Home>diy>Building & Construction>How To Create An Invoice For Construction

Building & Construction

How To Create An Invoice For Construction

Modified: January 24, 2024

Learn how to create professional construction invoices with our step-by-step guide. Simplify the billing process and keep track of payments for your building construction projects.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of construction, where attention to detail and efficient project management are crucial. As a construction professional, one of the essential tasks you will encounter is creating invoices for your services. An invoice serves as a formal document that outlines the services you have provided and the corresponding costs.

In this article, we will guide you through the process of creating an invoice for construction. We will cover everything from gathering essential information and choosing the right invoice template to including company and client details, listing goods and services, calculating costs and fees, applying taxes and discounts, adding terms and conditions, and providing payment details.

By following these steps, you will not only ensure that your invoices are accurate and professional but also streamline your billing process and improve your cash flow. Effective invoicing is a critical aspect of any construction business, as it helps you maintain a healthy financial position while fostering positive customer relationships.

So, let’s get started on crafting an invoice that reflects your professionalism and attention to detail!

Key Takeaways:

- Streamline your invoicing process by gathering essential information, choosing the right template, and adding clear payment details to ensure accuracy and professionalism in your construction business.

- Enhance client relationships and financial management by accurately listing goods and services, applying taxes and discounts, and including comprehensive terms and conditions in your construction invoices.

Read more: How To Create Construction Drawings

Preparing Essential Information

Before diving into the process of creating an invoice, it is crucial to gather all the necessary information. This step ensures that your invoice includes accurate details and is consistent with your records. Here are some essential pieces of information to gather:

- Client Information: Collect the full name, address, and contact details of your client. Ensuring that this information is accurate will prevent any delays or issues with the invoice’s delivery.

- Company Information: Compile your company’s name, logo, address, and contact details. This information will be included on the invoice and helps establish your brand identity and professionalism.

- Invoice Number: Assign a unique identification number to each invoice. This ensures that your invoices are properly organized and easily tracked for reference and record-keeping purposes.

- Date: Include the invoice date to indicate when the services were rendered. This helps both you and your client keep track of the timeline of the project and payment.

- Project Description: Provide a brief description of the project or services provided. This helps your client easily identify the specific work covered by the invoice.

- Payment Terms: Clearly define your payment terms, such as the payment due date, acceptable forms of payment, and any late payment fees or penalties. This ensures both parties are aware of the agreed-upon payment expectations.

By gathering all the essential information beforehand, you can streamline the invoice creation process and ensure the accuracy and consistency of your invoices. This step helps you maintain professionalism and shows your commitment to transparent communication with your clients.

