Home>Home Maintenance>What Does “Grade” Mean On Property Assessment

Home Maintenance

What Does “Grade” Mean On Property Assessment

Modified: March 6, 2024

Learn what the term "grade" signifies on property assessment and its significance in determining home maintenance needs. Explore practical tips for maintaining your home.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

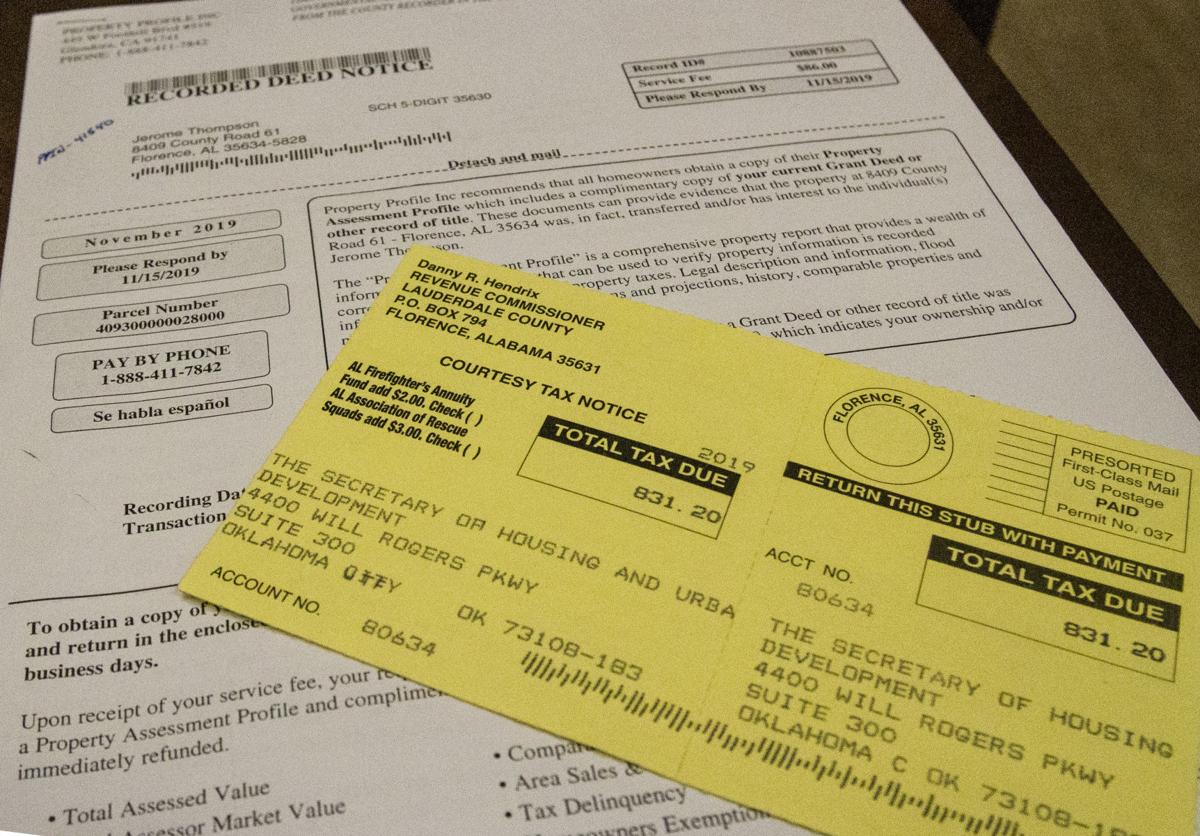

Welcome to the world of property assessments, where a multitude of factors come into play to determine the value of your property. If you’ve ever received a property assessment notice, you may have come across the term “grade.” But what does it mean? How does it impact your property assessment? In this article, we will explore the meaning of “grade” in property assessments and its significance in determining property values.

Property assessment is the process of evaluating the value of a property for taxation purposes. It involves the assessment of various elements, including the physical characteristics, location, and market conditions, to determine the fair market value of the property. The assessed value of a property typically affects the amount of property taxes an owner is required to pay.

When it comes to property assessments, the term “grade” refers to the classification or rating assigned to a property based on specific criteria. It serves as an indication of the overall quality or condition of a property compared to others in the same area.

Key Takeaways:

- Property grades reflect the quality and condition of a property compared to others in the area, impacting its assessed value and property taxes.

- Factors like physical condition, age, location, and market trends influence property grades, providing transparency and fairness in the assessment process.

Read more: What Does Property Assessment Mean

Definition of Property Assessment

In order to understand the meaning of “grade” in property assessment, it is important to first grasp the concept of property assessment itself. Property assessment is the process carried out by local governments or assessment authorities to determine the value of a property for taxation purposes.

The assessment process involves the evaluation of various factors that contribute to the value of a property, including but not limited to its size, location, condition, and amenities. Assessors, who are usually professionals with expertise in property valuation, conduct thorough inspections and research to arrive at a fair and accurate assessment value.

