Articles

How To Store Receipts For Taxes

Modified: January 6, 2024

Looking for articles on how to store receipts for taxes? Find valuable tips and strategies to organize your receipts effectively and maximize your tax deductions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

When it comes to filing taxes, keeping track of receipts is crucial. Receipts serve as proof of expenses, deductions, and credits, helping you minimize your tax liability and potentially maximize your refund. However, holding onto piles of receipts can quickly become overwhelming and disorganized.

In this article, we will explore the importance of storing receipts for taxes and provide you with guidelines and best practices for organizing and managing them. We will also discuss various physical and digital storage options to help you find the method that suits your needs best. So let’s dive in and discover how to store receipts for taxes effectively!

Key Takeaways:

- Organizing and storing receipts for taxes is essential for maximizing deductions, minimizing tax liability, and ensuring compliance with tax regulations. Utilize physical or digital storage options and follow best practices to streamline the tax preparation process.

- Implementing best practices for digital storage, knowing retention periods, and managing receipts throughout the year will help you stay organized, reduce stress during tax season, and make informed financial decisions. Stay proactive and establish a system that works for you.

Read more: How To Store Receipts For Business

Importance of Storing Receipts for Taxes

Storing receipts for taxes is not just a suggested practice; it is essential for several reasons:

- Proof of expenses: Receipts provide tangible evidence of the expenses you have incurred throughout the year. This includes business-related expenses such as office supplies, travel costs, and client entertainment, as well as personal expenses that may be eligible for deductions, such as medical bills or educational expenses.

- Deductions and credits: Keeping track of your receipts allows you to take advantage of deductions and credits that can lower your taxable income. Many expenses, such as mortgage interest, property taxes, and charitable contributions, require proper documentation in the form of receipts in order to claim them on your tax return.

- Audit protection: In the event of an audit, having well-organized receipts can make the process smoother and less stressful. Receipts serve as evidence to support the deductions you have claimed, ensuring that you can provide accurate information and substantiate your claims to the tax authorities.

- Tax planning: By keeping all your receipts in one place, you can easily review your spending patterns and identify areas where you may be able to reduce expenses or take advantage of additional deductions. This can help you make smart financial decisions and optimize your tax planning strategies for the future.

Storing receipts for taxes is not only a responsible practice but also a way to ensure compliance with tax regulations and optimize your financial situation. Now that we understand the importance of storing receipts, let’s explore some guidelines for organizing them effectively.

Guidelines for Organizing Receipts

To keep your receipts organized and easily accessible, follow these guidelines:

- Categorize receipts: Start by sorting your receipts into different categories based on their purpose, such as business expenses, personal expenses, charitable donations, or medical expenses. This will make it easier to locate specific receipts when needed.

- Label and date receipts: Clearly label each receipt with the corresponding expense category and date of purchase. This will help you quickly identify and categorize receipts when organizing them.