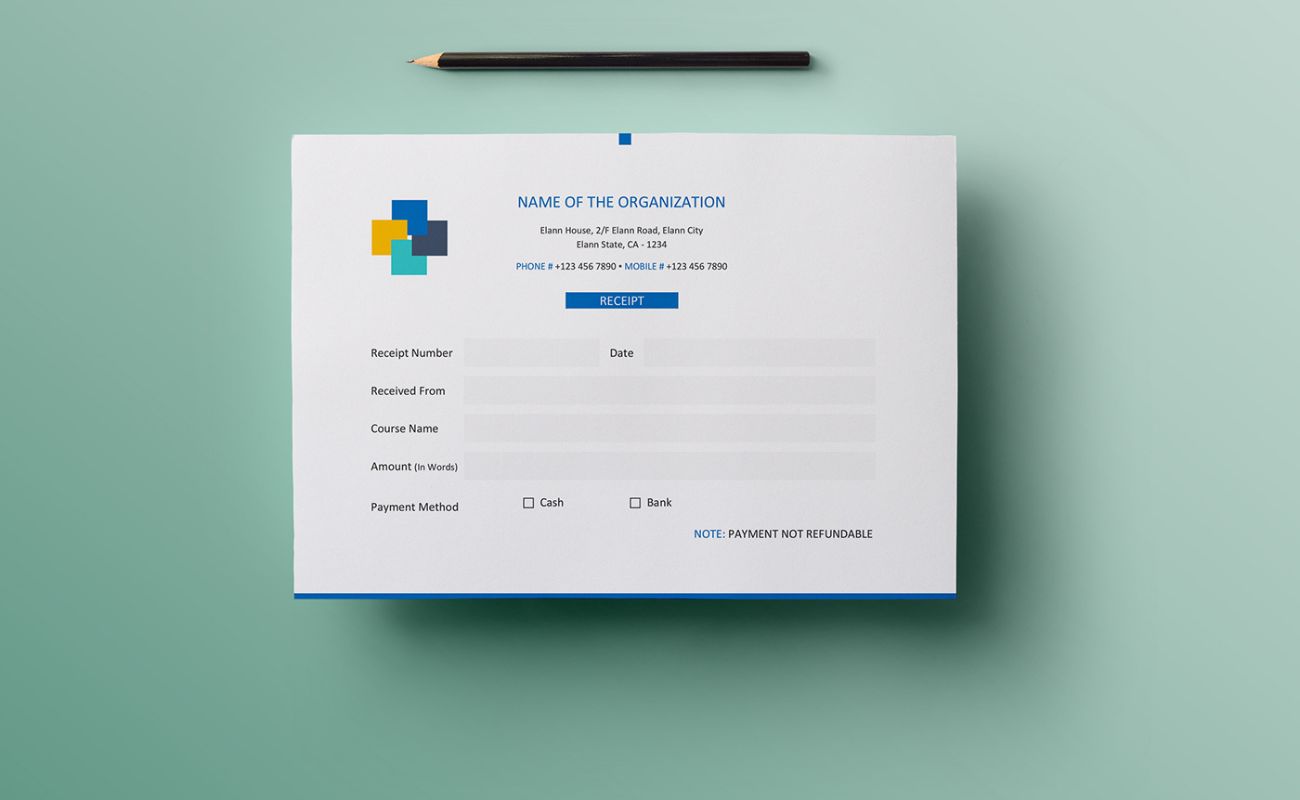

Choosing the Right Invoice Template

Once you have gathered all the necessary information, the next step in creating an invoice for construction is choosing the right invoice template. An invoice template serves as a framework that helps you structure and present your invoice in a professional and organized manner. Here are a few factors to consider when selecting an invoice template:

- Professional Appearance: Choose a template that aligns with your brand’s image and gives a polished and professional impression. Look for clean and modern designs with clear headings and sections.

- Customization: Look for a template that allows you to customize various elements such as colors, fonts, and logo placement. This enables you to personalize the invoice to reflect your company’s branding.

- Readability: Opt for a template that prioritizes readability, with legible fonts and appropriate font sizes. Ensure that the template allows you to present information in a well-structured and organized manner.

- Functionality: Consider the template’s functionality, such as the ability to include tax calculations, discounts, and subtotals. This ensures that all the necessary details are accurately reflected on the invoice.

- Accessibility: Choose a template that is compatible with your preferred software or online invoicing platform. This allows for easy editing and sharing with your clients.

There are various resources available online where you can find pre-designed invoice templates specifically tailored for the construction industry. Many invoicing software platforms also provide customizable templates that you can use. Take the time to explore different options and select a template that best suits your needs and preferences.

Remember that the chosen template should not only enhance the visual appeal of your invoice but also make it clear and easy for your clients to understand the provided information. A well-designed and professional-looking invoice signifies your attention to detail and professionalism, which can enhance your relationship with your clients and increase the chances of prompt payment.

Adding Your Company Information

Adding your company information is an essential step in creating an invoice for construction. This not only establishes your credibility but also ensures that your clients have the necessary details to contact you if needed. Here are the key elements to include when adding your company information to the invoice:

- Company Name: Display your company’s full legal name. This helps in identifying your business and differentiating it from others.

- Logo: Include your company logo on the invoice for brand recognition. Make sure the logo is clear and properly sized to maintain a professional appearance.

- Address: Provide your complete business address, including the street, city, state, and zip code. This allows clients to reach out to you and is necessary for professional communication.

- Contact Details: Include your primary contact information, such as phone number and email address. This facilitates easy and quick communication between you and your clients.

