Home>Home Maintenance>How To Appeal Property Assessment In Clark County, Nevada

Home Maintenance

How To Appeal Property Assessment In Clark County, Nevada

Modified: March 24, 2024

Learn how to appeal your property assessment in Clark County, Nevada. Expert tips and strategies for homeowners. Get the fair value for your home.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to Clark County, Nevada, a vibrant and thriving area known for its stunning landscapes, bustling city life, and diverse communities. If you own property in this county, you are likely familiar with the annual property assessment process and the impact it has on your property taxes.

Understanding property assessment and how it affects your finances is crucial. It allows you to ensure that your property’s value is accurately assessed, leading to fair and reasonable property tax assessments. However, there may be instances where you believe your property’s assessment is incorrect or higher than it should be. In such cases, you have the right to appeal the assessment.

This comprehensive guide will take you through the process of appealing a property assessment in Clark County, Nevada. We will explain the importance of property assessment, common reasons for appealing, the steps involved in filing an appeal, and how you can present your case effectively. By the end of this article, you will be equipped with the knowledge and tools to navigate the appeals process confidently.

Before we delve into the specifics of appealing a property assessment, let’s first establish why property assessments matter and how they impact your property taxes.

Key Takeaways:

- Appeal property assessment in Clark County, Nevada by gathering evidence, researching comparable properties, and presenting a strong case to ensure fair and accurate property valuations.

- Understand the impact of property assessment on property taxes and reasons for appealing assessments to navigate the process confidently and seek adjustments that reflect your property’s value.

Understanding Property Assessment in Clark County, Nevada

Property assessment is a process conducted by local government authorities to determine the value of a property for tax purposes. In Clark County, Nevada, the County Assessor’s Office is responsible for assessing property values. The assessed value is used to calculate property taxes, which fund various services and infrastructure in the county.

Property assessment serves several important purposes. First and foremost, it ensures fairness and equity in the distribution of property taxes among homeowners. By assessing properties based on their market value, the tax burden is distributed proportionally among property owners.

Furthermore, property assessment helps local municipalities to budget and plan effectively. Property tax revenue plays a crucial role in funding essential services such as schools, libraries, parks, and public safety. Accurate property assessments ensure that these resources are allocated in a manner that meets the needs of the community.

Now, let’s discuss how property assessment directly affects your property taxes. In Clark County, Nevada, property tax rates are established by various governing bodies, such as the county commission, school district, and other local agencies. These tax rates are then applied to the assessed value of your property to calculate your annual property tax bill.

If your property’s assessed value increases, either due to market appreciation or improvements you have made, your property taxes will likely increase as well. On the other hand, if your property’s assessed value decreases, you may benefit from lower property tax payments.

It is important to note that property taxes are not solely determined by the assessed value of your property. Other factors, such as the tax rates set by the governing bodies, exemptions, and special assessments, also influence the final amount you will owe in property taxes.

Understanding the link between property assessment and property taxes is crucial for homeowners in Clark County, Nevada. It enables you to monitor changes in your property’s assessed value and ensure that it aligns with market trends. If you believe your property assessment is inaccurate or unjustifiably high, you have the right to appeal the assessment and seek a fair adjustment.

Reasons for Appealing Property Assessment

Appealing a property assessment is a legitimate course of action if you believe that your property’s assessed value is incorrect or unjustified. There are several common reasons why property owners in Clark County, Nevada, choose to appeal their assessments. Let’s explore these reasons and provide examples of assessment errors that may warrant an appeal.

1. Market Value Discrepancies

One of the most common reasons for appealing a property assessment is a disagreement over the market value assigned to the property. If you believe that the assessed value does not accurately reflect the current market conditions, you may choose to appeal. For example, the assessor may have relied on outdated or inaccurate information, leading to an inflated assessment that does not align with the property’s actual value.

2. Comparative Property Analysis

Another basis for appealing a property assessment is a discrepancy in the assessed value compared to similar properties in the area. If you can provide evidence that your property is assessed at a higher value than comparable properties, you may have grounds for an appeal. This is often seen when properties with similar characteristics and locations have significantly lower assessments.

3. Assessment Errors

Assessment errors can also occur, leading to incorrect property valuations. Some common assessment errors include:

- Transcription errors: The assessor may have mistakenly entered incorrect property details, such as the number of rooms or the size of the lot.

- Mistaken improvements: If the assessor includes improvements that don’t exist or fails to account for significant improvements you have made to the property, it can result in an inaccurate assessment.

