Home>Home Maintenance>How The New York State Rental Property Assessment Is Calculated

Home Maintenance

How The New York State Rental Property Assessment Is Calculated

Modified: March 24, 2024

Learn how the assessment for rental properties in New York State is calculated, and how it affects your home maintenance costs. Explore our comprehensive guide now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of home maintenance! Whether you’re a homeowner, a renter, or a real estate investor, maintaining your property is essential for creating a safe and comfortable living environment. And while many people are familiar with routine maintenance tasks like cleaning, painting, and fixing small repairs, there’s a lot more to keeping a home in optimal condition.

In this comprehensive guide, we will delve into the various aspects of home maintenance, covering everything from basic upkeep to more complex repairs. You’ll learn how to identify common issues, understand when to DIY (do-it-yourself) and when to call in a professional, and explore preventive measures to avoid costly repairs down the line.

We’ll start by discussing the importance of regular home maintenance and the benefits it brings. From preserving the value of your property to ensuring the health and safety of your family, there are numerous reasons why home maintenance should be a top priority.

We’ll then move on to different areas of the home, such as the exterior, interior, plumbing, electrical systems, and HVAC (heating, ventilation, and air conditioning). For each area, we’ll provide practical tips and guidelines, covering areas like cleaning, inspecting, troubleshooting, and repairing.

Throughout the guide, we’ll also tackle common maintenance myths and misconceptions, debunking them with accurate information and expert advice. This will help you make informed decisions and avoid wasting time and resources on unnecessary tasks.

In addition to basic maintenance, we’ll explore more specialized topics. For example, we’ll discuss how to create a comprehensive home maintenance schedule, allowing you to stay organized and plan your tasks effectively.

We’ll also provide insights into sustainable home maintenance practices, including energy-saving tips and eco-friendly solutions. By adopting these practices, you can reduce your environmental impact and lower your utility bills, all while maintaining the integrity and functionality of your home.

Finally, we’ll dive into the world of DIY home maintenance. From choosing the right tools and materials to following step-by-step instructions, we’ll equip you with the knowledge and skills needed to tackle various projects on your own. However, we’ll also stress the importance of knowing your limits and recognizing when it’s necessary to call in a professional.

So, whether you’re a homeowner looking to protect your investment, a renter wanting to keep your living space in top shape, or an aspiring real estate investor seeking insights into property maintenance, this guide is for you. Let’s embark on this journey together and unlock the secrets of effective home maintenance!

Key Takeaways:

- The New York State rental property assessment is based on the property’s potential rental income, location, size, and condition, affecting property taxes. Property owners should review and verify their assessment value for accuracy.

- Understanding rental property assessment factors, expenses, and revenues is crucial for property owners to make informed decisions and ensure profitability. Challenges such as market fluctuations and transparency issues should be addressed for fair assessments.

Overview of the New York State Rental Property Assessment

When it comes to owning rental properties in New York State, understanding the assessment process is crucial. The rental property assessment determines the value of your property for tax purposes, affecting the amount of property taxes you are required to pay each year. This assessment is conducted by the local tax assessor’s office and takes various factors into consideration.

The purpose of the assessment is to ensure that property taxes are distributed fairly among property owners. It is based on the premise that properties of similar value should carry a similar tax burden. In New York State, the rental property assessment is determined using an income-based approach, focusing on the property’s rental income potential.

In simpler terms, the assessment is calculated by estimating the value of the property based on its potential to generate rental income. This differs from the assessment of residential properties, which is primarily based on the property’s market value.

Property owners should be prepared for their assessment to change over time, as rental income potential can fluctuate due to various factors such as changes in market conditions, property improvements, or changes in rental rates.

It’s important to note that the rental property assessment is distinct from the property’s market value, which is determined by real estate market conditions and sales data. The assessment value may not reflect the current market value of the property, especially in a rapidly changing real estate market.

The assessment process for rental properties involves analyzing various data and calculations to arrive at a fair and accurate assessment value. This includes considering factors such as the property’s location, size, condition, and rental income history.

