Articles

How To Store Receipts For Business

Modified: January 5, 2024

Learn the best methods for storing receipts in your business with our informative articles. Simplify your record-keeping process and stay organized.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Proper receipt storage is an essential aspect of managing a business efficiently. It not only ensures that you have the necessary records for internal purposes but is also crucial for tax compliance and potential audits. Saving and organizing receipts in a systematic manner can save you time and effort when it comes to reconciling expenses, tracking deductions, and presenting accurate financial statements.

In this article, we will delve into the importance of proper receipt storage for businesses and explore various methods to effectively store and manage receipts. Whether you prefer digital solutions or physical storage options, we will provide valuable insights and tips to optimize your receipt storage process.

So, let’s dive in and discover how you can streamline your receipt storage system for greater efficiency and peace of mind.

Key Takeaways:

- Proper receipt storage is crucial for tax compliance, expense tracking, and audit preparedness. Whether digital or physical, organized receipt storage saves time and ensures accurate financial records.

- Efficient receipt storage involves categorization, consistent maintenance, and backup protocols. Digital solutions offer convenience, while physical storage requires diligent organization and regular purging.

Read more: How To Store Business Receipts

Importance of Proper Receipt Storage

Proper receipt storage is not only beneficial for your business’s financial records but also plays a crucial role in several other aspects. Let’s explore the key reasons why it is important to give due attention to your receipt storage system:

- Tax Compliance: When it comes to filing your business taxes, having accurate and organized receipts is essential. Receipts serve as evidence of expenses incurred, which can be used to claim deductions and credits. Without proper documentation, you may miss out on potential tax savings or, worse, attract the attention of tax authorities during an audit.

- Audit Preparedness: Audits, although rare, can happen to any business. If you keep your receipts organized and easily accessible, you can avoid unnecessary stress and delays in the audit process. Having a clear trail of documented receipts gives credibility to your financial statements and demonstrates your commitment to accurate record-keeping.

- Expense Tracking: Efficient receipt storage enables you to track and categorize your business expenses effectively. By organizing receipts according to expense categories, you can gain valuable insights into your spending patterns, identify areas of overspending, and make informed decisions to optimize your budget.

- Budgeting and Forecasting: Receipt storage plays a vital role in budgeting and forecasting. By analyzing your expense receipts, you can estimate future spending, set realistic financial goals, and make informed projections about your business’s financial health. This can help you identify areas where you need to cut costs or invest more strategically.

- Proof of Transactions: Receipts serve as tangible evidence of business transactions. They provide proof of purchase and can be used to resolve disputes with vendors, suppliers, or customers. Additionally, having well-organized receipts can help you keep track of warranties, return policies, and other important details related to your purchases.

As you can see, proper receipt storage is not a mere administrative task but a critical component of your business’s financial management. It helps you stay compliant, ensures accurate record-keeping, and provides valuable insights to make informed decisions. Now that we understand the importance of receipt storage, let’s explore the different types of receipts you should keep for your business.

Types of Receipts to Keep for Business

Receipts come in various forms and serve different purposes for your business. Understanding which receipts to keep and their significance is crucial for maintaining accurate financial records. Here are some key types of receipts that you should prioritize storing:

- Purchase Receipts: These are perhaps the most common and important receipts to keep. They document your business’s purchases, whether it’s office supplies, equipment, inventory, or services. Purchase receipts provide valuable information such as the date of purchase, item description, price, and vendor details.

- Sales Receipts: If your business sells products or services directly to customers, it’s essential to retain sales receipts. These receipts provide evidence of your sales transactions, including the date, customer details, items or services sold, quantities, prices, and payment methods. Sales receipts are crucial for revenue tracking and customer dispute resolution.

- Expense Receipts: Expense receipts cover any expenses incurred by your business, such as travel, meals, utilities, rent, advertising, and professional services. These receipts should include details such as the date, vendor name, item description, cost, and payment method. Expense receipts are essential for accurate bookkeeping and claiming deductions during tax filing.

- Receipts for Business Investments: If you invest in assets or capital equipment for your business, it’s important to retain receipts for these transactions. These receipts serve as proof of your investment and are necessary for depreciation calculations, determining the value of assets, and potential future sales or write-offs.

