Home>Home Maintenance>How Can I Appeal A Property Assessment

Home Maintenance

How Can I Appeal A Property Assessment

Modified: March 6, 2024

Learn how to appeal a property assessment and reduce your tax burden. Discover the importance of home maintenance in maximizing your chances of a successful appeal.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to our guide on how to appeal a property assessment. If you own a home or property, you are likely familiar with property assessments. These assessments are conducted by local tax authorities to determine the value of your property for tax purposes. While property assessments are meant to be fair and accurate, there are times when homeowners may believe that their assessments are incorrect or unfair. In such cases, it is important to know your rights and take the necessary steps to appeal the assessment.

Appealing a property assessment can seem like a daunting task, but with the right guidance and knowledge, you can navigate through the process successfully. In this article, we will provide you with valuable insights on how to understand property assessments, reasons for appealing, gathering supporting documentation, filing an appeal, the appeals process, presenting your case, and the outcome of the decision.

It’s important to remember that property assessments play a crucial role in determining the amount of property taxes you owe. If you believe that your assessment is inaccurate, appealing it can potentially lower your tax liability. Let’s dive deeper into the world of property assessments and learn how to effectively appeal them.

Key Takeaways:

- Appeal your property assessment if you believe it’s inaccurate or unfair. Gather strong evidence, file an appeal, and present your case professionally to potentially lower your property tax burden.

- Understanding property assessments and the appeals process can help you navigate the system effectively. Stay organized, be prepared, and present a persuasive case to achieve a fair outcome.

Understanding Property Assessments

Before diving into the appeals process, it is crucial to have a solid understanding of property assessments. A property assessment is an evaluation of the value of your property performed by local tax authorities. This assessment serves as the basis for determining property taxes. Assessments are typically conducted on an annual or biennial basis, depending on local regulations.

Assessments consider various factors such as the size of the property, its location, recent sales of comparable properties, and any improvements or renovations made to the property. The goal of these assessments is to determine the fair market value of the property, which is the price it would likely sell for on the open market.

It’s important to note that property assessments are not always accurate. Factors such as market fluctuations, errors in data, and changes in property conditions can lead to inaccuracies in assessments. This is why it is essential for homeowners to review their assessments to ensure they are fair and reflect the true value of their property.

Property assessments also play a role in determining property tax rates. Local governments use these assessments to calculate the amount of property taxes homeowners need to pay. Generally, the higher the assessed value of a property, the higher the property taxes. Therefore, it is in the best interest of homeowners to ensure that their property assessments are as accurate as possible.

Knowing how property assessments work and what factors are considered can help you better understand the basis for the assessment of your property. It can also help you identify any discrepancies or errors that may exist in your assessment, giving you a solid foundation for appealing the assessment if necessary.

Reasons for Appealing a Property Assessment

There are several reasons why you may want to appeal a property assessment. It is important to note that you cannot appeal simply because you think your property taxes are too high. Appeals must be based on valid reasons that demonstrate an error or unfairness in the assessment process. Here are some common reasons for appealing a property assessment:

- Inaccurate Assessment: One of the most common reasons for appealing is if you believe that your property has been assessed at a value that is higher than its actual worth. This could be due to incorrect information about your property or flaws in the assessment methodology.

- Mistaken Property Identification: It is not uncommon for tax authorities to mistakenly assess your property as a different type or size than it actually is. This can lead to an incorrect assessment and result in higher property taxes.

- Comparative Sales: If you can provide evidence that comparable properties in your area are being assessed at a lower value than yours, it may be a valid reason for appealing your assessment. This can indicate an unfair assessment of your property.

- Property Damage or Devaluation: If your property has suffered damage or experienced a significant decrease in value due to factors beyond your control, such as natural disasters or local economic changes, you may have grounds for an appeal.

- Inequitable Assessments: In some cases, properties in the same neighborhood or area may be assessed at significantly different values, despite having similar characteristics. This can be seen as an unfair assessment and a reason to appeal.

