Home>Home Maintenance>How To Appeal Your 2024 Colorado Property Assessment And Win

Home Maintenance

How To Appeal Your 2024 Colorado Property Assessment And Win

Modified: March 24, 2024

Learn how to appeal your 2023 Colorado property assessment and increase your chances of winning. Discover effective home maintenance strategies to support your case.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the ultimate guide on how to appeal your 2023 Colorado property assessment and come out victorious. Property assessments are an essential part of the home maintenance process in Colorado. These assessments determine the value of your property and ultimately impact your property taxes. However, there may be instances when you disagree with the assessment and believe it is unfair or inaccurate. In such cases, it is important to know your rights and understand the steps necessary to file an appeal.

Appealing your property assessment may seem like a daunting task, but fear not! In this comprehensive guide, we will break down the process and provide you with expert tips and strategies to help you navigate through the assessment appeals process with confidence. Whether you are a homeowner, real estate investor, or commercial property owner, this guide is designed to empower you to take control of your property assessment and achieve a favorable outcome.

In the following sections, we will delve into the intricacies of the property assessment process, discuss how to determine if your assessment is fair, guide you in gathering evidence for your appeal, help you prepare a persuasive written appeal, outline the steps to submit your appeal, and provide tips for attending the appeal hearing.

We will also explore how to present your case effectively, negotiate a settlement if possible, and finalize your appeal. By following the steps outlined in this guide, you will be equipped with the knowledge and tools necessary to challenge your property assessment and increase your chances of success.

Please note that the information provided in this guide is for educational purposes only and is not intended to serve as legal advice. If you require legal assistance, it is recommended to consult with a professional property attorney or a tax consultant specializing in property assessments.

Now, let’s embark on this journey together and learn how to appeal your 2023 Colorado property assessment effectively!

Key Takeaways:

- Challenging your Colorado property assessment is your right if you believe it’s unfair. Gather evidence, write a strong appeal, and stay professional to increase your chances of success.

- If you’re unhappy with your property assessment, follow the steps in this guide to navigate the appeals process with confidence. Remember to be prepared, stay composed, and advocate for a fair evaluation.

Understanding the Property Assessment Process

Before diving into the process of appealing your property assessment, it is crucial to have a clear understanding of how property assessments work in Colorado. Property assessments are conducted to determine the value of your property, which in turn affects the amount of property taxes you are required to pay.

In Colorado, property assessments are typically conducted by the county assessor’s office. The assessor’s office uses a variety of factors to determine the value of your property, including market conditions, property characteristics, and comparable sales in the area.

It is important to note that property assessments in Colorado are done on a regular basis, usually every two years. The assessment period for the 2023 tax year will begin on January 1st, 2023. During this period, assessors will evaluate the market value of properties in the county to determine the new assessments.

