Home>Home Security and Surveillance>How Do I Report Home Security To Travelers Insurance

Home Security and Surveillance

How Do I Report Home Security To Travelers Insurance

Modified: March 6, 2024

Get peace of mind with Travelers Insurance. Learn how to report your home security and surveillance systems to ensure proper coverage for your property.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

When it comes to protecting your home, having a comprehensive home security system in place is crucial. Not only does it provide peace of mind, but it can also help lower your home insurance premiums. However, unfortunate events can still occur, and if you face a break-in, vandalism, or other security-related incidents, it’s essential to report them to your insurance provider.

In this article, we will guide you through the process of reporting home security incidents to Travelers Insurance. With their robust coverage options and reliable customer service, Travelers Insurance is a leading provider for homeowners insurance.

By promptly reporting home security incidents to Travelers Insurance, you can ensure a smooth claims process and receive the compensation you deserve. So, let’s dive into the steps involved in reporting home security incidents to Travelers Insurance.

Key Takeaways:

- Review your policy, gather documentation, and promptly report any home security incidents to Travelers Insurance to ensure a smooth claims process and fair compensation for your losses.

- Cooperate with the insurer’s investigation, follow up on your claim’s progress, and carefully assess the final settlement offer to maximize your chances of a favorable outcome with Travelers Insurance.

Step 1: Review Your Policy

Before filing a claim for a home security incident with Travelers Insurance, it’s crucial to review your policy to understand the coverage and exclusions. Familiarize yourself with the terms and conditions of your policy, including the deductible, limits, and any specific requirements for reporting claims.

Take the time to carefully read through your policy documentation, including the declarations page, coverage details, and endorsements. This will help you determine the extent of your coverage and ensure that the incident you’re reporting is covered.

If you have any questions or concerns regarding your policy, it’s always a good idea to contact Travelers Insurance directly. They have a team of knowledgeable agents who can provide clarification and address any queries you may have.

During the policy review process, make note of important information such as your policy number, effective dates, and contact information for your agent or claims department. Having this information readily available will streamline the claims process and ensure effective communication with Travelers Insurance.

Additionally, it’s worth noting any specific documentation and evidence requirements specified in your policy. This could include photographs, police reports, or invoices for repairs. Being aware of these requirements beforehand will help you gather the necessary documentation efficiently.

By thoroughly reviewing your policy, you’ll have a clear understanding of your coverage and what to expect during the claims process. This will ensure a smoother experience when reporting a home security incident to Travelers Insurance.

Step 2: Gather Documentation

Once you have reviewed your policy and confirmed that the home security incident is covered, the next step is to gather all the necessary documentation to support your claim. Having proper documentation is crucial to validate your claim and ensure a smooth claims process with Travelers Insurance.

Here are some essential documents and evidence you should gather:

- Police Report: If you have filed a report with the local police department, obtain a copy of the report. This report will serve as evidence of the incident and provide details that can support your claim.

- Photographic Evidence: Take detailed photographs of the damage or any items that were stolen or vandalized. Ensure that the photographs are clear and accurately capture the extent of the loss or damage.

- Receipts and Proof of Ownership: Gather receipts, invoices, or any other documentation that proves the value of the stolen or damaged items. This could include purchase receipts, appraisals, or warranty information. Having proof of ownership will strengthen your claim and help accurately assess the value of the loss.

- Video Surveillance Footage: If you have a home security system with video surveillance, gather any relevant footage that captures the incident. This footage can serve as crucial evidence supporting your claim.

- Repair and Replacement Estimates: Obtain estimates from reputable contractors or repair companies for the cost of repairing or replacing any damaged property. These estimates will help determine the financial loss you have incurred.

Ensure that all your documentation is organized and easily accessible. It’s also a good idea to make copies of all the documents so that you have backups in case any are misplaced or lost.

By gathering and organizing all the necessary documentation, you will be well-prepared to present a strong case to Travelers Insurance when reporting your home security incident. This will help expedite the claims process and increase the likelihood of a successful claim settlement.

