Home>Home Maintenance>How To Discover Your Property Assessment In Edenton, NC

Home Maintenance

How To Discover Your Property Assessment In Edenton, NC

Modified: March 6, 2024

Discover your property assessment in Edenton, NC with our helpful guide. Learn about home maintenance tips and techniques to keep your property in top shape.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to Edenton, NC, where homeowners like you take pride in their properties. As a responsible homeowner, it’s essential to understand the ins and outs of property assessment. Knowing your property assessment not only helps you understand the value of your home but also ensures that you pay the correct amount of property taxes.

Property assessment is a fundamental process that determines the value of real estate properties for tax purposes. In Edenton, NC, property assessments are carried out by the local government to maintain fairness and equity in property taxation. By understanding how assessments work and how to access them, you can make informed decisions about your property and address any concerns you may have.

In this article, we will guide you through the process of discovering your property assessment in Edenton, NC. We’ll explain the assessment process, how to access your assessment information, and provide valuable insights into appealing assessments and understanding assessment changes. So, let’s dive in and uncover the secrets of property assessment in Edenton!

Key Takeaways:

- Understanding property assessment in Edenton, NC is crucial for homeowners to ensure fair property taxes. Assessments consider factors like location, size, and market conditions, impacting tax liabilities.

- Accessing assessment information and appealing if necessary empowers homeowners. Factors like property improvements, market fluctuations, and exemptions can affect assessments, requiring informed decision-making.

Read more: How To Lower Your Property Assessment

Understanding Property Assessment

Property assessment is the process of determining the value of a property for taxation purposes. It is conducted by local government authorities to calculate property taxes accurately and fairly. The assessment takes into consideration various factors such as the property’s location, size, condition, and other relevant market data.

Assessments are essential because they directly impact the amount of property taxes you owe each year. A higher assessment value usually results in higher taxes, while a lower assessment may lead to reduced tax liability. It is crucial to understand how the assessment process works to ensure that your property is evaluated fairly and accurately.

In Edenton, NC, property assessments are conducted regularly, usually by the county or municipal tax assessor’s office. The assessor’s role is to determine the fair market value (FMV) of each property based on market conditions and other relevant factors. The FMV is the estimated price that the property would sell for on the open market.

It’s important to note that property assessments are not guarantees of market value or sale price. Instead, they serve as a basis for calculating property taxes. The assessment process aims to ensure that all properties are assessed equitably, so the tax burden is distributed fairly among property owners.

Assessments are not just limited to residential properties. They also apply to commercial properties, vacant land, and other real estate assets. The valuation methods used for assessment may vary depending on the property type and local regulations.

Now that you have a basic understanding of property assessment, it’s time to explore how the assessment process works specifically in Edenton, NC. In the next section, we’ll dive into the assessment process in more detail, providing you with insights into how your property is evaluated and how you can access your assessment information.

The Assessment Process in Edenton, NC

In Edenton, NC, the assessment process is carried out by the local government to determine the value of properties within the community. The process follows certain guidelines and procedures to ensure fairness and accuracy.

The assessment process typically begins with data collection. The tax assessor’s office gathers information about each property, including details such as the size of the land, building structures, improvements, and any relevant market data. This information helps in estimating the fair market value of the property.

Next, the assessor analyzes the data and applies valuation methods to determine the property’s assessed value. These methods may include sales comparison approach, cost approach, or income approach, depending on the property type and market conditions. The sales comparison approach compares the property to recently sold properties in the area, while the cost approach estimates the value based on the cost of replacing the property. The income approach is used primarily for income-producing properties, considering the income potential.

Once the assessed values are calculated, the assessor prepares a list, known as the assessment roll, which contains the assessed values of all properties in Edenton, NC. Property owners are then notified of their assessment values through official assessment notices.

It’s important to review the assessment notice carefully and ensure that all the information is accurate. If you have any concerns or believe that the assessment is inaccurate or unfair, you have the right to appeal the assessment. We will discuss the process of assessment appeals in detail in a later section.

