Home>Home Maintenance>How To Lower Your Property Assessment

Home Maintenance

How To Lower Your Property Assessment

Modified: March 6, 2024

Learn effective home maintenance techniques to lower your property assessment and save money. Discover valuable tips on reducing your home's assessed value and maximizing tax savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to our comprehensive guide on how to lower your property assessment. If you’re a homeowner concerned about the rising property taxes or just want to ensure that your property is assessed accurately, you’ve come to the right place. Understanding the property assessment process and knowing your rights as a homeowner can help you navigate through the assessment appeal process successfully.

A property assessment is an evaluation of the value of your property for tax purposes. The assessed value is used to determine the amount of property tax you owe. Unfortunately, property assessments are not always accurate, and that’s where this guide comes in handy. By following the steps outlined here, you’ll be equipped with the knowledge and tools necessary to challenge and potentially lower your property assessment.

Keep in mind that property assessment laws and procedures can vary from one jurisdiction to another, so it’s essential to research the specific regulations in your local area. This guide aims to provide a general overview and suggestions that are applicable in many regions, but make sure to consult local resources or seek professional advice for accurate and up-to-date information.

Ready to take control of your property assessment? Let’s dive into the details of how you can challenge and potentially reduce your property assessment!

Key Takeaways:

- Challenge your property assessment by researching, gathering evidence, and filing an appeal to potentially lower your property taxes and ensure a fair valuation.

- Understand the assessment process, check for errors, and present your case effectively to navigate the appeal process and advocate for a more accurate property assessment.

Understand Property Assessments

Before you can successfully navigate the property assessment appeal process, it’s crucial to have a solid understanding of how property assessments work. Property assessments are conducted by government agencies to determine the value of a property for tax purposes. The assessed value is used to calculate property taxes that homeowners are required to pay.

Assessments are typically based on various factors, including the physical characteristics of the property (such as size, age, and condition), the location, and the market value of similar properties in the area. The goal is to ensure that properties are assessed fairly and at a value that aligns with their market worth.

It’s important to note that property assessments are not always accurate. Factors like changes in the real estate market, property improvements, or errors in the assessment process itself can result in assessments that are higher than they should be. This is why it’s essential for homeowners to review their property assessments and, if necessary, challenge them to ensure fairness and accuracy.

When reviewing your property assessment, you should look for any discrepancies or errors that could be inflating the value. Examples of errors may include incorrect property dimensions, inaccurate property classifications, or outdated information about recent improvements or damage.

Understanding the assessment criteria used in your jurisdiction is also vital. Some areas may use the fair market value approach, while others may use the income approach or cost approach. Becoming familiar with the specific methodology employed in your region can help you identify potential flaws or inaccuracies in the assessment.

Keep in mind that property assessments are not static and can change over time. Assessments are often updated periodically, usually every few years, to reflect changes in property values. This means that even if your assessment was accurate in the past, it may no longer align with the current market conditions.

Now that we have an understanding of property assessments, let’s move on to the next step: researching your local assessment process.

Research Your Local Assessment Process

Once you have a clear understanding of property assessments, the next step in challenging and potentially lowering your property assessment is to research the local assessment process. Each jurisdiction may have its own set of rules and procedures for assessing properties, so it’s important to familiarize yourself with the specific regulations in your area.

Start by visiting the website of your local tax assessor’s office. They will often provide valuable information on the assessment process, including key dates, forms, and guidelines for filing an appeal. Take the time to read through these materials carefully to understand the steps you need to follow and any requirements you must meet.

Look for information on how the assessment values are calculated. Some areas may rely on recent sales data, while others may consider factors like property size, building quality, or income potential. Understanding the methodology used in your locality will help you better prepare your case and identify any potential weaknesses in the assessment.

It’s also essential to familiarize yourself with the deadlines for filing an appeal. Missing the deadline can result in the loss of your right to challenge the assessment. Make note of the appeal window and ensure you have all the necessary documentation and evidence prepared and submitted on time.

While researching the local assessment process, consider reaching out to the assessor’s office directly. They may be able to provide you with additional guidance or clarification on specific questions you may have. Building a good rapport with the assessors can also work in your favor, as they may be more willing to consider your evidence and arguments during the appeal process.

Additionally, don’t underestimate the power of networking with other homeowners in your area. Join local forums or discussion groups where property assessment issues are discussed. By connecting with others who have gone through the assessment appeal process, you can gain valuable insights, advice, and support.

