Home>Home Maintenance>What Factors Contribute To A Property Assessment

Home Maintenance

What Factors Contribute To A Property Assessment

Modified: March 6, 2024

Learn about the key factors that influence property assessments, including the important role of home maintenance in determining property values.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of property assessments, where the value of a property is determined through a thorough evaluation process. Property assessment is a crucial element in the real estate industry as it impacts various aspects, including property taxes, insurance premiums, and potential sale price.

Understanding the factors that contribute to a property assessment can empower homeowners, buyers, and sellers to make informed decisions. By knowing what influences the value of a property, individuals can take appropriate steps to enhance their property’s assessment and overall marketability.

In this article, we will delve into the world of property assessments and uncover the key factors that come into play when assessing the value of a property.

Key Takeaways:

- Location, size, condition, and neighborhood quality are key factors in property assessments. Understanding these factors can help homeowners and buyers make informed decisions about property value and marketability.

- Property improvements, amenities, and transportation access also influence property assessments. Knowing how these factors impact property value can guide decisions on renovations, purchases, and property investments.

Read more: What Is Property Assessment

Definition of Property Assessment

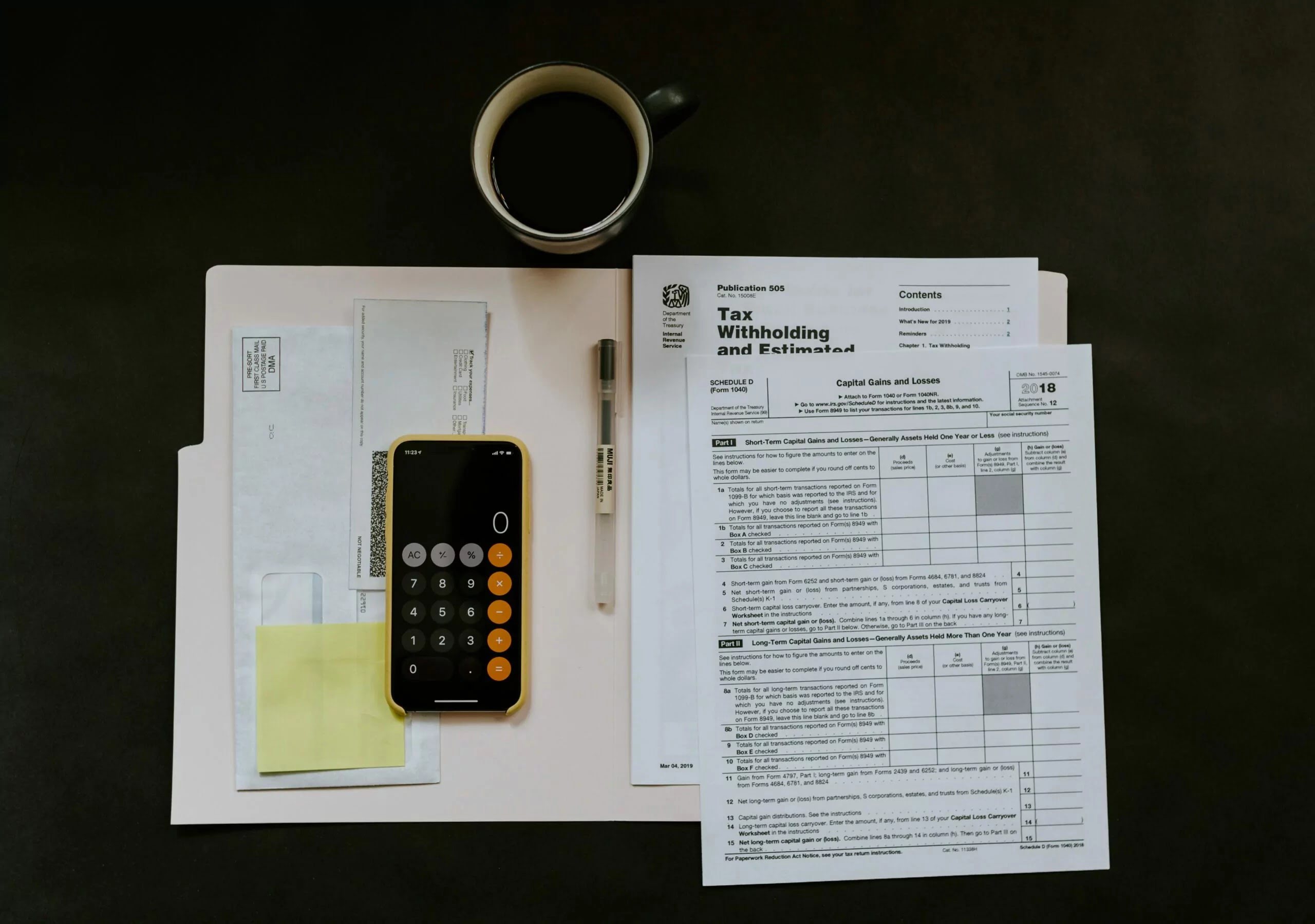

A property assessment refers to the process of evaluating the value of a property for taxation purposes or determining its market value. It involves collecting and analyzing data related to various factors that influence a property’s worth.

Property assessments are typically conducted by government authorities or professional assessors who are trained in property valuation techniques. The assessment is based on a combination of objective criteria, such as property size and location, as well as subjective factors, such as market trends and property condition.

The goal of a property assessment is to provide an accurate estimate of a property’s value, considering both the physical attributes of the property and the prevailing market conditions. This valuation serves as the basis for determining property taxes, insurance premiums, and potential sale prices.

It’s important to note that property assessments may vary depending on the purpose of the evaluation. A taxation assessment focuses on determining the value for property tax calculations, while a market assessment aims to determine the property’s value in the current real estate market.

Property assessments are conducted periodically, usually every few years, to account for changes in property values and market conditions. The assessment process involves gathering data, analyzing comparable property sales, considering local market trends, and applying valuation methods to determine the property’s worth.

It’s crucial to understand that property assessments are not always 100% accurate or reflective of the actual market value. They are estimations based on available data and professional judgment. However, property assessments play a vital role in ensuring fairness and consistency in property taxation and market transactions.

Now that we have a clear understanding of what property assessment entails, let’s explore the factors that contribute to a property’s assessed value.

