Home>Home Maintenance>How To Read A Property Assessment

Home Maintenance

How To Read A Property Assessment

Modified: March 6, 2024

Learn how to read and understand your property assessment to ensure accurate home maintenance. Explore the key aspects and important details in this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to our comprehensive guide on how to read a property assessment. Whether you are a homeowner, real estate investor, or simply curious about the value of a property, understanding how to interpret a property assessment is essential. A property assessment is an evaluation conducted by local government authorities to determine the value of a property for taxation purposes. It is important to be able to decipher the information contained in a property assessment to ensure its accuracy and assess its impact on your taxes. In this article, we will walk you through the process of reading a property assessment and provide you with the necessary knowledge to make informed decisions about your property.

Key Takeaways:

- Verify your property assessment for accuracy, including address and property details. Report any errors to the assessor’s office promptly to ensure fair taxation.

- Understand your property’s assessed value and factors affecting it. Compare with similar properties and previous assessments for insights and informed decisions.

Read more: What Is Property Assessment

Understanding Property Assessments

Before delving into the specifics of reading a property assessment, it is important to have a clear understanding of what exactly a property assessment is. A property assessment is an evaluation of the value of a property conducted by local government authorities. The purpose of a property assessment is to determine the taxable value of a property, which is used to calculate property taxes. Property assessments are typically conducted on an annual or biennial basis and are based on various factors such as the property’s location, size, condition, and recent sales of comparable properties in the area.

The assessed value of a property is not necessarily the same as its market value. While market value represents the price at which a property would sell in an open market, assessed value is used solely for taxation purposes. The assessed value often falls below the market value to provide a buffer and ensure fairness in the tax system. It is important to note that property assessments can vary significantly from one jurisdiction to another, as each local government has its own assessment methods and guidelines.

Property assessments are typically conducted by professional assessors who are responsible for determining the value of properties within their jurisdiction. These assessors undergo extensive training and follow standardized procedures to ensure accuracy and consistency in their assessments. They take into account various factors such as the property’s location, size, condition, improvements, and recent sales activity in the area. They also consider any applicable legislation, regulations, and policies that may impact the valuation process.

Property assessments are public records, which means that homeowners and other interested parties have the right to access this information. Property assessment values are often made available online through a local government’s website or can be obtained by contacting the assessor’s office. By understanding property assessments and how they are calculated, homeowners can gain valuable insight into the value of their property and how it compares to similar properties in the area.

Importance of Reading Property Assessments

Reading and understanding your property assessment is crucial for several reasons. Firstly, it allows you to verify the accuracy of the assessed value assigned to your property. Mistakes can happen, and an incorrect assessment value can result in overpaying property taxes. By reviewing your assessment, you can ensure that the information used to determine the value of your property is correct and up-to-date.

Furthermore, understanding your property assessment enables you to assess the fairness of your tax burden. Property taxes are calculated based on the assessed value of your property, so if the assessment seems inflated or inconsistent with similar properties in the area, it may be worth investigating further and potentially appealing the assessment.

Moreover, reviewing your property assessment provides an opportunity to identify any discrepancies in the property description. For example, if the square footage, number of bedrooms, or other key characteristics of your property are incorrect, it could impact the assessed value. By catching these errors, you can ensure that your property assessment is based on accurate information.

Another important reason to read your property assessment is to understand the factors that contribute to its value. Assessments take into account various factors, such as property location, size, condition, and recent sales activity. By understanding these factors, you can gain valuable insight into what influences the value of your property and how it compares to similar properties in the area.

Lastly, staying informed about your property assessment can help you make informed decisions about your property. If you are planning to sell, refinance, or make improvements to your property, understanding its assessed value is essential. It can help you determine a fair listing price, negotiate with lenders, and assess the potential return on investment for any improvements you plan to make.

