Home>diy>Building & Construction>How Are Taxes Assessed On New Construction

Building & Construction

How Are Taxes Assessed On New Construction

Modified: December 7, 2023

Learn how taxes are assessed on new construction projects and understand the process for building construction.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the world of building construction, where innovation and progress shape the landscapes of cities and neighborhoods. As the demand for new structures continues to rise, it is essential to understand the intricacies of tax assessment on new construction. In this article, we will explore the assessment process, factors considered in determining taxes, valuation methods, challenges to assessments, and potential tax exemptions and incentives for new construction projects.

When a new building is completed, tax assessors play a crucial role in valuing the property and determining the appropriate tax amount. This assessment process ensures that property owners contribute their fair share to the community and local government. Let’s dive into the details and shed light on how taxes are assessed on new constructions.

Key Takeaways:

- Understanding the assessment process for new construction is vital for property owners to anticipate tax obligations and ensure fair contributions to the community.

- Tax exemptions and incentives for new construction aim to alleviate financial burdens, promote economic growth, and encourage investment in community development.

Understanding the Assessment Process

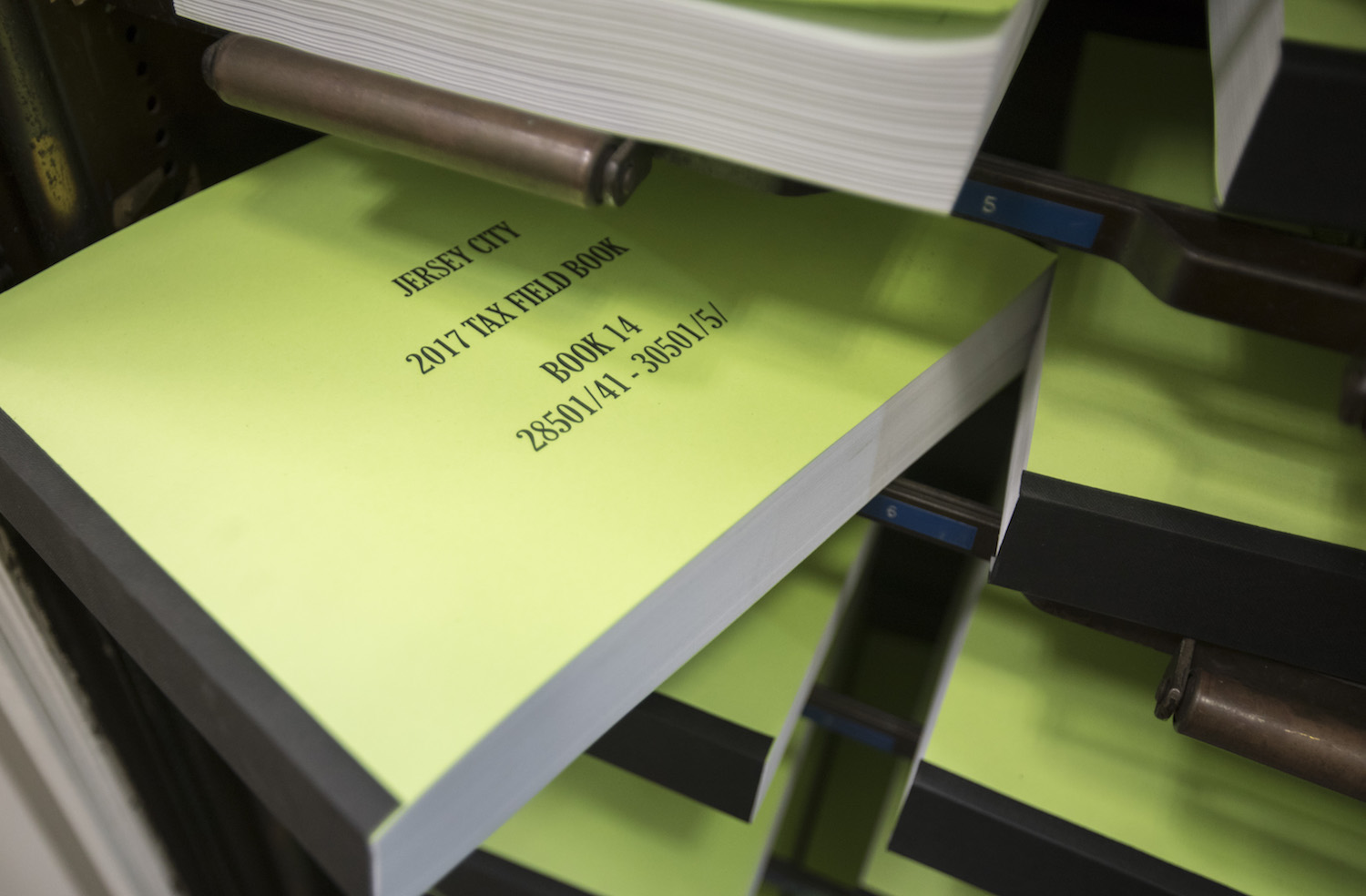

The assessment process is a systematic approach used by tax authorities to determine the value of a property for tax purposes. For new construction, this process involves evaluating the value of the completed building and land on which it stands. The main objective of the assessment process is to establish a fair and accurate taxable value.

Assessors typically conduct physical inspections of the property to gather data on its size, features, and improvements. They may also take into account various factors such as location, market conditions, and the cost of construction materials and labor.

During the assessment, assessors consider both the “as-is” value and the “as-completed” value of the property. The “as-is” value refers to the value of the property in its current state, including any incomplete or pending construction. The “as-completed” value reflects the estimated value of the property once all construction is finished.