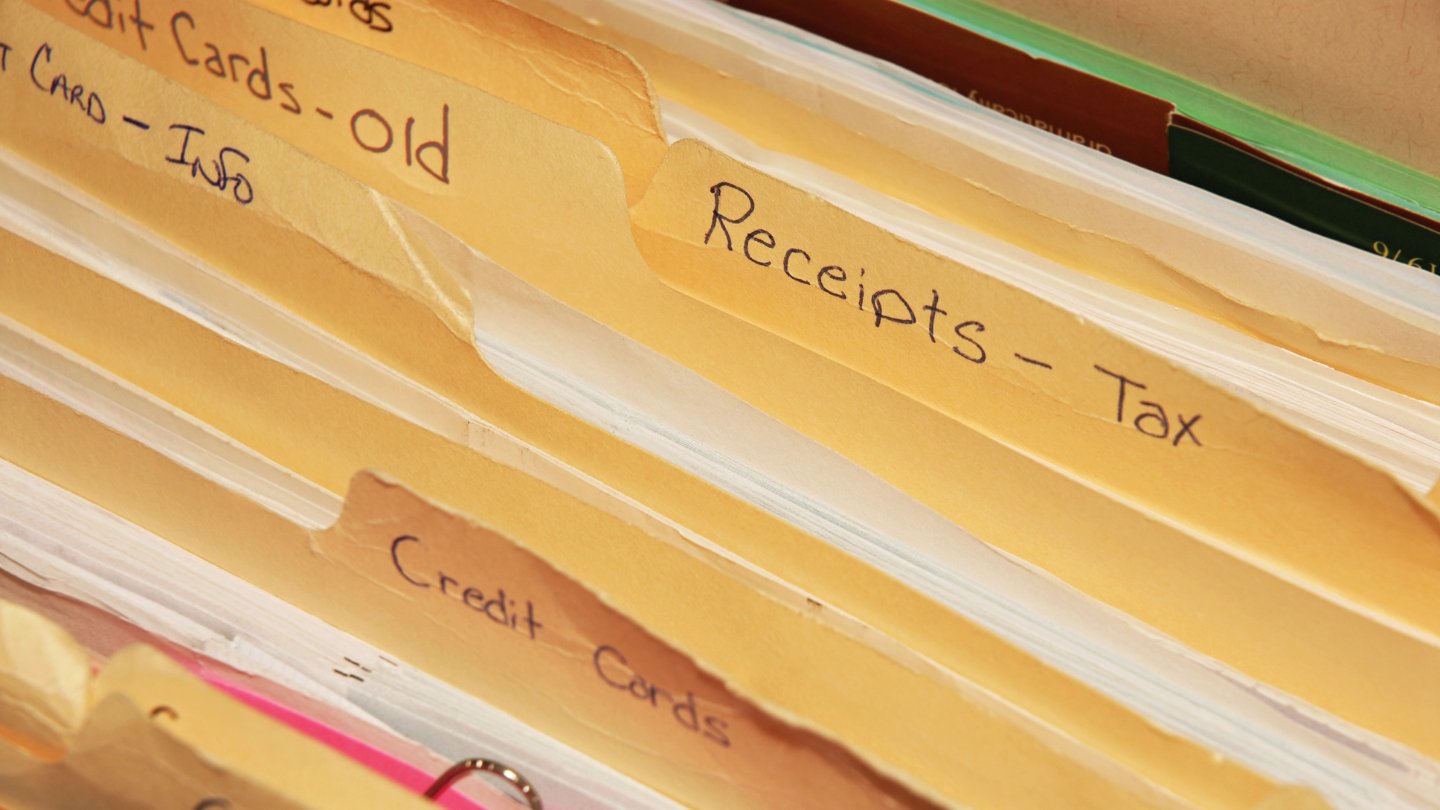

- Use separate folders or envelopes: Keep physical receipts organized by storing them in separate folders or envelopes labeled with the expense category. You can further categorize them by month or year, depending on your preference.

- Create a digital filing system: If you prefer digital storage, create a folder structure on your computer or cloud storage platform to store your digital receipts. Use clear and consistent naming conventions for each file to identify the expense category and date.

- Backup your digital receipts: It’s crucial to back up your digital receipts regularly to prevent data loss. Consider using external hard drives, cloud storage services, or online backup systems to ensure the safety and accessibility of your digital files.

- Keep a spreadsheet or software: A spreadsheet or expense tracking software can be useful for recording and categorizing your receipts. This will allow you to easily track your expenses, calculate deductions, and generate reports when needed.

- Scan or take pictures of physical receipts: If you prefer digital storage but receive paper receipts, consider scanning or taking pictures of them using a scanner or smartphone. This allows you to keep a digital copy as a backup while decluttering your physical space.

- Separate personal and business expenses: If you run a business or have deductible business expenses, it’s essential to keep your personal and business receipts separate. This will help you accurately determine your business-related expenses and simplify record-keeping.

By following these guidelines, you can establish an organized system for managing your receipts, making tax time less stressful and more efficient. Next, let’s explore the different physical and digital storage options available for storing your receipts.

Physical Storage Options

If you prefer to keep hard copies of your receipts, there are several physical storage options available:

- Accordion file: An accordion file is a portable option that allows you to categorize and store receipts in separate compartments. It’s a convenient option for those who prefer a manual filing system.

- Expanding file folder: Similar to an accordion file, an expanding file folder offers multiple pockets or compartments to organize your receipts. It provides the flexibility to expand as needed and is suitable for both small and large collections of receipts.

- Binder with sheet protectors: Using a binder with clear sheet protectors allows you to store receipts in a neat and organized way. You can insert the receipts into the sheet protectors based on category or date, making it easy to flip through and find specific receipts.

- File cabinet: A traditional file cabinet is a durable and secure option for long-term storage of receipts. You can use hanging file folders and label tabs to create a filing system that suits your needs.