- Incorrect zoning classification: If your property is zoned incorrectly, it can affect its value and warrant a reassessment.

- Incorrect property condition: If the assessor did not consider the actual condition of the property, such as damage or needed repairs, it can lead to an inflated assessment.

It is essential to carefully review your property assessment and identify any potential errors or discrepancies. Keep detailed records of any improvements made to your property and gather evidence to support your claim. This can include recent home appraisals, sales data of comparable properties, and photographs documenting any condition issues.

By understanding the common reasons for appealing a property assessment and being able to identify assessment errors, you can make a strong case for a fair assessment. The next step is to prepare for the appeals process, which we will discuss in the following section.

Preparing for the Appeals Process

If you have decided to appeal your property assessment in Clark County, Nevada, it is crucial to thoroughly prepare for the appeals process. Proper preparation will significantly increase your chances of a successful appeal. Here are two essential steps to take when getting ready to challenge your property assessment:

1. Gathering Supporting Documentation

One of the key elements in a successful property assessment appeal is providing strong supporting documentation. This documentation should demonstrate that your property is assessed incorrectly or unfairly. Here are some examples of documents and evidence that you should consider gathering:

- Recent home appraisals: A professional appraisal conducted by a licensed appraiser can provide an expert opinion on the value of your property.

- Comparable property sales data: Research recent sales of similar properties in your area to show that the assessed value of your property is inconsistent with comparable market values.

- Photographs: Take clear, detailed photographs of your property, particularly if there are any issues or damages that affect its value. These photographs can serve as visual evidence during the appeal hearing.

- Receipts for improvements: If you have made significant improvements to your property, gather receipts, contracts, and permits to demonstrate the value added to your property.

- Tax records: Review your property tax records to ensure that there are no discrepancies, such as incorrect property size, zoning classification, or exemptions that were not applied.

2. Researching Comparable Properties

An essential part of preparing for an appeal is conducting research on comparable properties in your area. Look for properties with similar characteristics, such as size, location, amenities, and condition. The goal is to find properties that have been assessed at lower values than yours but are comparable in all other aspects. This comparative analysis can strengthen your argument that your property is overvalued and warrant a reassessment.

Use online real estate platforms, public records, and consult with local real estate agents to gather information about recent property sales. Pay attention to factors such as sale prices, size, condition, and location of these properties. Keep detailed records of your research findings and include them in your documentation for the appeal.

By gathering supporting documentation and researching comparable properties, you will be well-prepared to present a strong case during the appeals process. In the next section, we will discuss the steps involved in filing an appeal.

If you want to appeal your property assessment in Clark County, Nevada, make sure to gather evidence of comparable property values in your area and present it to the County Assessor’s Office. Be prepared to make a strong case for why you believe your assessment is too high.

Filing an Appeal

Once you have gathered the necessary documentation and prepared your case, it’s time to file an appeal for your property assessment in Clark County, Nevada. Follow these essential steps to ensure a smooth and successful appeal process:

1. Review Assessment Notice

Start by carefully reviewing your property assessment notice. This notice typically includes information on the assessed value of your property, the basis for the assessment, and contact details for the County Assessor’s Office. Make sure to understand the information provided and note any discrepancies or errors.

2. Contact the Assessor’s Office

If you believe there is an error or you wish to appeal the assessment, contact the County Assessor’s Office. They will provide you with the necessary forms and instructions for filing an appeal. Be sure to ask about specific deadlines and requirements for appeals, as these can vary depending on the jurisdiction.

