Home>Home Maintenance>What Information Is Included In A Minnesota Property Assessment

Home Maintenance

What Information Is Included In A Minnesota Property Assessment

Modified: March 6, 2024

Learn everything you need to know about Minnesota property assessments, including valuable information on home maintenance. Get expert insights now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of home maintenance! We understand that owning a home comes with many responsibilities, and one of the most important aspects of homeownership is ensuring that your property is well-maintained. One crucial component of maintaining your home is staying on top of property assessments.

Property assessments play a vital role in determining the value of your home for tax purposes. They provide valuable information about your property’s characteristics, its current market value, and ultimately, the amount of property tax you are liable for. Whether you are a homeowner or a potential buyer, understanding property assessments is essential to making informed decisions.

In this article, we will delve into the world of property assessments, specifically focusing on the information included in Minnesota property assessments. We will explore the purpose and process of property assessments in Minnesota, the factors considered in determining property values, and the appeal process if you believe your assessment is inaccurate or unfair.

So, let’s roll up our sleeves and dive into the fascinating world of property assessments in Minnesota!

Key Takeaways:

- Property assessments in Minnesota determine the value of homes for tax purposes, ensuring fair tax distribution and transparency in the real estate market. Homeowners can appeal assessments if they believe they are inaccurate.

- Understanding property assessment notices and tax implications is crucial for homeowners to plan their finances effectively and make informed decisions about their property. It’s important to stay proactive and seek professional guidance when needed.

Property Assessment Overview

Before we delve into the specifics of Minnesota property assessments, let’s start with a general overview of what a property assessment entails. A property assessment is the process of determining the value of a property for taxation purposes. It is conducted by local government authorities, such as county assessor’s offices, to establish the fair market value of the property.

The fair market value represents the price at which a willing buyer and a willing seller would agree upon if the property were to be sold on the open market. It takes into account various factors, including the property’s physical characteristics, location, recent sales of comparable properties, and market conditions.

The primary purpose of property assessments is to distribute the tax burden fairly among property owners within a jurisdiction. Higher-valued properties typically pay higher property taxes compared to lower-valued properties.

In Minnesota, property assessments are conducted on a regular basis, usually every few years, to ensure that the property values reflect the current market conditions. These assessments are typically performed by local assessors who have a thorough understanding of the local real estate market.

It’s important to note that property assessments are not the same as property appraisals. While both involve determining the value of a property, appraisals are usually conducted for specific purposes, such as obtaining a mortgage or selling a property. Property assessments, on the other hand, are primarily used for taxation purposes.

Now that we have a basic understanding of property assessments, let’s take a closer look at how the property assessment process works in Minnesota.

Purpose of Property Assessments

Property assessments serve several important purposes in Minnesota. Understanding these purposes can help homeowners and buyers navigate the property assessment process and comprehend the implications it has on their financial obligations.

1. Taxation: The primary purpose of property assessments is to determine the value of properties for taxation purposes. By assessing the value, local taxing authorities can levy property taxes proportionate to the assessed value. This ensures a fair distribution of the tax burden among property owners.

2. Evaluation of Municipal Finances: Property assessments also assist local governments in evaluating their financial health. The property tax revenue collected based on assessed values can contribute to funding public services such as schools, roads, police, and fire departments. Accurate assessments are vital for efficient budget planning and resource allocation.

3. Equity and Fairness: Property assessments help promote equity and fairness among property owners. By valuing properties based on their market worth, assessments ensure that homeowners with similar properties pay a similar amount of taxes. This prevents any one property owner from bearing an unfair burden and helps maintain an equitable tax system.

4. Market Research and Planning: Property assessments provide valuable data to local governments, real estate professionals, and homeowners to conduct market research and make informed decisions. Assessments help in analyzing market trends, understanding property values, and predicting future changes, benefiting buyers, sellers, and investors alike.

5. Transparency: Property assessments contribute to transparency in the real estate market. By publicly disclosing assessed property values, the assessment process promotes openness and information accessibility to property owners, potential buyers, and other stakeholders.