In summary, reading your property assessment is important for verifying its accuracy, assessing the fairness of your tax burden, identifying discrepancies, understanding the factors that contribute to its value, and making informed decisions about your property. It empowers you as a homeowner to ensure your assessment is accurate, fair, and reflective of your property’s value.

Steps to Read a Property Assessment

Reading a property assessment may seem daunting at first, but by following these step-by-step guidelines, you can easily navigate through the document and gain a clear understanding of its contents:

- Obtain a Copy of the Property Assessment: Start by obtaining a copy of your property assessment. This can typically be done online through your local government’s website or by contacting the assessor’s office directly.

- Review the Property Identification Information: Begin by verifying that the property identification information on the assessment is correct. Check the property address, legal description, and other relevant details against the actual property. Report any discrepancies to the assessor’s office promptly.

- Analyze the Assessed Value: Pay close attention to the assessed value of your property. This value represents the estimate of your property’s worth for taxation purposes. Compare it with the market value or recent sales of similar properties in your area to ensure fairness.

- Examine the Property Description: Look for a detailed description of your property, including its size, number of rooms, and any notable features. Verify that this information accurately reflects your property’s characteristics.

- Understand the Assessment Factors: Familiarize yourself with the factors used to assess your property’s value. These may include location, size, age, condition, and recent sales activity in the area. Understanding these factors will give you insights into how the assessment was calculated.

- Identify any Exemptions or Deductions: Check if there are any exemptions or deductions applied to your property assessment. These may include homestead exemptions or special assessments for specific property types. Ensure that you are receiving all the eligible benefits.

- Check for any Errors or Discrepancies: Carefully review the assessment for any errors, such as incorrect measurements or discrepancies in property features. Report any inaccuracies promptly to the assessor’s office for correction.

- Compare with Previous Assessments: If you have received property assessments in previous years, compare them to the current assessment. Look for significant changes in the assessed value and property description to understand how your property’s value has changed over time.

By following these steps, you can effectively read and understand your property assessment. If you have any questions or concerns about the assessment, don’t hesitate to reach out to the assessor’s office for clarification. Remember, reading your property assessment ensures its accuracy, fairness, and provides you with valuable information about your property’s value.

Obtain a Copy of the Property Assessment

The first step in reading a property assessment is to obtain a copy of the assessment document. Depending on your local government’s practices, you may be able to access the assessment online through their website or by contacting the assessor’s office directly.

Start by visiting your local government’s website and navigating to the section related to property assessments. Look for a search function or a designated area where you can input your property address or identification number to access the assessment. In some cases, you may need to create an account or provide additional information to view the assessment online.

If online access is not available or if you prefer a physical copy of the assessment, contact the assessor’s office directly. They will be able to provide you with the necessary information on how to obtain a copy.

Once you have obtained the property assessment, it is important to save it for future reference. Keep a digital copy on your computer and consider printing a hard copy for your records. This way, you can easily reference the assessment whenever needed.

By obtaining a copy of the property assessment, you are taking the first step towards understanding the value and details associated with your property for taxation purposes.