Edenton, NC follows a reassessment cycle, which means that assessments are conducted periodically, typically every few years. Reassessment ensures that property values are aligned with current market conditions and that property taxes remain fair and equitable.

It’s worth noting that the assessment process can be complex, and the value assigned to a property may not always align perfectly with your expectations. However, understanding the assessment process and how your property is evaluated allows you to navigate the system more effectively and take appropriate actions if necessary.

Now that you have insight into the assessment process in Edenton, NC, let’s move on to the next section, where we will explore how you can access your property assessment information.

Accessing Your Property Assessment

Accessing your property assessment in Edenton, NC is a straightforward process that allows you to review the assessed value of your property and ensure its accuracy. There are several ways to access this information.

One of the most common methods is to visit the official website of the tax assessor’s office in Edenton, NC. The website typically provides an online property search tool or a property tax portal where you can enter your property address or parcel number to retrieve your assessment information. This convenient online access allows you to view details such as the assessed value, land size, building details, and any exemptions or deductions applied to your property.

If you prefer to access your property assessment information in person, you can visit the tax assessor’s office directly. The office is responsible for maintaining assessment records, and the staff will assist you in retrieving the necessary information. They can answer any questions you may have regarding your assessment and provide additional guidance if needed.

Another option is to contact the tax assessor’s office via phone or email. They can provide you with the necessary information, guide you through any required steps, and address any concerns you may have regarding your property assessment.

It’s important to keep in mind that property assessment information is considered public record and is available to anyone who seeks it. You have the right to access this information for your own property and for properties owned by others. However, it is essential to respect the privacy of others and utilize the information solely for legitimate purposes.

By accessing your property assessment, you can review the assessed value and ensure its accuracy. If you believe that your property is incorrectly assessed or if you have concerns about the valuation, you can take further action. In the next section, we will explore the process of appealing your property assessment in Edenton, NC.

Now that you know how to access your property assessment information, you can stay informed and take the necessary steps to address any concerns or discrepancies. In the next section, we will explore the assessment appeal process in Edenton, NC.