Understanding the purpose of property assessments in Minnesota is essential for homeowners and buyers. It allows them to comprehend how their property’s value is determined and how it affects their tax obligations. It also establishes the importance of accurate assessments in maintaining fairness, equity, and a robust local government.

Minnesota Property Assessment Process

In Minnesota, property assessments are conducted by county assessors’ offices. The assessment process involves several steps to determine the market value of each property within the jurisdiction. Let’s take a closer look at the property assessment process in Minnesota:

- Data Collection: The first step in the assessment process is collecting relevant data about each property. This includes information on the property’s physical characteristics, such as size, layout, number of bedrooms and bathrooms, and any modifications or additions. Additionally, data on recent sales of comparable properties in the area and prevailing market conditions are gathered and analyzed.

- Property Inspection: In some cases, assessors may conduct on-site inspections of the properties to verify the accuracy of the data collected. This allows them to assess the property’s condition, assess any improvements or changes made, and confirm the overall accuracy of the property’s information.

- Valuation: Once the necessary data has been collected and verified, assessors apply valuation methods to determine the market value of each property. They consider factors such as the property’s location, physical characteristics, recent sales data, and market trends. Several valuation methods can be used, including the sales comparison approach, income approach, and cost approach.

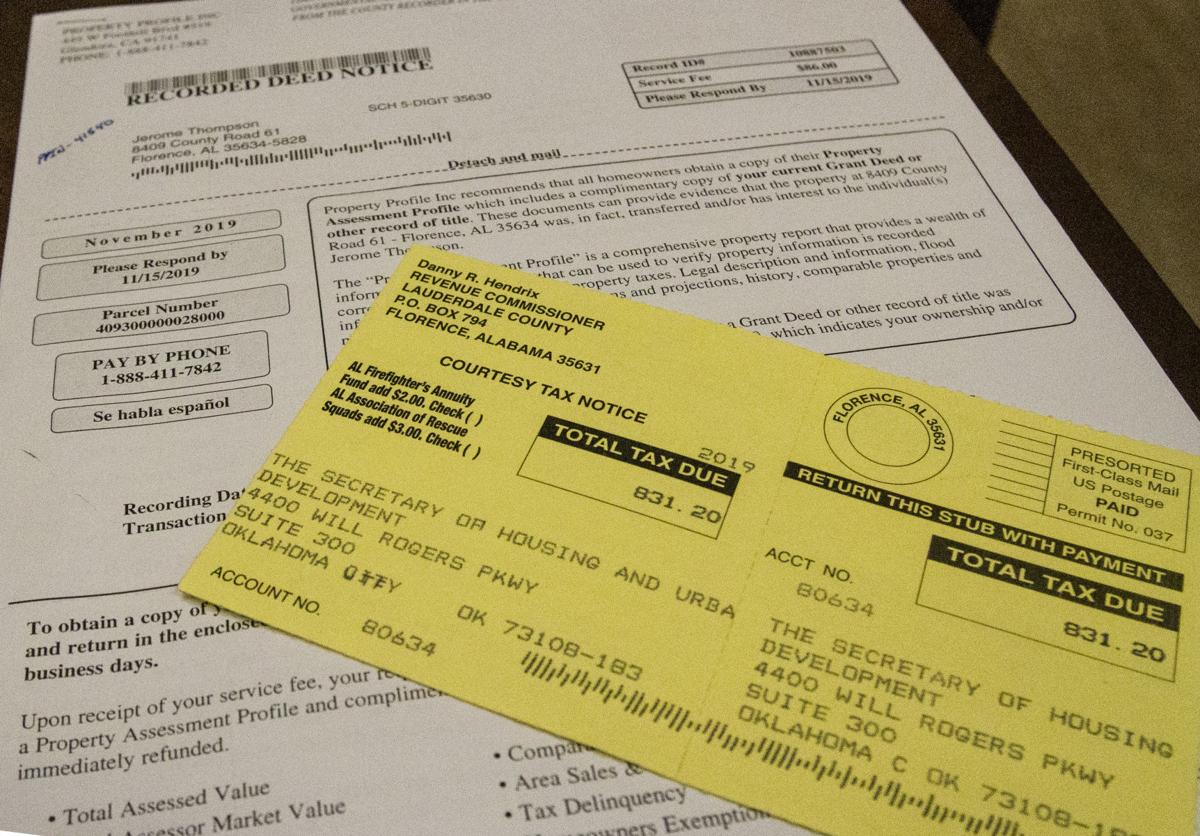

- Assessment Notification: After completing the valuation process, the county assessors send property assessment notices to property owners. These notices inform homeowners of their property’s assessed value and provide details on how to appeal the assessment if they believe it is inaccurate or unfair.