Read more: How To Do A Property Assessment

Review the Property Identification Information

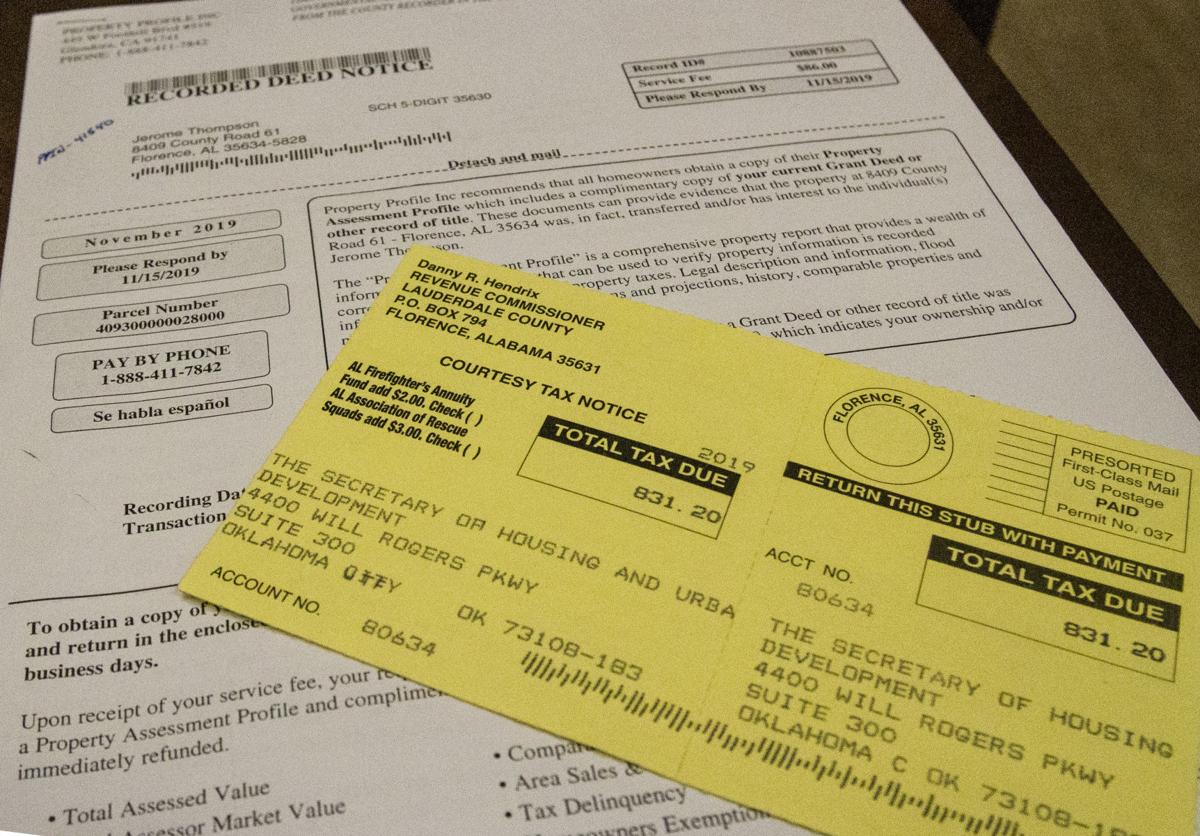

After obtaining a copy of the property assessment, the next step is to review the property identification information. This section of the assessment contains crucial details about your property, ensuring that it is correctly identified for taxation purposes.

Start by checking the property address listed on the assessment. Ensure that it matches the actual address of your property. If there are any discrepancies or errors in the address, promptly notify the assessor’s office to have them corrected. An incorrect address could result in issues related to property tax payments or other official documents.

Next, review the legal description of the property. The legal description provides a precise and official description of the property’s boundaries and location. It typically includes information such as lot numbers, block numbers, and any relevant property-specific identifiers. Verify that this information aligns with the actual property boundaries to avoid any discrepancies or confusion.

In addition to the address and legal description, examine other pertinent details such as the property’s owner of record. Ensure that the listed owner accurately reflects the current ownership of the property. If there have been any recent changes in ownership, such as a purchase or transfer, it is essential to have the ownership details updated.

Another essential aspect to review in this section is the property type classification. Properties are often categorized based on their use, such as residential, commercial, or agricultural. Confirm that the property type classification is accurate, as it can have an impact on the assessment and taxation of the property.

By thoroughly reviewing the property identification information, you can ensure that the assessment accurately identifies your property. Correct identification is crucial for the proper assessment of taxes and for maintaining accurate records related to the property.

Analyze the Assessed Value

One of the most important aspects of a property assessment is the assessed value. The assessed value represents the estimated value of your property for taxation purposes. It is crucial to analyze this value to ensure its accuracy and to understand how it may impact your property taxes.

