Home>Technology>Home Office Tech>How To Organize Invoices

Home Office Tech

How To Organize Invoices

Published: March 3, 2024

Learn how to efficiently organize your home office tech invoices with our expert tips and tricks. Streamline your invoicing process and stay organized.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Are you tired of sifting through piles of paperwork to find a specific invoice? Do you struggle to keep track of which invoices have been paid and which are still outstanding? Organizing invoices can be a daunting task, but with the right system in place, you can streamline the process and save yourself time and stress. In this article, we will explore the best practices for organizing invoices, including setting up a system, creating a filing system, using digital tools for organization, establishing a routine for invoicing, and managing overdue invoices. By implementing these strategies, you can take control of your invoicing process and maintain a more organized and efficient home or business.

Key Takeaways:

- Stay organized by setting up a designated space for invoices, creating a consistent naming system, and using color-coding to differentiate between paid and unpaid invoices. This helps minimize the risk of overlooking payments and reduces time spent searching for specific invoices.

- Leverage digital tools for invoice organization to streamline the invoicing process, automate recurring invoices, and gain valuable insights into financial performance. This modern approach enhances efficiency and accuracy in handling invoicing responsibilities.

Read more: How To Create An Invoice For Construction

Setting Up a System for Invoices

Setting up a system for invoices is the first step towards maintaining an organized invoicing process. Start by designating a specific area in your home or office for handling invoices. This could be a desk, a filing cabinet, or a dedicated folder on your computer. By having a designated space, you can avoid misplacing invoices and ensure that everything is in one central location.

Next, establish a consistent naming convention for your invoices. Whether you prefer to organize them by date, client name, or project number, having a standardized naming system will make it easier to locate specific invoices when needed. This also helps in categorizing and sorting invoices efficiently.

Consider using color-coding or labeling to differentiate between paid and unpaid invoices. This visual cue can help you quickly identify which invoices require attention and which ones have been settled. Additionally, it's beneficial to keep a separate folder or digital folder for paid invoices, making it easier to track payment history and reference past transactions.

To further streamline the process, create a checklist or spreadsheet template for each invoice. Include details such as the invoice number, client name, due date, amount, and payment status. This will serve as a quick reference guide and ensure that no invoice slips through the cracks.

By setting up a systematic approach to handling invoices, you can minimize the risk of overlooking payments, reduce the time spent searching for specific invoices, and maintain a more organized invoicing workflow.

