Home>Home Maintenance>How To Find Property Assessment In Arizona

Home Maintenance

How To Find Property Assessment In Arizona

Modified: March 6, 2024

Learn how to find property assessment in Arizona and ensure home maintenance compliance. Get expert tips and advice for property assessment in Arizona.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of property assessment in Arizona! Whether you’re a homeowner, prospective buyer, or simply curious about the value of properties in the state, understanding property assessment is essential. In this article, we’ll delve into the topic and explore various methods to find property assessment information in Arizona.

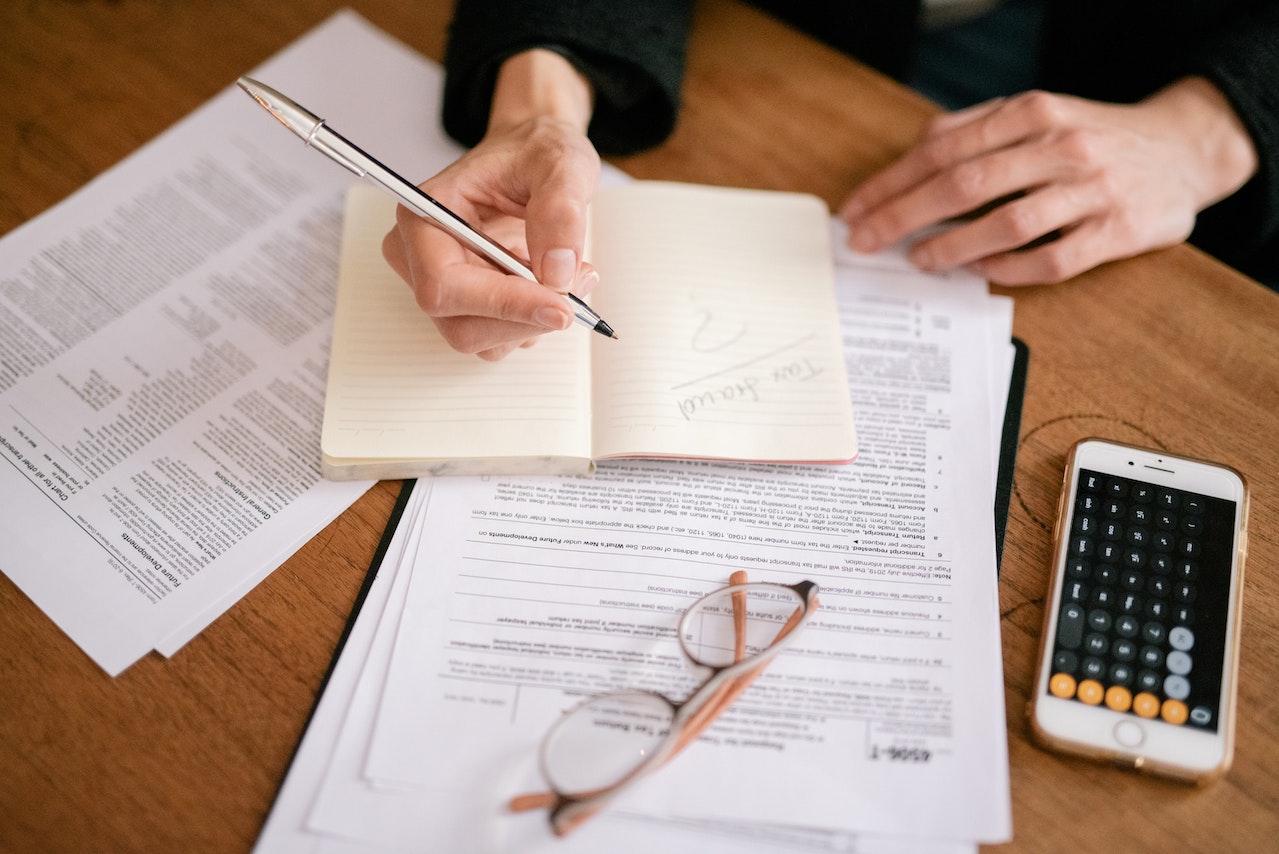

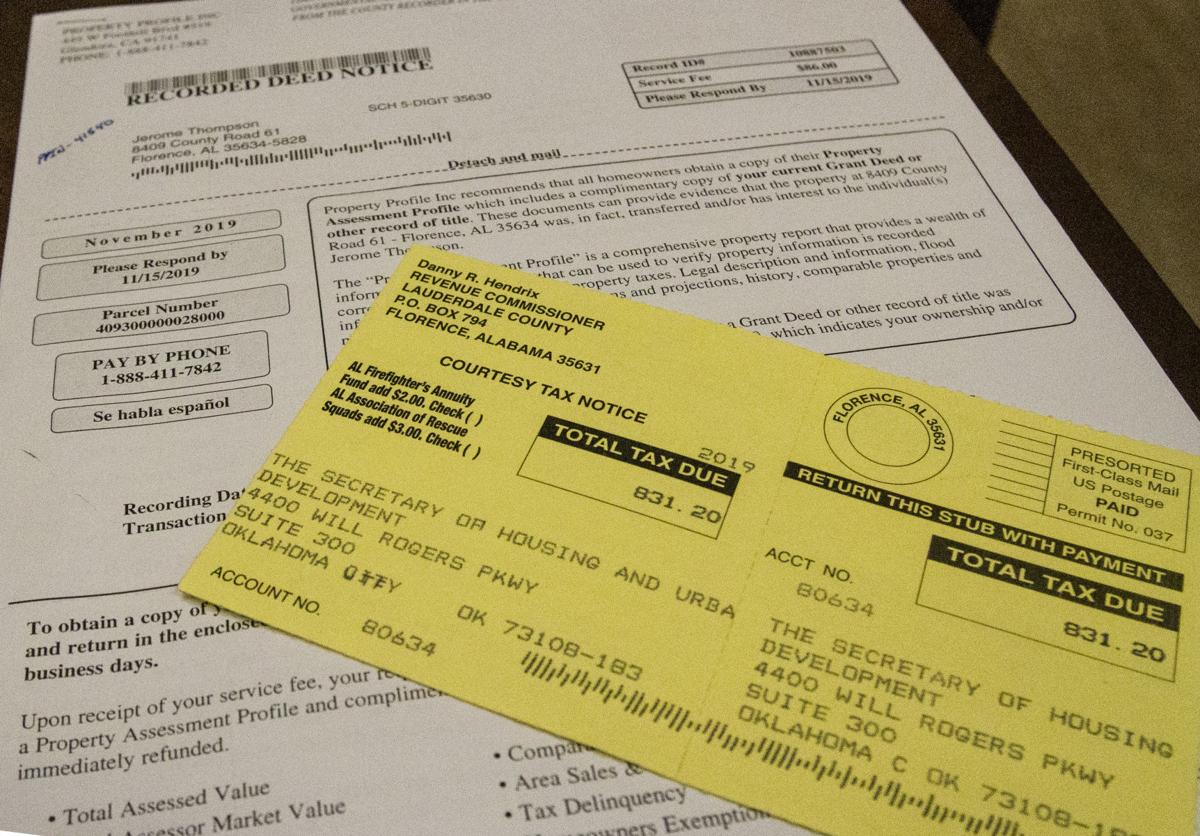

Property assessment is the process of determining the value of a property for taxation purposes. In Arizona, property assessments are conducted by county assessors. Assessors determine the value of properties based on factors such as location, property size, improvements, amenities, and recent comparable sales.

Knowing the assessed value of a property is crucial as it can affect property taxes, insurance premiums, and even the decision to buy or sell. With that in mind, let’s explore how you can find property assessment information in Arizona.

Key Takeaways:

- Understanding property assessment in Arizona is essential for homeowners and buyers. Factors like location, property size, improvements, and recent sales influence assessed values, impacting property taxes and market value.

- To find property assessment information in Arizona, utilize county assessor websites, online tools, and real estate agents. Keep in mind varying assessment cycles, tax implications, and the distinction between market and assessed values.

Read more: How To Find Property Assessment Value

Understanding Property Assessment in Arizona

Before we dive into the methods of finding property assessment information, let’s take a moment to understand how the assessment process works in Arizona.

In Arizona, the responsibility for property assessment lies with the county assessor’s office. Each county has its own assessor who is responsible for determining the assessed value of properties within their jurisdiction. The assessed value is used to calculate property taxes.

The assessment process involves the county assessor examining various factors to determine the value of a property. These factors include the location of the property, its size, the improvements made to the property, and the amenities it offers. The assessor also takes into account recent sales of comparable properties in the area.

It’s important to note that the assessed value is not necessarily the same as the market value. The market value is the amount a willing buyer would pay for the property in an open market. The assessed value, on the other hand, is a percentage of the market value and is used for taxation purposes.