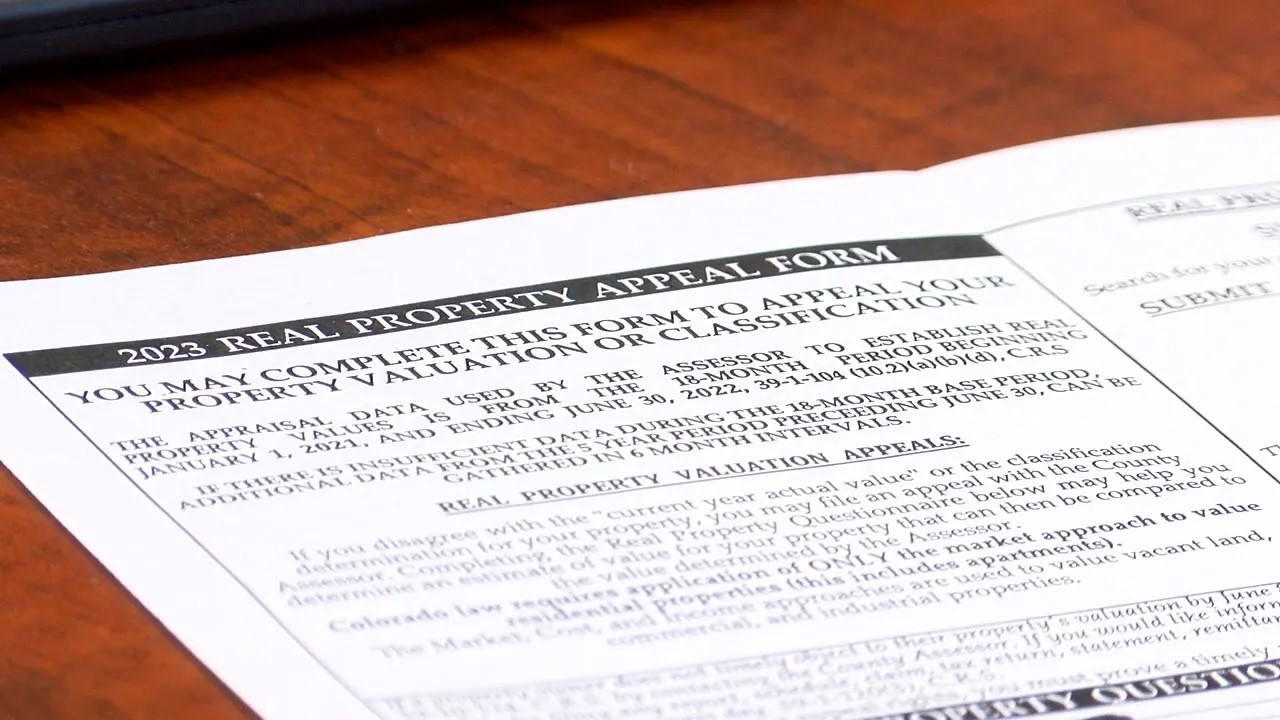

Once the assessments are completed, property owners in Colorado receive a Notice of Valuation in the mail. This notice provides important information, such as the assessed value of your property and the deadline to file an appeal.

When reviewing your Notice of Valuation, pay close attention to the assessed value of your property. This value may be based on comparable sales, property characteristics, and other relevant factors. It is essential to ensure that the assessed value is fair and accurately reflects the market value of your property.

If you believe that your property assessment is unfair or inaccurate, you have the right to appeal. The appeal process provides property owners with an opportunity to challenge the assessment and present evidence to support their claim.

It is important to understand that the burden of proof lies with the property owner. This means that you must provide evidence to demonstrate that the assessed value is incorrect or unreasonable. This evidence can include recent appraisals, comparable sales data, photographs, and any other information that supports your argument.

Keep in mind that the assessment appeals process in Colorado may vary slightly depending on the specific county. It is advisable to check with your local assessor’s office or the county’s website for detailed information on the appeals process and specific deadlines.

Now that you have a solid understanding of the property assessment process in Colorado, let’s move on to the next step: determining if your assessment is fair.

Determining if Your Assessment is Fair

Once you receive your Notice of Valuation and review the assessed value of your property, the next step is to determine if your assessment is fair. It is important to remember that a property assessment should reflect the market value of your property, which is the amount a willing buyer would pay for it in an open and competitive market.

Here are some factors to consider when determining if your assessment is fair:

- Comparable sales: Research recent sales of similar properties in your area. Look for properties with similar characteristics such as size, location, and condition. If the assessed value of your property is significantly higher than the sale prices of comparable properties, it may indicate an unfair assessment.

- Property characteristics: Assess the accuracy of the property characteristics listed on your assessment. Check for any errors in the size, number of bedrooms and bathrooms, improvements, and other relevant details. Inaccurate property information can lead to an inflated assessment.

- Market trends and conditions: Consider the current real estate market conditions in your area. If there has been a significant decline in property values, your assessment should reflect that. Conversely, if property values have increased, your assessment may be fair but higher than previous years.

- Assessment ratio: In Colorado, the assessed value is a percentage of the market value. This ratio, known as the assessment rate, varies depending on the property type. For residential properties, the assessment rate is currently 7.15%. Multiply the assessed value by the assessment rate to calculate the market value. Compare the calculated market value with the market value of similar properties to ensure consistency.

- Consult professionals: If you are unsure about the fairness of your assessment, consider seeking the assistance of a property appraiser or a real estate agent with expertise in your local market. They can provide an independent evaluation of your property’s value and help determine if the assessment is fair.

If, after considering these factors, you believe that your assessment is unfair or inaccurate, it may be time to file an appeal. Take note of the deadline indicated on your Notice of Valuation, as missing the deadline can result in the loss of your right to appeal.

In the next section, we will discuss how to gather evidence to support your appeal and strengthen your case.