- Receipts for Vendor Payments: It’s crucial to keep receipts for payments made to vendors, suppliers, or contractors. These receipts should include details such as the payment amount, payment date, recipient’s name, and a brief description of the payment purpose. Retaining these receipts helps you maintain accurate accounts payable records and ensures transparency in your financial dealings.

Remember, the specific types of receipts you need to store may vary based on your business’s industry, legal requirements, and specific expense categories. It’s always a good idea to consult with a financial advisor or tax professional for guidance on the types of receipts relevant to your business.

Now that we’ve discussed the types of receipts that are important to keep, let’s move on to organizing and sorting these receipts for easy access and retrieval when needed.

Organizing and Sorting Receipts

Once you’ve gathered the necessary receipts for your business, organizing and sorting them systematically is key to maintaining an efficient and streamlined record-keeping process. Here are some tips to effectively organize and sort your receipts:

- Receipt Categorization: Start by categorizing your receipts based on expense types, such as office supplies, utilities, travel, or marketing. Create folders or digital folders for each category to ensure easy sorting and retrieval.

- Date Order: Arrange your receipts chronologically by the date of purchase. This helps you track your expenses over time and provides a clear timeline of your financial transactions.

- Digital vs. Physical Organization: Choose the method that works best for you: digital or physical receipt organization. Digital organization involves scanning and storing receipts on your computer or using cloud-based applications, while physical organization uses folders, binders, or filing cabinets to store paper receipts.

- Naming Conventions: If you opt for digital receipt storage, develop a consistent naming convention for your files. This could include the vendor name, date, and a brief description of the expense. Standardizing file names ensures easy searchability and retrieval in the future.

- Backup and Security: For digital receipt storage, ensure you have proper backup systems in place to protect your data from loss or corruption. Regularly backup your digital files on external hard drives, cloud storage, or a combination of both.

- Separate Personal and Business Expenses: Keep your personal and business expenses separate. It’s vital for good record-keeping and makes it easier to track deductible business expenses during tax season.

- Color-Coding: Consider color-coding your physical folders or digital files to further enhance organization and quick identification of different expense categories.

- Regular Maintenance: Set aside dedicated time each month to review and organize your receipts. This helps prevent a backlog of receipts and ensures your records are up-to-date and accurate.

Remember, the key to effective organization is consistency and discipline. Develop a system that works best for your business and stick to it. By implementing these strategies, you’ll save time and effort when retrieving receipts for financial reporting, audits, or tax purposes.

Now that we’ve explored organizing and sorting receipts, let’s move on to explore digital receipt storage solutions.

Scan and digitize your receipts using a mobile app or scanner. Organize them in digital folders by date or category for easy access and retrieval.

Digital Receipt Storage Solutions

In today’s digital age, many businesses are opting for digital receipt storage solutions. These solutions offer numerous advantages, including convenience, accessibility, and space-saving capabilities. Here are some popular digital receipt storage options:

- Cloud Storage Platforms: Cloud storage platforms like Google Drive, Dropbox, and OneDrive enable you to store and access your digital receipts securely from anywhere with an internet connection. Create folders for different expense categories and upload scanned or digitally generated receipts to the appropriate folder.

- Expense Management Software: Utilizing expense management software, such as Expensify or QuickBooks, provides a comprehensive platform for organizing and storing digital receipts. These tools often come with features like receipt scanning, expense categorization, and integration with accounting software.

- Receipt Scanning Apps: Mobile apps like Adobe Scan, Evernote Scannable, and CamScanner allow you to capture and digitize paper receipts using your smartphone’s camera. These apps use optical character recognition (OCR) technology to extract important information from the receipts and store them digitally.

- Email and Digital Receipt Services: Many online retailers and service providers offer the option to receive receipts via email or provide digital receipts directly through their platforms. Take advantage of these digital options whenever available to minimize the need for physical receipt storage.

- Accounting Software: If you already use accounting software like QuickBooks, Xero, or FreshBooks, these platforms typically offer receipt storage capabilities. You can attach scanned or digital receipts directly to corresponding transactions in your accounting software, ensuring all related documentation is in one place.

