Home>Home Maintenance>How To Calculate Square Footage For Property Assessment Tax Purposes

Home Maintenance

How To Calculate Square Footage For Property Assessment Tax Purposes

Modified: March 6, 2024

Learn how to calculate square footage for property assessment tax purposes with our helpful guide. Ensure accuracy and save on your home-maintenance taxes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to our comprehensive guide on how to calculate square footage for property assessment tax purposes. Whether you own a residential or commercial property, accurately determining the square footage is essential for various reasons, including property valuation, rental rates, and property tax assessment. In this article, we will explain the importance of calculating square footage and provide you with different methods to help you accurately measure the size of your property.

Calculating square footage plays a crucial role in property assessment for taxation purposes. Property tax assessments are based on the value of the property, and one significant factor in determining its value is its size. Cities and counties often use the square footage of a property to calculate property taxes, as it helps them determine the fair market value of the property. Therefore, an accurate calculation of square footage ensures that you are not overpaying or underpaying your property taxes.

Moreover, understanding the square footage of your property is beneficial when it comes to property valuation. Whether you are planning to sell your property or refinance it, the square footage is a key metric used by real estate professionals and potential buyers to determine the property’s worth. Knowing the accurate square footage helps you price your property correctly and attract the right buyers.

In addition to property valuation and tax assessment, square footage calculations are essential when determining rental rates for residential or commercial properties. Landlords and property managers often use the square footage to determine the rental price per square foot, ensuring they are charging a fair rate that aligns with the property’s size.

Now that we understand the importance of correctly calculating square footage, let’s explore the different methods available to accurately measure the size of your property. Whether you choose to measure the exterior dimensions, the interior dimensions, or rely on an appraisal method, we will guide you through the process to ensure you arrive at an accurate square footage figure.

So, let’s dive in and learn how to calculate square footage for property assessment tax purposes!

Key Takeaways:

- Accurate square footage calculations are crucial for fair property taxes, proper valuation, and setting reasonable rental rates. Understanding the methods and considerations ensures transparency in property assessment.

- Whether using the exterior, interior, or appraisal method, it’s important to consider finished vs. unfinished areas, attached vs. detached spaces, and multi-level structures for accurate property assessment.

Read more: How To Calculate Attic Square Footage

Understanding Square Footage

Before we delve into the methods of calculating square footage for property assessment tax purposes, it’s important to have a clear understanding of what square footage actually means. In simple terms, square footage refers to the total measurement of a space in square feet. It is a unit of measurement used to quantify the size of a property or a specific area within a property.