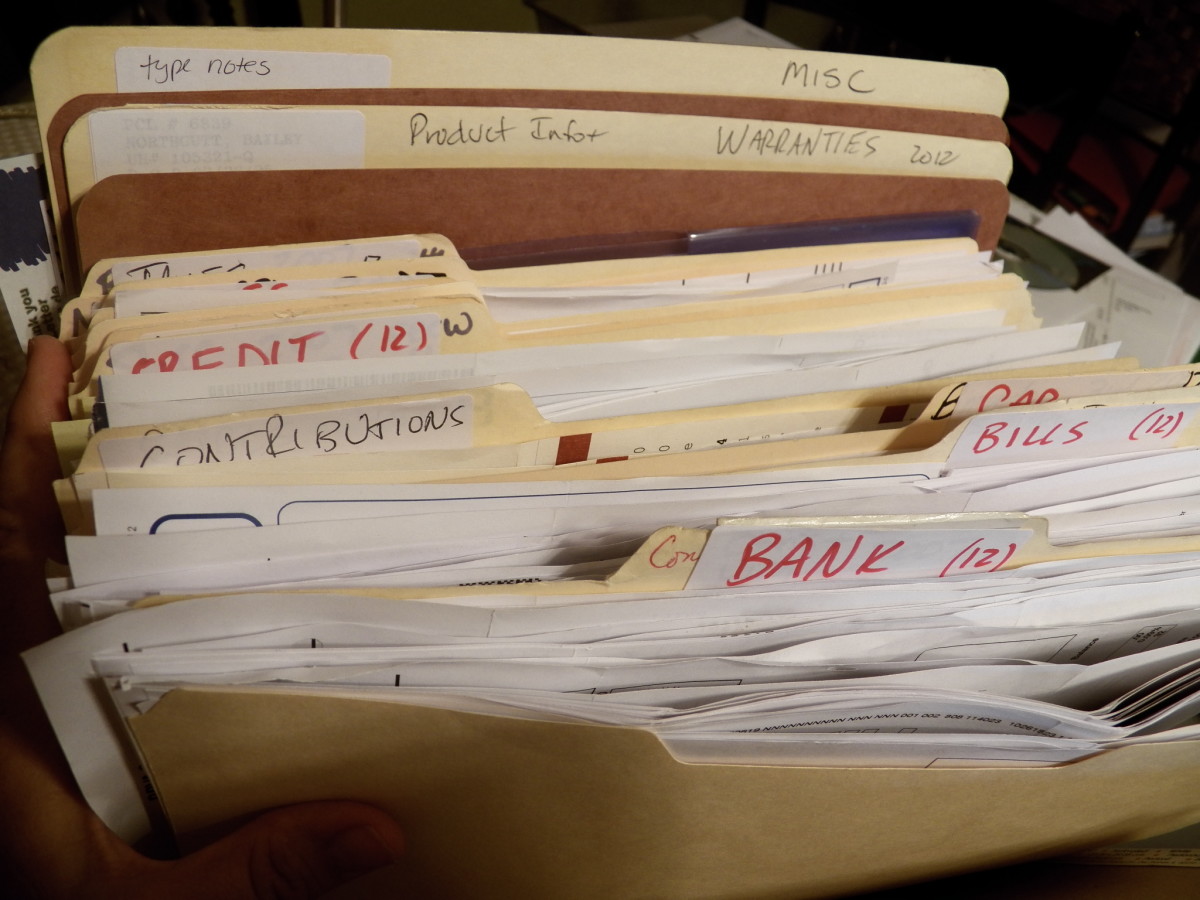

Creating a Filing System

Creating a filing system for your invoices is crucial for maintaining organization and accessibility. Start by categorizing your invoices based on different criteria such as client name, project type, or invoice date. Utilize hanging file folders or digital folders to separate and store invoices according to these categories. For physical filing, consider using a filing cabinet with clearly labeled tabs for easy navigation.

Within each category, arrange the invoices chronologically or alphabetically to facilitate quick retrieval. If opting for a digital filing system, create subfolders within the main invoice folder to further categorize and organize the invoices. This can include subfolders for each client, project, or month, depending on your preference.

To ensure consistency and uniformity, establish a naming convention for your digital invoice files. Incorporate relevant details such as the client's name, invoice number, and date to make it easier to identify specific invoices at a glance. For physical filing, use clear and descriptive labels on the file folders to avoid confusion and misplacement.

Consider implementing a backup system for your digital invoices, such as cloud storage or external hard drives, to safeguard against data loss. Regularly back up your digital invoice files to prevent any potential loss of important financial records.

By creating a well-organized filing system, you can significantly reduce the time spent searching for invoices, minimize the risk of misplacing important documents, and maintain a clear overview of your financial records.

Using Digital Tools for Organization

In today's digital age, leveraging digital tools for invoice organization can significantly streamline the invoicing process. Consider utilizing accounting software or dedicated invoicing platforms to manage and organize your invoices digitally. These tools often offer features such as invoice creation, tracking, and payment reminders, providing a centralized platform for all your invoicing needs.

Furthermore, digital tools can automate certain aspects of the invoicing process, such as recurring invoices for regular clients or automatic payment reminders for overdue invoices. This automation not only saves time but also reduces the likelihood of human error in managing invoicing tasks.

Cloud-based storage solutions, such as Google Drive or Dropbox, offer a convenient way to store and access digital invoices from anywhere with an internet connection. By digitizing your invoices and storing them in the cloud, you can ensure that your financial records are secure and easily accessible, even if you're away from your primary work location.

Consider integrating your digital invoicing tools with accounting software to synchronize invoice data with your financial records. This integration can provide a seamless flow of information, allowing for accurate tracking of income, expenses, and overall financial health.

Utilize digital tools to generate detailed reports on your invoicing activity, including outstanding payments, revenue trends, and client payment histories. These insights can help you make informed decisions about your invoicing strategies and identify areas for improvement in your financial management.

By embracing digital tools for invoice organization, you can streamline your invoicing process, reduce manual paperwork, and gain valuable insights into your financial performance. This modern approach to invoice management can enhance efficiency and accuracy in handling your invoicing responsibilities.

Create a system for organizing invoices, such as using a digital folder or binder with labeled sections for different vendors or time periods. This will make it easier to find and track your invoices.

Establishing a Routine for Invoicing

Consistency is key when it comes to managing invoices effectively. Establishing a routine for invoicing helps create a structured approach to handling financial transactions and ensures that invoicing tasks are completed in a timely manner. Here are some essential steps to consider when establishing a routine for invoicing:

-

Set Clear Invoicing Deadlines: Determine specific dates for generating and sending out invoices. Whether it's at the end of each week, month, or after completing a project, having a set schedule for invoicing helps maintain a regular flow of income and keeps clients informed about their financial obligations.

-

Allocate Dedicated Time for Invoicing: Block out dedicated time in your schedule for invoicing activities. This could be a few hours each week or a designated day each month to focus solely on creating and sending out invoices. By prioritizing invoicing tasks, you can avoid procrastination and ensure that invoices are promptly issued to clients.

-

Utilize Reminders and Alerts: Leverage calendar reminders or invoicing software alerts to prompt you when it's time to generate and send out invoices. These reminders serve as a helpful nudge to stay on top of your invoicing routine and prevent any missed deadlines.