When using digital receipt storage solutions, it’s important to follow proper backup protocols and ensure the security of your digital files. Regularly back up your digital receipts to external drives or other cloud storage services to prevent data loss. Additionally, implement appropriate security measures such as strong passwords and two-factor authentication to protect your sensitive financial information.

Now that we’ve explored digital receipt storage solutions, let’s move on to discuss physical receipt storage options for those who prefer a more traditional approach.

Read more: How To Organize Receipts For Business

Physical Receipt Storage Solutions

While digital receipt storage is gaining popularity, some businesses still prefer to have physical copies of their receipts. If you fall into this category, here are some physical receipt storage solutions to consider:

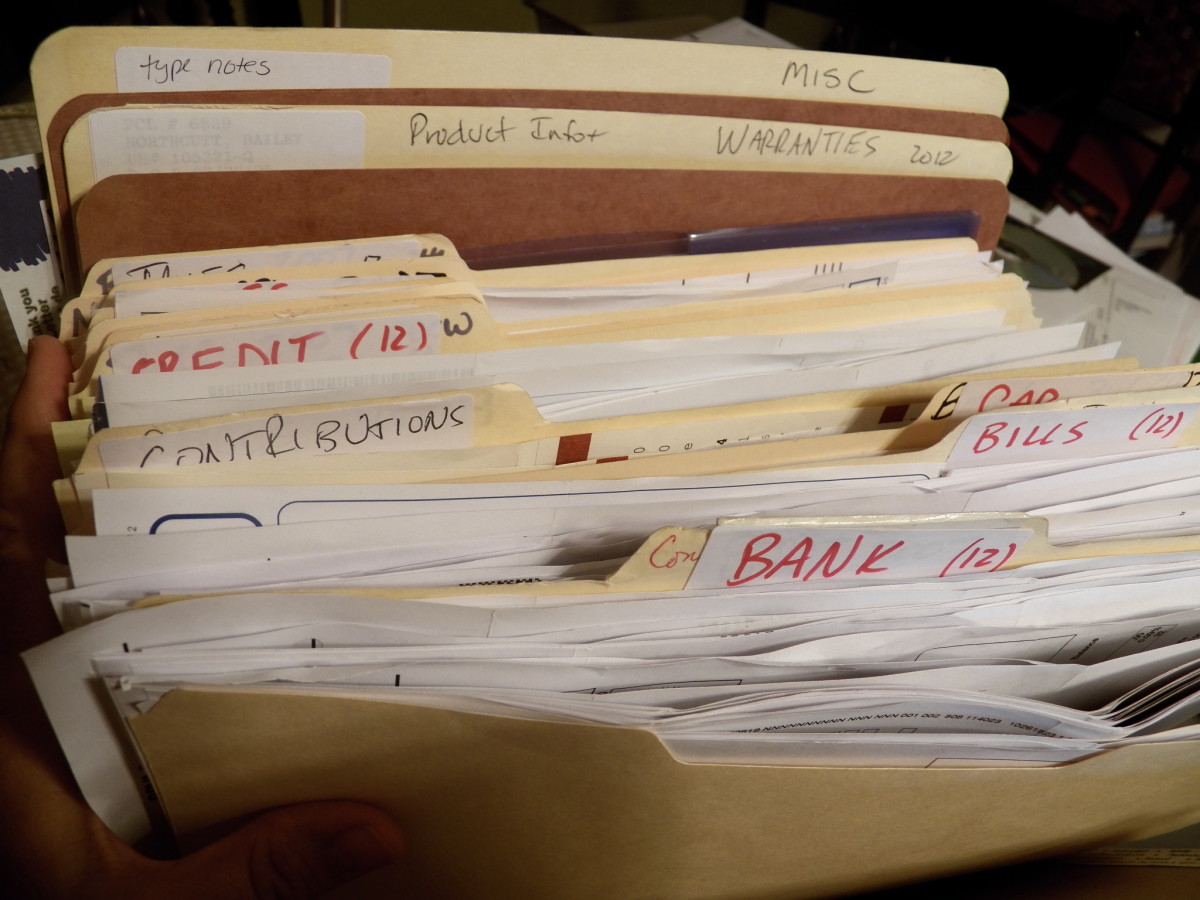

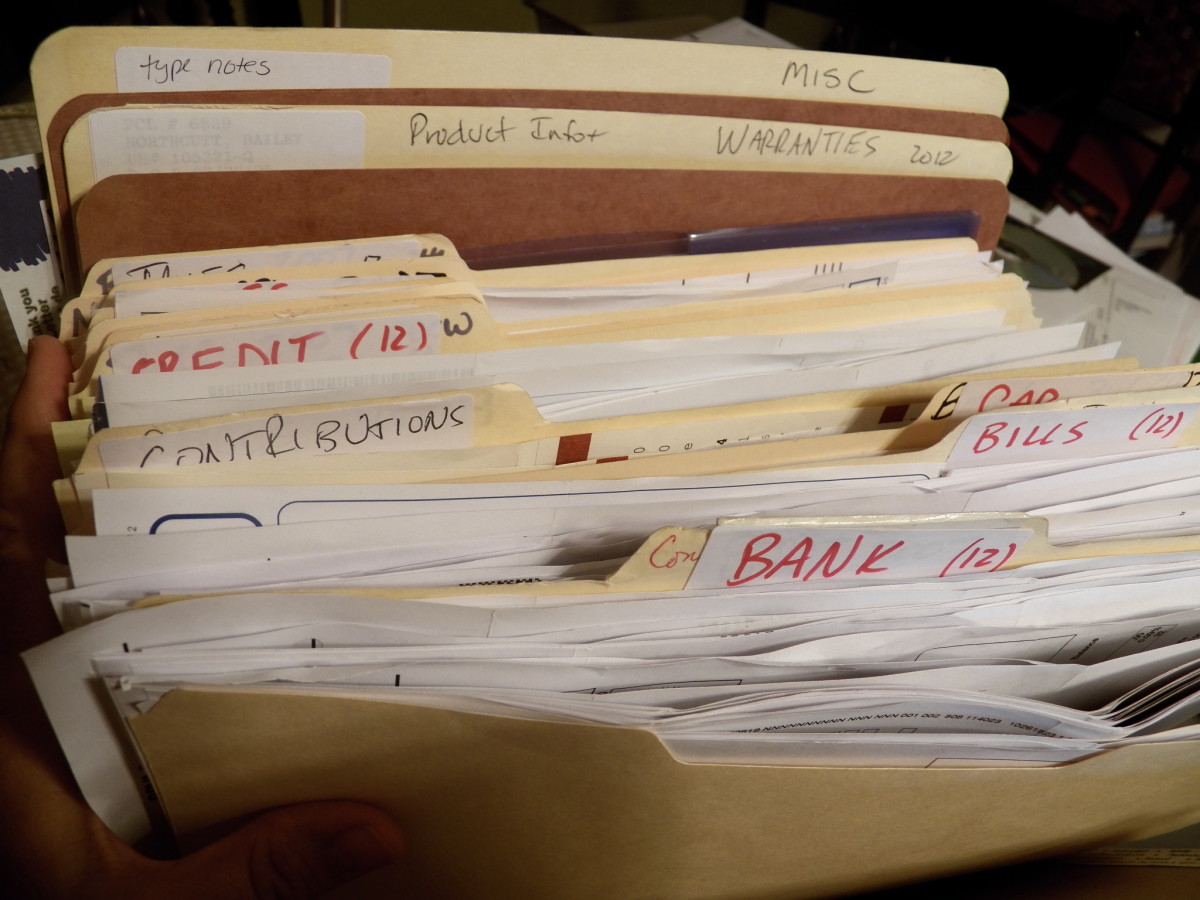

- Filing Cabinets: Invest in a filing cabinet to organize your paper receipts. Create separate folders for each expense category and arrange them alphabetically or by date for easy retrieval.

- Expanding Files or Accordion Folders: Expanding files or accordion folders with multiple sections can be a more compact alternative to filing cabinets. Label each section with the appropriate expense category and file receipts accordingly.

- Binders: Use binders with page protectors to store and organize your paper receipts. This allows for easy flipping through the pages and protects the receipts from damage or loss.

- Receipt Envelopes: Use labeled envelopes or envelopes with pockets to store your paper receipts. Organize them by expense category, vendor, or date, and store them in a secure and accessible location.