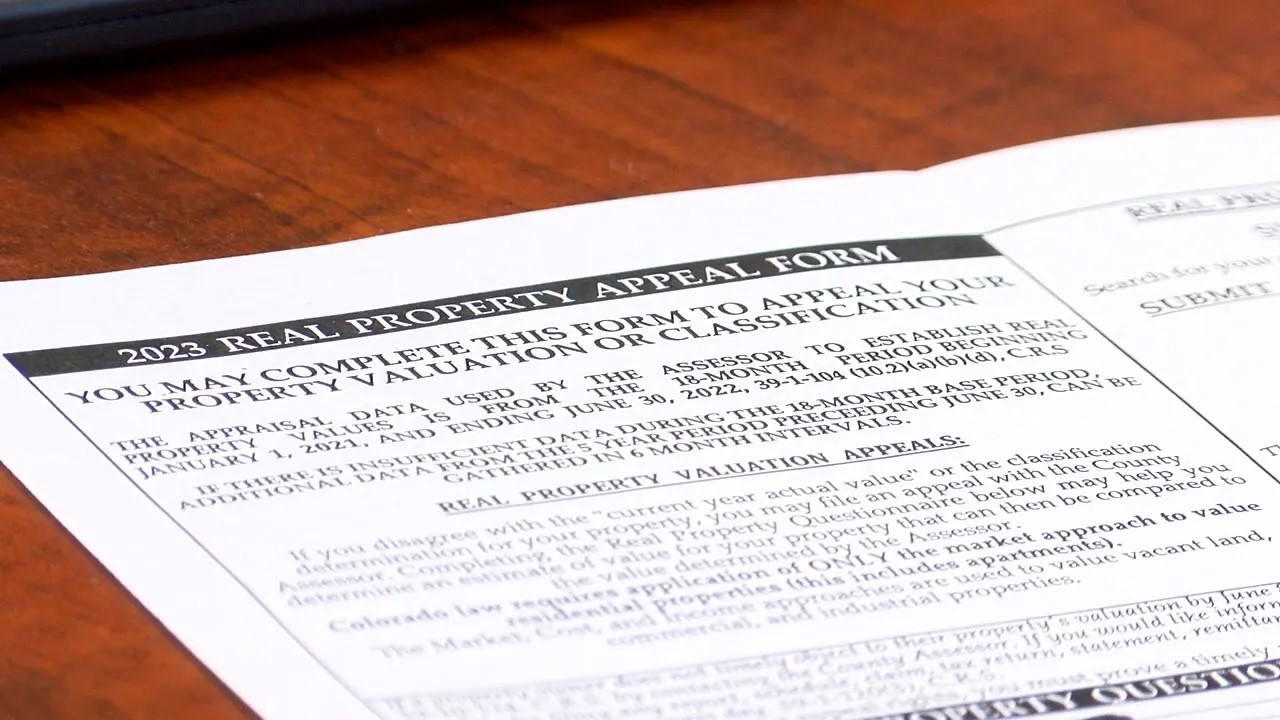

3. Complete the Appeal Form

Fill out the appeal form accurately and completely. Include all relevant information, such as your contact details, property address, and reasons for the appeal. Clearly explain why you believe the assessed value is incorrect or unfair, and attach any supporting documentation that strengthens your case.

4. Submit the Appeal Form

Submit the completed appeal form to the County Assessor’s Office before the specified deadline. It is important to adhere to the deadline to ensure your appeal is considered. Keep a copy of the appeal form and any supporting documents for your records.

5. Attend the Informal Hearing

After submitting your appeal, you will receive a notice regarding the date and time of the informal hearing. This is an opportunity for you to present your case to an assessor or an appeal panel. Come prepared with your documentation and be ready to explain your position and provide any additional evidence, if required.

6. Await the Decision

Following the informal hearing, the assessor or appeal panel will review your case and make a decision. They will notify you of their decision in writing. If the assessment is adjusted in your favor, your property tax bill will be revised accordingly. If the decision is not in your favor, you may have the option to continue the appeals process by requesting a formal hearing.

Remember to carefully read and follow all instructions provided by the County Assessor’s Office to ensure your appeal is processed correctly. By filing an appeal and participating in the appeals process, you are exercising your rights as a property owner to seek a fair assessment.

Read more: How Can I Appeal A Property Assessment

Presenting Your Case

When it comes to appealing your property assessment in Clark County, Nevada, presenting a strong and convincing case is crucial. Here are some tips to help you maximize your chances of success during the appeal hearing:

1. Be Prepared

Thoroughly prepare for the appeal hearing by organizing your documentation and familiarizing yourself with the details of your case. Review your appeal form, supporting evidence, and any relevant laws or regulations related to property assessments. Being well-prepared will help you present your case confidently and effectively.

2. Know Your Property

Have a good understanding of your property’s unique characteristics, including its size, condition, amenities, and location. Be prepared to discuss these details and highlight any factors that may justify a reassessment, such as damages, necessary repairs, or zoning changes.

3. Provide Clear and Concise Arguments

When presenting your case, articulate your arguments clearly and concisely. Focus on the key points that support your position and avoid going off on tangents. Make sure your arguments are easy to understand and be prepared to back them up with evidence and documentation.

4. Use Visual Aids

Visual aids, such as photographs or diagrams, can be powerful tools to support your arguments. Presenting clear visual evidence of property damages, improvements, or comparable properties can strengthen your case and make it easier for the assessors to understand your perspective.