Assessment values in Arizona are subject to change. Property owners may see fluctuations in their assessed values from year to year due to changes in the market, property improvements, or reassessments by the county assessor.

Now that we have a solid understanding of property assessment in Arizona, let’s explore the different methods you can use to find property assessment information.

Methods to Find Property Assessment

When it comes to finding property assessment information in Arizona, there are several methods you can use. Let’s take a look at some of the most effective ways to uncover this valuable information.

- Using the County Assessor’s Website: Many county assessors in Arizona provide online resources where you can search for property assessment information. Visit the official website of the county assessor’s office for the relevant county and look for a property search tool. Enter the property address or parcel number to access the assessment details.

- Contacting the County Assessor’s Office: If the county assessor’s website does not have a user-friendly property search tool, give them a call. The staff at the assessor’s office can provide you with the assessed value of a property over the phone or via email. Be sure to have the property address or parcel number ready for faster assistance.

- Utilizing Online Property Search Tools: There are various online platforms and websites that provide property assessment information for listings in Arizona. These tools allow you to search by address, property type, or parcel number. Some popular websites include Zillow, Realtor.com, and Redfin. Keep in mind that the assessment information on these platforms may not always be up-to-date or entirely accurate, so it’s best to cross-reference with official sources.

- Seeking Assistance from a Real Estate Agent: Real estate agents have access to comprehensive property databases and can provide you with accurate property assessment information. If you’re in the process of buying or selling a property, your real estate agent can help you determine the assessed value, potential tax implications, and overall market value of the property.

Each method has its own advantages, so it’s a good idea to explore multiple avenues to obtain the most accurate and up-to-date property assessment information. Now that you know how to find property assessment information, it’s also important to understand the factors that influence property assessment values in Arizona.

Using the County Assessor’s Website

One of the most convenient and direct ways to find property assessment information in Arizona is by utilizing the county assessor’s website. Many county assessors maintain online portals that provide access to property assessment data for their respective jurisdictions. Follow these steps to navigate the county assessor’s website and find the information you need:

- Visit the official website of the county assessor’s office for the relevant county in Arizona. Each county has its own website, so make sure you are on the correct one for the property you are interested in.

- Look for a property search or property lookup tool on the website. This is usually prominently displayed on the homepage or under a section labeled “Property Search” or “Assessor Services.” The layout and design may differ among counties, but the function should be similar.

- Enter the property address or parcel number into the search field. If you do not have the parcel number, you can typically search by the address or owner’s name as well.

- Click the search button or hit enter to initiate the search. The website will retrieve the property assessment information associated with the provided address or parcel number.

- Review the property assessment details. This will typically include the assessed value of the property, any exemptions that may apply, and other relevant information such as property classification and zoning.

- If necessary, you can also print or save a copy of the property assessment report for future reference or documentation purposes.

Using the county assessor’s website is a convenient way to access property assessment information at your own pace and from the comfort of your own home. It allows you to quickly gather the details you need without having to rely on external sources. However, keep in mind that the accuracy and timeliness of the information may vary, so it’s always a good idea to cross-reference with other sources if possible.

Continue reading to explore more methods of finding property assessment information in Arizona.

Contacting the County Assessor’s Office

If you prefer a more personal approach to finding property assessment information in Arizona, contacting the county assessor’s office directly is a reliable option. The staff at the assessor’s office can provide you with accurate and up-to-date assessment details for the property you are interested in. Here’s how you can go about it:

- Locate the contact information for the county assessor’s office in the specific county where the property is located. You can typically find this information on the county’s official website or through a simple online search.

- Make a phone call to the assessor’s office during their business hours. Prepare the property address or parcel number beforehand to provide to the staff for efficient assistance.

- Upon reaching the assessor’s office, ask to speak with someone who can provide property assessment information. This may be a specific department or individual responsible for property assessments.

- Inform the staff member of your intention to obtain the property assessment details and provide them with the necessary information. Be patient as they retrieve the information from their records, as this may take a few minutes.

- The staff member will then provide you with the assessed value of the property, along with any other relevant information such as property classification or zoning details.

- If you prefer written documentation, you can ask the staff member to email or mail you a copy of the property assessment report for your records.

By contacting the county assessor’s office, you can ensure that you are getting accurate and reliable property assessment information directly from the source. The staff members are trained professionals who can guide you through the process and address any questions or concerns you may have.

Now, let’s explore another effective method for finding property assessment information in Arizona.