- Review and Appeal: Property owners have the right to review their property assessments and appeal if they believe there are errors or inconsistencies. They can present evidence supporting their case, such as recent property sales data or professional appraisals. The appeals process typically involves submitting a written appeal to the county assessors’ office and attending a hearing to present their case.

- Final Assessment: After considering appeals and making any necessary adjustments based on the evidence provided, the county assessors finalize the property assessments. The finalized assessments will serve as the basis for calculating property taxes for the upcoming tax year.

It’s important for property owners to review their assessment notices thoroughly and understand their rights and options in the appeals process. Additionally, keeping accurate records of property improvements and staying informed about local real estate market trends can help ensure fair and accurate property assessments.

Factors Considered in Property Assessments

Property assessments in Minnesota take into account various factors to determine the market value of a property. Assessors consider both objective and subjective factors to ensure that assessments accurately reflect the property’s worth. Let’s explore some of the key factors that are commonly taken into consideration:

- Property Size and Improvements: The size of a property, including the land area and the size of any structures, plays a significant role in its assessment. Assessors also consider any improvements made to the property, such as renovations or additions, which can increase its value.

- Location and Neighborhood: The location of a property is a crucial factor in its assessment. Assessors analyze the neighborhood, proximity to amenities, schools, transportation, and other factors that contribute to the desirability of the area. Properties in highly sought-after neighborhoods are generally assessed higher.

- Comparable Sales: Assessors compare the property being assessed to similar properties that have recently sold in the area. These sales provide a benchmark for determining the property’s market value. Factors such as size, condition, age, and location are taken into account when selecting comparable properties.

- Market Trends: Assessors analyze current market trends to gauge the overall value of properties in the area. Factors such as supply and demand, interest rates, and economic conditions can influence property values. Assessments may reflect any changes in the local real estate market.

- Income-Generating Potential: For certain types of properties, such as commercial or rental properties, assessors may consider the income-generating potential. Factors such as rental income, vacancy rates, and operating expenses could impact the property’s market value.

- Property Age and Condition: The age and condition of a property are important factors in determining its value. Assessors consider factors such as the overall condition of the property, the age of the structure, and any maintenance or structural issues that may affect its value.

- Assessment Uniformity and Equity: To ensure fairness and consistency, assessors aim to apply uniform assessment standards across similar properties within the jurisdiction. Assessors strive to treat all property owners fairly and avoid any bias or discrimination in their assessments.

It’s important to note that each property assessment is unique, and the weight given to each factor may vary depending on the specific circumstances. Understanding the factors considered in property assessments can help property owners evaluate the accuracy and fairness of their assessments and make informed decisions during the appeals process.

Read more: What Is Property Assessment

Identifying Property Characteristics

When assessing the value of a property, it is essential to accurately identify and document its relevant characteristics. These property characteristics play a significant role in determining its market value. Assessors in Minnesota carefully consider various aspects of a property to ensure a fair and accurate assessment. Let’s explore some of the key property characteristics that assessors take into account:

- Physical Structure: The physical structure of a property includes its size, layout, number of rooms, and overall design. Assessors consider the square footage of the living space, the number of bedrooms and bathrooms, and any additional features such as a basement, attic, or garage.

- Land Size and Shape: The size and shape of the land on which a property is situated can impact its value. Assessors measure the dimensions of the land and consider factors such as its topography, views, and accessibility. The desirability of the land for potential use and development is also taken into account.