- Website: If you have a company website, include the URL on the invoice. This gives clients the opportunity to learn more about your services and establishes a stronger online presence.

When adding your company information, ensure that it prominently stands out on the invoice. You can place it at the top of the invoice, either to the left or right side, to make it easily visible. Using a consistent font and color scheme with your logo and branding elements helps maintain brand consistency throughout your invoices.

By including your company information, you are not only establishing your credibility but also ensuring that your clients have the necessary information to contact you for any inquiries or clarifications. Professionalism and clear communication are vital aspects of the construction business, and adding your company information on the invoice contributes to both.

Including Client Information

Alongside your company information, it is important to include the client’s information on the invoice. This helps in identifying the recipient of the invoice and ensures that it reaches the right person within the client’s organization. Here are the key elements to include when including client information:

- Client Name: Include the client’s full name or the business name. This ensures that the invoice is addressed to the correct entity.

- Client Address: Provide the complete address of the client, including the street, city, state, and zip code. This assists in accurate delivery and ensures that the invoice reaches the client’s billing department or relevant contact person.

- Contact Person: If applicable, include the name and contact details of the specific individual who should be addressed regarding payment matters. This helps in fostering clear communication and eliminates potential confusion.

- Email and Phone Number: Include the client’s email address and phone number, allowing for easy and direct communication if any payment or invoice-related queries arise.

When including client information on the invoice, ensure that it is presented clearly and prominently. You can place it below your company information, separated by a header or a horizontal line. This will help distinguish the two sections and make the invoice look organized and professional.

Accurate client information on the invoice ensures that the invoice is sent to the correct recipient and enables effective communication regarding payment matters. It also demonstrates your attention to detail and professionalism, which can further build trust and strengthen your business relationship with the client.

Read more: How To Organize Invoices

Listing Goods and Services

Listing the goods and services provided is a crucial step in creating an invoice for construction. This section outlines the specific work completed and allows your client to understand what they are being billed for. Here are some tips for effectively listing goods and services:

- Itemized Description: Provide a detailed description of each item or service performed. Be specific and concise, using clear language that accurately represents the work completed.

- Quantities: If applicable, include the quantity of each item or service provided. This helps the client understand the scale of the work performed.

- Unit Price: Assign a price or rate to each item or service. If there are multiple items or services, ensure that the unit price is clearly specified for each.

- Subtotals: Calculate the subtotal for each line item by multiplying the quantity by the unit price. This provides transparency and helps the client understand the breakdown of costs.

- Total Amount: Sum up the subtotals of all line items to determine the total amount owed by the client. Clearly display the total and highlight it to avoid any confusion.

When listing goods and services, organize the information in a clear and easy-to-read format. You can use a table with separate columns for the item description, quantity, unit price, and subtotal. This allows for a systematic and structured presentation of the work completed and the associated costs.

Remember to stay accurate and honest when listing goods and services. Providing a detailed and itemized description enhances transparency and eliminates any potential misunderstandings. It also helps you maintain a professional image and fosters trust between you and your clients.

When creating an invoice for construction, be sure to include detailed descriptions of the work completed, itemized costs for materials and labor, and any applicable taxes or fees. This will help ensure clear communication and prompt payment.

Calculating Costs and Fees

Calculating costs and fees accurately is a crucial step in creating an invoice for construction. It ensures that your clients are billed correctly and helps you maintain financial stability in your business. Here are some key factors to consider when calculating costs and fees:

- Labor Costs: Determine the labor costs associated with the project. This includes the number of hours worked by your team members, their respective hourly rates, and any overtime or special rates applicable.

- Material Costs: Calculate the cost of materials used for the project. This includes the cost of purchasing materials, any wastage or excess, and any markup or handling fees associated with sourcing the materials.

- Equipment Costs: If you have rented or used specialized equipment for the project, factor in the costs associated, such as equipment rental fees, fuel or maintenance costs, and any additional charges.

- Subcontractor Costs: If you have hired subcontractors for specific tasks, include their costs in your invoice. This includes their labor charges, any materials or equipment they used, and any markup or management fees.

- Additional Fees: Consider any additional fees or expenses incurred during the project, such as permits, inspections, or travel expenses. Make sure to include these costs in your calculations to provide an accurate representation of the total project cost.