Utilizing Online Property Search Tools

When it comes to finding property assessment information in Arizona, utilizing online property search tools can be a quick and efficient method. These tools aggregate data from various sources and provide access to property assessment details for listings in the state. Follow these steps to utilize online property search tools effectively:

- Choose a reliable online property search platform or website. Some popular options include Zillow, Realtor.com, and Redfin. Ensure that the website you select covers properties in Arizona and provides assessment information.

- Once on the website, locate the search bar or the option to search for properties. This is usually prominently displayed on the homepage or in the main navigation menu.

- Enter the property address, parcel number, or other relevant details to initiate the search. If the address is not recognized, try different variations or consider using the parcel number if available.

- Click the search button or hit enter to begin the search process. The website will scan its database and retrieve any available property assessment information related to the address or details you provided.

- Review the assessment details provided. This may include the assessed value of the property, any exemptions, and other relevant information such as property size or recent sales.

- Keep in mind that the assessment information on these platforms may not always be up-to-date or entirely accurate. It’s essential to cross-reference with official sources such as the county assessor’s office to ensure accuracy.

- Consider exploring multiple online property search tools to compare the assessment information and gather a more comprehensive understanding of the property’s value.

Utilizing online property search tools can save you time and effort by providing instant access to property assessment information. However, it’s important to exercise caution and verify the data from official sources to ensure accuracy and reliability.

Next, we’ll explore another method you can use to find property assessment information in Arizona.

Seeking Assistance from a Real Estate Agent

When it comes to navigating the world of property assessment in Arizona, seeking assistance from a knowledgeable real estate agent can be incredibly beneficial. Real estate agents have access to comprehensive property databases and can provide you with accurate property assessment information. Here’s how you can utilize the expertise of a real estate agent:

- Find a reputable and experienced real estate agent who is familiar with the local market in Arizona. You can ask for recommendations from friends, family, or colleagues, or search online for agents specializing in the area where the property is located.

- Once you have selected a real estate agent, communicate your intent to obtain property assessment information. Provide them with the necessary details, such as the property address or parcel number, and let them know the specific information you are seeking.

- The real estate agent will utilize their resources, such as MLS (Multiple Listing Service), to access accurate property assessment information. They can provide you with the assessed value, tax implications, and other relevant details related to the property assessment.

- In addition to assessment information, a real estate agent can also provide you with insights into the overall market value of the property. They can compare the assessed value to recent comparable sales in the area to determine if the property is undervalued or overvalued.

- Real estate agents can also offer guidance on how property assessments may impact the purchasing or selling process. They can help you negotiate better terms based on the assessed value or advise you on potential tax implications.

- Remember that real estate agents are professionals who are familiar with the intricacies of property assessment. They can offer valuable insights and help you make informed decisions regarding the property in question.

Working with a real estate agent can simplify the process of obtaining property assessment information. They can provide you with accurate, up-to-date details and offer their expertise to help you understand the implications of the assessment. Whether you’re buying, selling, or simply curious about property values, a real estate agent can be a valuable resource.

Now that we’ve explored different methods of finding property assessment information, let’s dive into the factors that influence property assessment values in Arizona.

You can find property assessments in Arizona by visiting the county assessor’s website or office. You can search for your property by address or parcel number to view its assessed value and other details.

Factors Influencing Property Assessment in Arizona

Property assessment values in Arizona are influenced by various factors that the county assessors take into consideration when determining the assessed value of a property. Understanding these factors can provide insights into why certain properties have different assessment values. Here are some key factors that influence property assessment in Arizona:

- Location and Neighborhood: The location of a property plays a significant role in its assessed value. Factors such as proximity to schools, amenities, transportation, and desirable neighborhoods can impact the assessment. Properties in more desirable locations often have higher assessed values.

- Property Size and Use: The size and use of a property are essential considerations in assessment. Larger properties or those with multiple units, such as apartment complexes, tend to have higher assessed values. Similarly, commercial properties may be assessed differently based on their size and intended use.

- Improvements and Amenities: The improvements made to a property can also affect its assessed value. Upgrades such as additions, renovations, pools, or other amenities can increase the assessment. The overall condition and quality of the property’s construction are also taken into account.

- Recent Comparable Sales: County assessors often look at recent comparable sales in the area to determine the assessed value of a property. If similar properties in the vicinity have recently sold for higher prices, it can have a positive impact on the assessment.

It’s important to note that these factors are not exhaustive, and other considerations may come into play depending on the specific circumstances. Property assessments can vary from year to year, reflecting changes in the market and property improvements. It’s always a good idea to consult with the county assessor’s office or a real estate professional for more detailed information.