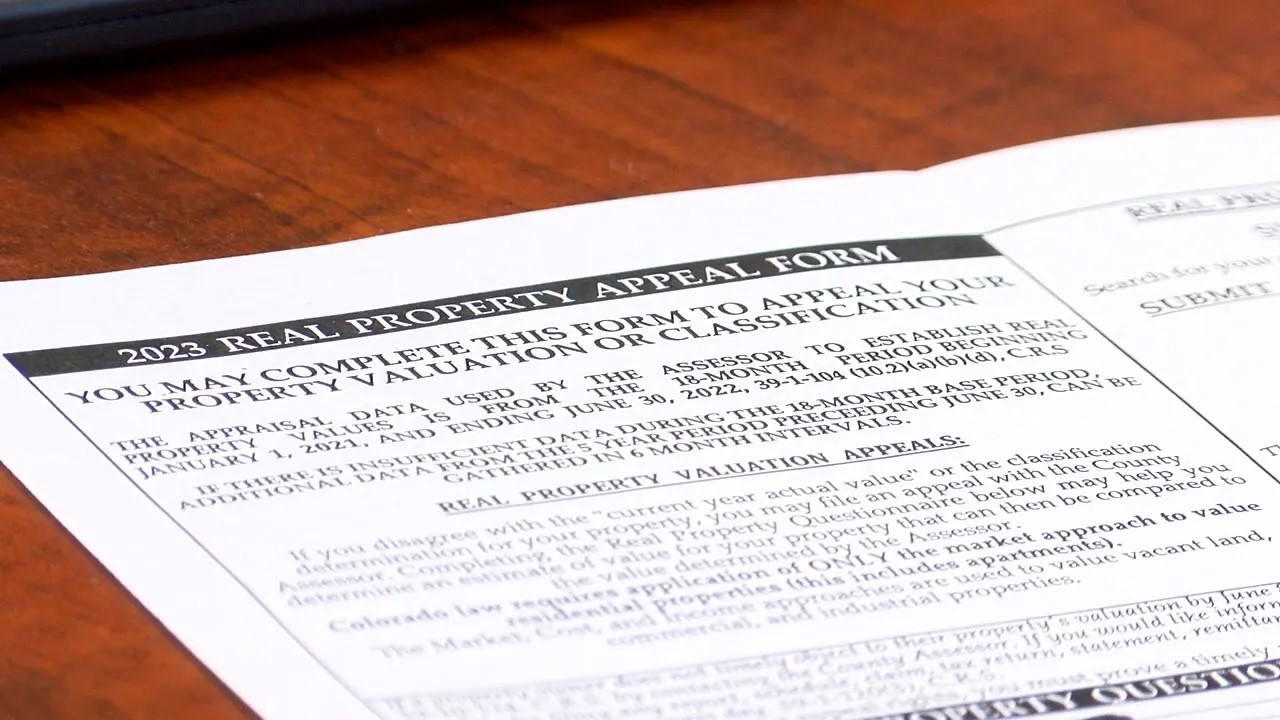

Exploring Assessment Appeals

If you disagree with your property assessment in Edenton, NC, you have the right to appeal the assessment. The appeal process allows you to present evidence and arguments to challenge the assessed value of your property.

The first step in the appeals process is to review your assessment notice carefully. Check for any errors or discrepancies in the information provided. If you believe that the assessed value is inaccurate or unfair, gather supporting evidence to strengthen your case.

Before proceeding with the formal appeal, it is advisable to contact the tax assessor’s office to discuss your concerns. They may be able to address your questions or provide explanations for the assessed value. In some cases, misunderstandings or errors can be resolved through open communication.

If you still wish to proceed with an appeal, you will need to follow the specific guidelines and deadlines set by the local government. In Edenton, NC, the appeal process typically involves submitting a formal appeal application to the tax assessor’s office.

Your appeal application should include a detailed explanation of why you believe the assessment is incorrect or unfair. Provide supporting evidence such as recent comparable sales data, property appraisals, or any other relevant documentation that supports your claim. It’s important to present a clear and logical argument to increase your chances of a successful appeal.

Once your appeal application is submitted, it will be reviewed by the local assessment review board or an appointed assessor. They will consider your arguments and evidence, along with the assessor’s original assessment, to make a decision.

If your appeal is successful, the assessed value of your property may be adjusted, resulting in a lower tax liability. However, if the review board upholds the original assessment, you may have the option to further appeal the decision through the court system. It’s important to consult with a tax professional or seek legal advice if you wish to pursue a court appeal.

Keep in mind that the appeal process can be time-consuming and may require additional fees. It’s essential to weigh the potential benefits against the effort and costs involved before deciding to proceed with an appeal.

Understanding the assessment appeals process empowers you as a homeowner to challenge an assessment that you believe is incorrect or unfair. However, it’s important to approach the process with adequate preparation, proper documentation, and a clear understanding of the local regulations.

Next, let’s explore some of the factors that can affect your property assessment in Edenton, NC.

You can discover your property assessment in Edenton, NC by visiting the Chowan County Tax Assessor’s office website or by contacting them directly. They can provide you with the most up-to-date information on your property assessment.

Read more: What Is Property Assessment

Factors Affecting Property Assessment

Several factors can influence the assessment of your property in Edenton, NC. Understanding these factors can help you gain insight into how your property value is determined and why it may differ from your expectations.

1. Location: The location of your property plays a significant role in its assessment. Properties located in desirable neighborhoods or areas with high demand tend to have higher assessed values. Factors such as proximity to amenities, schools, parks, and transportation can also affect the assessment.

2. Size and Features: The size and features of your property, including the land and building structures, are crucial factors in the assessment. Larger properties or those with additional features like swimming pools, outbuildings, or extensive landscaping may have higher assessed values compared to smaller or less developed properties.