- Property Age and Condition: The age and condition of a property can significantly influence its value. Assessors consider the overall condition of the property, including the quality of construction, the state of the infrastructure (such as plumbing and electrical systems), and any signs of wear and tear or needed repairs.

- Interior and Exterior Features: Assessors evaluate both the interior and exterior features of a property. This includes elements such as the quality of materials used, the presence of desirable amenities (such as fireplaces or swimming pools), architectural details, and the condition of the landscaping and outdoor areas.

- Location and Neighborhood: The location of a property and the attributes of its surrounding neighborhood are crucial factors. Assessors consider factors such as the proximity to schools, parks, shopping centers, and transportation options. They also assess the quality of the neighborhood in terms of safety, amenities, and desirability.

- Rental Income Potential: For investment properties, assessors may consider the income-generating potential of the property. This involves analyzing the rental income it could generate based on market demand and rental rates, as well as factors that might affect occupancy rates and operating expenses.

- Historical or Cultural Significance: In some cases, properties with historical or cultural significance may receive special consideration. Assessors weigh the importance of these factors when determining the property’s value and potential impact on the community.

Accurately identifying these property characteristics allows assessors to paint a comprehensive picture of a property’s market value. Property owners can help ensure a fair assessment by providing accurate information about their property’s characteristics and documenting any improvements or unique features that may affect its value.

When reviewing a Minnesota property assessment, look for details such as property value, land and building descriptions, tax information, and any recent improvements or changes to the property.

Valuation Methods Used

When assessing the market value of a property, assessors in Minnesota utilize various valuation methods to ensure an accurate and fair assessment. These valuation methods take into account different factors and approaches to determine the property’s worth. Let’s explore some of the commonly used valuation methods in property assessments:

- Sales Comparison Approach: The sales comparison approach is one of the most commonly used methods. It involves comparing the property being assessed to recently sold comparable properties in the area. Assessors consider factors such as size, location, condition, and amenities to estimate the property’s value based on the sales prices of similar properties.

- Income Approach: The income approach is primarily used for income-generating properties, such as rental properties. Assessors consider the potential income the property could generate and apply a capitalization rate to estimate its value. This method is based on the principle that the value of an income property is determined by the income it can generate.

- Cost Approach: The cost approach determines the value of a property by considering the cost of replacing or reproducing the property’s improvements. Assessors estimate the current cost of constructing a similar property and deduct depreciation based on its age, condition, and other factors. This method is often used for unique or specialized properties where there may not be many comparable sales.

- Mass Appraisal: In some cases, assessors use mass appraisal methods to value properties efficiently and accurately. Mass appraisal involves using statistical models and computer algorithms to analyze large amounts of data and identify property value patterns. This approach allows assessors to assess multiple properties quickly and consistently, making it particularly useful for areas with a high number of properties.

- Site Visits and Inspections: Assessors may conduct on-site visits and inspections to gather additional information and verify the accuracy of data. Site visits allow assessors to assess the property’s condition, quality, and any unique features that may affect its value. These visits enable assessors to make more informed judgments during the valuation process.

It’s important to note that the choice of valuation method depends on factors such as the type of property, its intended use, and the availability of data. Assessors use their expertise and professional judgment to determine which valuation method or combination of methods is most appropriate for a particular property.

By considering various valuation methods and taking into account the specifics of each property, assessors aim to provide fair and accurate property assessments that reflect the current market value.

Appeal Process for Property Assessments

In Minnesota, property owners have the right to appeal their property assessments if they believe they are inaccurate, unfair, or not reflective of the property’s market value. The appeal process allows property owners to present evidence and arguments to support their claim and request a reassessment. Let’s take a closer look at the appeal process for property assessments:

- Review Assessment Notice: The first step in the appeal process is carefully reviewing the assessment notice received from the county assessor’s office. The notice typically provides information about the assessed value and instructions on how to file an appeal.

- Understand Deadlines and Requirements: Property owners must be aware of the appeal deadlines and requirements set by their local jurisdiction. The specific timeline for filing an appeal and the necessary documentation may vary, so it is essential to understand and adhere to the provided guidelines.

