Home>Home Maintenance>Who Can Help Protest My Property Assessment

Home Maintenance

Who Can Help Protest My Property Assessment

Modified: March 6, 2024

Looking for assistance with protesting your property assessment? Find experts in home maintenance who can help you navigate the process and potentially lower your taxes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to our comprehensive guide on protesting your property assessment. If you’re a homeowner, you may have found yourself in a situation where you believe that the assessed value of your property is incorrect or unfairly high. Challenging your property assessment can be a complex and time-consuming process, but it’s important to understand your options and take action if you believe that your assessment is inaccurate.

In this article, we’ll provide you with valuable insights and step-by-step guidance to help you understand property assessments and navigate the process of protesting your assessment effectively. Whether you’re a first-time homeowner or have been living in your property for many years, knowing how to challenge your assessment can potentially save you money on your property taxes.

First, let’s start by understanding what property assessments are and how they impact you as a homeowner.

Key Takeaways:

- Challenging your property assessment can save you money on property taxes if you believe it’s inaccurate or unfairly high. Follow the steps, gather evidence, and consider professional help for a successful protest.

- Hiring a property assessment consultant, consulting with real estate agents, or seeking legal assistance can provide valuable expertise and support in disputing your property assessment. Utilize online resources for additional guidance.

Read more: How Can I Appeal A Property Assessment

Understanding Property Assessments

Property assessments are evaluations conducted by local governments to determine the value of real estate properties for taxation purposes. Assessments are typically performed on an annual or biennial basis and are used to determine the amount of property taxes that homeowners are required to pay.

The assessed value of a property is an estimate of its fair market value, which is the price that the property would likely sell for on the open market. Assessments take into account various factors, including the size and location of the property, its features and amenities, recent sales of similar properties in the area, and market trends.

It’s important to note that property assessments are not always 100% accurate. Local governments use various methods and formulas to calculate assessments, but these processes are not foolproof and sometimes result in assessments that do not accurately reflect the true value of a property.

Property assessments play a crucial role in determining property taxes. Higher assessments often translate to higher property tax bills, while lower assessments can lead to savings on taxes. Therefore, it’s essential for homeowners to review their assessments regularly and take action if they believe that their property is over-assessed.

Now that you have a basic understanding of property assessments, let’s explore some common reasons why homeowners may choose to protest their assessments.

Reasons for Protesting Your Property Assessment

Protesting your property assessment can be a strategic move to potentially save money on your property taxes. Here are some common reasons why homeowners choose to challenge their assessments:

- Overvaluation: One of the primary reasons for protesting an assessment is if you believe that your property has been overvalued. This may occur if the assessed value is higher than the actual market value of your property. An inflated assessment can result in higher property tax obligations than necessary.

- Comparable Properties: It’s essential to compare your property assessment to that of similar properties in your area. If you discover that your assessment is significantly higher than comparable properties, it may be worth challenging the assessment. This can be particularly relevant if the assessments of comparable properties have decreased in recent years while yours has remained high.

- Property Damage: If your property has suffered damage or experienced a decline in value due to factors beyond your control, such as natural disasters, structural issues, or changes in the surrounding area, it may be appropriate to protest your assessment. Evidence of property damage can support your argument for a lower assessment.

- Improper Assessing Methods: Assessments are supposed to be conducted using standardized methods and formulas. If you suspect that the assessing authority has not followed proper procedures or used inaccurate data, you may have grounds for a protest. Examples of improper assessing methods include using outdated information, miscalculating square footage, or relying on flawed appraisal techniques.

- Exemptions or Special Circumstances: Certain exemptions or special circumstances may apply to your property, reducing its assessed value. For instance, if you use your property for agricultural purposes, there may be specific tax incentives or exemptions that can lower your assessment. It’s crucial to understand any applicable exemptions or special circumstances and ensure that they are taken into account in your assessment.

These are just a few examples of why homeowners might choose to protest their property assessments. It’s important to carefully review your assessment and consider any factors that may indicate an inaccurate or unfair valuation. Now that you understand some of the reasons for protesting, let’s move on to the steps involved in challenging your property assessment.