Before proceeding with an appeal, it is important to gather supporting documentation and evidence to strengthen your case. This can include recent property appraisals, photographs of property damage, sales data of comparable properties, and any other relevant information that proves your assessment is inaccurate or unjust.

Understanding the valid reasons for appealing a property assessment can help you determine if you have a strong case. If you believe that your assessment is incorrect or unfair, it is worth exploring the appeals process to potentially reduce your property tax burden.

Gathering Supporting Documentation

When it comes to appealing a property assessment, having strong supporting documentation is crucial. This documentation will serve as evidence to support your claim and strengthen your case. Here are some key pieces of documentation to gather:

- Recent Property Appraisal: Obtaining a recent appraisal from a qualified professional can provide an independent assessment of your property’s value. This appraisal can serve as a credible piece of evidence to challenge the accuracy of the tax authority’s assessment.

- Photographic Evidence: If your property has suffered damage or has notable factors that affect its value, such as structural issues or outdated fixtures, capturing photographic evidence can be powerful support for your appeal. Visual documentation can help demonstrate the discrepancies between the tax authority’s assessment and the actual condition of your property.

- Comparable Sales Data: Researching and gathering data on recent sales of similar properties in your area can help establish a benchmark for your property’s value. If you can demonstrate that comparable properties are being assessed at a lower value than yours, it can strengthen your argument for an incorrect assessment.

- Property Improvement Records: If you have made significant improvements or renovations to your property, gather records of these upgrades. Providing documentation of the investment you have made in enhancing your property can demonstrate its higher value and support a lower assessed value.

- Tax Assessment Records: Reviewing your tax assessment records from previous years can help identify any inconsistencies or errors in the assessment process. If you notice a pattern of inaccurate assessments, it can be valuable evidence to support your appeal.

It is important to be organized and thorough when gathering your supporting documentation. Keep copies of all relevant documents and make sure they are easily accessible when it’s time to present your case. Having a comprehensive record of evidence can significantly improve your chances of a successful appeal.

Remember, the quality and relevance of your supporting documentation can have a significant impact on the outcome of your appeal. By taking the time to gather strong evidence, you can build a persuasive case to challenge the accuracy or fairness of your property assessment.

Filing an Appeal

Filing an appeal for your property assessment is the next step once you have gathered all the necessary supporting documentation. Keep in mind that the specific process and requirements may vary depending on your location. However, the following general guidelines can help you navigate the appeals process:

- Review the Assessment Notice: Start by carefully reviewing the assessment notice you received from the tax authority. This notice typically includes information on how to file an appeal, important deadlines, and any specific forms or documentation required.

- Understand the Deadline: Pay close attention to the deadline for filing an appeal. Missing this deadline could result in your appeal being dismissed. Make sure you understand how and when to file your appeal to avoid any complications.