Remember, knowledge is power. The more you educate yourself about the local assessment process, the better equipped you’ll be to navigate through it successfully. Now that you’ve researched the assessment process, the next step is to gather evidence of your property’s value.

Gather Evidence of Property Value

When challenging your property assessment, one of the key steps is to gather evidence that supports your claim of an inaccurate assessment. This evidence will help demonstrate that the assessed value of your property is higher than it should be, ultimately strengthening your case during the appeal process.

Here are some steps to consider when gathering evidence of your property’s value:

- Obtain recent sales data: Research recent sales of comparable properties in your area to get an idea of their market value. Look for properties that are similar in terms of size, condition, location, and features. This information will provide you with a basis for comparison to argue that your property has been overvalued.

- Consult with a real estate agent or appraiser: Reach out to a local real estate agent or appraiser who has expertise in your area. They can provide you with a professional estimation of your property’s value based on current market conditions and recent sales data. This opinion can carry weight during the appeal process.

- Document any property defects or issues: If your property has any significant defects, damages, or issues that affect its value, make sure to document them thoroughly. Take clear photographs and gather any relevant repair estimates or inspection reports. These documents will help support your argument that the assessed value should be adjusted downward.

- Compile evidence of neighborhood factors: Gather information about any negative factors that may impact your property’s value, such as noise pollution, heavy traffic, or proximity to undesirable establishments. Public records, online resources, and even testimonials from neighbors can provide supporting evidence in these cases.

- Consider hiring a professional: In more complex cases or if you are unsure about the value of your property, it may be worth engaging the services of a qualified property appraisal firm. These experts have access to extensive data and can provide a thorough and objective assessment of your property’s value.

Remember, the goal is to gather as much evidence as possible to demonstrate that your property’s assessed value is inaccurate. The more compelling and detailed your evidence, the stronger your case will be when you present it during the appeal process.

Once you have gathered all the necessary evidence, the next step is to carefully review your property assessment for any errors or discrepancies.

Check for Errors in the Assessment

As a homeowner, it’s important to review your property assessment for any errors or discrepancies that may have led to an inflated value. Mistakes can happen during the assessment process, and if left unaddressed, they can result in a higher property tax burden for you. Taking the time to carefully examine your assessment for errors is a crucial step in challenging and potentially lowering your property assessment.

Here are some key areas to focus on when checking for errors:

- Property information: Review the basic information about your property, including its size, lot dimensions, and any improvements. Ensure that these details are accurate and match the actual attributes of your property. Mistakes in property information can significantly impact the assessed value.

- Property classification: Check the designated classification of your property, such as residential, commercial, or agricultural. Assessments for different property types can have varying tax rates. Make sure your property is classified correctly to ensure fair taxation.

- Exemptions and deductions: Verify if you are properly receiving any eligible exemptions or deductions. This could include homestead exemptions, senior citizen exemptions, or any other applicable tax relief measures. These exemptions can lower your overall property tax liability.

- Comparable properties: Examine the assessment of comparable properties in your area. Look for inconsistencies or discrepancies between your property and similar ones. If you find properties with comparable features that are assessed lower than yours, it can be a strong case for appeal.

- Calculation errors: Double-check the math on your assessment. Ensure that all calculations, including factors like depreciation, are accurate. Calculation errors can lead to an incorrect assessed value.

If you identify any errors or discrepancies in your property assessment, it’s important to document them thoroughly. Take notes, gather evidence, and make copies of any supporting documents that can substantiate your claims. These records will be valuable when you file an appeal and present your case to the assessor’s office.

Once you have checked for errors in your assessment and collected the necessary evidence, it’s time to move on to the next step: filing an appeal with the assessor’s office.

Consider gathering evidence of any structural damage, outdated features, or other factors that may lower the value of your property. Present this information to your local assessor for a potential reduction in your property assessment.