- Receipt scanner: A receipt scanner is a useful tool for digitizing your paper receipts. It scans the receipts and saves them as digital files, allowing you to reduce clutter while still maintaining a backup copy of your receipts.

Choose the physical storage option that works best for you, considering factors such as your space limitations, the volume of receipts you have, and your personal preference for accessing and organizing your receipts.

In addition to physical storage options, digital storage provides a convenient and accessible way to store your receipts. Let’s explore some of the digital storage options next.

Digital Storage Options

Digital storage offers numerous advantages when it comes to organizing and managing your receipts. Here are some popular digital storage options:

- Cloud storage: Cloud storage platforms like Google Drive, Dropbox, or OneDrive provide secure and accessible storage for your digital receipts. You can create folders and subfolders to organize your receipts by category or date, and access them from any device with an internet connection.

- Receipt management apps: There are various receipt management apps available that offer features specifically designed for managing digital receipts. These apps allow you to capture, organize, and categorize your receipts, often providing additional functionalities such as expense tracking and reporting.

- Email storage: If you receive digital receipts via email, you can create a specific email folder dedicated to storing these receipts. This provides a convenient way to keep all your digital receipts in one place, accessible from any device with email access.

- Dedicated receipt management software: There are software solutions available specifically designed for receipt management. These programs offer advanced features such as optical character recognition (OCR) technology to extract data from receipts, expense categorization, and integration with accounting systems.

- Mobile scanning apps: Mobile scanning apps allow you to capture digital copies of your paper receipts using the camera on your smartphone. These apps often have features that can enhance the quality of the scanned image, making it easier to read and store digitally.

When selecting a digital storage option, consider factors such as accessibility, security, ease of use, and compatibility with your existing devices and software. Remember to back up your digital receipts regularly to prevent data loss and ensure their long-term preservation.

Now that we have explored the physical and digital storage options, let’s move on to best practices for managing your digital receipts effectively.

Scan and save your receipts electronically to ensure they are easily accessible and organized for tax time. Use a cloud storage service or dedicated receipt management app for easy retrieval.

Read more: How To Store Receipts

Best Practices for Digital Storage

When it comes to organizing and storing digital receipts, following these best practices will ensure that your documents are secure, easily accessible, and well-maintained:

- Create a folder structure: Design a clear and organized folder structure within your chosen digital storage platform. Categorize receipts by type, date, or any other relevant criteria. This will help you locate specific receipts quickly and efficiently.

- Use descriptive file names: Give your digital receipt files descriptive names that clearly indicate the expense category, vendor, and date. This will make it easier to identify the receipts at a glance without having to open each file.

- Separate personal and business receipts: Keep your personal and business receipts in separate folders or directories to ensure accurate record-keeping and simplify tax preparation for both personal and business expenses.

- Consistently scan or save receipts: Develop a habit of scanning or saving digital receipts as soon as you receive them. This will minimize the risk of losing or misplacing paper receipts and reduce clutter in your physical space.

- Ensure document integrity: Use reliable scanning techniques or digital receipt apps to ensure the quality and legibility of scanned receipts. Avoid distorted or poorly captured images that may hinder readability.

- Consider using OCR technology: Optical Character Recognition (OCR) technology can extract key information from scanned receipts, making them searchable and easily retrievable within your digital storage platform. This can save you time when searching for specific expenses.

- Regularly back up your receipts: Back up your digital receipts to external hard drives, cloud storage, or other backup systems to prevent data loss. This will provide an additional layer of security and ensure that your receipts are protected in case of any technical issues or device failures.

- Maintain data security: Ensure that your digital storage platform is secure and encrypted to protect your sensitive financial information. Use strong, unique passwords, enable two-factor authentication, and regularly update your security settings.

By implementing these best practices, you can effectively manage your digital receipts, reduce clutter, and streamline your tax preparation process.

Next, let’s discuss the retention periods for tax receipts to ensure you know how long to keep your receipts for tax purposes.

Retention Periods for Tax Receipts

Knowing how long to keep your tax receipts is important for proper record-keeping and compliance with tax regulations. While the specific retention periods can vary based on various factors such as your location and type of expenses, here are some general guidelines:

- Individual tax returns: In most cases, it is recommended to keep your tax receipts and related documents, such as bank statements and W-2 forms, for a minimum of three years. This is the typical period during which the tax authorities can audit your return.

- Business expenses and deductions: If you run a business, it is advisable to retain your supporting documents, including receipts, invoices, and financial records, for a longer period. Generally, keeping records for at least six to seven years is recommended to cover the audit period.