Gathering Evidence for Your Appeal

When preparing to appeal your property assessment, one of the most crucial steps is gathering evidence to support your case. This evidence will strengthen your argument and help prove that your assessment is unfair or inaccurate. Here are some key pieces of evidence you should consider gathering:

- Recent appraisals: Obtain a current appraisal of your property from a licensed appraiser. Appraisals provide an unbiased and professional assessment of your property’s value, which can be used as supporting evidence in your appeal.

- Comparable sales data: Research recent sales data of similar properties in your area. Look for properties that have similar characteristics such as size, location, and condition. This data will help establish a basis for comparison and show that your assessment is out of line with comparable properties.

- Photographs: Take clear and detailed photographs of your property, both inside and outside. Highlight any features or conditions that may impact its value. These visual aids can be powerful evidence to support your argument during the appeal process.

- Documentation of property defects: If your property has any structural or functional defects that could potentially lower its value, gather any relevant documentation such as repair estimates, inspection reports, or invoices for repairs. This evidence can demonstrate that your assessment does not account for these issues.

- Tax assessments of comparable properties: Obtain the tax assessments of comparable properties in your area. Compare their assessed values with yours to identify any disparities. This information can help establish that your assessment is not in line with the assessments of similar properties.

- Property records: Review your property records, including building permits, property surveys, and any other relevant documents. These records can provide valuable information about the history and condition of your property, which can be used to support your appeal.

It is important to organize and document all the evidence you gather for your property assessment appeal. Keep copies of all documents and maintain a clear record of the information you have gathered. This will help you build a strong and persuasive case during the appeal process.

In addition to gathering evidence, consider consulting with a property appraiser or a real estate agent with expertise in your local market. They can provide professional insights and guidance regarding the strength of your case and the supporting evidence you have gathered.

Now that you have gathered the necessary evidence, it’s time to prepare your written appeal. In the next section, we will guide you through the process of structuring and presenting your appeal in a compelling manner.

Preparing Your Written Appeal

When filing an appeal for your property assessment, one of the most crucial steps is preparing a well-written appeal letter. This letter serves as your formal request to the county assessor’s office to reconsider your property assessment. A persuasive and well-structured appeal letter can significantly increase your chances of success. Here are some key points to consider when preparing your written appeal:

- Address the letter correctly: Begin your appeal letter with the appropriate salutation and ensure that you have accurately addressed it to the right person or department within the county assessor’s office. Double-check the contact information to avoid any delivery issues.

- Be concise and clear: Keep your appeal letter concise, clear, and to the point. State the purpose of the letter upfront and provide a brief introduction of yourself, including your name, property address, and account number.

- Explain why you are appealing: Clearly state the reasons why you are appealing your property assessment. Provide a detailed explanation of why you believe the assessment is unfair or inaccurate. Refer back to the evidence you have gathered and include specific examples to support your claims.

- Use persuasive language: Use persuasive language to make your case. Tie your arguments to relevant laws, regulations, or guidelines to show that the assessment does not align with established standards. Highlight any discrepancies in the assessment process or errors in the property information.

- Include supporting documentation: Attach copies of the evidence you have gathered, such as recent appraisals, comparable sales data, photographs, repair estimates, or any other relevant documents. Clearly label and reference each piece of evidence in your letter.

- Request a specific outcome: Clearly state the desired outcome of your appeal, whether it is a reduction in the assessed value, a correction of inaccurate property information, or any other appropriate resolution. Be reasonable in your request and support it with solid reasoning.

- Provide your contact information: Include your contact information, including your phone number, email address, and mailing address, in case the assessor’s office needs to contact you for further clarification or to schedule a hearing.

- Be polite and professional: Maintain a polite and professional tone throughout your appeal letter. Avoid using aggressive language or making personal attacks. Stick to the facts and focus on the merits of your case.

Once you have drafted your appeal letter, take the time to review and proofread it for clarity, grammar, and spelling errors. A well-written letter enhances your credibility and demonstrates your seriousness about the appeal.

Make copies of your appeal letter and all supporting documentation before submitting them. It is recommended to send your appeal by certified mail or through a reliable tracked delivery service to ensure it reaches the county assessor’s office within the specified deadline.

In the next section, we will discuss the process of submitting your appeal and the importance of adhering to the deadlines set by the assessor’s office.