Purpose of Property Assessment

The primary purpose of property assessment is to determine the value of a property for various purposes, including taxation, insurance, and real estate transactions. Let’s take a closer look at the specific purposes of property assessments:

- Property Taxation: One of the main purposes of property assessment is to establish the value of a property for tax assessment. The assessed value is used to calculate property taxes that homeowners or property owners are required to pay to local governments and municipalities. By accurately assessing property values, tax authorities can ensure a fair and equitable distribution of the tax burden among property owners.

- Insurance Purposes: Insurance companies use property assessments to determine the replacement cost or the amount of coverage required for a property. Assessments help insurers evaluate the potential risk associated with a property and set appropriate premiums. A thorough assessment takes into account factors such as property size, construction materials, and features that impact the property’s insurability.

- Real Estate Transactions: Property assessments play a crucial role in real estate transactions, particularly during the buying and selling process. Buyers and sellers rely on assessments to determine a fair market value for the property. Assessments provide a starting point for negotiations, ensuring that both parties have a clear understanding of the property’s worth.

- Market Analysis: Property assessments help capture trends and patterns in the real estate market. By analyzing assessments of similar properties in an area, real estate professionals can assess market conditions, identify emerging trends, and make informed investment decisions. Property assessments contribute to market transparency and facilitate the evaluation of supply and demand dynamics.

Furthermore, property assessments help local governments in urban planning and zoning decisions. They provide valuable information about property values, which can be used to determine land use regulations, redevelopment plans, and infrastructure development.

Overall, the purpose of property assessment is to provide an objective and standardized method for evaluating the value of a property. By assessing properties accurately and fairly, property assessments contribute to taxation transparency, insurance coverage adequacy, real estate market analysis, and informed decision-making.

Now that we understand the purpose of property assessments, let’s explore the key factors that influence a property’s assessed value.

Factors Affecting Property Assessment

Property assessment involves a comprehensive evaluation of various factors that contribute to the value of a property. These factors can vary depending on the location, market conditions, and the specific assessment methodology used. Here are ten key factors that commonly influence property assessments:

- Location of the Property: The location of a property is a crucial determinant of its assessed value. Factors such as proximity to amenities, schools, transportation, and desirable neighborhoods can significantly impact the assessment. Properties located in prime areas or sought-after neighborhoods generally command higher assessments.

- Property Size and Configuration: The size and configuration of a property, including the lot size, square footage, and layout, play a significant role in its assessment. Larger properties often have higher assessments, while unique configurations or irregularly shaped lots may have different valuation considerations.