Now that we understand the factors that influence property assessment, let’s explore some important considerations to keep in mind regarding property assessment in Arizona.

Location and Neighborhood

When it comes to property assessment in Arizona, one of the key factors that influence the assessed value is the location and neighborhood of the property. Location plays a crucial role in determining the value of a property because it affects the desirability and demand for homes in that area.

In general, properties located in desirable neighborhoods, close to amenities and in proximity to schools, tend to have higher assessed values. These neighborhoods often have a higher demand from buyers, which can drive up property prices and subsequently the assessment values.

Accessibility to major highways, public transportation, and popular destinations can also impact the assessment. Properties that are conveniently located to these amenities are typically more attractive to potential buyers, leading to higher assessed values.

Furthermore, the overall quality and reputation of the neighborhood can have an influence on the assessment. Neighborhoods with low crime rates, well-maintained infrastructure, and a strong sense of community often contribute to higher property values.

It’s important to note that the location and neighborhood factor in property assessment is subjective and can vary from one county to another. Each county assessor evaluates these aspects differently, so it’s essential to consult the specific county’s assessment guidelines for accurate information.

In some cases, properties located in less desirable areas or neighborhoods may have lower assessed values compared to similar properties in more sought-after locations. However, it’s important to remember that property assessment is not solely determined by location and neighborhood factors, but rather a combination of multiple criteria.

Understanding the influence of location and neighborhood on property assessment in Arizona can be valuable for homeowners, potential buyers, and investors. It allows them to assess the potential value of a property and make informed decisions when it comes to buying or selling real estate.

Now, let’s explore another factor that influences property assessment in Arizona: property size and use.

Property Size and Use

Property size and use are significant factors that influence property assessment in Arizona. The size of a property, including the land it sits on and the structures built upon it, directly impacts its assessed value.

In general, larger properties tend to have higher assessed values compared to smaller properties. The size of the land can determine its potential for development and expansion, making it more valuable in the eyes of assessors. Similarly, properties with larger structures, such as spacious homes or commercial buildings, may also have higher assessments due to the increased value of the overall property.

Property use is another crucial aspect considered during assessment. Properties used for residential purposes, commercial activities, or industrial operations are assessed differently based on their intended use. Commercial properties, for example, may have higher assessments due to their potential for generating income.

Properties with multiple units, such as duplexes or apartment complexes, may also have higher assessed values due to the potential for rental income. Assessors take into account the income potential when determining the assessment value of such properties.

It’s important to note that changes in property use, such as converting a residential property into a commercial property or vice versa, can significantly impact the assessment. Assessors may reevaluate the property based on its new use and adjust the assessed value accordingly.

When it comes to property size and use, it’s crucial to consider local zoning regulations and restrictions as they can also influence the assessment. Properties located in areas with higher land values or specific zoning designations may have higher assessed values.

It’s important for property owners to accurately report the size and use of their properties to assessors during the assessment process. This ensures that the assessment reflects the true characteristics of the property and helps avoid any assessment discrepancies.

Understanding the impact of property size and use on assessment values in Arizona can help property owners, buyers, and investors assess the market value of a property and make informed decisions regarding their real estate investments.

Now, let’s explore another influential factor in property assessment: improvements and amenities.

Improvements and Amenities

When it comes to property assessment in Arizona, the improvements and amenities on a property can have a significant impact on its assessed value. Assessors take into account the enhancements and amenities that contribute to the overall value and desirability of a property.

Improvements refer to any changes or additions made to the property that enhance its value. This can include renovations, expansions, or upgrades to the structure of the property, such as adding a new room, updating the kitchen, or installing high-quality flooring. Assessors consider the quality and extent of these improvements when determining the assessed value. Properties with more substantial and higher-quality improvements tend to have higher assessments.

Amenities are features or extras that can enhance the property’s appeal and value. This can include amenities like swimming pools, landscaped gardens, outdoor entertainment areas, or luxury finishes. Assessors take these amenities into account when evaluating the property and assigning an assessed value. Properties with desirable amenities often have higher assessed values due to the added value these features provide.

It’s important to note that not all improvements or amenities directly result in higher assessed values. Assessors consider the cost, quality, and functionality of the improvements and amenities when determining their impact on the assessment value. Additionally, the age and condition of the improvements can also factor into the assessment process.

Property owners should keep accurate records of the improvements made to their properties and communicate these changes to assessors during the assessment process. This ensures that assessors are aware of the upgrades and can accurately assess the value of the property.