Steps to Protesting Your Property Assessment

Protesting your property assessment involves a series of steps that require careful preparation and attention to detail. Here is a step-by-step guide to help you navigate the process:

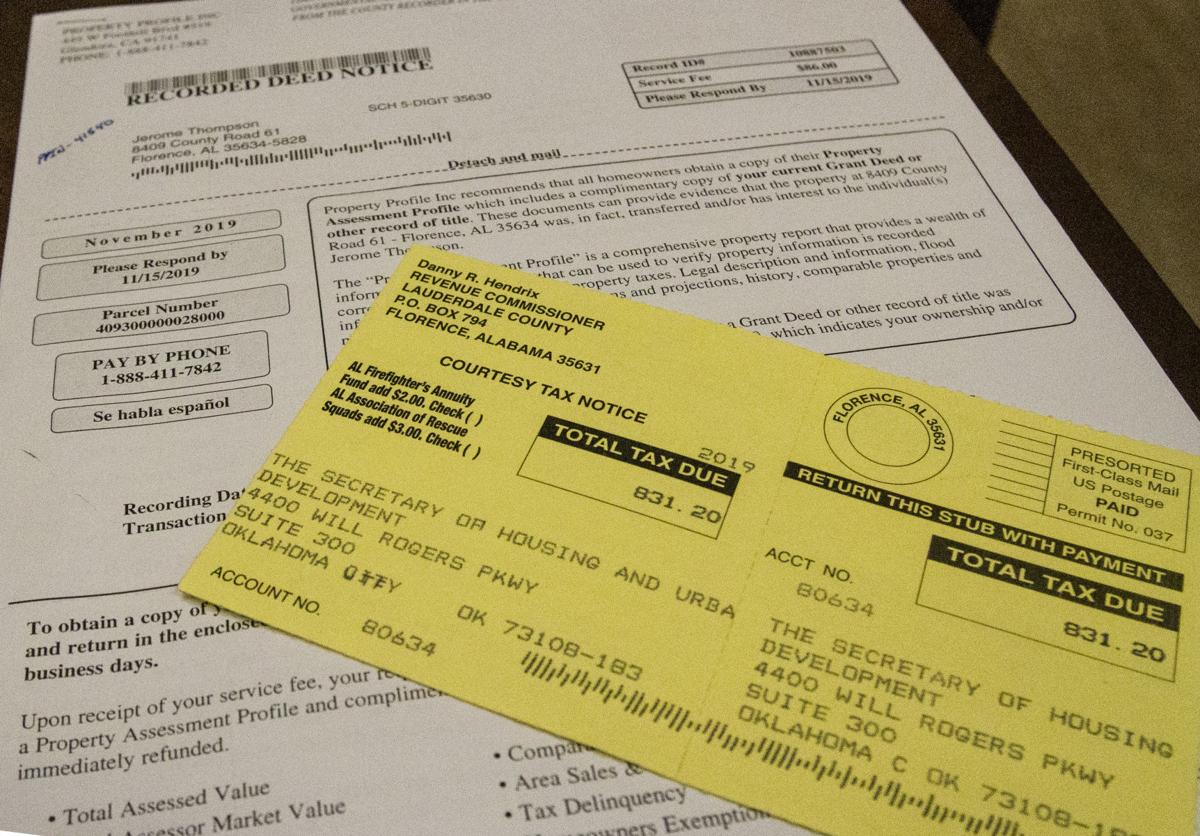

- Review your assessment: Start by reviewing your property assessment notice thoroughly. Ensure that all the details, including property size, features, and any relevant exemptions or special circumstances, are accurate. Take note of the assessed value and compare it to similar properties in your area.

- Gather evidence: Collect evidence to support your claim that your property assessment is inaccurate or unfair. This may include recent appraisals, property inspection reports, photographs, or sales information of comparable properties. The more evidence you have, the stronger your case will be.

- Contact the assessor’s office: Reach out to your local assessor’s office for guidance on the protest process. They can provide you with the necessary forms, deadlines, and instructions for submitting your protest. Ask any questions you may have to ensure that you have a clear understanding of the requirements.