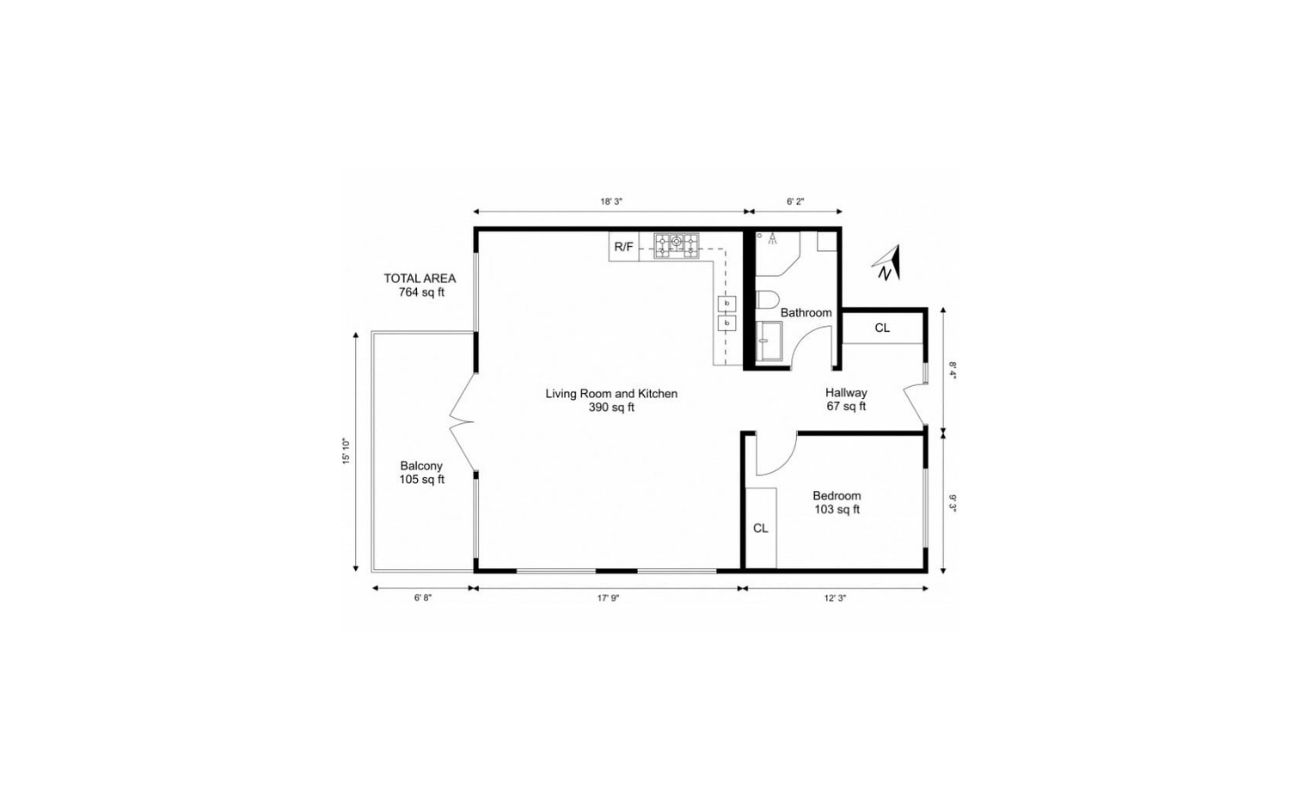

Square footage is calculated by multiplying the length of a room or area by its width. For example, if a room measures 10 feet in length and 12 feet in width, the square footage would be 120 square feet (10′ x 12′ = 120 sq ft).

It’s important to note that square footage calculations are typically based on the interior dimensions of a space. This means that walls, pillars, and other structural elements are included in the measurement. However, certain areas—such as garages, porches, and decks—may be excluded from the square footage calculation, depending on local building codes and assessment guidelines.

In addition to measuring the interior dimensions, it’s also essential to consider the height or ceiling height of a space. While square footage primarily refers to the floor area, the cubic footage—calculated by multiplying the length, width, and height of a space—can also be relevant in certain cases. This is especially true when assessing areas with tall or vaulted ceilings, such as atriums or multi-level spaces.

It’s worth mentioning that square footage can vary depending on different measurement standards followed in various regions. In the United States, square footage is typically measured in imperial units (feet and inches). However, some other countries may use metric units (such as square meters) for measuring the size of a property.

Having a solid understanding of square footage is essential as we move on to discuss its importance in property assessment tax purposes. By accurately determining the square footage of your property, you can ensure fair taxation, proper property valuation, and make informed decisions when it comes to buying, selling, or leasing real estate.

Importance of Calculating Square Footage for Property Assessment Tax Purposes

Calculating the square footage of a property accurately is of utmost importance for property assessment tax purposes. The square footage serves as a key factor in determining the value of a property for taxation and assessment purposes. Let’s explore why calculating square footage is crucial in this context:

Fair Property Tax Assessment: Property taxes are levied based on the assessed value of a property. The square footage of a property directly influences its assessed value, as larger properties are generally considered to be more valuable. By calculating the square footage accurately, property owners can ensure that their property taxes are fair and in line with the actual size and value of their property.

Accurate Property Valuation: Square footage is an essential component when determining the value of a property. Real estate professionals, appraisers, and potential buyers use square footage as a benchmark to evaluate the price of a property. Accurately calculating the square footage ensures that the property is priced correctly, resulting in a fair and realistic valuation.

Proper Rental Rate Determination: If you own a rental property, knowing the accurate square footage is crucial for setting rental rates. Rental rates are often determined based on the size of the property, measured in square footage. By calculating the square footage correctly, landlords can ensure that the rental rates are reasonable and in line with comparable properties in the market.

Compliance with Building Codes: Local building codes and regulations may have specific requirements for square footage calculations. For instance, certain structures such as garages, porches, or decks may not be included in the square footage calculation if they are not considered habitable spaces. Accurate square footage calculations ensure compliance with these codes, preventing any potential legal issues.