Additionally, the local tax assessor’s office may utilize rental income data from similar properties in the area to determine a fair market rent for the property being assessed. This ensures that the assessment is based on realistic rental income potential.

Once the assessment value is determined, it is multiplied by the local tax rate to calculate the property taxes owed. The tax rate is set by the local government and can vary from one municipality to another.

It’s important for rental property owners to review their assessment value and verify its accuracy. If you believe the assessment is incorrect, you may have the option to file an appeal with the tax assessor’s office. This typically involves providing supporting documentation and evidence to support your claim.

Overall, understanding the rental property assessment process in New York State is essential for rental property owners to ensure fair taxation. By knowing how the assessment value is calculated and being proactive in reviewing its accuracy, property owners can effectively manage their property taxes and potentially save money in the long run.

Factors Considered in the Assessment Calculation

When calculating the assessment value for rental properties in New York State, several factors are taken into consideration. These factors help determine the property’s rental income potential and, subsequently, its assessment value. Understanding these factors is important for property owners to grasp how their assessments are determined.

Location: The location of the rental property plays a significant role in its assessment calculation. Properties in desirable neighborhoods or areas with high demand for rentals generally have a higher rental income potential, thus leading to a higher assessment value.

Size and Condition: The size of the property, along with its condition and amenities, also affect the assessment. Larger properties with more bedrooms, bathrooms, and living spaces often command higher rental rates, leading to a higher assessment value. Additionally, well-maintained properties with updated features and attractive amenities may have a higher rental income potential, influencing the assessment value.

Rental Income History: The rental income history of the property is a significant factor in the assessment calculation. The assessor may review the property’s rental income records and consider the average rental income generated over a specific period. This helps estimate the property’s potential to generate future rental income and contributes to the assessment value.

Comparative Market Analysis: The local tax assessor’s office may conduct a comparative market analysis, comparing the rental income potential of the assessed property to similar properties in the area. This analysis ensures that the assessed value is based on realistic rental income potential and helps maintain fairness in the assessment process.

Market Conditions: Market conditions, such as supply and demand dynamics, can influence the assessment calculation. If the rental market in the area is experiencing high demand and low supply, rental rates may be higher, leading to a higher assessment value. Conversely, if the market is saturated with rental properties, rental rates may be lower, impacting the assessment value.

Property Expenses: While the assessment calculation primarily focuses on rental income potential, property expenses are also taken into account. The assessor may consider factors such as property taxes, insurance costs, and maintenance expenses when calculating the assessment value. These expenses help provide a more accurate reflection of the property’s true rental income potential.

Changes in Rental Rates: Changes in rental rates can impact the assessment value. If rental rates in the area have significantly increased or decreased, the assessor may adjust the assessment value accordingly to reflect the current market conditions.

It’s important to remember that these factors are not exhaustive, and the assessment calculation may involve additional considerations based on local regulations and specific property characteristics. Rental property owners should consult with their local tax assessor’s office for detailed information on how the assessment is calculated in their specific area.

By understanding the factors involved in the assessment calculation, rental property owners can gain insights into the assessment process and proactively manage their property taxes. Regularly reviewing the assessment value and ensuring its accuracy can help property owners avoid overpaying on property taxes and maintain fair taxation.

Determining the Rental Value of the Property

When it comes to rental properties, determining the rental value is a key step in setting the right price for your property and attracting potential tenants. The rental value is the amount you can reasonably charge for your property based on its features, location, and market conditions. Let’s explore the factors that are considered when determining the rental value of a property.

Market Research: Conducting market research is crucial in understanding the rental market in your area. This involves analyzing similar properties in your neighborhood to see what rental prices they are commanding. Look for properties that are comparable in size, location, amenities, and condition. This research will give you an idea of the prevailing rental rates in your area.

Location: The location of your property plays a significant role in determining its rental value. Properties in highly desirable neighborhoods, close to amenities such as schools, shopping centers, parks, and public transportation, tend to command higher rental prices. Factors like safety, proximity to employment opportunities, and the overall appeal of the neighborhood will impact the rental value.