Read more: What Is Property Assessment

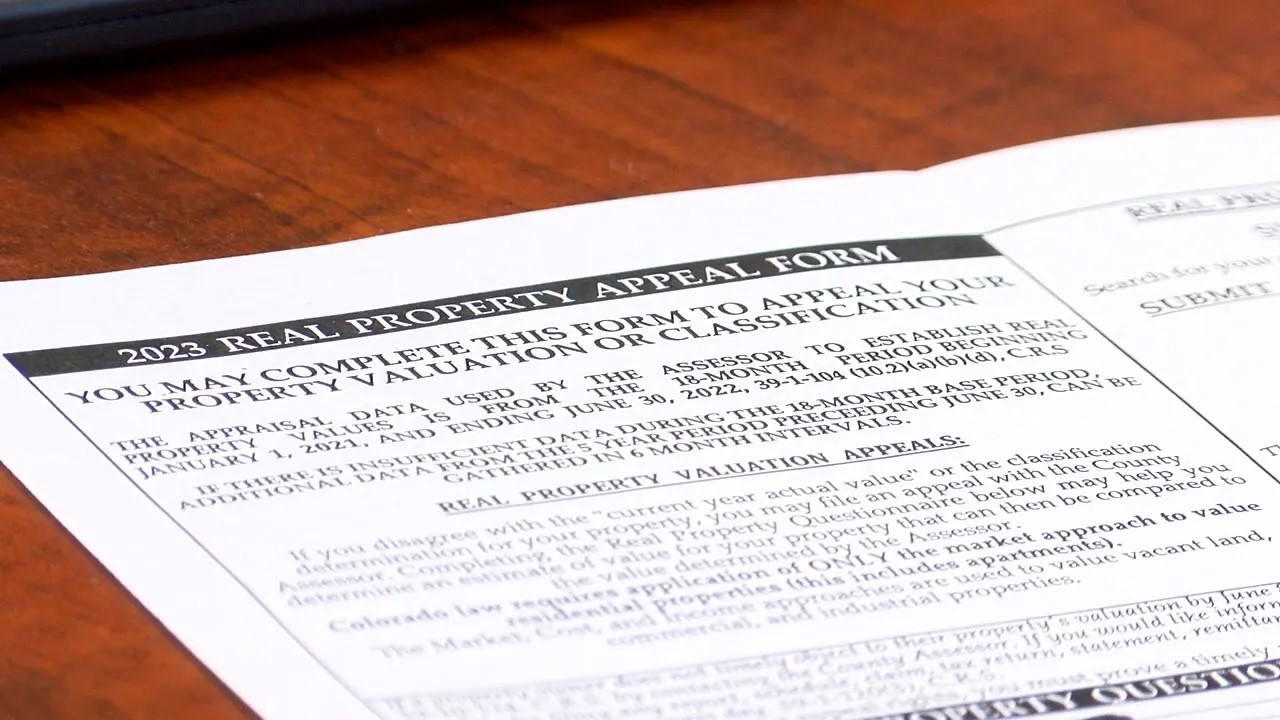

File an Appeal with the Assessor’s Office

If you believe that your property assessment is inaccurate or unfairly high, it’s important to take action by filing an appeal with the assessor’s office. Filing an appeal allows you to formally challenge the assessment and present your case for a potential reduction in the assessed value of your property.

Here are the steps to follow when filing an appeal:

- Review the appeal process: Familiarize yourself with the specific procedures and requirements for filing an appeal in your jurisdiction. Visit the website of the assessor’s office or contact them directly to obtain the necessary forms and information.

- Observe the deadline: Pay close attention to the deadline for filing an appeal. Missing the deadline can result in the loss of your right to challenge the assessment. Make sure to submit your appeal within the specified timeframe.

- Complete the appeal form: Fill out the appeal form accurately and provide all the required information. Be sure to clearly state the reasons for your appeal and include any supporting evidence or documentation to strengthen your case.

- Submit the appeal: Once you have completed the appeal form, submit it to the assessor’s office. Follow the specified submission method, whether it’s through mail, electronically, or in-person. Keep a copy of your appeal for your records.

- Pay attention to the review process: After you have submitted your appeal, the assessor’s office will review your case. They may request additional information or schedule an inspection of your property. Cooperate with any requests and promptly provide the necessary documentation or access to your property.

- Prepare for the appeal hearing: In some cases, an appeal may involve a formal hearing. This allows you to present your case before an appeals board or a hearing officer. Take the time to prepare your arguments and gather any additional evidence or witnesses that can support your claim.

It’s important to approach the appeal process in a professional and respectful manner. Maintain clear and concise communication with the assessor’s office, and follow all instructions and guidelines provided. Remember, you are presenting a case for a potential reduction in your property assessment, so it’s crucial to present your information effectively and persuasively.