- Age and Condition of the Property: The age and condition of a property directly affect its assessed value. Newer properties or those in excellent condition generally receive higher assessments. Assessors consider factors such as the quality of construction, renovation history, and overall maintenance when evaluating a property’s condition.

- Comparable Sales in the Area: Assessors consider recent comparable sales in the area to determine the value of a property. These sales provide valuable insights into the current market conditions and help establish a benchmark for the assessment. Comparable sales involve properties similar in size, location, condition, and amenities to ensure a fair assessment.

- Market Trends and Economic Conditions: Property assessments are influenced by market trends and economic conditions. Assessors take into account factors such as supply and demand dynamics, interest rates, and overall economic stability when evaluating a property’s value. Fluctuations in the real estate market can impact property assessments in both positive and negative ways.

- Amenities and Features of the Property: Assessors consider the amenities and features of a property when determining its value. Features such as swimming pools, outdoor living spaces, updated kitchens, and other desirable amenities can increase the assessment. Assessors also consider the presence of additional structures like garages, sheds, or guest houses.

- Zoning and Land Use Regulations: Zoning and land use regulations have a significant impact on property assessments. Assessors consider factors such as the allowed land uses, density limitations, and potential for development when assessing a property’s value. Zoning designations and regulations can affect the potential use and value of a property.

- Surrounding Neighborhood: The quality and reputation of the surrounding neighborhood can influence a property’s assessment. Factors such as the presence of well-maintained homes, low crime rates, access to amenities, and the overall desirability of the neighborhood can positively impact property assessments.

- Property Improvements and Upgrades: Assessments take into account any improvements or upgrades made to a property. Renovations that enhance the property’s functionality, aesthetics, or energy efficiency can increase the assessment. Upgrades such as adding a new roof, remodeling the kitchen, or updating the electrical system can positively impact the value.

- Accessibility and Transportation: The accessibility and transportation options available near a property can affect its assessment. Properties with convenient access to highways, public transportation, and amenities tend to have higher assessments. Easy access to schools, shopping centers, and employment opportunities can also have a positive impact on assessment values.

It’s important to note that property assessments are conducted using a combination of these factors, and the weightage assigned to each factor may vary depending on the assessment methodology and local regulations.

By understanding the factors that influence property assessments, homeowners, buyers, and sellers can make informed decisions and take steps to positively impact their property’s assessed value.

Location of the Property

The location of a property is one of the primary factors that influence its assessed value. Whether you’re buying, selling, or assessing a property for taxation purposes, the location plays a crucial role in determining its worth.

The desirability and convenience of the property’s location can significantly impact its assessment. Properties located in prime areas, such as vibrant urban centers, upscale neighborhoods, or waterfront locations, typically command higher assessments. These locations offer proximity to amenities, schools, entertainment options, and other conveniences that make them highly sought-after.

Additionally, the specific neighborhood or district within a location can also affect the assessment. Factors such as low crime rates, well-maintained surroundings, and a strong sense of community can contribute to a higher assessment value. Properties in neighborhoods with a reputation for being safe and appealing tend to receive more favorable assessments.

Another aspect of location that impacts property assessments is proximity to transportation and accessibility. Properties with easy access to highways, public transportation, and major thoroughfares are often valued more than those in secluded or less accessible areas. The availability of convenient transportation options and accessibility to key destinations can positively influence the assessment.

It’s important to note that assessments are not solely based on the location itself, but also on the specific attributes and amenities associated with that location. Factors such as the quality of schools in the area, nearby parks, shopping centers, and recreational facilities can all contribute to a higher assessment value.

For example, a property located in a neighborhood with top-rated schools may receive a higher assessment due to the added value associated with access to quality education. Similarly, a property located near a renowned golf course or a popular shopping district may receive a higher assessment due to the increased desirability and convenience associated with such amenities.

It’s worth mentioning that assessments take into account the local market conditions and the supply and demand dynamics of a particular location. Assessors consider factors such as recent comparable sales in the area to establish a benchmark and ensure a fair assessment based on market trends.

Ultimately, the location of a property is a critical factor in determining its assessed value. The desirability, convenience, and market conditions of the location can significantly impact the assessment. By understanding the importance of location in property assessments, homeowners and buyers can make informed decisions based on the value associated with a particular location.

Read more: What Is A Personal Property Assessment

Property Size and Configuration

The size and configuration of a property are key factors that affect its assessed value. Assessors consider the physical dimensions, lot size, and layout of a property when determining its worth. Let’s explore how property size and configuration impact assessments.