Step 3: Contact Travelers Insurance

After reviewing your policy and gathering all the necessary documentation, it’s time to contact Travelers Insurance to report your home security incident. Promptly notifying your insurance provider is crucial to ensure a smooth claims process and receive the necessary guidance.

Here are the steps to contact Travelers Insurance:

- Locate your policy number and contact information for Travelers Insurance. This information can typically be found on your policy documents or their website.

- Call the designated claims phone number provided by Travelers Insurance. It’s essential to report the incident as soon as possible to initiate the claims process.

- When speaking with a representative, provide them with accurate information about the home security incident. Be prepared to provide details such as the date and time of the incident, a description of what happened, and any injuries sustained.

- Inform the representative that you have gathered the necessary documentation and evidence to support your claim. They will guide you on the next steps and provide any additional information or forms that need to be completed.

- Take note of the claim reference number and the name of the representative you spoke with for future reference. This will make it easier to track the progress of your claim.

Travelers Insurance is known for their excellent customer service, so don’t hesitate to ask any questions or express any concerns you may have. They are there to assist you throughout the claims process and provide guidance on the necessary steps to take.

Remember, it’s crucial to report the home security incident as soon as possible to Travelers Insurance. The earlier you report the incident, the sooner they can initiate the investigation and start processing your claim.

Step 4: File a Claim

After contacting Travelers Insurance and providing them with the details of your home security incident, the next step is to file a formal claim. Filing a claim is an important part of the process, as it officially notifies your insurance provider that you are seeking coverage for the loss or damage you have experienced.

Here are the steps to file a claim with Travelers Insurance:

- Complete the necessary claim forms: Travelers Insurance may require you to complete specific claim forms that gather detailed information about the incident. These forms can often be obtained from their website or through their claims department. Fill out the forms accurately and provide all the requested details.

- Submit the completed claim forms: Once you have filled out the necessary forms, submit them to Travelers Insurance as instructed. You can typically submit the forms electronically or via mail, depending on their preferred method.

- Include all supporting documentation: Along with the claim forms, include all the supporting documentation you gathered in Step 2. This includes the police report, photographs, receipts, and any other evidence that strengthens your claim.

- Provide accurate information: When completing the claim forms, ensure that all the information you provide is accurate and consistent with the supporting documentation. Any discrepancies or inconsistencies may delay the claims process.

It’s important to adhere to any specific guidelines or requirements outlined by Travelers Insurance when filing your claim. This will ensure that your claim is processed efficiently and reduces the chances of any unnecessary delays.

Once you have filed your claim, Travelers Insurance will review the information provided, assess the situation, and begin their investigation. They may assign a claims adjuster to your case who will evaluate the damages and work with you to determine an appropriate settlement amount.

Throughout the claims process, it’s essential to maintain open and regular communication with Travelers Insurance to stay informed about the progress of your claim and provide any additional information required. Keeping accurate records of all communication with Travelers Insurance will also be helpful in case you need to reference any discussions or agreements.

By filing a claim with Travelers Insurance, you are taking the necessary steps to seek compensation for the losses or damages you have experienced due to the home security incident. Stay proactive and engaged throughout the process to ensure a fair and efficient claim settlement.

When reporting home security to Travelers Insurance, make sure to document all security measures such as alarms, deadbolts, and security cameras. This can help lower your insurance premiums.

Step 5: Provide Necessary Information

Once you have filed a claim with Travelers Insurance, it’s important to provide any additional information or documentation that may be requested by the insurance company. This step ensures that your claim is thoroughly evaluated and helps facilitate the claims process.

Here are some important points to consider when providing necessary information to Travelers Insurance:

- Respond promptly to requests: Travelers Insurance may need additional information to assess your claim. It’s crucial to respond to their requests in a timely manner to avoid any unnecessary delays in the claims process. Follow any instructions provided by the claims adjuster or representative and provide the requested information or documentation as soon as possible.