- Complete and submit the protest form: Fill out the protest form provided by the assessor’s office, making sure to include all the required information and supporting documentation. Be concise, clear, and organized in presenting your case. Keep copies of all documents for your records.

- Attend the hearing: In many cases, a hearing will be scheduled to discuss your protest. This is an opportunity for you to present your case in person and provide additional evidence to support your claim. Be prepared to answer questions and provide any requested information.

- Negotiate or appeal: Depending on the outcome of the hearing, you may have the opportunity to negotiate a revised assessment with the assessor’s office. If you are still not satisfied with the results, you can consider appealing the decision to a higher authority, such as a local board of assessors or a property tax appeals board.

- Consider professional help: If navigating the protest process seems overwhelming or if you feel unsure about presenting your case effectively, you may want to consider hiring a property assessment consultant or seeking legal assistance. These professionals have expertise in property assessments and can provide valuable guidance and support throughout the process.

Remember, each jurisdiction may have specific rules and procedures for protesting property assessments. It’s crucial to follow the guidelines provided by your local assessor’s office and adhere to all deadlines and requirements. Now that you have an understanding of the steps involved, let’s explore some options for seeking assistance with your property assessment protest.

Hiring a Property Assessment Consultant

When it comes to protesting your property assessment, hiring a property assessment consultant can be a valuable investment. These professionals specialize in property valuations and have in-depth knowledge of the assessment process. Here’s how a property assessment consultant can assist you:

- Expertise and experience: Property assessment consultants have a deep understanding of property valuations and the factors that can affect assessments. They stay up to date with market trends, comparable property sales, and assessing methods employed by local governments. With their expertise and experience, they can provide insights and strategies to help you build a strong case for a lower assessment.

- Data analysis and research: Property assessment consultants have access to a wide range of data and resources to conduct comprehensive research on your property and the surrounding area. They can analyze market data, recent property sales, and evaluate the accuracy of the assessment. Using this information, they can identify potential discrepancies and gather evidence to support your case.

- Preparation and documentation: A property assessment consultant will guide you through the process of preparing and organizing the necessary documentation for your protest. They can help you gather the relevant evidence, complete the forms correctly, and ensure that all required information is included. Their attention to detail can significantly increase your chances of success.

- Negotiation and representation: During the hearing or negotiation stage, a property assessment consultant can represent you and advocate for your interests. They understand the nuances of the negotiation process and can present your case effectively to the assessor’s office. Their negotiation skills and knowledge of property assessments can lead to more favorable outcomes.

- Save time and reduce stress: Challenging a property assessment can be time-consuming and complex. By hiring a property assessment consultant, you can offload the tasks and responsibilities associated with the protest process. This frees up your time and allows you to focus on other priorities while having confidence that a professional is handling your case.

Keep in mind that hiring a property assessment consultant comes with a cost. Fees may vary depending on the complexity of your case and the consultant’s level of expertise. However, the potential savings on property taxes resulting from a successful assessment protest can outweigh the initial investment.

Before hiring a property assessment consultant, research and evaluate potential candidates. Look for consultants with a solid track record, positive reviews, and relevant experience in your local area. Schedule consultations to discuss your case and ask about their approach, success rate, and fees. This will help you make an informed decision and select the right consultant for your specific needs.

In addition to consulting with a property assessment consultant, consider exploring other sources of assistance, such as real estate agents and legal professionals. We’ll cover these options in more detail next.

Consider reaching out to a real estate agent, property appraiser, or tax assessor for guidance on protesting your property assessment. They can provide valuable insight and assistance in navigating the process.

Read more: What Is Property Assessment

Consulting with Real Estate Agents

When it comes to protesting your property assessment, consulting with real estate agents can provide you with valuable insights and guidance. Real estate agents have in-depth knowledge of the local housing market and can offer their expertise in assessing property values. Here’s how a real estate agent can assist you:

- Market knowledge: Real estate agents have a deep understanding of the local housing market and can provide you with information about recent property sales, market trends, and property values in your area. They can help you compare your property assessment to similar properties that have recently sold, providing you with a clear picture of whether your assessment is accurate or inflated.