- Gather Supporting Evidence: To strengthen the appeal, property owners should gather relevant supporting evidence. This may include recent sales data of comparable properties, appraisals, property condition documentation, or any other information that demonstrates inaccuracies in the assessment.

- Submit Written Appeal: Property owners must submit a written appeal to the county assessor’s office within the designated timeframe. The appeal should clearly state the reasons for the challenge and provide supporting documentation. It is crucial to follow the specific instructions provided by the assessor’s office.

- Attend a Hearing: Depending on the jurisdiction and the complexity of the appeal, a hearing may be scheduled. During the hearing, property owners have the opportunity to present their case to a review board or an administrative hearing officer. It is essential to prepare a well-organized and persuasive argument based on the supporting evidence gathered.

- Receive a Decision: After the appeal is heard, the review board or hearing officer will provide a decision. The decision may either uphold the original assessment or grant a reassessment based on the evidence presented. Property owners will receive written notice of the decision.

- Further Appeals: If property owners are unsatisfied with the decision, they may have further options for appeal. This could involve appealing to a higher-level board, seeking mediation, or pursuing a legal appeal through the court system.

It is important for property owners to carefully review the assessment notice, be familiar with the appeal process, and provide supporting evidence to make a strong case. Consulting with a professional such as a real estate attorney or a licensed appraiser can provide guidance and assistance throughout the appeal process.

Remember, the appeal process may vary depending on the jurisdiction, so it is crucial to consult the specific guidelines provided by the local authorities where the property is located.

Understanding Property Assessment Notices

Property owners in Minnesota receive property assessment notices from their county assessor’s office, providing important information about the assessed value of their property. Understanding these assessment notices is crucial for property owners to comprehend how the value was determined and to take appropriate action if necessary. Let’s explore the key components of property assessment notices:

- Assessed Value: The assessment notice will prominently display the assessed value of the property. This value represents the estimated market value of the property as determined by the assessor’s office. It is important to note that the assessed value may not necessarily reflect the current market value or the property’s potential sales price.

- Taxable Value: The assessment notice may also provide the taxable value of the property. The taxable value is a portion of the assessed value that is used to calculate property taxes. It is typically a percentage of the assessed value set by local tax authorities and may be subject to additional adjustments or exemptions.

- Notice Period and Deadlines: The assessment notice will include information about the notice period and any deadlines for filing an appeal. It is crucial to pay attention to these dates and ensure that any appeals or requests for reassessment are submitted within the specified timeframe. Missing the deadline may result in the loss of the opportunity to challenge the assessment.

- Contact Information: The assessment notice will provide contact information for the county assessor’s office. It is important to use this contact information if you have any questions or need further clarification regarding the assessment or the appeal process. The assessor’s office can provide guidance and assistance throughout the process.

- Instructions for Appeals: The assessment notice may include specific instructions on how to file an appeal if you believe the assessment is inaccurate or unfair. It is essential to carefully follow these instructions, including submitting a written appeal with supporting evidence within the designated timeframe.

- Property Characteristics: Assessment notices may include a summary of the property’s characteristics, such as the size of the land, the number of rooms, and any improvements or additions. Reviewing this information allows property owners to ensure its accuracy and identify any discrepancies that may affect the assessed value.

- Additional Information: The assessment notice may contain additional information or disclosures relevant to the assessment process. This may include explanations of valuation methods used, the jurisdiction’s tax rates, or any changes in tax laws or regulations that may impact the property assessment.

Understanding property assessment notices is crucial for property owners to determine whether the assessed value accurately reflects their property’s market value. If there are concerns or discrepancies, property owners should follow the instructions provided on the assessment notice to file an appeal or request a reassessment, providing supporting evidence as necessary. Consulting with a real estate professional or a licensed appraiser can also be helpful in understanding and navigating the assessment notice.

By being proactive and staying informed, property owners can ensure that their assessments are fair and accurate, leading to a better understanding of their financial obligations and tax responsibilities.