- Be thorough and accurate: When providing information or documentation, be thorough and accurate. Double-check all the details to ensure accuracy before submitting them to Travelers Insurance. Inaccurate or incomplete information may lead to delays or complications in the claims process.

- Keep copies of all submitted documents: It’s important to keep copies of all documents, forms, and correspondence related to your claim. This will serve as proof of the information you provided and will be useful in case any discrepancies arise in the future.

- Maintain open communication: Throughout the claims process, maintain open communication with Travelers Insurance. If you have any questions or concerns, don’t hesitate to reach out to your claims adjuster or the customer service department. Clear and constant communication will help ensure that all necessary information is provided and that you stay informed about the progress of your claim.

- Follow any additional instructions: Travelers Insurance may provide specific instructions regarding the submission of information or documentation. It’s essential to follow these instructions carefully to meet their requirements and facilitate the evaluation of your claim.

By providing the necessary information requested by Travelers Insurance, you are supporting the evaluation of your claim and helping expedite the claims process. Remember to stay proactive, organized, and responsive to ensure a smooth experience and a timely settlement of your claim.

Step 6: Cooperate with Insurer’s Investigation

After filing a claim with Travelers Insurance, they will initiate an investigation to assess the validity and extent of your home security incident. It is important to cooperate fully with the insurer’s investigation to ensure a fair evaluation of your claim and to support the timely resolution of your case.

Here are some key points to keep in mind when cooperating with the insurer’s investigation:

- Provide accurate and detailed information: During the investigation, Travelers Insurance may ask for additional information or clarification regarding your claim. Be honest and provide accurate details about the incident to the best of your knowledge. This will help the insurer understand the circumstances surrounding the case and make an informed decision.

- Comply with requests for documentation: If the insurer requests further documentation, such as financial records, proof of ownership, or repair estimates, make sure to provide these promptly. This documentation will support your claim and assist Travelers Insurance in assessing the extent of your losses.

- Cooperate with any inspections or interviews: Depending on the nature of the incident, Travelers Insurance may conduct inspections or interviews to gather more information. Cooperate fully with these processes, allowing access to your property or answering questions truthfully. This will aid in the investigation and help reach a resolution for your claim.

- Keep records of all interaction: Throughout the investigation, maintain a record of all communication with Travelers Insurance. This includes the names of any representatives you speak with, dates and times of conversations, and summaries of what was discussed. Having this information readily available will help provide clarity and serve as a reference if needed in the future.

- Stay responsive: Respond promptly to any inquiries or requests from Travelers Insurance. Timely communication and cooperation will help expedite the investigation and ensure a prompt resolution of your claim.

Remember, cooperating with Travelers Insurance’s investigation is essential to demonstrate the validity of your claim and facilitate a fair settlement process. By providing accurate information, complying with requests for documentation, and engaging in open communication, you can contribute to a smooth and efficient resolution of your home security claim.

Step 7: Follow Up and Track Claim Progress

Once you have filed a claim and cooperated with the insurer’s investigation, it’s important to stay proactive and follow up on the progress of your claim with Travelers Insurance. By doing so, you can ensure that your claim is being processed in a timely manner and address any concerns or issues that may arise. Here are some key steps to follow up and track the progress of your claim:

- Document claim details: Keep all documents related to your claim organized in one place. This includes claim forms, receipts, correspondence, and any other relevant information. Having all the necessary documents readily available will make it easier to reference and provide accurate information when following up.

- Establish a point of contact: Identify a specific representative or claims adjuster at Travelers Insurance who is handling your claim. This will allow for a more direct and efficient line of communication. Make note of their name, contact information, and any reference numbers associated with your claim.

- Follow up regularly:Reach out to the designated representative periodically to inquire about the status of your claim. Be respectful of their time, but also be proactive in seeking updates to stay informed. You can ask questions about the progress, any additional information needed, or anticipated timelines for resolution.

- Maintain a record of communication: Keep a log of all conversations and correspondence you have with Travelers Insurance regarding your claim. Document the date, time, and details of each communication to have a clear record of discussions and agreements.