Once you have filed the appeal, the next step is to prepare for the assessment appeal hearing, if applicable. We will explore this step in detail in the next section.

Prepare for the Assessment Appeal Hearing

If your property assessment appeal moves forward and involves a formal hearing, it’s important to adequately prepare to present your case before the appeals board or hearing officer. The appeal hearing provides you with an opportunity to provide additional evidence, present arguments, and convince the decision-makers of the need for a reduction in your property assessment.

Here are some steps to follow when preparing for the assessment appeal hearing:

- Review your case and gather evidence: Refresh your memory on the specific reasons for your appeal and review all the evidence you have gathered. Make sure you have organized your evidence and supporting documentation in a clear and easy-to-understand manner.

- Develop a persuasive argument: Clearly articulate your main points and arguments for why the assessed value of your property should be lowered. Focus on the key factors that you believe contribute to the overvaluation, such as recent sales data, property defects, or discrepancies with comparable properties.

- Create a visual presentation: If permitted, consider creating a visual presentation to accompany your verbal arguments. This can include slides, photos, graphs, or any other visual aids that help illustrate your points and support your evidence.

- Practice your presentation: Take the time to practice your presentation and anticipate potential questions or objections from the appeals board or hearing officer. Rehearsing will help you feel more confident and prepared during the actual hearing.

- Consider seeking professional representation: If you feel overwhelmed or unsure about presenting your case, you might consider hiring a lawyer or property tax consultant to represent you at the hearing. They can provide valuable expertise and navigate the legal process on your behalf.

- Be professional and respectful: During the hearing, maintain a professional and respectful demeanor. Follow any guidelines or rules provided by the appeals board or hearing officer. Clearly and succinctly present your case, and address any questions or concerns raised by the decision-makers.

Remember, the goal of the appeal hearing is to present your evidence and arguments persuasively to convince the decision-makers to lower your property assessment. By being well-prepared and confident in your presentation, you increase your chances of achieving a favorable outcome.

Once the assessment appeal hearing has concluded, the next step is to review the decision and determine if further action is necessary. We will explore this final step in the next section.

Present Your Case at the Hearing

At the assessment appeal hearing, you will have the opportunity to present your case before the appeals board or hearing officer. This is your chance to effectively communicate your arguments, present evidence, and convince the decision-makers of the need for a reduction in your property assessment.

Here are some tips to help you present your case effectively at the hearing:

- Be prepared and organized: Arrive at the hearing with all your evidence and documentation well-organized and easily accessible. Use tabs or dividers to divide your materials clearly, making it easier to refer to specific documents during your presentation.

- Stay focused and concise: Clearly articulate your main points and arguments and stick to the most compelling evidence that supports your case. Avoid unnecessary tangents or excessive repetition. Present your information in a clear, logical, and concise manner.

- Use visual aids effectively: If allowed, utilize visual aids such as slides, charts, or photos to help illustrate your points. Visual aids can make complex information easier to understand and can enhance the overall clarity and impact of your presentation.

- Support your arguments with evidence: Present your evidence systematically, providing clear explanations of how each piece of evidence supports your case. Emphasize any discrepancies in the assessment, recent sales data, property defects, or comparisons with similar properties to bolster your argument.

- Be respectful and professional: Maintain a professional and respectful demeanor throughout the hearing. Address the decision-makers with courtesy, and listen attentively to any questions or concerns they may have. Respond thoughtfully and substantively to any inquiries or objections raised.

- Anticipate and address counterarguments: Be prepared to address any counterarguments or objections that may arise during the hearing. Anticipate the potential questions or concerns of the decision-makers and have well-reasoned responses ready. Stay calm and composed, maintaining focus on the strengths of your case.

- Provide a strong closing statement: End your presentation with a strong closing statement summarizing your main arguments and reinforcing your request for a reduction in your property assessment. Leave the decision-makers with a clear understanding of why your case is compelling and deserving of a favorable outcome.

Remember that every hearing is different, and the specific guidelines or procedures may vary. Make sure to familiarize yourself with any specific rules or protocols established by the appeals board or hearing officer prior to the hearing.

By presenting your case confidently, providing compelling evidence, and effectively addressing any questions or objections, you increase your chances of achieving a favorable outcome in your assessment appeal.

Once the hearing is concluded, the decision will be made, and it’s important to review that decision and determine if further action is necessary. We will explore this final step in the next section.