Equitable Property Assessments: Calculating square footage accurately ensures that properties are assessed fairly and equitably. Whether you own a residential or commercial property, precise square footage calculations prevent disparities in property assessments, promoting a fair and balanced tax system.

By understanding the importance of calculating square footage for property assessment tax purposes, property owners can take the necessary steps to ensure accurate measurements. This not only benefits them in terms of fair taxation and property valuation but also contributes to a more transparent and equitable property assessment system.

Methods for Calculating Square Footage

When it comes to calculating square footage for property assessment tax purposes, there are various methods you can use. The choice of method depends on the type of property, the available data, and the specific requirements of your local assessment authorities. Let’s explore three common methods for calculating square footage:

- Exterior Measurement Method: This method involves measuring the external walls of the property to determine its square footage. To calculate the square footage using this method, measure the length and width of the property’s external walls. Make sure to include all existing structures, such as bay windows, as part of the measurement. However, it’s important to note that this method typically includes the thickness of the external walls, so you may need to adjust for this factor.

- Interior Measurement Method: The interior measurement method involves measuring the dimensions of individual rooms and areas within the property and adding them together to calculate the total square footage. To use this method, measure the length and width of each room, including any nooks, alcoves, or irregularly shaped areas. Be sure to include all structural elements, such as walls, in the measurement. Once you have the measurements for each area, add them together to determine the total square footage of the property. It’s important to note that this method may not account for common areas or shared spaces, such as hallways or stairwells, which may need to be considered separately.

- Appraisal Method: The appraisal method involves relying on a professional property appraiser to determine the square footage. Appraisers use market value assessments, comparing your property to similar properties in the area to determine its worth. The square footage plays a significant role in this assessment, as properties of similar sizes tend to have similar values. While this method may be more subjective and dependent on the expertise of the appraiser, it can provide an accurate square footage based on current market conditions.

Each method has its advantages and considerations, and the choice of method may vary depending on the specific property and its purpose of assessment. It’s important to consult with local assessment authorities or professionals in the field to determine the most appropriate method for your situation.

Additionally, when calculating square footage, there are several relevant considerations to keep in mind, including:

- Finished vs. Unfinished Areas: Depending on local guidelines, the square footage calculation may include only finished areas, such as living spaces, bedrooms, and bathrooms, or it may include unfinished areas, such as basements or attics. Be sure to clarify which areas should be included in the square footage based on local regulations.

- Attached vs. Detached Spaces: If your property has attached or detached spaces, such as garages, workshops, or sheds, you may need to consider them separately when calculating square footage. These spaces may have different regulations or guidelines for inclusion in the overall square footage calculation.

- Multi-level Structures: For properties with multiple levels, the square footage of each level needs to be measured and accounted for. Take care to accurately measure each level’s dimensions and include them in the final calculation.

By utilizing the appropriate method for calculating square footage and considering these relevant factors, you can ensure an accurate assessment of the property’s size for taxation purposes. This, in turn, helps maintain fairness and consistency in property assessments for both property owners and local authorities.

Exterior Measurement Method

The exterior measurement method is one way to calculate the square footage of a property for assessment purposes. This method involves measuring the external walls of the property, taking into account any additional structures like porches and decks. Here’s how to use the exterior measurement method:

Measuring External Walls: To begin, measure the length and width of each exterior wall of the property. Use a tape measure and start from one corner of the wall and measure to the opposite corner. Repeat this process for each wall and record the measurements.

Including or Excluding Porches and Decks: When using the exterior measurement method, it’s important to determine whether porches and decks are included in the square footage calculation. Local building codes and assessment guidelines may have specific rules regarding the inclusion of these structures. In some cases, porches and decks may be included in the square footage calculation if they are enclosed, heated, and considered as habitable spaces. On the other hand, if they are open-air structures or not included in the heated living area, they may be excluded from the square footage calculation. Consult with local regulations or assessment authorities to determine whether to include or exclude these structures.

Once you have measured all the external walls and determined whether porches and decks are included, calculate the square footage by multiplying the length and width of each wall and summing up the measurements. Remember to account for any adjustments needed for the thickness of the external walls, as this method typically includes the wall thickness as part of the measurement.

The exterior measurement method is a convenient way to calculate square footage for assessment purposes, as it provides a comprehensive overview of the property’s size based on its external dimensions. However, it’s important to follow local regulations and guidelines to ensure accurate and compliant calculations.

Now that we’ve covered the exterior measurement method, let’s move on to the next method: the interior measurement method.