Read more: How Can I Appeal A Property Assessment

Submitting Your Appeal

Once you have prepared your written appeal, the next step is to submit it to the appropriate department within the county assessor’s office. It is crucial to follow the submission instructions provided on your Notice of Valuation and adhere to the specified deadlines. Here are the key steps to submit your appeal:

- Double-check the requirements: Review the appeal submission requirements stated on your Notice of Valuation. Ensure that you have included all the necessary documents, such as your appeal letter, supporting evidence, and any additional forms or paperwork requested by the assessor’s office.

- Make copies: Copy all the documents you are submitting, including your appeal letter and supporting evidence. It is important to keep a record of everything you send for future reference.

- Send it via certified mail or delivery service: It is recommended to send your appeal by certified mail or through a reliable tracked delivery service. This provides proof of the date and time of submission and ensures that your appeal reaches the assessor’s office within the specified deadline.

- Keep a record of the receipt: When sending your appeal, obtain a receipt or tracking number as proof of submission. Keep this receipt in a safe place as it serves as evidence that you complied with the submission requirements and met the deadline.

- Document any communication: If you have any direct communication with the assessor’s office, whether it’s via email, phone, or mail, make sure to keep a record of the details. Note the date, time, and content of the conversation or correspondence for future reference.

Submitting your appeal on time and following the specified requirements is crucial to ensure that your case is properly reviewed. Failure to adhere to the deadlines or provide the necessary documents may result in your appeal being deemed invalid or dismissed.

Once your appeal is submitted, the assessor’s office will review your case and notify you of the next steps. This may include scheduling an appeal hearing or requesting additional documentation or information. Stay proactive and responsive during this process to ensure a smooth and efficient resolution.

In the next section, we will discuss the importance of attending the appeal hearing, should one be scheduled, and provide tips on presenting your case effectively.

Gather evidence of comparable property values in your area to support your appeal. Look for recent sales of similar properties and use this data to make your case.

Attending the Appeal Hearing

After submitting your appeal, there is a possibility that an appeal hearing will be scheduled. The hearing provides you with the opportunity to present your case in person and engage in a dialogue with the assessor or the appeals board. While not all appeals result in a hearing, attending one can be valuable in supporting your claim. Here are some important considerations when attending an appeal hearing:

- Prepare your arguments: Prior to the hearing, review your appeal letter, supporting evidence, and any additional documents you have submitted. Familiarize yourself with the key points you want to communicate during the hearing and practice presenting them concisely and persuasively.

- Know the details: Understand the specifics of your property assessment and the reasons why you believe it is unfair or inaccurate. Be prepared to address any questions or challenges raised by the assessor or the appeals board.

- Arrive early and dress appropriately: It is important to arrive early on the day of the hearing to allow time for check-in and to familiarize yourself with the surroundings. Dress professionally, as this demonstrates respect for the proceedings and enhances your credibility.

- Stay calm and composed: During the hearing, remain calm and composed. Present your arguments clearly and confidently, while also being courteous and respectful. Avoid becoming defensive or confrontational, as this can weaken your case.

- Be open to discussion: The appeal hearing is an opportunity for a dialogue between you and the assessor or the appeals board. Be open to discussing your concerns, answering questions, and providing additional information or context when necessary. Remember to listen carefully to any counterarguments or explanations offered by the assessor or the appeals board.

- Use visual aids if possible: If you have visual aids such as photographs, charts, or graphs that can help support your case, bring them to the hearing. Visual aids can make your arguments more impactful and memorable.

- Stay focused on the facts: Stick to the facts and avoid personal anecdotes or emotional appeals. Present objective evidence and logical arguments to support your position. The appeals board is primarily interested in the factual basis of your appeal.

- Take notes: During the hearing, take notes of any important points discussed, questions asked, or any additional requests or instructions provided by the assessor or the appeals board. These notes will be helpful for reference and follow-up after the hearing.

Attending the appeal hearing allows you to present your case directly to the decision-makers and provides an opportunity for a fair and open discussion. It is an important step towards achieving a favorable outcome for your property assessment appeal.

In the next section, we will discuss tips on effectively presenting your case during the appeal hearing to maximize your chances of success.