3. Market Conditions: Market conditions can impact property assessments. When the real estate market is hot, with high demand and rising prices, assessments are likely to reflect the increase in property values. Conversely, during a downturn or recession, assessments may be lower to account for decreased property values.

4. Improvements and Renovations: Any improvements or renovations made to your property can affect its assessed value. Adding a new addition, upgrading the kitchen or bathroom, or making significant structural changes can result in a higher assessment. It’s crucial to keep track of any improvements and report them to the tax assessor’s office to ensure accurate assessment.

5. Comparable Sales: The value of recently sold properties in your area, known as comparable sales, can influence your property assessment. The tax assessor may use these sales to determine the fair market value of your property. If there are limited comparable sales or if your property differs significantly from the sold properties, adjustments may be made to the assessment.

6. Economic Factors: Economic factors such as inflation, interest rates, and local economic conditions can impact property assessments. Changes in the economy can influence supply and demand dynamics, leading to fluctuations in property values and, consequently, assessments.

7. Exemptions and Deductions: Certain exemptions or deductions, such as those for primary residences, senior citizens, or veterans, can affect property assessments. These exemptions or deductions may lower the assessed value and, subsequently, the property tax liability.

It’s important to note that property assessments are not always perfect indicators of a property’s true market value. Assessments are conducted periodically, and variations in assessed values can occur due to several factors. If you believe your assessment is unfair or inaccurate, you have the right to appeal, as discussed in a previous section.

Now that you understand the factors that can affect your property assessment, let’s explore how assessment changes are handled in Edenton, NC.

Understanding Assessment Changes

In Edenton, NC, property assessments can change over time due to various factors. Understanding these assessment changes is crucial to staying informed about the value of your property and any potential impact on your property taxes.

1. Reassessment Cycle: In Edenton, NC, assessments are typically conducted on a reassessment cycle. This means that assessments are reassessed periodically, usually every few years. The purpose of reassessment is to ensure that property values are aligned with current market conditions. As a result, you may notice changes in your assessed value between reassessment periods.

2. Market Fluctuations: Assessment changes can occur due to fluctuations in the real estate market. When the market is experiencing significant growth or decline, property values can change. Assessments aim to reflect these market trends and ensure fairness in property taxation.

3. Property Improvements or Deterioration: Any improvements or deterioration to your property can impact its assessed value. If you have made substantial renovations or additions to your property, the assessed value may increase. On the other hand, if your property has experienced neglect or deterioration, the assessed value may decrease.

4. Changes in Exemptions or Deductions: Changes in the exemptions or deductions that apply to your property can also lead to assessment changes. For example, if you previously qualified for a specific exemption but no longer meet the criteria, your assessed value may increase.

5. Assessment Appeals: Assessment appeals can result in assessment changes. If you appealed your assessment and the review board determined that a change is warranted, your assessed value may be adjusted accordingly.

It’s essential to stay informed about assessment changes for your property. If you receive an assessment notice indicating a change in your assessed value, review it carefully to understand the reasons behind the change. If you have any questions or concerns, contact the tax assessor’s office for further clarification.

Remember that assessment changes do not automatically translate to changes in your property taxes. The assessed value is just one component used to calculate property taxes. Tax rates and other factors also come into play.

Being aware of assessment changes allows you to anticipate potential changes in your property taxes and plan your finances accordingly. It’s beneficial to stay informed and seek guidance from the tax assessor’s office or a financial advisor if you have any concerns or questions regarding assessment changes.

Now that you have a better understanding of assessment changes, let’s explore resources available to assist you with property assessment and taxation matters in Edenton, NC.

Resources for Further Assistance

When it comes to property assessment and taxation matters in Edenton, NC, there are several resources available to provide further assistance and guidance. Whether you have questions about your property assessment, need help with appeals, or require general information about property taxes, these resources can be valuable references.