- Storage Boxes: If you have a large volume of receipts, consider using storage boxes designed for documents. Label the boxes appropriately and organize the receipts within folders or envelopes.

When using physical receipt storage solutions, it’s important to keep the receipts in a clean, dry, and organized manner. Regularly review and remove receipts that are no longer needed for record-keeping purposes to avoid clutter and confusion.

Remember, physical receipt storage solutions require diligent maintenance and may occupy valuable office space. Be mindful of potential wear and tear on paper receipts, as well as the risk of loss due to accidents, natural disasters, or misplacement.

Now that we’ve explored both digital and physical receipt storage solutions, let’s move on to some tips for efficient receipt storage regardless of the method you choose.

Tips for Efficient Receipt Storage

Regardless of whether you choose digital or physical receipt storage solutions, implementing these tips will help you maintain an efficient and organized receipt storage system:

- Make it a Habit: Get into the habit of collecting and storing receipts consistently. Make it a part of your routine to immediately file or digitize receipts as soon as you receive them.

- Separate Personal and Business Receipts: Keep personal and business receipts separate to avoid confusion and streamline your expense tracking.

- Stay Consistent: Develop a standardized naming convention for your digital receipts or a labeling system for physical receipts. Consistency will save you time when searching for specific receipts.

- Scan or Photograph Receipts: Whether you choose digital or physical storage, consider scanning or photographing your receipts as a backup. This provides an additional layer of protection against loss or damage.

- Digitize Older Receipts: If you have a backlog of paper receipts, set aside time to digitize them using a scanning app or a desktop scanner. This will help you transition to a more streamlined and efficient digital receipt storage system.

- Use Software Tools: Take advantage of expense management software or accounting software that offer receipt management features. These tools can streamline the process of categorizing, storing, and retrieving digital receipts.

- Regularly Review and Purge: Periodically review your receipt storage system and purge receipts that are no longer needed for record-keeping or tax purposes. This will help reduce clutter and improve the efficiency of your storage system.

- Backup Your Data: Whether you choose digital or physical storage, create backups of your receipt data regularly. For digital storage, utilize cloud storage or external drives. For physical storage, consider storing copies of important receipts in a secure off-site location.

- Consult with Professionals: If you’re unsure about the best approach to receipt storage, seek guidance from accounting professionals or financial advisors. They can provide insights and recommendations tailored to your business’s specific needs.

By following these tips, you can establish an efficient and organized receipt storage system that saves you time and ensures accuracy when it comes to financial reporting, tax compliance, and business decision-making.

Now that we’ve covered various tips for efficient receipt storage, let’s wrap up our discussion.

Conclusion

Proper receipt storage is a crucial component of effective business management. From tax compliance to expense tracking, organizing and storing receipts accurately can save you time, improve financial reporting, and provide peace of mind. Whether you choose digital or physical receipt storage solutions, there are numerous options available to suit your preferences and business needs.

When it comes to digital storage, cloud platforms, expense management software, receipt scanning apps, and accounting software offer convenient and accessible solutions. They allow you to easily categorize, search, and retrieve digital receipts, ensuring accurate record-keeping and streamlined financial management.

On the other hand, physical receipt storage solutions such as filing cabinets, binders, or envelopes can be a suitable choice for those who prefer a more traditional approach. Just make sure to maintain proper organization, labeling, and regular purging to avoid clutter and confusion.

Regardless of the storage method you choose, implementing efficient receipt storage practices is essential. Make it a habit to collect and store receipts consistently, separate personal and business expenses, and regularly review and back up your receipt data. By staying organized and maintaining a systematic approach, you’ll be well-prepared for tax time, audits, and financial analysis.

Remember, consult with professionals if you need guidance on the specific types of receipts to keep or the best storage methods for your business. They can offer tailored advice based on your industry, legal requirements, and unique circumstances.

In conclusion, by giving due attention to proper receipt storage, you’ll ensure accurate financial record-keeping, facilitate tax compliance, and gain valuable insights into your business’s financial health. So, start implementing these tips today and enjoy the benefits of an efficient receipt storage system for your business.

Frequently Asked Questions about How To Store Receipts For Business

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Store Receipts For Business”