Presenting Your Case

Presenting your case effectively during the appeal hearing is crucial to maximizing your chances of success. It is your opportunity to communicate your arguments clearly, provide supporting evidence, and convince the assessor or the appeals board that your property assessment is unfair or inaccurate. Here are some tips on how to present your case persuasively:

- Organize your presentation: Structure your presentation in a logical and organized manner. Begin by clearly stating your position and the reasons why you believe the assessment is unfair or inaccurate. Then present your evidence and supporting documentation, referring back to specific points in your appeal letter.

- Be concise and to the point: Make sure your presentation is concise and focused. State your arguments clearly and avoid unnecessary tangents. Use plain language and avoid jargon to ensure that your message is easily understood.

- Highlight key evidence: Emphasize the most compelling pieces of evidence that support your case. Use visual aids, such as photographs or charts, to illustrate your points effectively. Clearly explain how each piece of evidence refutes the assessment and demonstrates the unfairness or inaccuracy.

- Address counterarguments: Anticipate and address any counterarguments or explanations that the assessor or the appeals board may present. Be prepared to explain why you believe their counterarguments are not valid and provide evidence to support your position.

- Stay composed and confident: Maintain a calm and confident demeanor throughout your presentation. Speak clearly and maintain eye contact with the assessor or the appeals board. Confidence in your presentation can help strengthen the credibility of your arguments.

- Respectfully engage in discussion: Be open to engaging in a respectful discussion with the assessor or the appeals board. This allows you to further clarify your position, answer any additional questions, and address any concerns they may have. Stay focused on the facts and ensure that your responses are well-reasoned and supported by evidence.

- Reiterate your desired outcome: Clearly state your desired outcome at the end of your presentation. This can include a specific reduction in the assessed value or a correction of inaccurate property information. Restate your reasons for requesting this outcome and provide a compelling rationale.

- Stay professional and courteous: Maintain a professional and courteous attitude throughout the hearing. Treat everyone involved with respect, even if you disagree with their arguments or decisions. Being professional and courteous can help create a positive impression and may impact the final outcome.

Remember, the appeal hearing is your opportunity to present your case directly. It is essential to be well-prepared, present your arguments effectively, and engage in a respectful and constructive dialogue.

After presenting your case, the appeals board will evaluate the evidence and arguments presented by both sides. In the final section, we will discuss the possibility of negotiating a settlement and the steps involved in finalizing your appeal.

Negotiating a Settlement

During the property assessment appeal process, there is a possibility of negotiating a settlement with the assessor’s office. A settlement is an agreement reached between you and the assessor’s office that resolves the dispute regarding your property assessment. Here are some key points to consider when negotiating a settlement:

- Be open to compromise: Understand that negotiations often require compromise from both parties. Be open to discussing different potential outcomes and explore potential solutions that can satisfy both your concerns and the assessor’s office.

- Present your case effectively: During negotiations, reiterate your arguments and present your evidence in a clear and concise manner. Highlight the reasons why you believe the assessment is unfair or inaccurate, and emphasize the supporting evidence you have gathered.

- Listen to the assessor’s perspective: Understand the assessor’s viewpoint and consider their arguments and evidence. Actively listen to their rationale for the initial assessment, and be prepared to address any concerns or counterarguments they may raise.

- Propose a reasonable solution: Based on the evidence and discussions, propose a reasonable solution that considers both parties’ interests. This can include a specific reduction in the assessed value, a change in property information, or any other mutually agreeable resolution.

- Consider the cost-benefit analysis: Assess the potential costs and benefits of continuing the appeal process versus reaching a settlement. Consider factors such as time, expenses, and the likelihood of success. Weigh these factors against the settlement offer presented by the assessor’s office.

- Document the settlement agreement: If a settlement is reached, make sure to document the agreed-upon terms in writing. This ensures that both parties are clear on the resolution and protects your rights. Review the settlement agreement carefully before signing and seek legal counsel if necessary.

- Finalize any necessary paperwork: After reaching a settlement, follow any instructions provided by the assessor’s office regarding the next steps. This may involve completing additional paperwork or forms to finalize the settlement and update your property assessment.

- Maintain professionalism: Throughout the negotiation process, maintain a professional and respectful demeanor. Avoid personal attacks or confrontational behavior. Professionalism can help foster a positive negotiating environment and increase the likelihood of reaching a mutually beneficial agreement.