Review the Decision and Take Further Action if Needed

After presenting your case at the assessment appeal hearing, the appeals board or hearing officer will make a decision regarding the reduction of your property assessment. It’s important to carefully review this decision to determine if it aligns with your expectations and whether any further action is necessary.

Here are the steps to take when reviewing the decision and deciding on further action:

- Read the decision letter: The decision will typically be communicated to you in writing. Take the time to read the decision letter carefully, paying attention to any explanations or justifications provided. Make note of the outcome and any specific details mentioned.

- Evaluate the decision against your expectations: Compare the decision to your expectations and the arguments you presented during the hearing. Determine if the outcome aligns with what you were aiming to achieve. If the decision is in your favor and your property assessment has been reduced, congratulations! You can proceed accordingly with the new assessment.

- If the decision is unfavorable: If the decision is not in your favor or does not significantly lower your property assessment, you may need to consider further action. Evaluate the reasons provided in the decision letter and determine if there were any errors or misunderstandings during the hearing process.

- Consider your options for further action: If you believe that the decision was unfair or incorrect, you may have various options for further action. These options can include appealing the decision to a higher authority, such as a local tax board or even pursuing legal recourse if necessary. Consult with a lawyer or property tax consultant to understand the potential avenues available to you.

- Decide on the best course of action: Based on your evaluation and the advice you receive, decide on the best course of action. Assess the potential costs, time commitments, and likelihood of success associated with each option. Determine if pursuing further action is justified based on the potential benefits it may bring.

- Take action within the specified timeframe: If you decide to pursue further action, make sure to adhere to any deadlines or specified timeframes for filing appeals or initiating legal proceedings. Procrastination can result in the loss of your ability to challenge the decision later on.

- Seek professional assistance if needed: If you choose to proceed with further action, consider enlisting the help of a lawyer or property tax consultant who specializes in property assessment appeals. They can provide valuable guidance, expertise, and support throughout the process.

Remember, reviewing the decision and deciding on further action requires careful consideration and understanding of the potential implications. It’s essential to weigh the costs and benefits and gather professional advice if necessary to ensure you make an informed decision.

By reviewing the decision and taking appropriate action, you can continue to advocate for a fair and accurate property assessment that aligns with the value of your property.

Overall, navigating the process of challenging and potentially lowering your property assessment requires thorough research, preparation, and effective communication. By following the steps outlined in this guide, you can increase your chances of achieving a favorable outcome and reducing your property tax burden.

Good luck with your property assessment appeal, and may your efforts lead to a fair and accurate assessment of your property!

Conclusion

Congratulations on completing our comprehensive guide on how to lower your property assessment. Armed with knowledge and proactive strategies, you are now better equipped to navigate the assessment appeal process and challenge an inaccurate or unjust property assessment.

Throughout this guide, we covered key steps to help you in your journey:

- Understanding property assessments and their impact on your tax obligations.

- Researching your local assessment process to familiarize yourself with the specific rules and requirements in your jurisdiction.

- Gathering evidence of your property’s value to support your claim for a lower assessment.

- Checking for errors in the initial assessment, such as incorrect property information or calculation mistakes.

- Filing an appeal with the assessor’s office, following the prescribed procedures and deadlines.

- Preparing for the assessment appeal hearing by organizing your evidence, practicing your presentation, and remaining professional.

- Presenting your case at the hearing, effectively articulating your arguments and providing compelling evidence.

- Reviewing the decision made by the appeals board or hearing officer, and determining whether further action is needed.

Remember that the assessment appeal process can vary from one jurisdiction to another, so it’s crucial to research and understand the specific rules and regulations that apply to your area. Consult local resources or seek professional advice for accurate and up-to-date information.

Challenging your property assessment is not without its challenges, but with persistence and proper preparation, you have a chance to achieve a fair and accurate assessment that aligns with the value of your property. Whether your goal is to reduce your property tax burden or simply ensure a fair valuation, the steps outlined in this guide can help you navigate the process more confidently.

We hope that this guide has been informative and empowering, enabling you to take control of your property assessment and advocate for fairness. Remember to review the decision and decide on further action if necessary, considering the potential costs and benefits associated with each option.

Good luck on your journey to lowering your property assessment, and may your efforts lead to a more equitable and just valuation of your property!

Frequently Asked Questions about How To Lower Your Property Assessment

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Lower Your Property Assessment”