cash flow is the lifeblood of construction projects, ensuring the availability of funds to meet financial obligations and sustain the project’s progress. Effective cash flow management is vital for the success and continuity of construction projects, as it enables timely payment of expenses, mitigates project risks, builds strong relationships, leverages financing opportunities, and maximizes profitability.

In this article, we have explored the definition of cash flow in construction and its importance in project management. We have discussed the factors that can affect cash flow, such as payment terms, project delays, and unforeseen costs. Additionally, we have provided strategies for managing and improving cash flow, including accurate cost estimation, timely invoicing and payment collection, streamlined procurement processes, effective subcontractor management, and regular cash flow forecasting.

We have also addressed common challenges in cash flow management, such as delayed payments, unanticipated expenses, and project delays. By understanding these challenges, construction professionals can proactively address them and implement strategies to mitigate their impact on cash flow.

Furthermore, we have explored key performance indicators (KPIs) for monitoring cash flow, including the cash flow ratio, days sales outstanding (DSO), working capital, and cash conversion cycle. Regular monitoring of these KPIs provides insights into the project’s cash flow position and aids in decision-making for improving financial management.

In conclusion, effective cash flow management is crucial for ensuring the financial health and success of construction projects. By implementing proactive strategies, closely monitoring cash flow, and addressing challenges in a timely manner, construction professionals can navigate potential pitfalls, optimize financial resources, and position their projects for success.

So, armed with the knowledge gained from this article, go forth and proactively manage your project’s cash flow, ensuring a solid financial foundation and a smooth journey towards construction project success.

Frequently Asked Questions about What Is Cash Flow In Construction

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “What Is Cash Flow In Construction”