Start by locating the assessed value on the property assessment document. This value is typically displayed prominently on the assessment form. It may appear as a single total value or be broken down by land value and building value.

Once you have located the assessed value, compare it to the market value of your property. Market value is the likely price at which a property would sell in a competitive and open market. You can estimate the market value by conducting research on recent sales of similar properties in your area or by consulting with real estate professionals.

If the assessed value is significantly higher or lower than the estimated market value, it may be worth further investigation. Discrepancies between assessed value and market value can occur due to various factors, such as changes in the local real estate market or errors in the assessment process.

Additionally, consider the assessed value in relation to other properties in your area. Look for properties similar to yours and compare their assessed values. If there is a significant disparity, it may be worth requesting a reassessment or appealing the assessment to ensure fair and equitable taxation.

Keep in mind that property assessments are subject to change from year to year, as they take into account factors such as property improvements, market conditions, and changes in local taxing policies. Therefore, it is essential to review the assessed value on each annual assessment and identify any significant changes.

By analyzing the assessed value, comparing it to market values, and considering its fairness in relation to similar properties, you can gain a better understanding of how your property’s value is assessed for taxation purposes.

When reading a property assessment, pay attention to the assessed value, property description, and any exemptions or deductions. This will give you a clear understanding of the property’s value and potential tax implications.

Examine the Property Description

As you continue to read your property assessment, it’s important to examine the property description section. This section provides detailed information about the physical characteristics and attributes of your property, which directly impact its assessed value.

Start by reviewing the property’s size and dimensions. Check if the assessment accurately reflects the total square footage of your property, including any land, buildings, or structures on the premises. Confirm that the measurements align with the actual size of your property, as errors in these measurements can result in an incorrect assessment.

Next, examine the property’s boundaries and shape. The assessment should outline the property’s boundaries, including any easements, right-of-ways, or other relevant details. Make sure these boundaries align with the actual boundaries of your property to avoid any misunderstandings or disputes.

Take note of the building(s) on the property and their descriptions. Look for information regarding the number of rooms, bedrooms, bathrooms, and any notable features or improvements. Confirm that these details accurately represent the physical characteristics of your property. Any discrepancies or errors should be reported to the assessor’s office for correction.

Consider other aspects of the property description that may impact the assessed value. This can include factors such as the property’s age, condition, architectural style, and any significant improvements or renovations. These details contribute to the overall assessment and should be reviewed for accuracy and relevance.

In some cases, there may be additional information provided in the property description section, such as zoning classification, access points, or land use designations. Familiarize yourself with these details as they can impact the assessed value and potential future use of the property.

By thoroughly examining the property description, you can ensure that the assessment accurately reflects the physical characteristics of your property. Identifying any discrepancies or errors in this section will help maintain an accurate assessment and ensure fair taxation.

Understand the Assessment Factors

In order to properly interpret a property assessment, it is crucial to understand the assessment factors that contribute to the determination of value. Assessors take various factors into consideration when assessing the value of a property for taxation purposes.

One of the primary factors is the property’s location. Assessors consider factors such as proximity to amenities, transportation, schools, and desirable neighborhoods. Properties located in highly sought-after areas or with breathtaking views are typically assessed at higher values.

The size and dimensions of the property also play a significant role. Assessors assess the total area of the land, as well as the size and square footage of any buildings or structures on the property. Generally, larger properties or buildings tend to have higher assessed values.

The condition of the property is another crucial assessment factor. Assessors evaluate the overall state of the property, including the quality of construction, maintenance, and any necessary repairs. Well-maintained properties are often assessed at higher values compared to those in poor condition.

The age of the property is also taken into account. Older properties may have lower assessed values due to factors such as outdated construction materials or design. Newer properties, on the other hand, may have higher assessed values due to modern features and materials.