-

Streamline Invoicing Processes: Identify ways to streamline the invoicing process to make it more efficient. This could involve using invoice templates, automating recurring invoices for regular clients, or integrating payment gateways to facilitate swift transactions. By simplifying the invoicing workflow, you can save time and reduce the administrative burden associated with invoicing.

-

Follow Up on Overdue Invoices: Incorporate a follow-up procedure for overdue invoices into your routine. Set specific intervals for sending payment reminders or making follow-up calls to clients with outstanding payments. Consistent follow-up demonstrates your commitment to timely payments and encourages clients to fulfill their financial obligations promptly.

-

Regularly Review and Update Invoicing Practices: Periodically review your invoicing routine to identify any bottlenecks or areas for improvement. Assess the effectiveness of your current practices and make adjustments as necessary to optimize your invoicing workflow.

By establishing a routine for invoicing, you can instill discipline in managing financial transactions, maintain a steady cash flow, and foster strong client relationships through transparent and timely invoicing practices. Consistent invoicing routines contribute to a more organized and efficient approach to financial management.

Read more: How To Make A Lawn Care Invoice

Tips for Managing Overdue Invoices

Dealing with overdue invoices can be a challenging aspect of managing your finances. However, implementing effective strategies for managing overdue invoices can help minimize financial disruptions and maintain positive client relationships. Here are some valuable tips for handling overdue invoices:

-

Send Polite Reminders: Initiate the process by sending polite and professional payment reminders to clients with overdue invoices. Clearly communicate the outstanding amount, the due date, and provide instructions for making the payment. Maintaining a respectful tone in your reminders can encourage clients to prioritize settling their overdue invoices.

-

Follow Up with Personalized Communication: If initial reminders do not yield a response, consider following up with personalized communication. A phone call or personalized email can convey the urgency of the situation and provide an opportunity to address any potential issues or concerns that may be hindering prompt payment.

-

Offer Flexible Payment Options: In some cases, clients may be experiencing temporary financial constraints that hinder their ability to settle invoices promptly. Consider offering flexible payment options, such as installment plans or extended payment deadlines, to accommodate their circumstances while still ensuring that you receive the outstanding payments.

-

Implement Late Payment Penalties: Clearly outline late payment penalties in your invoicing terms and conditions. This can serve as a deterrent for delayed payments and incentivize clients to adhere to the agreed-upon payment timelines. Be transparent about the consequences of late payments to encourage timely settlements.

-

Utilize Debt Collection Services: If persistent reminders and follow-ups do not yield results, consider engaging professional debt collection services. These services specialize in recovering overdue payments and can escalate the collection process through legal means if necessary. While this step should be a last resort, it can be an effective measure for recovering outstanding debts.

-

Maintain Professionalism and Persistence: Throughout the process of managing overdue invoices, maintain professionalism and persistence in your communication with clients. Clearly articulate the impact of overdue payments on your business operations and emphasize the importance of resolving the outstanding invoices to maintain a positive working relationship.

-

Review and Adjust Invoicing Policies: Periodically review your invoicing policies and terms to identify potential areas for improvement. Assess the effectiveness of your current approach to managing overdue invoices and make adjustments to your invoicing terms, payment deadlines, or late payment penalties as needed to minimize future occurrences of overdue payments.

By implementing these tips for managing overdue invoices, you can navigate the challenges associated with late payments while safeguarding your financial stability and fostering positive client relationships. Effective management of overdue invoices contributes to a more organized and sustainable approach to financial management.

Conclusion

In conclusion, organizing invoices is a fundamental aspect of maintaining financial order and efficiency in both personal and business settings. By setting up a systematic approach for handling invoices, creating a well-organized filing system, leveraging digital tools for organization, establishing a routine for invoicing, and implementing effective strategies for managing overdue invoices, individuals and businesses can streamline their invoicing processes and ensure timely payments.

Maintaining a structured system for invoices not only reduces the risk of overlooking payments but also fosters transparency and accountability in financial transactions. By categorizing and storing invoices systematically, whether in physical or digital form, individuals can access their financial records with ease and confidence.

The integration of digital tools for invoice organization offers a modern and efficient approach to managing invoicing tasks. Automation, cloud storage, and seamless integration with accounting software contribute to a more streamlined and accurate invoicing process, ultimately enhancing overall financial management.

Establishing a routine for invoicing and implementing strategies for managing overdue invoices are essential components of maintaining a healthy cash flow and client relationships. Consistent invoicing practices and effective communication regarding overdue payments contribute to a more organized and sustainable approach to financial management.

In essence, by implementing the best practices for organizing invoices, individuals and businesses can minimize the administrative burden associated with invoicing, maintain a clear overview of their financial records, and foster positive relationships with clients through transparent and timely invoicing practices. Embracing these strategies can lead to a more organized, efficient, and sustainable approach to financial management.

Frequently Asked Questions about How To Organize Invoices

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Organize Invoices”