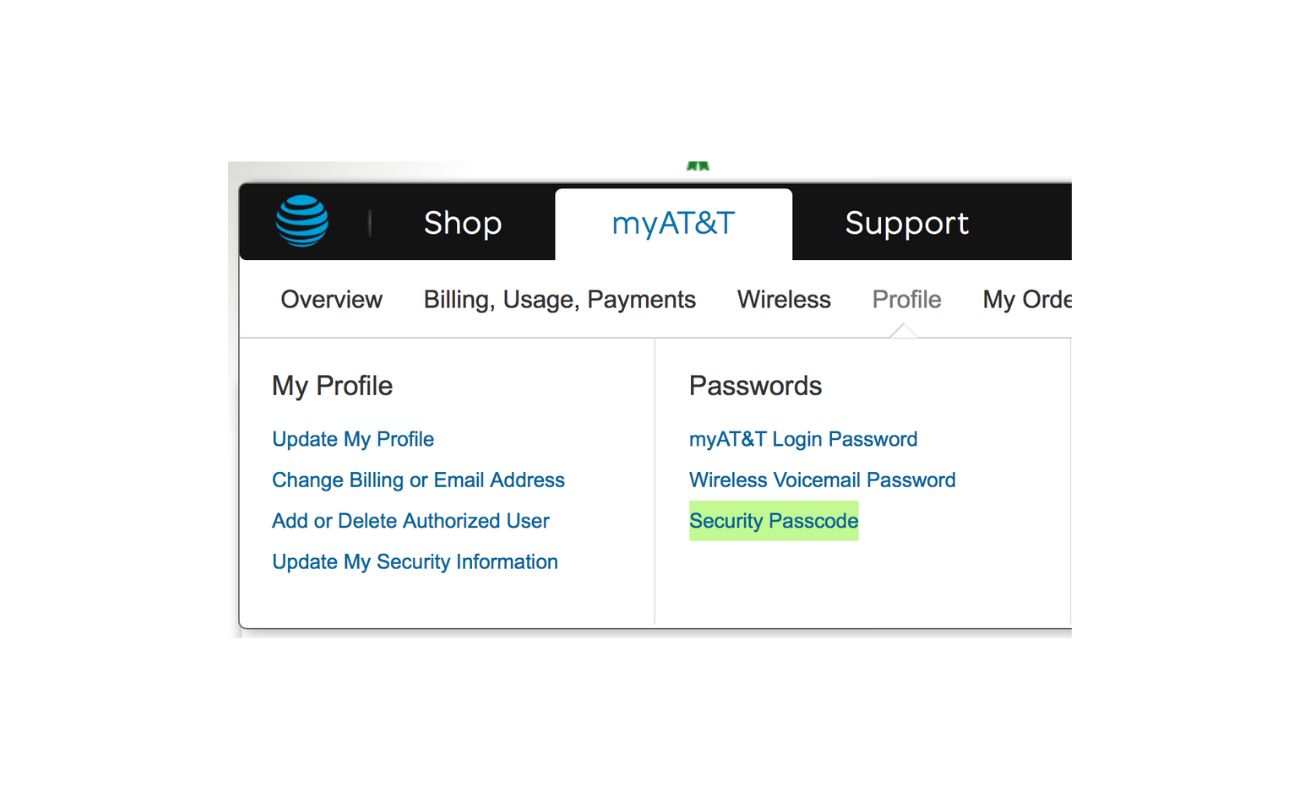

- Utilize online tools: Many insurance companies, including Travelers Insurance, offer online portals or mobile apps that allow you to track the progress of your claim. Take advantage of these tools to monitor updates, view any pending requests or documentation needed, and access important claim-related information.

- Escalate if necessary: If you encounter any challenges or delays in the processing of your claim, escalate the matter to a supervisor or higher-level representative at Travelers Insurance. Be prepared to provide detailed information about the issue and any steps taken to resolve it. Escalating the matter can often help expedite the resolution of any outstanding concerns.