Other assessment factors may include the use and zoning of the property. Assessors consider whether the property is used for residential, commercial, or agricultural purposes, as well as any restrictions or regulations imposed by zoning regulations. These factors can have a significant impact on the assessed value.

Understanding the assessment factors allows you to gain insight into how the value of your property was determined. By recognizing the significance of these factors, you can better assess the fairness and accuracy of your property assessment.

Read more: How To Challenge A Property Assessment

Identify any Exemptions or Deductions

When reading a property assessment, it’s important to identify any exemptions or deductions that may apply to your property. Exemptions and deductions can lower the assessed value of your property, resulting in potential tax savings. Here are some key points to consider:

Homestead Exemptions: Many jurisdictions offer homestead exemptions, which reduce the assessed value of a property for homeowners who use it as their primary residence. This exemption can provide significant tax savings. Check if your property assessment indicates the application of a homestead exemption and ensure that you are receiving the full benefit.

Senior or Disability Exemptions: Depending on your jurisdiction, there may be additional exemptions available for seniors or individuals with disabilities. These exemptions can help reduce the assessed value and provide additional tax relief. Review the assessment to see if any specific exemptions for seniors or individuals with disabilities have been applied to your property.

Special Assessments: Some properties may be subject to special assessments such as municipal improvement districts or community facilities districts. These assessments are typically used to fund specific local infrastructure projects. If your property is subject to any special assessments, ensure that they have been accurately reflected in your assessment.

Other Deductions or Exemptions: Depending on your local jurisdiction, there may be additional deductions or exemptions available. For example, certain energy-efficient improvements or historic preservation status may result in deductions or exemptions. Review your property assessment to identify any other specific deductions or exemptions that may apply to your property.

If you believe that you qualify for any exemptions or deductions that are not reflected in your property assessment, contact the assessor’s office to inquire about the requirements and application procedures. It’s essential to maximize any potential tax savings by ensuring that you are receiving all eligible exemptions and deductions.

Identifying and understanding any exemptions or deductions on your property assessment can help reduce your overall property tax liability. Take the time to carefully review the assessment and confirm that all applicable exemptions and deductions have been taken into account.

Check for any Errors or Discrepancies

When reading a property assessment, it is crucial to carefully review the document for any errors or discrepancies. Mistakes in the assessment can potentially result in an inaccurate valuation and higher property taxes. Here are some key steps to follow when checking for errors or discrepancies:

Verify Property Information: Start by ensuring that all the property information listed on the assessment is correct. Check the property address, legal description, and owner’s name to confirm their accuracy. Any errors in these details should be promptly reported to the assessor’s office for correction.

Review Building Details: Examine the description of any buildings or structures on the property. Take note of the number of rooms, bedrooms, bathrooms, and other relevant details. Verify that these specifications accurately reflect the physical attributes of the property. If you notice any discrepancies, notify the assessor’s office to have them corrected.

Check Property Size: Confirm that the size of the property, including the land and any improvements, matches the actual measurements. If the assessed size differs significantly from the actual size, it can impact the valuation of the property. Report any discrepancies in measurements immediately to ensure an accurate assessment.

Inspect Assessed Value: Carefully analyze the assessed value assigned to your property. Compare it to previous assessments and recent sales of similar properties in your area. If there is a significant disparity, it may be worth investigating further and potentially appealing the assessment. Report any irregularities or inconsistencies to the assessor’s office.

Consider Property Condition: Evaluate the property’s condition as described in the assessment. Assessors take into account the condition when determining the value of the property. If you believe that the condition described is inaccurate or outdated, provide documentation and evidence supporting your claim to the assessor’s office for reevaluation.

Address Additional Errors: Be on the lookout for any other errors or discrepancies in the assessment. This can include incorrect property classifications, missed exemptions, or miscalculations. Notify the assessor’s office of these errors promptly to ensure an accurate valuation.