Property Size and Amenities:Closely consider the size and layout of your property. Larger properties with more bedrooms, bathrooms, and living spaces generally command higher rental prices. The inclusion of desirable amenities, such as a garage, a backyard, or updated appliances, can also increase the rental value.

Property Condition: The condition of your property plays a crucial role in determining its rental value. Well-maintained properties with updated features, fresh paint, and minimal repairs needed will often attract higher rental prices. Ensure that your property is in good condition and address any necessary repairs or improvements before determining the rental value.

Market Demand and Supply: Consider the current demand and supply dynamics in the rental market. If there is high demand and limited rental properties available, you may be able to set a higher rental price. Conversely, if the supply of rental properties is greater than the demand, you may need to set a more competitive price to attract tenants.

Comparable Rentals: Analyzing similar rental properties in your area is essential. Look for properties with similar features and similar rental prices. This will help you gauge the market and set a competitive rental value for your property.

Consideration of Expenses: It’s essential to consider the expenses associated with owning and maintaining the rental property. Factor in costs such as property taxes, insurance, maintenance, and any HOA (Homeowners Association) fees. These expenses will impact the rental value you set to ensure a profitable return on your investment.

Reviewing Rental Policies: In order to set the right rental value, review the rental policies and regulations in your area. Familiarize yourself with any rent control laws, rent increase restrictions, or other regulations that may impact the amount you can charge for rent.

Consult Professionals: If you’re unsure about determining the rental value of your property, consider consulting professionals such as real estate agents or property managers who have expertise in the local rental market. They can provide valuable insights and help you set the appropriate rental price.

Remember, setting the right rental value is crucial for attracting good tenants and maximizing your rental income. By considering factors such as market research, property features, location, and market conditions, you can determine a rental value that is competitive, fair, and reflects the true worth of your property.

When calculating the assessment for rental properties in New York State, the assessor considers factors such as the property’s income, expenses, and market value. It’s important to keep detailed records of these to ensure an accurate assessment.

Adjustments for Property Expenses and Revenues

When managing a rental property, it’s important to consider both the expenses and revenues associated with it. Adjusting for these factors allows you to accurately assess the profitability of your investment and make informed decisions to maximize returns. Let’s explore the adjustments typically made for property expenses and revenues.

Property Expenses: Property expenses are the costs associated with owning and maintaining the rental property. These expenses can include property taxes, insurance, repairs and maintenance, property management fees, mortgage payments, utilities, and any other expenses directly related to the property. It’s crucial to account for these expenses when assessing the financial viability of your rental property.

Property Taxes: Property taxes vary depending on the location of the property and its assessed value. Property owners need to account for these taxes when calculating the profitability of their investment. It’s important to review your property tax assessment to ensure its accuracy and explore any potential tax deductions or exemptions that may apply to your situation.

Insurance: Property insurance is essential for protecting your investment. It covers damage to the property due to unforeseen events such as natural disasters or accidents. The cost of insurance premiums should be factored into your overall expenses.

Repairs and Maintenance: Routine repairs and maintenance are inevitable when owning a rental property. From plumbing issues to electrical repairs and general upkeep, these expenses can add up over time. It’s important to set aside a portion of your rental income for these ongoing expenses, as neglecting necessary repairs can lead to more costly issues down the line.

Property Management Fees: If you choose to hire a property management company to handle the day-to-day operations of your rental property, their fees should be factored into your expenses. Property management fees are typically a percentage of the monthly rental income and cover services such as tenant screening, rent collection, maintenance coordination, and legal compliance.

Mortgage Payments: If you have financed the purchase of your rental property with a mortgage, the monthly mortgage payment should be considered as an expense. This includes the principal amount and interest, along with any applicable escrow payments for property taxes and insurance.

Utilities: Depending on your rental agreement, you may be responsible for covering certain utilities for your tenants. These expenses, such as water, electricity, gas, or trash removal, should be factored into your overall expenses. If utilities are billed directly to the tenants, you may need to estimate an average monthly cost to account for any vacant periods.