- Property evaluation: Real estate agents are skilled in evaluating properties and determining their market value. They can conduct a thorough assessment of your property, taking into account its unique features, condition, location, and recent sales of comparable properties. This evaluation can be a valuable resource when preparing your case for protesting the assessment.

- Guidance on protest process: Real estate agents are familiar with the process of protesting property assessments in your area. They can provide you with guidance on the steps involved, the necessary documentation, and the timeline to follow. They may also advise you on the likelihood of success based on their experience and knowledge of local assessors and appeal boards.

- Negotiation skills: If a hearing or negotiation is required during the protest process, real estate agents can leverage their negotiation skills to advocate for a lower assessment on your behalf. They can present your case effectively, highlighting the relevant market data and supporting evidence. Their expertise in property valuations can help you achieve a more favorable outcome.

- Access to resources: Real estate agents often have access to a wide range of resources and tools that can support your assessment protest. They may have access to comprehensive property databases, market analysis reports, and other industry-specific resources that can strengthen your case and provide additional evidence for a lower assessment.

When consulting with real estate agents, choose those who are knowledgeable about the local market and have experience in property assessments. Look for agents who have a track record of successfully assisting homeowners with protesting their assessments. Schedule appointments to discuss your situation and ask about their understanding of the assessment process and their approach to helping you challenge your assessment.

Keep in mind that real estate agents may charge for their services. Discuss their fees upfront so that you have a clear understanding of the costs involved. Remember that the potential savings on property taxes resulting from a successful assessment protest can outweigh the consulting fees.

In addition to consulting with real estate agents and property assessment consultants, you may also consider seeking legal assistance to help you navigate the assessment protest process. We’ll explore this option next.

Seeking Legal Assistance

When challenging your property assessment, seeking legal assistance can be a viable option to ensure that your rights as a homeowner are protected. Lawyers specializing in property tax law can provide you with the necessary legal expertise and guidance throughout the assessment protest process. Here’s how they can assist you:

- Legal knowledge and expertise: Property tax lawyers have a deep understanding of property tax laws, regulations, and the assessment process. They can analyze the specific laws applicable to your jurisdiction and provide you with advice tailored to your situation. Their legal knowledge and expertise can help you build a solid case for a lower assessment.

- Evaluation of legal options: A property tax lawyer can review the specifics of your case and evaluate the legal options available to you. They can assess the strength of your case, identify any legal arguments that can support your protest, and advise you on the best course of action to take. Their expertise in property tax law can help you navigate the complex legal landscape.

- Preparation of legal documents: Challenging a property assessment may require the preparation and filing of various legal documents. Property tax lawyers can assist you in preparing and submitting these documents correctly and on time. They can ensure that all necessary information is included and that your case is presented in the best possible manner.

- Representation in hearings or appeals: If a hearing or appeals process is required during the assessment protest, a property tax lawyer can represent you and advocate for your interests. They can present your case effectively, cross-examine witnesses, and argue on your behalf. Their legal experience and knowledge of property tax laws can significantly increase your chances of success.

- Negotiation and settlement: In some cases, negotiations with the assessor’s office or other parties may be necessary to reach a resolution. A property tax lawyer can use their negotiation skills to secure a fair and favorable outcome. They can liaise with the relevant authorities and work towards an agreement that reduces your property assessment and saves you money on property taxes.

When seeking legal assistance, look for property tax lawyers who specialize in property tax law and have experience in assessment protests. Research their backgrounds, read reviews or recommendations, and schedule consultations to discuss your case. During these consultations, ask about their success rate, fees, and approach to handling property assessment protests.

It’s important to consider that legal representation may come with higher costs compared to other options. However, the expertise and guidance provided by a property tax lawyer can be invaluable, especially if your case is complex or if you’re facing significant financial implications due to an inaccurate assessment.

Now that you’re aware of the various options for disputing your property assessment, let’s explore additional resources and tools that can assist you in your assessment protest process.