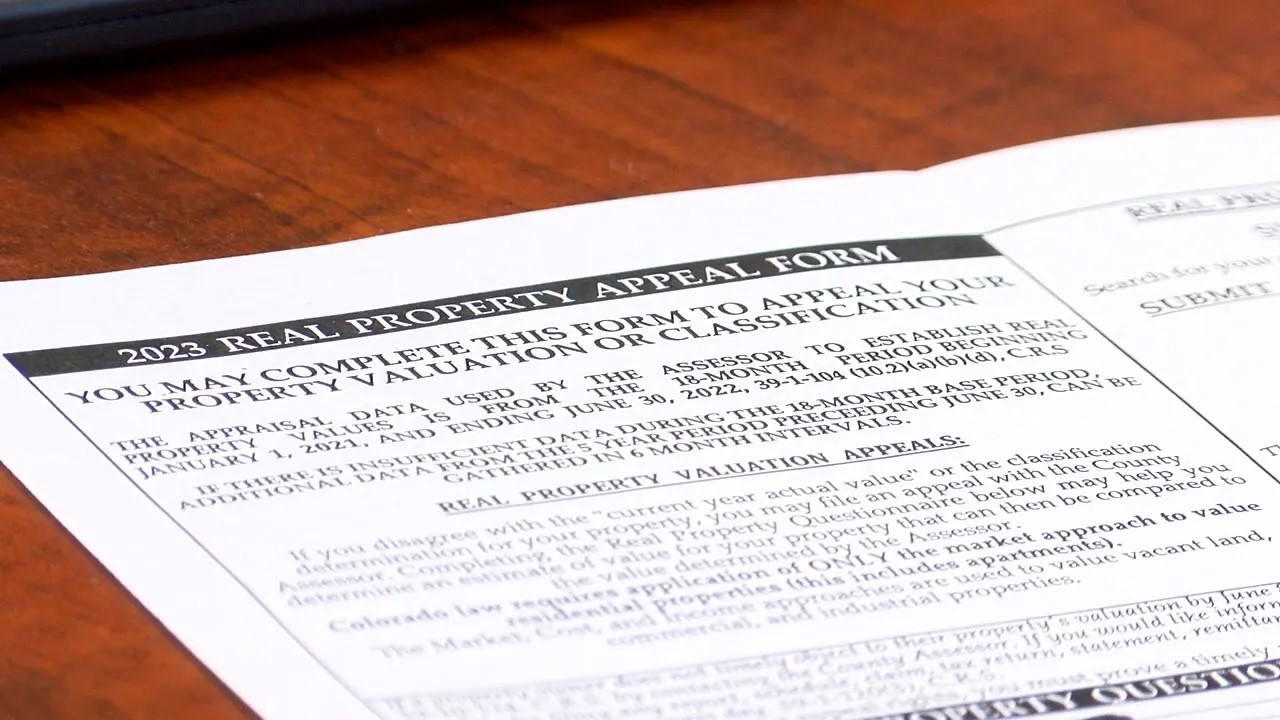

- Complete the Appeal Form: Most jurisdictions require you to complete an appeal form provided by the tax authority. This form will ask for your contact information, details about your property, reasons for the appeal, and any supporting documentation you have. Fill out the form accurately and thoroughly, providing all the necessary information to support your case.

- Submit the Appeal: Once you have completed the appeal form, submit it to the appropriate tax authority as instructed. Ensure that you include all the required supporting documentation along with your appeal form. Keep copies of everything you submit for your records.

- Pay Attention to Fees: Some jurisdictions may require a filing fee when submitting your appeal. Make sure to review the instructions and guidelines provided by the tax authority to determine if a fee is required and how to pay it.

Once you have filed your appeal, you will receive a confirmation or acknowledgement of your submission. This may include information on the next steps in the appeals process or any additional documentation you need to provide. It’s essential to keep track of all correspondence and deadlines throughout the process to ensure you don’t miss any important information.

Remember, every jurisdiction may have its own specific rules and procedures for filing appeals, so it’s vital to consult the relevant tax authority website or seek legal advice if needed. By following these general steps and adhering to the guidelines set by your local tax authority, you will have effectively filed an appeal for your property assessment.

When appealing a property assessment, gather evidence of comparable properties’ assessments, recent appraisals, and any physical issues with your property. Present this information to the assessor for review.

The Appeals Process

Once you have filed an appeal for your property assessment, the appeals process will begin. While the specifics may vary depending on your location, the following steps generally outline the typical appeals process:

- Initial Review: After receiving your appeal, the tax authority will conduct an initial review of your case. They will assess the validity of your appeal and review the supporting documentation you provided.

- Assessor Review: In some cases, an assessor from the tax authority may visit your property to assess its condition and value. They may compare it to the evidence you provided and evaluate any discrepancies or concerns raised in your appeal.

- Appeals Hearing: Depending on the jurisdiction and the complexity of the case, you may have the opportunity to present your case at an appeals hearing. This hearing allows you to personally explain your reasons for appealing the assessment and provide additional evidence to support your claims.