Property Size:

The overall size of a property plays a significant role in its assessment. Larger properties tend to have higher assessments, as they offer more space and potential for various uses. Assessors take into account the total square footage of the property, including the living area, outdoor space, and any additional structures like garages or sheds.

When it comes to residential properties, assessors consider factors such as the number of bedrooms, bathrooms, and the overall floor area. The size of rooms, such as the living room, kitchen, and bedrooms, can also influence the assessment. A larger property typically translates to a higher assessed value due to the increased usable space and potential for various living arrangements.

On the other hand, smaller properties, such as studios or condos, may have lower assessments due to their reduced square footage and limited space. However, the value of smaller properties can still be influenced by other factors such as location, condition, and amenities.

Property Configuration:

The configuration and layout of a property also influence its assessed value. Assessors consider factors such as the arrangement of rooms, the flow of the property, and the functionality of the space. Properties with well-designed layouts that maximize space and offer practicality tend to have higher assessments.

Assessors also consider the overall condition and quality of the property’s configuration. Properties with desirable features like open-concept layouts, ample natural light, well-planned storage solutions, and efficient use of space can receive higher assessments. These features enhance the livability and appeal of the property.

Moreover, the presence of additional structures on the property, such as garages, guest houses, or outdoor living spaces, can positively impact the assessment. These additional features increase the overall utility and value of the property, resulting in a higher assessed value.

It’s important to note that the assessment of property size and configuration is conducted within the context of the local market conditions and the specific property type. Assessors consider the standards and norms for properties in a given area to ensure fair and accurate assessments.

By understanding the importance of property size and configuration in assessments, homeowners and buyers can assess the value associated with different property sizes and layouts. This knowledge can guide decision-making when considering properties of varying sizes and configurations.

Age and Condition of the Property

The age and condition of a property are critical factors that influence its assessed value. Assessors consider these factors to determine the overall quality and potential longevity of a property. Let’s explore how the age and condition of a property impact its assessment.

Age of the Property:

The age of a property is a significant factor in property assessments. Older properties tend to have lower assessments compared to newer ones. This is because age brings with it the potential for wear and tear, outdated features, and the need for maintenance or renovation.

Assessors consider the age of the property to assess the remaining useful life and potential depreciation. They take into account factors such as the materials used in construction, the overall condition of the structure, and the long-term durability of the property. A well-maintained older property may have a higher assessment compared to one that has not been adequately maintained.

Condition of the Property:

The condition of a property is a crucial aspect of its assessment. Assessors evaluate the overall state of the property, including its structural integrity, maintenance history, and any visible signs of damage or deterioration. A well-maintained property in good condition will typically receive a higher assessment than one that requires significant repairs or has visible issues.

Assessors consider various factors when assessing the condition of a property, such as the quality of construction, the presence of any structural issues, the age and condition of major systems like HVAC, plumbing, and electrical, and the general level of upkeep.

Properties that have been recently renovated or updated may receive higher assessments due to the improved condition and increased market appeal. Renovations that enhance the functionality, aesthetics, or energy efficiency of a property generally result in a higher assessed value.

It’s important to note that assessors take into account the expected lifespan of different components of a property when evaluating its condition. For example, the age and condition of the roof, windows, and major systems can significantly impact the overall assessment.

Additionally, assessors also consider the ongoing maintenance and upkeep of a property. Regular maintenance, timely repairs, and proactive care can positively influence the assessment by indicating that the property is well-maintained and less likely to have underlying issues.

Understanding the impact of the age and condition of a property on assessments can help homeowners and buyers make informed decisions. By considering these factors, individuals can assess the value associated with older properties and evaluate the potential costs of maintaining or renovating a property in poor condition.

Comparable Sales in the Area

When assessing the value of a property, one crucial factor that assessors consider is the recent comparable sales in the area. Comparable sales, also known as “comps,” provide valuable insights into the market value of a property by comparing it to similar properties that have recently sold.

Assessors analyze the sales prices of properties that are similar in terms of size, location, condition, and amenities to the property being assessed. This comparison helps establish a benchmark and ensures a fair assessment based on recent market trends.

By looking at comparable sales, assessors can determine how similar properties have been valued and how market forces have influenced their prices. They consider factors such as the sale price per square foot, the time it took for the properties to sell, and any unique features or attributes that influenced the sale price.

The goal of using comparable sales is to gauge the value of the property being assessed within the context of the local real estate market. Assessors look for recent sales that are the most similar to the property in terms of location, size, and condition. These sales serve as evidence of what buyers in the market are willing to pay for properties with similar characteristics.