Revenues: Revenues from your rental property primarily come from the rental income you receive from tenants. However, it’s important to consider other potential revenue streams as well. Here are some adjustments to consider for property revenues:

Vacancy Rate: Vacancy periods are common in rental properties, and it’s important to account for this when assessing revenues. Factor in an average vacancy rate or estimate the duration of vacant periods based on historical data. This adjustment will provide a more realistic picture of your rental income.

Additional Income: Apart from rental income, there may be other revenue sources associated with your property. This can include income from on-site laundry facilities, parking spaces, storage units, or any other services or amenities you offer tenants. These additional income streams should be factored into your overall revenues.

Projected Rent Increases: If you plan to increase the rental rates in the future, you can incorporate these projected rent increases into your revenue calculations. However, it’s important to assess the market conditions and legal restrictions that may impact your ability to raise the rent.

Adjustment for Seasonal Fluctuations: Some rental properties may experience seasonal fluctuations in demand and rental rates. If your property is situated in a location where rental demand varies throughout the year, you may need to make adjustments to your revenue projections accordingly.

By accurately accounting for both property expenses and revenues, you can gain a clear understanding of the financial performance of your rental property. This information will help you make informed decisions, set appropriate rental prices, and ensure the profitability of your investment.

Assessment Calculation Process

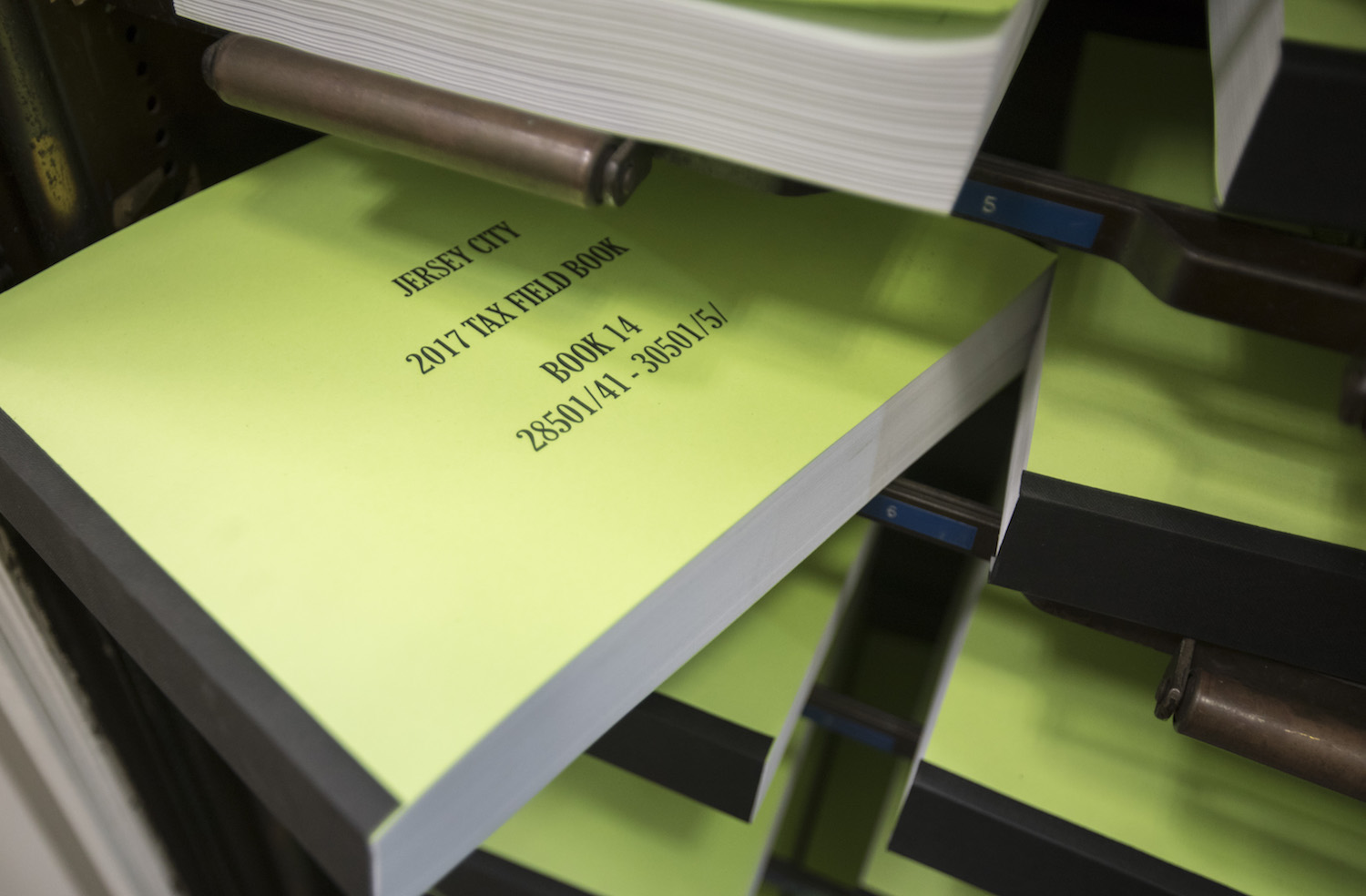

The assessment calculation process for rental properties in New York State involves several steps to determine the fair and accurate value for tax purposes. Understanding this process is essential for rental property owners to have transparency and confidence in their property assessments. Here’s a breakdown of the assessment calculation process:

Income Analysis: The assessment calculation primarily focuses on the income potential of the rental property. Tax assessors rely on income analysis to estimate the property’s rental income and determine its value. They take into account factors such as the number of rental units, historical rental income, and current rental rates in the area.

Gross Potential Income: The first step in the calculation process is determining the gross potential income (GPI) of the property. This involves estimating the total amount of rental income the property could generate if all units were occupied at market rental rates. The assessors may consider market research, rental surveys, and comparable property data to determine the GPI.

Effective Gross Income: From the gross potential income, adjustments are made to account for any vacancies or rental concessions that may affect the actual rental income. The resulting figure is known as the effective gross income (EGI), which reflects the property’s actual income potential.