However, it’s crucial to remember that not all improvements or amenities will lead to an immediate increase in the assessed value. Assessors follow specific guidelines and regulations, and the impact of improvements and amenities on assessments may vary across different counties in Arizona.

Understanding the influence of improvements and amenities on property assessment in Arizona allows property owners to make informed decisions regarding property upgrades and renovations. These enhancements not only enhance the overall value of the property but also have the potential to impact the assessment value positively.

Now, let’s explore the final factor influencing property assessment in Arizona: recent comparable sales.

Recent Comparable Sales

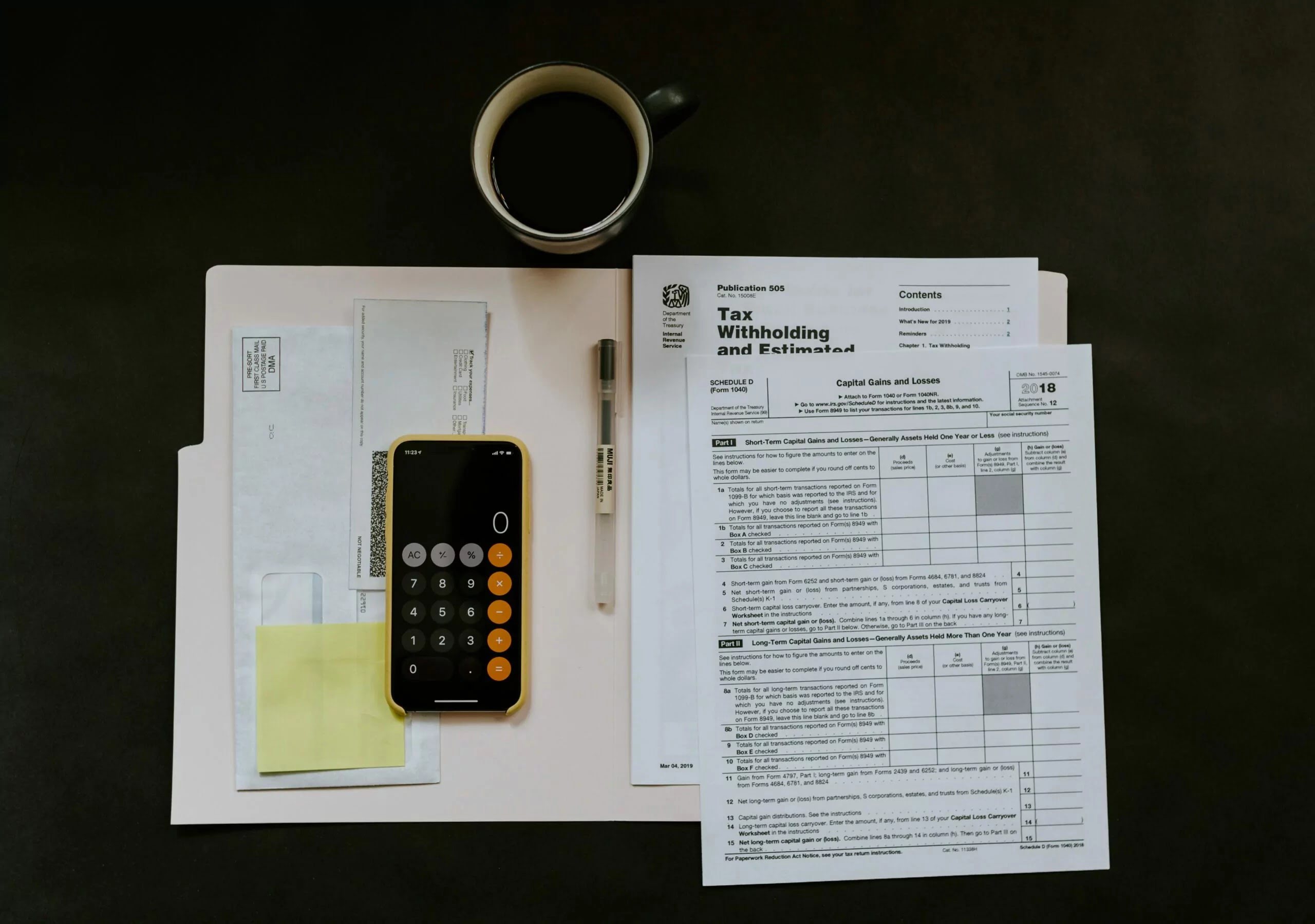

One of the key factors that influence property assessment in Arizona is the analysis of recent comparable sales in the area. Assessors examine the prices at which similar properties have been sold in the vicinity to determine the assessed value of a property.