When calculating square footage for property assessment tax purposes, measure the length and width of each room, then multiply the two measurements together to get the square footage. Don’t forget to include any additional spaces like closets or hallways.

Interior Measurement Method

The interior measurement method is another approach to calculate the square footage of a property for assessment purposes. This method involves measuring the dimensions of individual rooms and areas within the property, taking into consideration whether to include or exclude certain structural elements. Here’s how to use the interior measurement method:

Measuring Room Dimensions: Begin by measuring the length and width of each room within the property. Use a tape measure and start from one corner of the room, measuring to the opposite corner. Be sure to measure the dimensions at the widest points of the room for accuracy. Repeat this process for each room and record the measurements.

Including or Excluding Structural Elements: When using the interior measurement method, it’s essential to determine which structural elements should be included or excluded in the square footage calculation. Generally, the interior measurement method includes all walls, including any protruding alcoves, bay windows, or other architectural features, in the square footage. However, certain structural elements, like non-habitable closets or spaces with low ceilings, may be excluded. Additionally, common areas such as hallways or staircases may also require separate consideration. Consult local regulations or assessment authorities to ensure compliance with specific guidelines.

Once you have measured the dimensions of each room and determined which structural elements to include or exclude, add up the square footage of each room to obtain the total interior square footage of the property. It’s worth noting that this method may not account for areas shared between multiple properties, such as hallways or entrances, which may be factored into the assessment separately.

The interior measurement method provides a more detailed breakdown of a property’s square footage by measuring individual rooms and areas. This method allows for better precision in determining the size of each livable space within the property, taking into account the shape and layout of the interior. However, it’s important to adhere to local guidelines and regulations when including or excluding structural elements.

Now that we have covered the interior measurement method, let’s move on to the next method: the appraisal method.

Appraisal Method

The appraisal method is a unique approach to calculating square footage that involves relying on a professional property appraiser to assess the market value of a property. This method takes into consideration the influence of square footage on the property’s value. Here’s how the appraisal method works:

Market Value Assessment: With the appraisal method, a professional property appraiser evaluates the property’s value based on various factors, including its square footage. The appraiser takes into account the current real estate market conditions, recent sales of comparable properties, and other relevant factors to determine the fair market value of the property. Square footage plays a significant role in this assessment because properties of similar sizes tend to have similar values.

Influence of Square Footage on Property Value: When applying the appraisal method, the appraiser considers the relationship between square footage and property value. Generally, larger properties with greater square footage tend to command higher prices in the real estate market. This is because larger properties offer more living space, more potential uses, and often have more amenities or features. By understanding the impact of square footage on property value, an appraiser can account for this factor when determining the market value of the property.

By utilizing the appraisal method, property owners can benefit from the expertise of a professional appraiser who has a deep understanding of the local real estate market. The appraiser will inspect the property, assess its size, and determine the square footage based on their knowledge and experience.

It’s important to note that the appraisal method is more subjective compared to the exterior or interior measurement methods. The value assessment relies on the appraiser’s judgment and expertise, considering various factors in addition to square footage. However, by engaging a qualified appraiser with knowledge of the local market, property owners can obtain a reliable and accurate square footage estimate for assessment purposes.

Now that we’ve covered the appraisal method, let’s move on to discussing some relevant considerations when calculating square footage for property assessment.

Relevant Considerations

When calculating square footage for property assessment, there are several relevant considerations to keep in mind. These factors help ensure accuracy and adherence to local regulations. Let’s explore some of the key considerations:

Finished vs. Unfinished Areas: When calculating square footage, it’s important to determine whether to include finished or unfinished areas. Finished areas typically include living spaces, such as bedrooms, bathrooms, kitchens, and living rooms. Unfinished areas, on the other hand, may consist of basements, attics, or storage areas that lack the necessary features for habitability. Depending on local regulations, you may need to exclude unfinished areas from the square footage calculation to maintain consistency and fairness.

Attached vs. Detached Spaces: If your property has attached or detached spaces, such as garages, workshops, or sheds, you should consider whether to include them in the square footage calculation. Attached spaces are directly connected to the main property, while detached spaces are separate structures on the property. The inclusion or exclusion of these spaces may be subject to local regulations and assessment guidelines. Consult with your local authorities to determine how to factor these spaces into the square footage calculation.