When calculating costs and fees, it is important to be transparent with your clients. Clearly state the breakdown of costs associated with labor, materials, equipment, subcontractors, and any additional fees. This helps your clients understand how the total amount on the invoice is derived and prevents any misunderstandings or disputes.

Accurate calculation of costs and fees not only ensures that you are properly compensated for your work but also demonstrates your professionalism and attention to detail. It fosters trust and credibility with your clients and contributes to a smooth invoicing process.

Applying Taxes and Discounts

Applying taxes and discounts accurately is an important step in creating an invoice for construction. It ensures that the final amount due from your client is calculated correctly and takes into account any applicable taxes or discounts. Here’s how to handle taxes and discounts:

- Taxes: If there are any applicable taxes, such as sales tax or value-added tax (VAT), include them in your invoice. Check the tax regulations in your jurisdiction to determine the appropriate tax rates and ensure compliance. Clearly state the tax amount and indicate the tax rate used for calculation.

- Discounts: If you have agreed to provide any discounts to your client, clearly indicate them on the invoice. Specify the discount amount or percentage and subtract it from the total amount. Provide a proper explanation of the discount, such as an early payment discount or a loyalty discount.

When applying taxes and discounts, it is important to clearly communicate and document them on the invoice. This promotes transparency and helps your clients understand the final amount that they are required to pay. It also helps with accurate record-keeping and ensures compliance with tax regulations in your industry.

Additionally, double-check your calculations to ensure that the taxes and discounts are accurately applied. Mistakes in these calculations can lead to incorrect invoice amounts and may result in confusion or disputes with your clients. Taking the time to review and verify the calculations ensures the accuracy of your invoice and helps maintain a professional image.

By accurately applying taxes and discounts, you demonstrate your commitment to fairness and transparency in your invoicing process. This builds trust with your clients and encourages timely payments.

Adding Terms and Conditions

Adding terms and conditions to your construction invoice is a critical step for setting clear expectations and protecting your rights as a contractor. These terms and conditions outline the specific terms of agreement between you and your client regarding payment, project scope, deadlines, and other important aspects. Here’s how to include terms and conditions effectively:

- Payment Terms: Clearly state the payment terms, including the payment due date, accepted forms of payment, and any late payment fees or penalties. Specify if partial payments or deposits are required and the consequences of non-payment or late payments.

- Project Scope: Outline the scope of work covered by the invoice. Specify the tasks, deliverables, and any limitations or exclusions. This helps prevent any disputes or misunderstandings regarding the extent of your responsibilities.

- Deadlines: Include any agreed-upon deadlines for completion of the project or specific milestones. This provides clarity to both you and your client and helps manage expectations.

- Change Orders: Specify how changes or additions to the project scope will be handled. Outline the procedure for approving and invoicing for any additional work that falls outside the initial agreement.

- Dispute Resolution: Include a clause on dispute resolution, outlining the steps to be taken in the event of a disagreement or dispute. This may include mediation, arbitration, or other methods to resolve conflicts.

- Ownership and Intellectual Property: If applicable, state the ownership and intellectual property rights associated with the work performed. Clarify whether any rights or access to intellectual property are granted upon full payment.

When adding terms and conditions, ensure that they are written in clear and concise language. Use bullet points or numbering to make them easily readable. Place the terms and conditions either at the bottom of the invoice or on a separate page attached to the invoice.

By including clear and comprehensive terms and conditions, you establish a solid foundation for your business relationship with your client. These terms protect your rights, outline the agreed-upon terms of the project, and help mitigate potential disputes or misunderstandings along the way.

Read more: How To Make A Lawn Care Invoice

Including Payment Details

Including clear payment details on your construction invoice is essential for facilitating smooth and timely payments. By outlining the various payment options and providing the necessary banking information, you make it easier for your clients to fulfill their payment obligations. Here’s how to include payment details effectively:

- Payment Methods: Clearly state the accepted payment methods that you offer, such as bank transfers, credit card payments, or checks. If you accept online payment platforms like PayPal or Stripe, provide the relevant account information or links.