Operating Expenses: The next step involves deducting the property’s operating expenses from the effective gross income. Operating expenses include costs such as property taxes, insurance, repairs and maintenance, property management fees, utilities, and other relevant expenses. These expenses are deducted to determine the net operating income (NOI) of the property.

Capitalization Rate: To convert the net operating income (NOI) into an estimated property value, assessors utilize a capitalization rate. The capitalization rate is a percentage that represents the rate of return an investor would expect from the property based on the NOI. The specific capitalization rate used can vary depending on factors such as property type, location, and market conditions.

Assessed Value: Once the capitalization rate is applied to the net operating income, the result is the estimated assessed value of the property. This value represents the property’s worth for tax assessment purposes.

Local Tax Rate: Lastly, the local tax rate is applied to the assessed value to determine the annual property tax owed. The local tax rate is set by the municipality in which the property is located.

It’s important to note that the rental property assessment calculation process may vary slightly across different municipalities within New York State. Local tax assessors may use additional factors or adjustments unique to their area. Additionally, changes in market conditions, property improvements, or other factors may result in periodic reassessments of the property’s value.

Rental property owners should review their assessments regularly and verify the accuracy of the data used in the calculation. If there are discrepancies or concerns about the assessment, property owners may have the option to file an appeal with the local tax assessor’s office.

Understanding the assessment calculation process empowers rental property owners to have a clearer picture of how their property’s value is determined for tax purposes. This knowledge allows owners to assess the fairness of their assessment and take appropriate steps to manage their tax obligations effectively.

Challenges and Controversies in the Assessment Calculation

The assessment calculation process for rental properties, like any system, is not without its challenges and controversies. Property owners, assessors, and even local communities may encounter issues that raise concerns about the fairness and accuracy of the assessment. Understanding these challenges can shed light on potential areas of improvement and lead to a more equitable assessment process. Here are some common challenges and controversies that can arise:

Market Fluctuations: One challenge in the assessment calculation is dealing with market fluctuations. Real estate markets can experience significant shifts in rental rates due to factors like changes in demand, economic conditions, or neighborhood development. These fluctuations may affect the accuracy of the assessment, as rental income potential can vary over time.