- Review and Decision: After the appeals hearing or upon completion of the review process, the tax authority will make a decision regarding your appeal. They will notify you of their decision in writing, providing an explanation of their findings and any adjustments made to your property assessment.

- Acceptance or Further Appeal: If you are satisfied with the outcome of your appeal and believe that the revised assessment is fair, you can accept the decision. However, if you are still dissatisfied with the result, you may have the option to pursue further appeal options, such as filing an appeal with a higher administrative body or seeking legal recourse.

Throughout the appeals process, it is essential to remain organized and responsive to any requests or deadlines from the tax authority. Promptly provide any additional information or documentation they may require, and keep copies of all correspondence for your records.

Remember that each jurisdiction may have its own specific rules and timeline for the appeals process, so be sure to consult the guidelines provided by the tax authority or seek legal advice as needed.

Presenting Your Case

When it comes to presenting your case during the appeals process, there are a few key strategies to keep in mind:

- Be Prepared: Prior to the appeals hearing or any interactions with the tax authority, thoroughly review your supporting documentation and familiarize yourself with the details of your case. Be prepared to present your arguments clearly and concisely.

- Stay Focused: During the appeals hearing or any written submissions, focus on the key points that support your case. Present evidence that demonstrates an error or unfairness in the assessment process, and avoid unnecessary tangents or unrelated information.

- Be Professional and Respectful: Maintain a professional and respectful demeanor throughout the process. Treat the representatives from the tax authority with courtesy and avoid becoming confrontational or argumentative.

- Utilize Expert Opinion: If you have access to expert opinions, such as appraisers or real estate professionals, consider including their statements or written reports as additional evidence to support your case. Expert opinions can carry significant weight in the appeals process.

- Craft a Persuasive Argument: Take the time to carefully construct your argument, emphasizing the discrepancies or unfairness in the original assessment. Present a clear, logical, and persuasive case to support your appeal.

By following these strategies and effectively presenting your case, you increase your chances of a successful outcome during the appeals process. It’s important to remember that each case is unique, and the success of your appeal will depend on the strength of your evidence and the adherence to the rules and regulations set by the tax authority.

Presenting Your Case

When it comes to presenting your case during the appeals process, there are a few key strategies to keep in mind:

- Be Prepared: Prior to the appeals hearing or any interactions with the tax authority, thoroughly review your supporting documentation and familiarize yourself with the details of your case. Be prepared to present your arguments clearly and concisely.

- Stay Focused: During the appeals hearing or any written submissions, focus on the key points that support your case. Present evidence that demonstrates an error or unfairness in the assessment process, and avoid unnecessary tangents or unrelated information.

- Be Professional and Respectful: Maintain a professional and respectful demeanor throughout the process. Treat the representatives from the tax authority with courtesy and avoid becoming confrontational or argumentative.

- Utilize Expert Opinion: If you have access to expert opinions, such as appraisers or real estate professionals, consider including their statements or written reports as additional evidence to support your case. Expert opinions can carry significant weight in the appeals process.

- Craft a Persuasive Argument: Take the time to carefully construct your argument, emphasizing the discrepancies or unfairness in the original assessment. Present a clear, logical, and persuasive case to support your appeal.

During the appeals hearing or written submissions, it is important to present your case in a comprehensive and persuasive manner. Here are some tips to help you effectively present your case:

- Organize Your Evidence: Arrange your supporting documentation in a logical order that aligns with your argument. This will make it easier for the tax authority to follow your line of reasoning and understand the basis for your appeal.

- Provide Clear Explanations: Clearly articulate the reasons for your appeal, highlighting any errors or unfairness you have identified in the assessment process. Be specific and provide as much detail as possible to support your claims.

- Use Visual Aids: Visual aids can help effectively convey your message. Consider using charts, graphs, or photographs to illustrate key points or demonstrate inconsistencies in the assessment. Remember to label and explain each visual aid clearly.