By actively following up and tracking the progress of your claim, you can stay informed about its status and ensure that it is being handled efficiently by Travelers Insurance. Regular communication and record-keeping will give you peace of mind and enable you to take appropriate action if any issues arise during the claims process.

Step 8: Assess the Final Settlement

After going through the claims process with Travelers Insurance, you will receive a final settlement offer for your home security incident. It’s important to carefully assess the settlement to ensure that it adequately compensates you for the losses you have incurred.

Here are some key points to consider when assessing the final settlement:

- Review the settlement offer: Carefully evaluate the settlement offer provided by Travelers Insurance. Take note of the amount being offered and compare it to the extent of your losses and the coverage outlined in your insurance policy.

- Consider the deductible: Take into account the deductible specified in your policy. The deductible is the amount you are responsible for paying before your insurance coverage applies. Ensure that the deductible has been appropriately factored into the settlement amount.

- Assess the coverage limits: Confirm that the settlement offer does not exceed the maximum coverage limits stated in your policy. If it does, question the insurer to understand the reasoning behind the decision.

- Consult with a professional if needed: If you have any concerns about the settlement offer or feel that it may not adequately compensate you for your losses, consider consulting with a public adjuster or an attorney who specializes in insurance claims. They can provide expert advice and guidance regarding your options.

- Understand the terms and conditions: Ensure that you fully understand the terms and conditions of the settlement offer. Take note of any additional requirements or obligations you may have after accepting the settlement.

- Negotiate if necessary: If you believe that the settlement offer is insufficient, you can negotiate with Travelers Insurance. Provide them with any additional documentation or evidence that supports your argument for a higher settlement amount.

- Make a decision: Based on your assessment, make a decision on whether to accept or reject the settlement offer. Consider the potential benefits of accepting the offer, such as a timely resolution, versus the potential risks and costs of pursuing further action.

- Communicate your decision: Once you have made a decision, communicate it to Travelers Insurance promptly. If you accept the settlement, follow any instructions provided to finalize the claim. If you reject the offer, clearly articulate your reasons and explore other options available to you.

Assessing the final settlement offered by Travelers Insurance is a crucial step in the claims process. Take the time to carefully evaluate the offer and consider seeking professional advice if needed. By making an informed decision, you can ensure that you receive fair compensation for your home security incident.

Conclusion

Reporting a home security incident to Travelers Insurance requires careful attention to detail and adherence to the proper steps. By following the outlined process, you can ensure a smooth claims experience, efficient communication with the insurance provider, and a fair settlement for your losses. Here’s a recap of the steps:

- Review Your Policy: Familiarize yourself with your coverage, exclusions, and reporting requirements.

- Gather Documentation: Collect all necessary documentation, including police reports, photographs, receipts, and repair estimates.

- Contact Travelers Insurance: Report the incident and provide accurate information to initiate the claims process.

- File a Claim: Complete claim forms and submit them along with the necessary documentation.

- Provide Necessary Information: Respond promptly to requests for additional information or documentation from Travelers Insurance.

- Cooperate with Insurer’s Investigation: Be honest, provide accurate information, and comply with any inspections or interviews.

- Follow Up and Track Claim Progress: Maintain open communication with Travelers Insurance, document conversations, and utilize online tools to track the progress of your claim.

- Assess the Final Settlement: Carefully review the settlement offer, consider deductibles and coverage limits, and consult professionals if needed before making a decision.

Remember, thorough preparation, timely reporting, and active participation throughout the process will help ensure a favorable outcome. By following these steps, you increase your chances of receiving fair compensation for your home security incident.

While it is always essential to safeguard your home and prevent security incidents, it’s comforting to know that Travelers Insurance is there to support you in case of unexpected events. Trust in their expertise and rely on their customer service to guide you through the claims process successfully.

By taking the necessary steps and being proactive in reporting your home security incident, you can navigate the claims process with Travelers Insurance efficiently, protecting your home and securing the compensation you rightfully deserve.

Frequently Asked Questions about How Do I Report Home Security To Travelers Insurance

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.