5. Remain Professional and Courteous

During the appeal hearing, maintain a professional and courteous demeanor. Treat the assessors or appeal panel with respect and address them in a calm and polite manner. Being respectful and professional can help create a positive impression and may influence the decision in your favor.

6. Bring Supporting Witnesses

If you have witnesses who can provide additional testimony or evidence to support your case, consider bringing them to the appeal hearing. This can include contractors, appraisers, or other experts who can provide professional insights and validate your claims.

7. Be Open to Negotiation

During the appeal hearing, be open to negotiation and compromise. Assessors may consider adjusting the assessed value based on the evidence presented. If the assessors offer a reasonable compromise, carefully evaluate the proposal and consider accepting it if it aligns with your desired outcome.

Remember, the goal is to present a compelling case based on valid evidence and arguments. By following these tips, you can effectively advocate for a fair reassessment of your property’s value.

The Decision and Beyond

After the appeal hearing for your property assessment in Clark County, Nevada, you will receive the decision from the assessment board. This decision will determine whether your property assessment will be adjusted in your favor or upheld as originally assessed. Here’s what you need to know about the decision and the options available to you:

1. Receiving the Assessment Board’s Decision

The assessment board will notify you of their decision in writing. The decision will outline whether they have granted your appeal and adjusted the assessed value of your property or denied your appeal and upheld the original assessment. Take the time to carefully review the decision and understand the reasons provided by the board.

2. Options After a Denied Appeal

If your appeal is denied and you disagree with the decision, you still have options to pursue further action. Consider the following alternatives:

- Request a Formal Hearing: In some cases, you may have the option to request a formal hearing. This will involve presenting your case to a different panel or hearing officer, providing an opportunity to state your arguments again and present any additional evidence. Check with the County Assessor’s Office to determine if this option is available.

- Seek Mediation or Arbitration: Mediation or arbitration can be an alternative to a formal hearing. It involves a neutral third party who can help facilitate a resolution between you and the assessors. This option allows for negotiation and compromise, potentially resolving the dispute outside of a formal hearing.

- Consult an Attorney: If you believe that your case has strong legal grounds, seeking legal advice from an attorney who specializes in property tax appeals can be beneficial. An attorney can assess your case, provide guidance on the best course of action, and represent you in any legal proceedings.

- Consider Future Appeals: Depending on local regulations, you may have the option to appeal your property assessment in future years. If you believe that the current assessment is unjustified, you can continue to challenge it in subsequent years.

When deciding on your next steps, carefully weigh the costs, benefits, and likelihood of success in each option. Seeking professional advice and considering your specific circumstances will help you make an informed decision.

Remember, the decision of the assessment board is not necessarily the final word. You have the right to advocate for a fair assessment of your property and pursue the available avenues to ensure your concerns are addressed.

Conclusion

Appealing a property assessment in Clark County, Nevada, can be a complex process, but it is an important step in ensuring fair and accurate property valuations. Understanding property assessment, its impact on property taxes, and the reasons for appealing assessments is crucial for homeowners.

In this comprehensive guide, we have discussed the significance of property assessment and its role in determining property taxes. We have also explored common reasons for appealing assessments, such as market value discrepancies and assessment errors.

Preparing for the appeals process involves gathering supporting documentation, such as recent appraisals, comparable property data, and photographs. Researching comparable properties helps strengthen your case by demonstrating inconsistencies between your assessment and similar properties in the area.

When filing an appeal, it is important to review the assessment notice, contact the County Assessor’s Office, complete the appeal form accurately, and submit it within the specified deadline. Attending the informal hearing gives you an opportunity to present your case, supported by evidence and clear arguments.

While the decision of the assessment board is final in many cases, there are options to pursue further action if your appeal is denied. These options include requesting a formal hearing, seeking mediation or arbitration, consulting an attorney, or considering future appeals.

Ultimately, the goal of appealing a property assessment is to ensure a fair and equitable valuation of your property. By navigating the appeals process and presenting a compelling case, homeowners can seek adjustments that accurately reflect their property’s value.

We hope this guide has provided you with valuable insights into appealing property assessments in Clark County, Nevada. Remember to stay informed, gather supporting evidence, and advocate for fair assessments. With persistence and the proper preparation, you can work towards achieving a more accurate and equitable property valuation.

Frequently Asked Questions about How To Appeal Property Assessment In Clark County, Nevada

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Appeal Property Assessment In Clark County, Nevada”