Gentrification: In areas experiencing gentrification, there can be disparities between the existing rental properties and newcomers’ high-end developments. Assessing rental properties accurately in such areas can be a challenge, as the income potential and market value of properties may differ greatly.

Comparable Property Data: The availability and accuracy of comparable property data can impact the assessment calculation. Assessors rely on data from similar properties to make fair assessments. However, if there is a lack of data or inconsistencies in the data available, it may affect the accuracy of the assessment value.

Disputes over Rental Income: Rental income, a crucial component of the assessment calculation, is sometimes a subject of disputes. Property owners may argue that the estimated rental income is too high or may provide evidence to support a higher or lower income potential. Resolving such disputes can be challenging and may require thorough examination of rental records and market data.

Assessor’s Subjectivity: Assessors play a crucial role in the assessment process, but their subjectivity can sometimes be a point of concern. Different assessors may have varying approaches to assessing rental properties, which can lead to inconsistencies in the assessments. Ensuring standardized guidelines and training for assessors can help mitigate this challenge.

Assessment Appeals: Property owners have the right to appeal their assessments if they believe the calculated value is incorrect. The review and appeals process can add complexity and potential delays to the assessment calculation, as each appeal needs to be considered and resolved on an individual basis.

Transparency and Communication: Lack of transparency and effective communication can contribute to controversies in the assessment calculation. Property owners may feel uninformed about the assessment process or have difficulty understanding the factors that influence their property’s value. Better communication and transparency can help address these concerns and build trust among property owners.

Legislation and Legal Challenges: Challenges may also arise due to changes in legislation or legal disputes regarding assessment practices. Tax laws, exemptions, or changes in regulations can impact the assessment calculation, leading to potential controversies or legal challenges.

Efforts to address these challenges and controversies include regular assessment reviews, standardized assessment methodologies, clear guidelines for assessors, and improved communication between assessors and property owners. Ongoing discussions and collaborations between stakeholders can further refine the assessment process and promote fairness and accuracy in property assessments.

By acknowledging and addressing the challenges and controversies in the assessment calculation, local governments and tax assessors can strive for a more equitable, transparent, and effective system that accurately reflects the rental income potential and value of properties.

Conclusion

Understanding the assessment calculation process for rental properties in New York State is crucial for property owners to navigate the world of property taxation effectively. The assessment takes into account factors such as rental income potential, property expenses, market conditions, and location to determine a fair and accurate value for tax purposes.

Throughout this guide, we have explored the different aspects of the assessment calculation, including an overview of the process, the factors considered, and the challenges and controversies that can arise. By delving into these topics, we aimed to provide property owners with a comprehensive understanding of how their assessments are determined and the factors influencing their property’s value.

It’s important for property owners to stay informed and proactive in managing their property assessments. Regularly reviewing the assessment value, verifying its accuracy, and addressing any concerns or disputes through the appropriate channels can ensure fair taxation and promote transparency in the assessment process.

Additionally, understanding the rental value of your property, adjusting for expenses and revenues, and conducting market research can help you set appropriate rental prices and maximize the financial return on your investment. By carefully managing your property’s income and expenses, you can optimize profitability and make informed decisions about your rental property.

Lastly, it’s essential to stay aware of the challenges and controversies that can arise in the assessment calculation process. Market fluctuations, disputes over rental income, subjectivity of assessors, and concerns about transparency and communication are just a few examples. By addressing these challenges and seeking improvements in the assessment process, governments and assessors can promote fairness and accuracy in property assessments, ultimately benefiting all parties involved.

As a property owner, staying educated and informed about the assessment calculation process will empower you to confidently navigate the world of property taxation, effectively manage your property’s value, and ensure fair treatment. By embracing a proactive approach, you can make informed decisions, maximize profitability, and protect your investment for years to come.

Frequently Asked Questions about How The New York State Rental Property Assessment Is Calculated

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How The New York State Rental Property Assessment Is Calculated”