Read more: What Is A Property Assessment Notice

Tax Implications of Property Assessments

Property assessments in Minnesota have significant tax implications for property owners. The assessed value of a property directly impacts the amount of property tax that the owner is liable to pay. Understanding these tax implications is crucial for homeowners to plan their finances effectively. Let’s delve into the tax implications of property assessments:

Property Tax Calculation:

The assessed value of a property serves as the basis for calculating property taxes. Property tax rates are determined by local taxing authorities, such as counties, cities, school districts, and other local entities. These tax rates, when applied to the assessed value, determine the amount of property tax owed by the property owner.

Changes in Assessed Value:

Changes in assessed value can result in adjustments to property tax payments. If the assessed value of a property increases, the property owner may see an increase in their property tax bill. Conversely, if the assessed value decreases, the property owner may see a reduction in their property tax liability.

Annual Property Tax Statements:

Property owners receive annual property tax statements that provide detailed information about their property tax obligations. These statements typically include the assessed value, the applicable tax rates, and the amount of property tax owed. Property owners should carefully review these statements to ensure accuracy.

Tax Caps and Limits:

Some jurisdictions may have tax caps or limits in place to restrict the amount by which a property’s assessed value can increase each year. These caps aim to provide property owners with more predictable tax increases and protect them from significant year-over-year spikes in property taxes.

Property Tax Exemptions and Relief Programs:

Property owners may be eligible for various exemptions or relief programs that can help reduce their property tax burden. These programs include homestead exemptions for primary residences, exemptions for senior citizens or veterans, and programs for low-income individuals or individuals with disabilities. It is important for property owners to research and understand the eligibility criteria for these programs.

Impact on Selling or Buying Property:

Property assessments can also impact the sale and purchase of properties. Buyers may consider the property’s assessed value and associated taxes as part of their decision-making process. A higher assessed value and property tax may affect a buyer’s affordability and willingness to purchase. Additionally, sellers may need to disclose the previous and current assessments to potential buyers.

Challenging Assessments:

Property owners have the right to challenge their assessments if they believe they are inaccurate or unfair. The appeal process, as mentioned earlier, provides an opportunity to present evidence and arguments to request a reassessment. Challenging an assessment can potentially result in a reduction in the property’s assessed value and lower property tax obligations.

Understanding the tax implications of property assessments allows homeowners to plan their finances effectively and be prepared for their property tax obligations. It is important to stay informed about local tax laws, exemptions, and relief programs available to maximize tax savings. Consulting with a tax professional or a real estate attorney can provide further guidance and assistance in navigating property tax matters.

Conclusion

Property assessments play a crucial role in the world of home maintenance and ownership. Understanding the process and implications of property assessments is essential for homeowners in Minnesota. Through this comprehensive guide, we have explored the various aspects of property assessments, including their purpose, the assessment process, factors considered, and the appeal process.

Property assessments serve the primary purpose of determining the value of a property for taxation purposes, ensuring a fair distribution of the tax burden among property owners. The assessment process involves data collection, property inspections, valuation methods, and the issuance of assessment notices. Factors such as property size, location, comparable sales, and market trends are considered in determining the property’s value. Property owners have the right to appeal their assessments if they believe they are inaccurate or unfair, following a specific process and providing supporting evidence.

Understanding property assessment notices is crucial for property owners. These notices provide essential information about assessed value, taxable value, deadlines, and instructions for appealing the assessment. They also offer insights into property characteristics and additional disclosure information.

The tax implications of property assessments should not be overlooked. The assessed value directly impacts property tax obligations, and property owners should be aware of the calculations, potential changes in assessed value, tax caps, and exemption or relief programs available to them. Being knowledgeable about property assessments can help property owners effectively plan their finances and navigate the purchase or sale of properties.

In conclusion, property assessments are an integral part of homeownership in Minnesota. By understanding the assessment process, appealing when necessary, and grasping the tax implications, property owners can ensure fair assessments, accurate property values, and informed financial decisions. Stay proactive, be aware of local regulations, and seek professional guidance when needed to maximize the benefits of property assessments.

Frequently Asked Questions about What Information Is Included In A Minnesota Property Assessment

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

Why did Mn change self storage from commercial to industrial when the IRS recognized them as commercial?