In some cases, assessors may make adjustments to the comparable sales to account for differences in specific attributes or features. For example, if the assessed property has an additional bedroom compared to the comparable sales, the assessed value may be adjusted to reflect this difference.

It’s important to note that assessors rely on accurate and up-to-date data on comparable sales. This information is typically obtained from public records, real estate databases, and professional networks. The more recent and relevant the comparable sales data, the more accurate the assessment is likely to be.

Comparable sales are especially useful in areas where there is a high turnover of properties and a significant number of recent sales. In such areas, assessors can draw upon a larger pool of data to establish a clearer picture of the market value.

It’s worth mentioning that while comparable sales are an essential factor in property assessments, they are not the sole determinant of a property’s value. Assessors also consider other factors discussed in this article to arrive at a comprehensive and accurate assessment.

By utilizing comparable sales data, assessors work to ensure fair and consistent assessments that reflect the market value of a property. Understanding the role of comparable sales in property assessments can help homeowners and buyers evaluate the value of a property and make informed decisions regarding its sale, purchase, or taxation.

When considering factors that contribute to a property assessment, be sure to take into account the location, size, condition, and any recent renovations or improvements made to the property. These factors can all impact the assessed value.

Market Trends and Economic Conditions

Market trends and economic conditions play a significant role in property assessments. Assessors take into account the overall state of the real estate market and the broader economic factors that impact property values. Understanding these trends and conditions is essential for evaluating a property’s assessed value accurately.

Market Trends:

Assessors track market trends to determine how they may influence property values. They analyze factors such as supply and demand dynamics, price fluctuations, and the overall activity level in the real estate market. Assessors consider whether it’s a buyer’s market, a seller’s market, or a balanced market to gauge the potential impact on property assessments.

In a seller’s market, where the demand for properties outweighs the supply, assessors may see an increase in property assessments due to the high competition among buyers. Conversely, in a buyer’s market with more supply than demand, property assessments may be affected, potentially resulting in lower assessed values.

Market trends also influence the appreciation rates of properties. Assessors consider historical data on property value appreciation in the local market. They may adjust assessments based on these trends to account for future value changes in the assessed property.

Economic Conditions:

Economic conditions, such as interest rates, inflation, and employment rates, can impact property assessments. Assessors consider the overall economic stability and growth in a region to determine the potential impact on property values. A stable economy with low unemployment rates and steady growth can contribute to higher assessments, as it indicates a favorable environment for property investments.

On the other hand, economic downturns or periods of uncertainty can have a dampening effect on property values. Assessors may take into account these economic factors when assessing a property, adjusting the assessed value to reflect the potential risks and uncertainties associated with economic conditions.

Assessors consider local economic indicators, such as job growth, infrastructure development, and industry shifts, to understand the impact on property values in specific areas. For example, a region experiencing a significant influx of new businesses and employment opportunities may see an increase in property assessments due to increased demand and market activity.

It’s important to note that assessors are trained to understand and interpret market trends and economic conditions within the context of property assessments. They analyze data, consult industry reports, and rely on their expertise to ensure that assessments accurately reflect both micro-level property-specific trends and broader market and economic factors.

By considering market trends and economic conditions, assessors strive to make assessments that are reflective of the current real estate environment and the potential impact on property values. Understanding these factors can help homeowners, buyers, and sellers navigate the market and make informed decisions regarding property assessments and transactions.

Read more: What Is Property Assessment Profile

Amenities and Features of the Property

The amenities and features of a property are important factors that influence its assessed value. Assessors take into account the unique attributes and desirable elements that enhance the appeal and functionality of a property. Let’s explore how amenities and features impact property assessments.

Amenities:

Amenities refer to the additional features or facilities that add value and enhance the overall desirability of a property. These could include amenities such as swimming pools, fitness centers, tennis courts, playgrounds, or community spaces. Properties with sought-after amenities often receive higher assessments due to the added convenience, luxury, and quality of life they offer to residents.

Assessors also consider amenities within the property itself, such as high-end finishes, top-of-the-line appliances, or technologically advanced features like home automation systems. These amenities contribute to the overall appeal and can result in a higher assessed value.

Features:

The features of a property refer to its specific characteristics, both interior and exterior. Interior features include layout, room sizes, the presence of additional rooms like a home office or a media room, the quality of construction, and the overall design aesthetics. Well-designed and functional features can positively impact the assessed value.