- State Your Desired Outcome: Clearly communicate what you believe is a fair and accurate assessment of your property. Provide supporting evidence to justify the value you are proposing.

- Remain Calm and Confident: It is natural to feel nervous during the appeals process, but try to remain calm and confident. Speak clearly and assertively to convey your arguments effectively.

Remember, the goal of presenting your case is to demonstrate the errors or unfairness in the original assessment and provide compelling evidence to support your appeal. By following these strategies and effectively presenting your case, you increase your chances of a successful outcome during the appeals process.

Decision and Reassessment

After presenting your case and going through the appeals process, a decision will be made regarding your property assessment. The tax authority will review the evidence presented, consider your arguments, and provide their ruling. Here are some things to expect with regards to the decision and reassessment:

- Written Notification: The tax authority will notify you in writing of their decision. This notification will include the outcome of your appeal and the reasons behind their ruling. It is important to carefully review this communication to understand the basis for their decision.

- Accepted Appeal: If your appeal is successful and the tax authority agrees that there were errors or unfairness in the original assessment, they will make the appropriate adjustments. This may result in a lower assessed value for your property and, subsequently, a reduction in your property taxes.

- Rejection of Appeal: In some cases, the tax authority may reject your appeal if they find that the original assessment was fair and accurate. If this happens, you will need to determine if you want to pursue further appeal options, such as seeking legal advice or escalating the matter to a higher administrative body.

- Reassessment Process: If your appeal is accepted, the tax authority will proceed with reassessing the value of your property. This may involve conducting a new assessment or adjusting the previous assessment based on the decision of the appeals process. The reassessment will take into account the changes deemed necessary due to the appeal.

Once the reassessment has been completed, the tax authority will issue a new property valuation or assessment notice. This notice will reflect the revised value of your property and any changes in your property tax obligations accordingly.

If you are dissatisfied with the decision of the appeals process, there may be additional steps you can take to further challenge the assessment. This can include seeking legal advice or consulting with a professional who specializes in property tax appeals.

It is important to remember that the outcome of an appeal can vary, and there is no guarantee that your appeal will be successful. However, by presenting a strong case, providing compelling evidence, and understanding the assessment process, you increase your chances of achieving a fair and accurate assessment of your property.

Conclusion

Navigating the process of appealing a property assessment can be overwhelming, but armed with the right knowledge and strategies, you can take control of your situation. Understanding property assessments, the reasons for appealing, gathering supporting documentation, filing an appeal, and presenting your case are all key steps in this process. Remember, the decision and reassessment may not always go in your favor, but by presenting a compelling case, you increase your chances of achieving a fair outcome.

It is important to stay organized and thorough throughout the appeals process. Gather all relevant documentation, such as property appraisals, photographs, and sales data, to support your case. Keep copies of all correspondence, and be mindful of deadlines and requirements set by the tax authority.

When presenting your case, be prepared, focused, and professional. Use expert opinions and visual aids to strengthen your arguments, and clearly explain any errors or unfairness in the original assessment. Craft a persuasive argument that clearly states your desired outcome and justifies your proposed property value.

After the appeals process, you will receive a decision from the tax authority. If your appeal is successful, your property will be reassessed, potentially resulting in a lower assessed value and reduced property taxes. However, if your appeal is rejected, you may want to consider further recourse options, such as seeking legal advice or escalating the matter to a higher administrative body.

Remember that the outcome of an appeal can vary, and there are no guarantees. However, by understanding the process, presenting a strong case, and being persistent, you can increase your chances of achieving a fair and accurate assessment of your property.

We hope this guide has provided you with valuable insights into the appeal process for property assessments. If you believe that your assessment is incorrect or unfair, we encourage you to take action and explore the available avenues for appeal. By doing so, you can potentially reduce your property tax burden and ensure that your assessment reflects the true value of your property.

Frequently Asked Questions about How Can I Appeal A Property Assessment

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How Can I Appeal A Property Assessment”