Using Online Resources and Tools

When protesting your property assessment, utilizing online resources and tools can provide you with valuable information and assistance throughout the process. Here are some online resources and tools that can help you in disputing your property assessment:

- Government websites: Many local government websites offer information and resources related to property assessments and the protest process. These websites often provide access to assessment records, guidelines for filing a protest, and contact information for the assessor’s office. Be sure to explore the official government website for your jurisdiction to gather relevant information.

- Property assessment databases: Some jurisdictions provide online databases where you can search for property assessments and compare them to similar properties. These databases can be valuable in determining the accuracy and fairness of your assessment. You can use the information obtained to support your case during the protest process.

- Online valuation tools: Online valuation tools, such as real estate websites or home valuation platforms, can provide you with estimates of property values based on comparable sales and market data. While these tools are not an official assessment, they can serve as a reference point for assessing the fairness of your property’s valuation.

- Protest guides and FAQs: Many websites, including government portals and property tax-related websites, offer guides and frequently asked questions (FAQs) specifically tailored to assist homeowners in protesting their property assessments. These resources can provide helpful tips, step-by-step instructions, and answers to common questions about the protest process.

- Online forums and communities: Engaging with online forums or communities focused on real estate, property assessments, or tax matters can provide you with valuable insights and support from other homeowners who have gone through the assessment protest process. These forums can be a source of information, advice, and encouragement as you navigate the challenges of disputing your assessment.

While online resources and tools can offer valuable information and assistance, it’s important to be cautious and rely on verified and reputable sources. Verify the credibility of the websites or tools you use, ensure they are from reliable sources, and cross-reference the information obtained with official government resources whenever possible.

Additionally, keep in mind that online resources and tools should be used as supplements to your own research and professional advice. They can provide you with a better understanding of the assessment process and assist you in gathering relevant information, but they should not be used as a substitute for consulting with property assessment consultants, real estate agents, or legal professionals.

Now that you’re equipped with a variety of options to help you in protesting your property assessment, take the necessary steps to gather information, evaluate your assessment, and determine the best course of action to challenge an inaccurate or unfair valuation.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal or professional advice. Consult with a qualified professional for specific guidance related to your assessment protest.

Conclusion

Protesting your property assessment can be a worthwhile endeavor if you believe that your assessment is inaccurate or unfairly high. By taking action and following the proper steps, you can potentially save money on your property taxes and ensure that your assessment reflects the true value of your property.

In this comprehensive guide, we’ve covered the key aspects of protesting your property assessment. We discussed understanding property assessments and the reasons why homeowners choose to challenge their assessments. We also outlined the steps involved in the protest process, including reviewing your assessment, gathering evidence, submitting the protest form, attending hearings, and considering negotiation or appeals.

We explored the benefits of hiring a property assessment consultant who can provide expertise, conduct research, assist with documentation, and represent you during the protest. Consulting with real estate agents can also offer valuable insights into local market trends and property evaluations. Seeking legal assistance from property tax lawyers can provide you with the necessary legal expertise and representation as you navigate the protest process.

We also highlighted the importance of utilizing online resources and tools, such as government websites, property assessment databases, online valuation tools, protest guides, and online forums. These resources can provide you with information, support, and assistance in gathering relevant data to support your case.

As you embark on your assessment protest journey, remember to carefully review your assessment, gather strong evidence, and follow the specific procedures outlined by your local assessor’s office. Consider the various options available to you, such as hiring a property assessment consultant, consulting with real estate agents, seeking legal assistance, and utilizing online resources.

Keep in mind that every jurisdiction may have different rules and timelines for protesting assessments. It’s important to stay informed and be proactive in taking action within the allotted time frame.

Protesting your property assessment is about advocating for a fair and accurate valuation of your property. By challenging an inflated or erroneous assessment, you can potentially save money on your property taxes and ensure that you’re paying a fair amount based on the true value of your property.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal or professional advice. Consult with a qualified professional for specific guidance related to your assessment protest.

Frequently Asked Questions about Who Can Help Protest My Property Assessment

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “Who Can Help Protest My Property Assessment”