Exterior features include landscaping, outdoor living spaces, decks, patios, or gardens. The presence of well-maintained landscaping and outdoor areas can increase the assessed value of a property. Outdoor features that add privacy, such as fencing or mature trees, can also positively influence assessments.

In addition to physical amenities and features, assessors also take into consideration energy-efficient or sustainable features of a property. Features such as solar panels, energy-efficient windows, or smart home systems aimed at reducing energy consumption can result in a higher assessed value due to long-term cost savings and environmental benefits.

Assessors weigh the impact of amenities and features based on market demand and buyer preferences. They may also consider the cost associated with maintaining or replicating these amenities and features when assessing a property. Properties with unique or highly desirable amenities and features that are in demand in the local market are typically assigned higher assessed values.

It’s important to note that the value assigned to amenities and features can vary depending on the regional market and buyer preferences. Features that are highly valued in one area may hold less significance in another. Assessors rely on local market knowledge and recent sales data to ensure accurate assessments that reflect the value associated with specific amenities and features.

By understanding the importance of amenities and features in property assessments, homeowners and purchasers can consider the added value and appeal that these elements bring to a property. This knowledge can help inform decisions regarding property improvements and investments in features that may positively impact assessed values.

Zoning and Land Use Regulations

Zoning and land use regulations are significant factors that impact property assessments. Assessors take into account the zoning designations and regulations imposed by local authorities when determining the assessed value of a property. Let’s explore the role of zoning and land use regulations in property assessments.

Zoning Regulations:

Zoning regulations dictate how land can be used within a specific area. Local governments establish zoning ordinances to guide development, control land use, and maintain the desired character of neighborhoods. Zoning designations can include residential, commercial, industrial, agricultural, or mixed-use categories.

Assessors consider the zoning designation assigned to a property when evaluating its assessed value. Properties zoned for higher-density residential or commercial use, for example, may receive higher assessments due to the potential for increased development or commercial activity.

Zoning also determines setback requirements, building height restrictions, and other regulations that can impact the value and use of a property. Assessors evaluate these regulations to determine the property’s potential and limitations, which can affect the assessment accordingly.

Land Use Regulations:

Land use regulations further define how properties can be utilized within specific zones. These regulations may include restrictions or specific guidelines on property density, building design, signage, parking, or environmental considerations. Assessors take into account these land use regulations when assessing a property’s value.

Assessors evaluate the land use regulations to assess how they impact the property’s marketability and the potential for development. For example, a property located in an area with strict environmental regulations that limit development may receive a lower assessment due to the restricted opportunities for land use.

Assessors also consider any non-conforming use or variance granted to a property, which allows it to deviate from zoning requirements. Non-conforming uses or variances can impact assessments, as they may provide additional flexibility or potentially limit the property’s value.

Understanding the zoning and land use regulations is crucial for property owners, buyers, and sellers. Compliance with zoning regulations ensures that the property is used in a manner that aligns with local requirements and can help maintain property values in the area.

It’s important to note that assessors rely on local zoning and land use regulations established by the municipality or local government. These regulations may be subject to updates or changes over time. Assessors stay informed about any changes in regulations to ensure accurate and up-to-date assessments.

By considering zoning and land use regulations, assessors strive to evaluate properties accurately based on their permitted uses, potential for development, and compliance with local regulations. Understanding the impact of these regulations can assist property owners and buyers in assessing the value associated with a property’s zoning and land use designations.

Surrounding Neighborhood

The surrounding neighborhood is an important factor that affects the assessed value of a property. Assessors consider the quality, desirability, and overall character of the neighborhood when evaluating a property’s worth. Let’s explore the role of the surrounding neighborhood in property assessments.

Quality of the Neighborhood:

The quality of the surrounding neighborhood contributes to the assessed value of a property. Assessors take into account factors such as the overall cleanliness, safety, and maintenance of the neighborhood. Well-kept neighborhoods with clean streets, manicured lawns, and minimal signs of neglect or disrepair generally lead to higher assessments.

Assessors also consider the presence of community amenities, such as parks, recreational facilities, playgrounds, and green spaces. These amenities contribute to the quality of life and desirability of the neighborhood, positively influencing property assessments.

Furthermore, assessors take into account the presence of community services and infrastructure in the neighborhood. These can include schools, libraries, hospitals, shopping centers, and transportation options. Easy access to such services and amenities increases the appeal and value of a property.