Remember, negotiating a settlement can be a favorable option to resolve the property assessment dispute without the need for further appeals or legal proceedings. However, it is essential to carefully evaluate the terms of the settlement offer and ensure that it aligns with your goals and interests.

In the final section, we will discuss the steps involved in finalizing your appeal and the importance of following through until the resolution is confirmed.

Finalizing Your Appeal

After going through the property assessment appeal process, it is important to finalize your appeal to bring closure to the dispute. Finalizing your appeal involves completing the necessary steps to ensure that the resolution is confirmed and implemented. Here are the key steps to finalize your appeal:

- Obtain the decision in writing: Once the appeal hearing or negotiation process is complete, request a written decision from the assessor’s office. This decision will outline the outcome of your appeal and any adjustments made to your property assessment.

- Review the decision carefully: Take the time to review the written decision thoroughly. Ensure that it accurately reflects the resolution agreed upon or the outcome determined by the appeals board. If you have any concerns or questions about the decision, seek clarification from the assessor’s office.

- Verify the implementation of the resolution: If the decision includes a reduction in the assessed value or any other adjustments, verify that the assessor’s office has made the necessary changes to your property assessment. Check your updated property tax statement or contact the assessor’s office directly to confirm the implementation.

- Keep copies of all documentation: Make copies of the written decision, any settlement agreement, and any other relevant documentation related to your appeal. Keep these copies in a safe place for future reference, in case any discrepancies or issues arise in the future.

- Pay the revised property taxes, if applicable: If the resolution of your appeal results in a reduction in the assessed value, your property taxes may be adjusted accordingly. Ensure that you pay the revised amount as indicated in your updated property tax statement to comply with your tax obligations.

- Note important dates and deadlines: Be aware of any future deadlines or requirements related to your property assessment. This may include upcoming reassessments or the need to file future appeals if you believe there are still unresolved issues with your assessment.

- Seek professional assistance, if necessary: If you encounter any challenges or issues in finalizing your appeal, consider seeking professional assistance from a property attorney or a tax consultant. They can provide guidance and ensure that all necessary steps are properly completed.

Finalizing your appeal is an important step towards achieving a resolution to your property assessment dispute. It ensures that the agreed-upon adjustments are implemented and that any necessary actions on your part, such as paying revised property taxes, are undertaken.

Remember to keep a record of all documentation related to your appeal, as it may be required for future reference or in the event of any discrepancies or questions that may arise. By following through to finalize your appeal, you can achieve the desired outcome and bring closure to the property assessment dispute.

With this final step complete, congratulations on successfully navigating the property assessment appeals process! Should you encounter any future assessment issues, you can refer back to this guide for reference and support.

Conclusion

Congratulations! You have reached the end of our comprehensive guide on how to appeal your 2023 Colorado property assessment and come out victorious. We have covered the entire process, from understanding the property assessment process to finalizing your appeal. By following the steps outlined in this guide and employing the strategies provided, you have equipped yourself with the knowledge and tools necessary to challenge your property assessment effectively.

Remember, appealing your property assessment is your right as a property owner. If you believe that your assessment is unfair or inaccurate, it is crucial to take action and advocate for a proper evaluation of your property’s value. The information and tips shared in this guide will help you navigate the appeals process with confidence, empowering you to present your case and evidence in a compelling manner.

Throughout this guide, we have emphasized the importance of gathering evidence, preparing a well-written appeal, submitting it on time, attending an appeal hearing if necessary, and potentially negotiating a settlement. These steps, combined with a professional and composed approach, increase your chances of achieving a fair resolution to your property assessment dispute.

We hope that this guide has provided valuable insights and guidance, helping you better understand the property assessment process and the necessary steps to challenge an unfair or inaccurate assessment. However, it is essential to remember that the information provided in this guide is for educational purposes only and should not substitute professional advice. If you require legal or tax assistance, it is highly recommended to consult with a qualified property attorney or tax consultant.

Now, armed with your newfound knowledge, go forth and advocate for the fairness and accuracy of your property assessment! Remember to gather evidence, prepare a strong appeal, and present your case confidently. With determination and persistence, you can successfully appeal your 2023 Colorado property assessment and achieve a favorable outcome.

Best of luck on your property assessment journey, and may your efforts result in a successful appeal!

Frequently Asked Questions about How To Appeal Your 2024 Colorado Property Assessment And Win

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Appeal Your 2024 Colorado Property Assessment And Win”