The assessed value of a property serves as the basis for calculating property taxes. The higher the assessed value, the higher the property taxes an owner is likely to pay. Conversely, a lower assessed value can lead to reduced property tax obligations.

It is important to note that property assessment is conducted periodically, typically every few years, to reflect changes in property values and market conditions. This ensures that assessments remain current and reflective of the prevailing real estate market.

Now that we have a basic understanding of property assessment, let us delve deeper into the meaning of “grade” and its significance in property assessments.

Meaning of “Grade” in Property Assessment

In the context of property assessments, the term “grade” refers to the classification or rating assigned to a property based on specific criteria. It provides an indication of the overall quality or condition of a property compared to others in the same area.

Assessors use various factors to determine the grade of a property, including the age, size, design, and overall condition of the building. They also consider external factors such as landscaping, views, and proximity to amenities like schools, parks, and transportation.

The grade of a property can range from “A” to “D” or “F,” with “A” indicating the highest quality and condition, and “D” or “F” representing properties that require significant improvements or repairs.

Grade classifications may also include symbols or adjectives to further describe the condition of the property. For example, a property may be classified as “A+” for being exceptional or “C-” for being in fair condition but needing some repairs.

It is important to note that property grades are assigned based on objective criteria and industry standards. Assessors follow guidelines set by their jurisdiction to ensure consistency in grading properties. These guidelines help prevent bias or arbitrary assessments and ensure a fair and accurate representation of a property’s condition.

By assigning grades, assessors aim to provide a clear and standardized measure of a property’s quality or condition. This information is valuable not only for property owners but also for potential buyers, lenders, and insurance companies who rely on property assessments to make informed decisions.

Now that we understand the meaning of “grade” in property assessments, let’s explore the factors that assessors consider when determining property grades.

Factors Considered in Determining Property Grades

When assessing a property and assigning a grade, assessors take into account various factors that can influence the quality and condition of a property. These factors can vary depending on the jurisdiction and specific assessment guidelines, but here are some common considerations:

- Physical Condition: Assessors inspect the property’s structural components, including the foundation, roof, walls, and systems such as plumbing and electrical. They assess the overall condition and functionality of these components to determine if any repairs or upgrades are needed.

- Age and Maintenance: The age of a property can play a role in its grade. Older properties may require more maintenance and potential repairs. Assessors consider the level of upkeep and maintenance that has been performed on the property, as well as any renovations or updates that have been done.

- Size and Layout: The size and layout of a property can impact its grade. Assessors consider factors such as the number of rooms, usable square footage, and how well the layout accommodates modern living standards.

- Location: The location of a property is an important factor in determining its grade. Assessors consider the proximity to amenities such as schools, parks, shopping centers, and public transportation. They also assess the desirability of the neighborhood and any external factors that may affect the value, such as noise or pollution.

- Landscaping and Curb Appeal: The condition of the property’s landscape and curb appeal is also taken into consideration. Assessors evaluate the quality of the lawn, trees, and plants, as well as the overall appearance of the property from the street.

- Market Conditions: Assessors consider the overall real estate market conditions when determining property grades. Factors such as supply and demand, recent sales data, and market trends can influence the grade assigned to a property.

It is important to note that these factors are not exhaustive, and assessors may consider additional elements based on the specific guidelines of their jurisdiction.

By evaluating these factors, assessors can assign an accurate and fair grade to a property, providing valuable information for property owners, buyers, and other stakeholders.

Now that we understand the factors that influence property grades, let’s explore the importance of these grades in property assessments.

The “grade” on a property assessment refers to the overall quality and condition of the property. It can affect the property’s value and potential for improvements.

Importance of Property Grades

Property grades play a crucial role in property assessments as they provide a standardized measure of a property’s quality or condition. Here are some reasons why property grades are important:

1. Fair and Consistent Assessments: Property grades ensure that assessments are fair and consistent across different properties. By following established guidelines and criteria, assessors can provide an objective evaluation of a property’s condition, which helps maintain fairness in the assessment process.

2. Transparency and Accountability: Property grades promote transparency and accountability in property assessments. Property owners have the right to know how their property was evaluated and why it received a certain grade. Assessors must justify their assessments based on specific criteria, enhancing trust and confidence in the assessment process.

3. Informing Property Owners: Property grades provide valuable information to property owners about the condition of their property. They offer insights into areas that may require maintenance or improvement, helping property owners make informed decisions about their property’s upkeep and potential renovations.

4. Property Valuation: Property grades influence the assessed value of a property. Higher grades, indicating better quality and condition, can result in higher assessed values. This has a direct impact on the amount of property taxes an owner is required to pay. Property owners can leverage property grades to understand the correlation between the condition of their property and its assessed value.

5. Market Comparisons: Property grades allow for easier comparison between properties in the market. When buying or selling a property, knowing the grades of comparable properties provides a better understanding of their relative value. Buyers can use property grades as a reference point to assess the quality and condition of a property and negotiate accordingly.