- Banking Information: Include your banking information, such as the account name, account number, and routing number. This ensures that your clients have the necessary details to make direct bank transfers if preferred.

- Payment Instructions: Provide clear instructions on how to initiate the payment. Include any specific references or invoice numbers that the client should use when making the payment to ensure accurate allocation.

- Due Date: Clearly state the payment due date, specifying the exact date when the payment is expected. This helps your clients understand the timeframe they have for making the payment.

- Late Payment Information: Include information about any late payment penalties or fees that will be imposed if the payment is not received by the due date. Specify the percentage or flat amount and any grace period provided.

Consider placing the payment details prominently on the invoice, either at the top or bottom of the document. Use a clear and easily readable font to ensure that the information is easily visible and understandable.

By including comprehensive payment details, you improve the efficiency of your invoicing process and increase the likelihood of receiving timely payments. Clear and transparent payment instructions help eliminate confusion and make it convenient for your clients to fulfill their financial obligations.

Reviewing and Finalizing the Invoice

Before sending out the construction invoice, it is crucial to review and finalize it to ensure accuracy and professionalism. Taking the time to carefully review the invoice helps in preventing errors and maintains a positive impression on your clients. Here’s how to review and finalize the invoice effectively:

- Check for Accuracy: Review the entire invoice for any errors, including typos, incorrect amounts, or missing information. Double-check mathematical calculations and ensure that all details are accurate and consistent.

- Verify Dates and Descriptions: Ensure that the invoice date matches the date when the services were provided. Review the descriptions of goods and services to confirm that they properly represent the work completed.

- Formatting and Layout: Check the overall formatting and layout of the invoice. Ensure that the sections are organized logically, with clear headings and consistent styling. Confirm that the font sizes are appropriate and that the invoice is visually appealing.

- Add Personalized Touch: Consider adding a personalized message or expression of gratitude to your clients. This simple gesture can help strengthen the relationship and leave a positive impression.

- Save a Copy: Save a digital copy of the finalized invoice for your records. This ensures that you have a backup in case of any disputes or reference needs in the future.

Once you have reviewed and finalized the invoice, it is ready to be sent to your client. Choose the most suitable method of delivery, whether it’s email, postal mail, or utilizing an online invoicing platform. Ensure that you have the correct contact details to avoid any delivery delays or issues.

Remember, a well-reviewed and finalized invoice reflects your professionalism and attention to detail. It increases the chances of prompt payment, fosters positive relationships with your clients, and contributes to the overall success of your construction business.

Conclusion

Creating a well-crafted invoice is a vital aspect of running a successful construction business. A professionally designed and accurately detailed invoice helps you maintain a healthy cash flow, establish trust with your clients, and ensure smooth financial transactions. By following the steps outlined in this guide, you can create invoices that are both functional and visually appealing.

Start by gathering all the essential information, including your company details and client information. Choose a suitable invoice template that aligns with your brand and provides the necessary customization options. List the goods and services clearly, ensuring that each item is accurately described, priced, and subtotaled. Calculate costs and fees accurately, considering labor, materials, equipment, and any applicable subcontractor charges.

Additionally, remember to apply taxes and discounts correctly, clearly stating the tax amount and any discount applied. Including terms and conditions provides clarity and protects your rights as a contractor. Ensure that payment details are clearly outlined, specifying accepted payment methods, banking information, and the payment due date.

Before sending out your invoices, take the time to review and finalize them, ensuring accuracy and a professional presentation. Double-check for any errors, confirm dates and descriptions, and add a personal touch to show appreciation to your clients. Saving a copy of the finalized invoice helps maintain proper record-keeping.

By following these steps, you will be able to create comprehensive and engaging invoices for your construction business. Professional invoices not only enhance your brand image but also streamline your billing process, foster positive client relationships, and ultimately contribute to the overall success of your business.

Remember, clear and transparent invoicing is a reflection of your professionalism and attention to detail. By creating well-crafted invoices, you set the foundation for strong financial management and ensure that your construction business continues to thrive.

Frequently Asked Questions about How To Create An Invoice For Construction

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Create An Invoice For Construction”