Accurate and error-free property assessments are essential for fair taxation. By checking for errors or discrepancies in your assessment and promptly reporting them to the assessor’s office, you can help ensure that your property is valued correctly and that you are not overpaying on your property taxes.

Compare with Previous Assessments

Comparing your current property assessment with previous assessments is an essential step in understanding the changes in your property’s value over time. This comparison can provide valuable insights into how your property has been assessed and help you identify any significant discrepancies or trends. Here’s how you can effectively compare your assessments:

Locate Previous Assessments: Gather your previous property assessments for reference. These may be available online through your local government’s website or in your personal records. Ensure you have assessments from the past few years to track any changes.

Compare the Assessed Values: Start by comparing the assessed values of your property from previous assessments. Look for any significant increases or decreases in the values over time. Keep in mind that fluctuations in the market and changes in the property itself, such as renovations or improvements, can impact the assessed value.

Consider the Property Description: Review the property descriptions in the previous assessments and compare them to the current assessment. Pay attention to any changes or discrepancies in the details of your property, such as square footage, number of rooms, or property boundaries. Note any updates or inaccuracies that need to be addressed.

Assess Changes in Exemptions or Deductions: Check if there have been any modifications to the exemptions or deductions applied to your property assessment. Changes in eligibility or modifications to local tax laws could impact the assessed value. Ensure that all eligible exemptions and deductions are being applied consistently over the years.

Identify Any Trends or Patterns: Analyze the assessed values over time to identify any trends or patterns. Are the assessments consistently increasing? Are there any sudden jumps or drops in value? Understanding these trends can help you anticipate potential changes in property taxes and make informed decisions about your property.

Investigate Significant Discrepancies: If you notice significant discrepancies between your current assessment and previous assessments, it may be worth investigating further. Consider factors such as changes in the market value of properties in your area or any changes in the property itself that could account for the discrepancies. If necessary, consult with a qualified appraiser or reach out to the assessor’s office for clarification.

Comparing your current property assessment with previous assessments allows you to track changes in your property’s value and identify any potential issues or inconsistencies. By staying informed about these assessments, you can ensure the accuracy of your property’s valuation and make informed decisions related to taxes and property management.

Conclusion

Reading and understanding your property assessment is crucial for homeowners, investors, and anyone interested in knowing the value of a property. By following the steps outlined in this guide, you can navigate through the assessment document with confidence and gain valuable insights into the assessed value and details of your property.

Obtaining a copy of the property assessment is the first step, allowing you to access the information and review it thoroughly. Ensure that the property identification information is accurate, including the address, legal description, and owner’s name. Any discrepancies should be reported promptly for correction.

Analyzing the assessed value is key in assessing the fairness and accuracy of your property assessment. Compare the assessed value to market values of similar properties and consider any disparities. Understanding the assessment factors can provide valuable insight into how your property’s value is determined, considering elements such as location, size, condition, and other relevant factors.

Identifying any exemptions or deductions that apply to your property can lead to potential tax savings. Be aware of homestead exemptions, senior or disability exemptions, as well as other deductions specific to your jurisdiction. Additionally, checking for errors or discrepancies in the assessment is essential to maintain accuracy. Review the property description and make sure it accurately reflects the characteristics of your property.

Lastly, comparing your current property assessment with previous assessments helps you track changes in your property’s value over time. This comparison can unveil trends and provide insights into the factors influencing variations in assessed values.

Understanding your property assessment empowers you to make informed decisions about your property, ensure accurate taxation, and identify any necessary corrections or appeals. If you have any concerns or questions about your assessment, reach out to the assessor’s office for assistance.

Remember, property assessments are not set in stone and can be subject to changes. Stay informed, review your assessment annually, and take appropriate actions if necessary. By being proactive and knowledgeable about your property assessment, you can have confidence in its accuracy and make informed decisions regarding your property.

Frequently Asked Questions about How To Read A Property Assessment

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Read A Property Assessment”