1. Edenton Tax Assessor’s Office: The Edenton Tax Assessor’s Office is the primary resource for property assessment and taxation matters. They can provide information about the assessment process, assist with accessing your assessment information, and answer any specific questions you have about your property. Contact their office directly for personalized assistance.

2. Official Website: The official website of the Edenton Tax Assessor’s Office is a valuable resource for accessing assessment information, understanding assessment procedures, and finding forms or documents related to property assessment and taxation. The website may also contain FAQs, helpful guides, and contact information for further assistance.

3. County or Municipal Government Websites: Visit the official websites of Chowan County and the town or municipality of Edenton. These websites often provide relevant information on property assessment, tax rates, and other taxation-related matters specific to your locality.

4. Online Property Portals: Online property portals, such as county-assessor websites or third-party platforms, can be useful for accessing your property assessment details. These portals often provide search functions where you can enter your property address or parcel number to retrieve your assessment information. Be sure to use trusted and official portals to ensure accurate and up-to-date information.

5. Tax Professionals: If you require in-depth assistance or have complex questions about your property assessment or taxation issues, consider consulting with a tax professional or a certified public accountant (CPA) who specializes in property taxation. They can provide personalized advice, guide you through the appeals process, and ensure that you meet all the necessary requirements.

6. Peer Community: Engaging with local homeowner associations or attending community meetings can provide a platform for discussing property assessment and taxation matters. Sharing experiences and insights with fellow homeowners in Edenton, NC, can help you gain a better understanding and learn about any local nuances or challenges regarding property assessments in your community.

It’s important to note that while these resources can provide valuable information and guidance, it is always recommended to seek professional and personalized advice when necessary. Taxes and assessments can be complex, and individual circumstances may vary.

By utilizing these resources, you can stay informed, navigate the property assessment process more effectively, and ensure that your property taxes are fair and accurate.

Let’s wrap things up in the next section.

Conclusion

Understanding your property assessment in Edenton, NC, is vital for responsible homeownership. By familiarizing yourself with the assessment process, accessing your assessment information, exploring appeal options, and considering the factors that affect assessments, you can make informed decisions and ensure fairness in property taxation.

Property assessment serves as a basis for calculating property taxes, reflecting the value of your property for tax purposes. It takes into account various factors such as location, size, market conditions, improvements, and exemptions. Assessments are conducted periodically to align with current market values, ensuring fairness and equity among property owners.

Accessing your property assessment information is relatively straightforward in Edenton, NC. Through online portals provided by the tax assessor’s office, personal visits to the office, or direct communication with the staff, you can review your assessment details and address any concerns or discrepancies that may arise.

If you disagree with your assessment, the appeals process allows you to challenge the assessed value. By providing evidence and arguments, you can present your case to the assessment review board and potentially secure a reassessment. However, it’s important to approach the appeal process with proper documentation, preparation, and a clear understanding of the local regulations.

Various factors can affect property assessments, including location, property features, market conditions, improvements, and exemptions. Understanding these factors provides valuable insight into how assessments are determined and why they may change over time.

In Edenton, NC, resources such as the tax assessor’s office, official websites, online portals, tax professionals, and peer community engagement can provide further assistance and guidance for property assessment and taxation matters. Utilizing these resources can help you navigate the assessment process, stay informed, and ensure that your property taxes are accurate and fair.

By taking the time to understand and stay engaged in the property assessment process, you can fulfill your responsibilities as a homeowner, make informed decisions regarding your property, and contribute to the equitable distribution of property taxes in Edenton, NC.

Remember, if you have specific questions or concerns about your property assessment, it is always best to consult with the tax assessor’s office or seek professional advice. They can provide personalized assistance based on your unique circumstances.

Armed with this knowledge and the available resources, you are well-equipped to navigate the world of property assessment in Edenton, NC, and ensure that your property is valued accurately and fairly for taxation purposes.

Frequently Asked Questions about How To Discover Your Property Assessment In Edenton, NC

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Discover Your Property Assessment In Edenton, NC”