Desirability of the Neighborhood:

The overall desirability of the neighborhood significantly impacts property assessments. Factors such as low crime rates, good schools, and proximity to employment centers or major attractions contribute to a higher assessed value. Neighborhoods with a strong sense of community and a positive reputation tend to receive more favorable assessments.

Assessors consider the demand for properties within the neighborhood. If a neighborhood is known for its high demand and limited availability, property assessments are likely to be higher. The desirability and scarcity factor of the neighborhood can result in increased competition among buyers, driving up property values.

Character of the Neighborhood:

The character of the neighborhood refers to the unique qualities, architectural styles, and historical significance of the area. Assessors evaluate whether the property fits harmoniously within the neighborhood. Properties that are consistent with the character of the neighborhood and maintain its overall aesthetic appeal tend to receive higher assessments.

Assessors also consider any ongoing neighborhood improvement initiatives or revitalization efforts. These initiatives can positively impact property assessments by enhancing the overall appeal and value of the neighborhood over time.

It’s important to note that the surrounding neighborhood is evaluated within the context of the local market. What may be highly desirable in one area may hold less significance in another. Assessors rely on their local market knowledge and recent sales data to ensure that assessments accurately reflect the value associated with the surrounding neighborhood.

By considering the quality, desirability, and character of the surrounding neighborhood, assessors strive to make fair and accurate property assessments. Understanding the role of the neighborhood in property assessments can help homeowners and buyers evaluate the value associated with a particular neighborhood and make informed decisions regarding property purchases or improvements.

Property Improvements and Upgrades

Property improvements and upgrades are factors that significantly impact property assessments. Assessors take into account any enhancements or modifications made to a property that contribute to its overall value. Let’s explore how property improvements and upgrades affect property assessments.

Renovations and Upgrades:

Assessors consider renovations and upgrades made to a property when determining its assessed value. These can include major renovations, such as kitchen or bathroom remodels, adding square footage, or improving the overall quality of the property. Assessors evaluate the scope and quality of these renovations to determine their impact on the property’s value.

Renovations that enhance functionality, aesthetics, energy efficiency, or overall livability can result in a higher assessed value. Upgrades such as modernizing electrical systems, replacing outdated plumbing, or installing energy-efficient features are typically viewed positively by assessors. These upgrades contribute to the property’s desirability and can result in a higher assessed value.

It’s important to note that assessors consider the cost and return on investment of the improvements and upgrades. They assess whether the improvements align with market trends and whether the investment adds commensurate value to the property. Assessors may also consider the condition and quality of the pre-existing features and compare them to the improvements made.

Maintenance and Repairs:

In addition to major renovations and upgrades, assessors also consider the overall maintenance and condition of the property. A well-maintained property with minimal deferred maintenance typically receives a higher assessed value. Regular upkeep, timely repairs, and addressing maintenance issues are indicative of a property that has been cared for and is more likely to retain its value.

Deferred maintenance or significant repair needs can negatively influence property assessments. Assessors may adjust the assessed value to account for any necessary repairs or condition issues, which can result in a lower assessed value. It’s essential for property owners to address any maintenance or repair needs to maintain or improve their property assessments.

Timing of Improvements:

Timing is an important consideration when it comes to property improvements and assessments. Assessors take into account when the improvements were made and how they align with current market trends. Improvements made shortly before the assessment may have a more significant impact on the assessed value compared to improvements made several years prior.

Additionally, assessors consider how improvements contribute to the property’s overall marketability. Assessments may be influenced by the presence of desirable or sought-after features, such as a new roof, updated kitchen or bathroom, or modern flooring. These improvements can attract potential buyers and contribute to a higher assessed value.

It’s important for property owners to maintain records of any improvements and upgrades made, including permits, receipts, and documentation. Providing this information to assessors can help ensure accurate and appropriate assessments.

By considering property improvements and upgrades, assessors strive to make assessments that reflect the added value contributed by these enhancements. Understanding the impact of improvements and upgrades on property assessments can help homeowners make informed decisions regarding renovations and improvements that may positively impact the assessed value of their property.

Read more: What Are Property Assessment Caps

Accessibility and Transportation

Accessibility and transportation options are key factors that influence property assessments. Assessors take into account the ease of access to transportation networks and the availability of various transportation options when evaluating the value of a property. Let’s explore how accessibility and transportation impact property assessments.

Proximity to Transportation:

The proximity of a property to transportation infrastructure, such as highways, freeways, and arterial roads, can positively impact its assessed value. Easy access to these transportation networks enhances the property’s appeal and convenience, leading to higher assessments. Properties located near major transportation corridors often provide faster commuting times and increased connectivity, which can contribute to their desirability among buyers.