6. Insurance and Financing: Property grades are also taken into consideration by insurance companies and lenders. Insurance premiums and loan terms may be influenced by the condition of a property. A higher property grade can result in easier access to financing or lower insurance rates, while a lower grade may require additional documentation or higher premiums.

Overall, property grades serve as a critical component of property assessments, ensuring fairness, transparency, and informed decision-making for property owners, buyers, and other stakeholders.

Now that we understand the importance of property grades, let’s explore how they can impact the assessed values of properties.

Understanding the Impact of Property Grades on Assessment Values

The grade assigned to a property can have a significant impact on its assessed value, which in turn affects the property taxes that owners are required to pay. Here’s how property grades influence assessment values:

Higher Grade, Higher Assessment Value: Properties with higher grades indicating better quality and condition typically have higher assessed values. Assessors consider factors such as the age, size, design, and overall condition of the property to determine its grade. A property with a higher grade is considered more desirable and valuable, leading to a higher assessed value.

Lower Grade, Lower Assessment Value: Conversely, properties with lower grades indicating poorer quality or condition will likely have lower assessed values. These properties may require repairs, updates, or improvements, which can result in a decrease in their assessed value.

Variations in Assessment Values: Assessors take into account the specific grade assigned to a property when calculating its assessed value. They consider the market, location, and other relevant factors, but the grade serves as an integral component of the assessment process. Different grades can lead to significant variations in assessed values, even among properties located in the same area.

Impact on Property Taxes: The assessed value of a property, influenced by its grade, directly affects the amount of property taxes an owner is required to pay. Higher graded properties typically have higher assessed values, resulting in higher property tax obligations. Conversely, lower graded properties may be subject to lower property taxes.

It is important to note that the specific formula for calculating property taxes can vary depending on the jurisdiction. However, the assessed value of a property, influenced by its grade, is a key factor in determining the tax liability.

Property owners should be aware of the impact that property grades can have on their assessed values. By understanding the connection between grade and value, owners can make informed decisions regarding property maintenance, renovations, and potential tax implications.

Now, let’s explore some examples of different property grades and their characteristics.

Examples of Different Property Grades and Their Characteristics

Property grades can vary depending on the specific jurisdiction and assessment guidelines. However, here are some common examples of different property grades and their corresponding characteristics:

Grade A:

- Excellent overall condition

- Newer construction or recent major renovations

- High-quality materials and finishes

- Modern amenities and features

- Prime location with desirable views or proximity to amenities

Grade B:

- Good condition, with minor signs of wear and tear

- Well-maintained property with regular upkeep

- Functional layout and design

- Moderate to high-quality materials and finishes

- Decent location, with convenient access to amenities

Grade C:

- Fair condition, requiring some repairs or updates

- Average age of the property

- May have outdated features or design elements

- Lower-quality materials and finishes

- Less desirable location or limited access to amenities

Grade D or F:

- Poor condition, in need of significant repairs or renovations

- Older construction with outdated systems and components

- Significant deficiencies affecting functionality or safety

- Low-quality materials and finishes

- Less desirable location with limited amenities

It is important to note that these examples are general and can vary depending on local assessment guidelines. Property assessments are conducted by professionals who follow specific criteria and guidelines provided by their jurisdiction to assess a property’s grade accurately.

Understanding these different property grades and their characteristics can help property owners, buyers, and other stakeholders make informed decisions regarding property purchases, renovations, and potential tax implications.

Now that we have explored examples of different property grades, let’s conclude our discussion.

Conclusion

Property assessments play a significant role in determining the value of a property for taxation purposes. The term “grade” in property assessments refers to the classification or rating assigned to a property based on specific criteria. It provides an indication of the overall quality or condition of a property compared to others in the same area.

Property grades are assigned based on factors such as the physical condition, age, maintenance, size, layout, location, landscaping, and market conditions. These grades serve as a standardized measure of a property’s quality and condition, ensuring fairness, transparency, and consistency in the assessment process.

The assigned property grade directly impacts the assessed value of a property, which in turn influences the amount of property taxes an owner is required to pay. Higher grades typically result in higher assessed values and higher tax obligations, while lower grades may lead to lower assessed values and lower tax liabilities.

Understanding the impact of property grades on assessment values is crucial for property owners, buyers, and other stakeholders. It helps in making informed decisions regarding property maintenance, renovations, market comparisons, insurance, financing, and tax planning.

By considering examples of different property grades and their characteristics, individuals can gain insight into the different levels of quality and condition that properties may possess. This knowledge enables them to make informed decisions when buying or selling properties and helps them understand the potential impact on their tax obligations.

In conclusion, property grades are an integral part of property assessments. They provide a standardized measure of a property’s quality and condition, ensuring fairness, transparency, and accuracy in the assessment process. By understanding the meaning of “grade” in property assessments and its importance in determining property values, individuals can navigate the world of property assessments with greater confidence and knowledge.

Frequently Asked Questions about What Does "Grade" Mean On Property Assessment

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “What Does “Grade” Mean On Property Assessment”