Multi-level Structures: For properties with multiple levels, it’s important to measure the square footage of each level and consider them when calculating the overall square footage. Measure the dimensions of each level separately, including any staircases or common areas. Take care to accurately measure each level’s dimensions and include them in the final calculation. Multi-level structures can add complexity to the square footage calculation, but it’s crucial to account for each level to ensure an accurate assessment.

By considering these factors, you can ensure a more accurate and comprehensive square footage calculation for property assessment purposes. Adhering to local regulations and guidelines helps maintain fairness and consistency in the assessment process, benefiting both property owners and assessment authorities.

Now that we’ve discussed the relevant considerations when calculating square footage, let’s move on to applying these calculations to property assessment.

Applying Square Footage Calculations to Property Assessment

Once you have determined the square footage of your property using the appropriate method and considered relevant factors, it’s time to apply these calculations to the property assessment process. Here’s how to effectively use square footage calculations for property assessment:

1. Consult Local Assessment Guidelines: Before submitting your square footage calculations to the assessment authorities, it’s crucial to consult the local guidelines and regulations. Each jurisdiction may have specific requirements regarding the calculation and reporting of square footage for property assessment. Make sure you understand these guidelines to ensure compliance and accuracy.

2. Prepare Documentation: Gather all relevant documentation that supports your square footage calculations. This includes measurements taken using the chosen method, photographs or sketches of the property, and any additional information requested by the assessment authorities. Having organized and documented information helps in the assessment process and provides a clear reference for any disputes or inquiries that may arise.

3. Submit the Information: Follow the designated process and submit your square footage calculations along with the necessary paperwork to the appropriate assessment authority. This may be a local government office, tax assessment department, or any other designated entity responsible for property assessment. Ensure that you meet all submission deadlines and provide accurate and complete information to facilitate a smooth assessment process.

4. Attend Assessments or Reviews: In some cases, you may be required to attend assessment meetings or reviews to present your square footage calculations and provide additional information if needed. Be prepared to answer any questions, provide clarifications, and address any concerns raised by the assessing authorities. Active participation in the assessment process can help ensure accurate and fair property valuation based on the square footage calculations.

5. Seek Professional Assistance if Needed: If you are unsure about the calculations or face challenges in determining the square footage, consider seeking professional assistance from appraisers, real estate agents, or surveyors who have expertise in property assessment. They can guide you through the process, help with accurate calculations, and ensure compliance with local regulations.

By following these steps and applying your square footage calculations to the property assessment process, you can contribute to a fair and transparent valuation of your property. Accurate square footage calculations help ensure that your property is assessed appropriately for taxation, property valuation, rental rates, and other relevant purposes.

Now that we’ve covered the application of square footage calculations to property assessment, let’s conclude our comprehensive guide.

Conclusion

Congratulations! You have now gained a comprehensive understanding of how to calculate square footage for property assessment tax purposes. We’ve explored different methods, including the exterior measurement method, interior measurement method, and appraisal method, each offering unique advantages depending on your specific needs and local regulations.

Calculating square footage accurately is essential for fair property tax assessment, proper property valuation, and setting reasonable rental rates. It ensures that property owners pay their fair share of taxes based on the assessed value of their properties and helps in determining the market value when buying, selling, or leasing real estate.

Throughout this guide, we’ve discussed important considerations when calculating square footage, such as distinguishing between finished and unfinished areas, considering attached and detached spaces, and accounting for multi-level structures. Adhering to local regulations and guidelines is crucial to maintaining consistency and fairness in the assessment process.

Remember to consult with your local assessment authorities and follow their guidelines when submitting your square footage calculations. Document your measurements and be prepared to attend assessment meetings or reviews if required. If you encounter any challenges or are unsure about the calculations, consider seeking assistance from professionals with expertise in property assessment.

Accurate square footage calculations help ensure transparency and fairness in property assessment and contribute to a balanced tax system. By understanding and applying these calculations correctly, you can navigate the assessment process with confidence and ensure that your property is valued accurately.

Thank you for joining us on this journey to learn about calculating square footage for property assessment tax purposes. We hope this guide has been informative and empowers you to make informed decisions regarding your property. As always, consult with local authorities and professionals for specific guidance in your area. Happy calculating!

Frequently Asked Questions about How To Calculate Square Footage For Property Assessment Tax Purposes

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Calculate Square Footage For Property Assessment Tax Purposes”