In addition to highways and freeways, assessors also consider the accessibility to public transportation options, such as bus stops, train stations, or subway lines. Properties located within walking distance of these public transportation options generally receive higher assessments due to the added convenience and connectivity they offer.

Infrastructure Improvements:

Assessors also take into account planned or existing infrastructure improvements in the vicinity of a property. These could include new road constructions, expansion of transportation networks, or the development of new transportation hubs. The presence or potential for these infrastructure improvements can positively impact property assessments, as they enhance access and improve transportation options in the area.

Walkability and Bikeability:

Assessors consider the walkability and bikeability of a neighborhood as part of the assessment. Walkable neighborhoods with sidewalks, pedestrian-friendly streets, and amenities within walking distance contribute to higher assessments. The presence of bike lanes, bike-sharing programs, or designated bicycle routes can also positively impact property values.

Accessibility to Amenities:

The accessibility of a property to amenities such as schools, grocery stores, shopping centers, restaurants, and recreational facilities is also considered. Properties located within close proximity to these amenities tend to receive higher assessments. The convenience and ease of access to everyday essentials and recreational activities enhance the overall value of the property.

Assessors also evaluate the neighborhood’s overall connectivity and access to employment hubs. Properties located near major job centers or areas with a high concentration of employers may receive higher assessments due to their potential for shorter commutes and increased employment opportunities.

It’s important to note that assessors not only consider the physical proximity of the property to transportation options but also the overall impact on the property’s value. Factors such as noise pollution, visual impact, and privacy considerations may be taken into account as well.

By taking into account accessibility and transportation options, assessors ensure that property assessments reflect the added value associated with convenient access to various modes of transportation and nearby amenities. Understanding the importance of accessibility and transportation in property assessments can help homeowners and buyers evaluate the benefits and convenience associated with a property’s location.

Conclusion

Property assessment is a comprehensive process that takes into account various factors to determine the value of a property. By understanding these factors, homeowners, buyers, and sellers can make informed decisions to enhance property assessments and improve marketability.

We explored ten key factors that contribute to property assessments:

- Location of the Property: The location plays a crucial role in assessing a property’s value, considering proximity to amenities, transportation, and desirability of the neighborhood.

- Property Size and Configuration: The size and layout of a property influence its assessed value, with larger properties often receiving higher assessments.

- Age and Condition of the Property: Assessors consider the age and condition of a property, with newer and well-maintained properties generally receiving higher assessments.

- Comparable Sales in the Area: Assessors analyze recent comparable sales to establish the market value and gauge the assessed value of a property.

- Market Trends and Economic Conditions: Property assessments are influenced by market trends and economic factors, such as supply and demand, interest rates, and overall economic stability.

- Amenities and Features of the Property: Desirable amenities and features contribute to higher assessments, emphasizing the appeal and functionality of a property.

- Zoning and Land Use Regulations: Zoning designations and land use regulations impact assessments by determining property use, density limitations, and development potential.

- Surrounding Neighborhood: The quality, desirability, and character of the surrounding neighborhood influence property assessments.

- Property Improvements and Upgrades: Renovations, upgrades, and overall property condition play a crucial role in assessments, with well-maintained and improved properties often receiving higher values.

- Accessibility and Transportation: The ease of access to transportation networks, proximity to amenities, and overall connectivity affect property assessments.

By considering these factors, assessors strive to provide accurate and fair assessments that reflect the value associated with a property. It’s important to note that property assessments may vary based on local market conditions, regulations, and assessment methodologies.

Homeowners and buyers can benefit from understanding the factors that affect property assessments. This knowledge can help in making informed decisions, whether it’s regarding property improvements, evaluating purchase opportunities, or understanding the impact of assessments on property taxes and insurance premiums.

Remember, property assessments are not static and may be subject to change over time. Regular assessments are conducted to account for market fluctuations, changes to property condition, and other factors that impact the value of a property. By staying informed and proactive, property owners can actively manage and improve their assessed value.

Ultimately, property assessments play a vital role in ensuring fairness, transparency, and an accurate reflection of a property’s value. By understanding the factors influencing property assessments, individuals can navigate the real estate market with greater confidence and make informed decisions regarding their properties.

Frequently Asked Questions about What Factors Contribute To A Property Assessment

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “What Factors Contribute To A Property Assessment”