When assessing a property, assessors look for properties that share similar characteristics, such as location, size, condition, and use. These properties, known as comparables or “comps,” serve as benchmarks for determining the assessed value of the property in question. By comparing the property to recently sold properties with similar attributes, assessors can ensure a fair and accurate assessment value.

The sales prices of recent comparable properties play a crucial role in determining the assessed value. If the recently sold properties have higher sale prices, it can indicate a strong real estate market in the area, which may lead to a higher assessed value for the property being assessed.

It’s important to note that assessors consider both the sales prices and the specific characteristics of the comparable properties when making assessments. This includes factors such as the condition of the property, any improvements or renovations made, and the time of the sale.

Keep in mind that the assessed value is not the same as the market value. The assessed value is typically calculated as a percentage of the market value, which can vary depending on local regulations and assessment practices. It’s crucial to consult the county assessor’s office or a real estate professional for a complete understanding of the assessed value and its relationship to recent comparable sales in the area.

Understanding the role of recent comparable sales in property assessment in Arizona can provide property owners and potential buyers with insights into the market value of a property. It allows them to compare the assessed value to recent sales and evaluate the fairness of the assessment value.

Now that we have explored the factors that influence property assessment in Arizona, it’s essential to consider some important considerations regarding property assessment.

Important Considerations Regarding Property Assessment

When it comes to property assessment in Arizona, there are several important considerations to keep in mind. Here are some key points to consider:

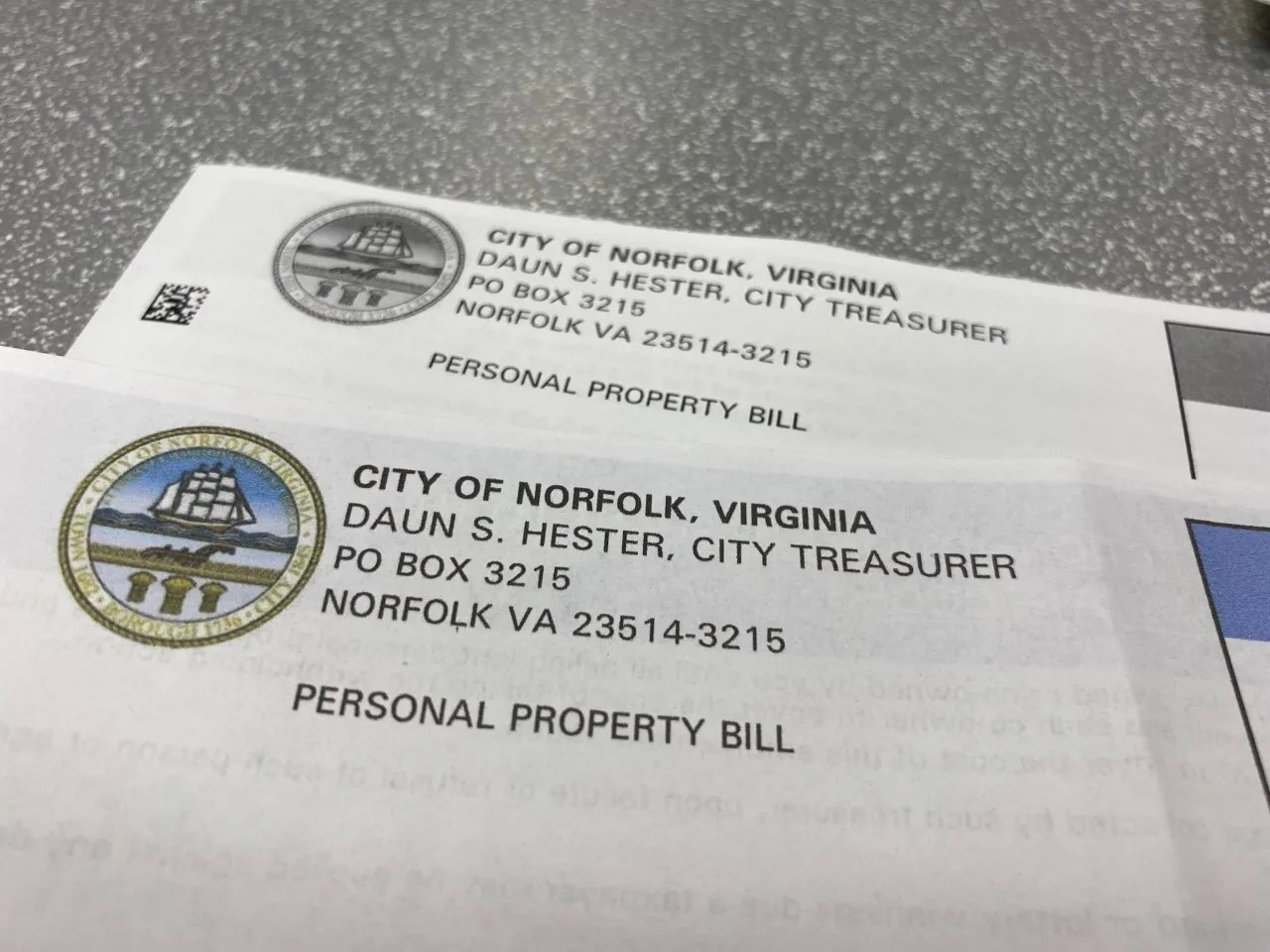

- Varying Assessment Cycles: Different counties in Arizona may have varying assessment cycles. Some counties reassess properties annually, while others do so every few years. It’s important to be aware of the assessment cycle in the specific county where your property is located to understand when changes to the assessed value may occur.

- Appealing Assessments: If you believe that the assessed value of your property is inaccurate or unfair, you have the right to appeal the assessment. Each county has its own process for assessment appeals, and it’s important to follow the guidelines and deadlines set by the county assessor’s office. Providing evidence such as recent appraisals or sales data of comparable properties can strengthen your case during the appeal process.

- Property Tax Implications: The assessed value of a property directly affects property taxes. Higher assessed values can result in higher property tax bills. It’s important to consider the potential tax implications when buying or selling a property and factor in these costs when budgeting.

- Market Value vs. Assessed Value: It’s essential to understand that the assessed value is not necessarily the same as the market value of a property. The market value is the price that a willing buyer and seller would agree upon in an open market transaction, while the assessed value is used for taxation purposes. Assessors typically calculate the assessed value as a percentage of the market value, which can vary across different counties in Arizona.

- Regular Assessment Reviews: It’s a good practice to regularly review your property assessment to ensure its accuracy. Keep track of any changes or improvements made to the property and communicate these updates to the county assessor’s office during the assessment cycle. This helps ensure that the assessed value reflects the current state of the property.

- Consulting with Professionals: If you have questions or concerns about property assessment in Arizona, it’s beneficial to consult with professionals such as real estate agents, appraisers, or tax advisors. They can provide expert guidance and help you navigate the complexities of property assessment.

By keeping these considerations in mind, property owners can have a better understanding of the assessment process and make informed decisions regarding their properties. It’s essential to stay informed, review assessments regularly, and take appropriate action if necessary.

Now, let’s conclude our article on finding property assessment information in Arizona.

Conclusion

Understanding property assessment in Arizona is crucial for homeowners, buyers, and investors alike. It provides valuable insights into the assessed value of a property, which affects property taxes, insurance premiums, and overall market value. By utilizing various methods, such as using the county assessor’s website, contacting the county assessor’s office, utilizing online property search tools, or seeking assistance from a real estate agent, you can access property assessment information with ease.

Several key factors influence property assessment in Arizona. Factors such as location and neighborhood, property size and use, improvements and amenities, and recent comparable sales play a significant role in determining the assessed value. It’s important to understand these factors and how they affect assessments to have a comprehensive understanding of a property’s value.

Throughout the assessment process, it’s essential to keep in mind important considerations, including varying assessment cycles, the option to appeal assessments, property tax implications, and the distinction between market value and assessed value. Regularly reviewing assessments and consulting with professionals can help ensure accurate assessments and informed decision-making.

Whether you’re a homeowner looking to understand the value of your property, a buyer considering a real estate investment, or simply curious about the assessment process, the information provided in this article will guide you in finding property assessment information in Arizona.

Remember, property assessment is a complex process, and it’s crucial to rely on official sources and seek professional advice when needed. By being proactive and informed about property assessment, you can make confident and knowledgeable decisions regarding your property and its value.

Now you’re equipped with the knowledge you need to navigate the world of property assessment in Arizona. Start exploring the various methods, consider the influencing factors, and make the most of the available resources to access property assessment information with confidence.

Frequently Asked Questions about How To Find Property Assessment In Arizona

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Find Property Assessment In Arizona”