- Property-related documents: For property-related transactions, such as buying or selling a home or investment property, it’s wise to keep receipts and related paperwork for several years after the transaction. This includes records of mortgage payments, property improvements, and any expenses related to the acquisition or sale of the property.

- Investment transactions: If you engage in investment activities, keep records of your purchase and sale transactions, dividends received, and any associated expenses. These records may be required to calculate capital gains or losses when you sell your investments in the future. It’s generally recommended to retain these records for at least three to seven years.

- Charitable contributions: If you make charitable donations, retain receipts or acknowledgment letters from the charitable organizations as evidence of your contributions. Keep these records for three to seven years, depending on your country’s tax regulations.

It’s important to note that these are general guidelines, and specific rules may vary depending on your location and individual circumstances. Always consult with a tax professional or refer to the tax regulations in your jurisdiction to ensure compliance with the specific record-keeping requirements.

Now that we understand the retention periods for tax receipts, let’s move on to some tips for managing your receipts effectively throughout the year.

Tips for Managing Receipts Throughout the Year

Managing your receipts throughout the year will save you time and stress when tax season approaches. Here are some helpful tips to stay organized:

- Collect receipts immediately: Make it a habit to collect and store receipts as soon as you receive them. Avoid the temptation to throw them in a random drawer or bag, as this can lead to misplaced or lost receipts.

- Digitize receipts: Whenever possible, opt for digital receipts instead of paper copies. Many retailers offer the option to email receipts, reducing the risk of losing them and making them easier to organize digitally.

- Set up an email folder: Create a specific folder in your email account dedicated to storing digital receipts. File the receipts there as soon as they arrive, ensuring they are easily accessible when needed.

- Use a designated receipt wallet or envelope: Keep a small envelope or wallet in your bag or car specifically for storing physical receipts. This way, you can quickly place them in the designated space and avoid them cluttering your wallet or pockets.

- Record expenses immediately: As you incur expenses, record the details immediately in a spreadsheet, accounting software, or a dedicated expense tracking app. This will ensure that you have an accurate record of your expenses and eliminate the need to rely solely on receipts.

- Regularly reconcile receipts: Set aside time on a monthly or quarterly basis to reconcile your receipts with your financial records. This will help identify any missing or misplaced receipts and ensure that you have a complete record of your expenses.

- Review and purge receipts: Periodically review your receipts and determine which ones are no longer needed for tax purposes. Safely dispose of unnecessary receipts to declutter your storage system and make room for new ones.

- Consider mobile apps: There are various mobile apps available that can help you organize and manage your receipts on the go. These apps allow you to scan and categorize receipts, track expenses, and generate reports, making the process more convenient and efficient.

- Work with a tax professional: If you find managing receipts overwhelming or need assistance with tax planning, consider working with a tax professional. They can guide you in organizing your receipts, provide advice on deductibility, and ensure compliance with tax regulations.

By implementing these tips, you can stay organized throughout the year and be well-prepared for tax season, avoiding last-minute stress and ensuring that you can maximize your deductions and credits.

Now, let’s wrap up our discussion on storing receipts for taxes.

Conclusion

Storing receipts for taxes is a crucial part of effective financial management and tax compliance. By keeping track of your expenses and having proper documentation in the form of receipts, you can maximize your deductions, minimize your tax liability, and be well-prepared in the event of an audit.

In this article, we explored the importance of storing receipts, guidelines for organizing them, and various physical and digital storage options available. We discussed best practices for digital storage, retention periods for tax receipts, and tips for managing receipts throughout the year.

Whether you choose physical storage options such as accordion files or binders, or opt for digital storage solutions like cloud platforms or receipt management apps, finding a method that suits your needs and preferences will ensure that your receipts are organized, accessible, and secure.

Remember to utilize best practices such as categorizing receipts, labeling and dating them, using descriptive file names, and regularly backing up your digital receipts. Also, be mindful of the retention periods for tax receipts and keep your records for the recommended duration based on your location and circumstances.

By following these guidelines and proactively managing your receipts, you can streamline the tax preparation process, mitigate the risk of errors or lost deductions, and have a clear overview of your financial transactions throughout the year.

So, take the time to establish a system that works for you, stay organized, and keep track of your receipts. It will not only ensure smooth tax filings but also empower you to make informed financial decisions for a successful future.

Frequently Asked Questions about How To Store Receipts For Taxes

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Store Receipts For Taxes”