It is important to note that the assessment process varies from jurisdiction to jurisdiction, and each has its own set of rules and regulations. Some areas may use mass appraisal methods, where assessments are based on a standardized valuation model applied to a group of similar properties. Others may employ individualized appraisals, where each property is assessed independently based on its unique characteristics and market conditions.

Once the assessment is completed, the assessed value of the property becomes the basis for calculating property taxes. Local tax authorities then apply a tax rate to this assessed value to determine the property owner’s tax liability.

Understanding the assessment process is vital for property owners, as it helps them anticipate their tax obligations and plan their finances accordingly. It also ensures transparency and fairness in the taxation system, as properties are evaluated using standardized methodologies and criteria.

Assessing Taxes on New Construction

Assessing taxes on new construction involves determining the value of the completed building and incorporating it into the overall property assessment. This process ensures that new structures contribute their fair share to the local tax base. Let’s explore how taxes are assessed on new construction and the factors that are considered.

When a new construction project is completed, tax assessors perform a thorough evaluation of the property to determine its value. This evaluation takes into account various factors such as the size, location, quality of construction, and any additional amenities or improvements on the property.

In some areas, tax assessors may use cost-based valuation methods to assess the value of new construction. This method involves calculating the total cost of construction, including materials, labor, and overhead, and then adjusting it based on factors such as depreciation and market conditions.

In other cases, assessors may use a market-based approach to value new construction. This involves comparing the completed building to similar properties in the area that have recently sold. By analyzing recent sales data and considering market trends, assessors can arrive at an estimated market value for the new construction.

It’s important to note that the assessed value of new construction may not always reflect the actual market value of the property. Assessors strive to establish a fair and consistent assessment, but market fluctuations and other factors may impact the assessed value.

Once the value of the new construction is determined, it is added to the overall assessed value of the property. This combined assessed value is then used to calculate the property taxes owed by the owner.

It’s worth mentioning that the process of assessing taxes on new construction can vary depending on local laws and regulations. Some jurisdictions provide specific guidelines for valuing new construction, while others rely on the discretion of tax assessors.

Overall, assessing taxes on new construction is an important step in ensuring that property owners contribute their fair share to the local community. By accurately valuing new structures, tax authorities can maintain a balanced and equitable tax system.

Factors Considered in Assessing Taxes on New Construction

When assessing taxes on new construction, tax authorities take into account several factors to determine the value of the property. These factors help establish a fair and accurate assessment that reflects the worth of the completed building. Let’s explore the key factors considered in assessing taxes on new construction.

- Location: The location of the property plays a significant role in its value assessment. Factors such as proximity to amenities, schools, transportation, and desirable neighborhoods can influence the assessed value of new construction. Properties in prime locations often command higher tax assessments.

- Size and Square Footage: The size of the building and its total square footage are important factors in determining its assessed value. Larger buildings generally have higher tax assessments as they typically require more materials and resources during construction.

- Quality of Construction: The quality of construction is another essential factor. Assessors consider the materials used, craftsmanship, and overall durability of the building. Higher-quality construction often leads to an increase in the assessed value of the property.

- Additional Amenities and Improvements: Assessors take into account any additional amenities or improvements made to the property. This includes features such as swimming pools, landscaping, energy-efficient upgrades, and other enhancements that can add value to the new construction.

- Market Conditions: Market conditions, both local and regional, can also affect the assessment of new construction. Assessors analyze recent sales data and market trends to determine how the value of the property compares to similar properties in the area.

- Cost of Construction Materials and Labor: The cost of construction materials and labor is an important consideration. Assessors take into account the expenses incurred during the construction process, including the cost of materials, architectural design, permits, and labor wages. These costs can influence the assessed value of the property.

- Age and Condition: While new construction is generally assessed at its full value, the age and condition of the building are taken into account. Over time, factors such as wear and tear, maintenance, and updates may affect the assessed value of the property.

- Any Legal Restrictions or Zoning Regulations: Assessors also consider any legal restrictions or zoning regulations that may impact the assessment of new construction. These can include building codes, land use limitations, and zoning ordinances that may affect the property’s value.

By carefully evaluating these factors, tax authorities can determine an equitable assessment for new construction, ensuring that property owners contribute their fair share to the local tax base.

When new construction is assessed for taxes, the value is typically based on the cost of construction, land value, and any improvements. It’s important to keep detailed records of all expenses related to the construction to ensure accurate assessment.

Valuation Methods for New Construction

When assessing taxes on new construction, tax authorities utilize various valuation methods to determine the value of the completed building. These methods help ensure that the assessment accurately reflects the worth of the property. Let’s explore some common valuation methods used for new construction.

- Cost Approach: The cost approach is a commonly used method for valuing new construction. This approach involves estimating the total cost of constructing a similar building from scratch and then adjusting it based on factors such as depreciation and market conditions. The cost approach considers the expenses incurred during construction, including materials, labor, permits, and architectural design.

- Market Approach: The market approach relies on comparing the new construction to similar properties in the area that have recently sold. Assessors analyze recent sales data and consider the market conditions to establish an estimated market value for the new construction. This approach is useful in areas where there are sufficient comparable sales to make accurate comparisons.

- Income Approach: The income approach is primarily used for commercial properties or properties that generate rental income. This method involves estimating the potential income that the new construction could generate and applying a capitalization rate to determine its value. The income approach takes into account factors such as rental rates, vacancy rates, operating expenses, and potential returns on investment.

- Mass Appraisal: In some jurisdictions, tax authorities use mass appraisal methods for valuing new construction. This approach involves applying a standardized valuation model to a group of similar properties. Assessors use statistical analysis, computer models, and market data to determine the assessed value of new construction based on the characteristics and market conditions of comparable properties.

- Physical Inspection: As part of the valuation process, tax assessors often conduct physical inspections of the new construction. This allows them to gather data on the size, features, and quality of the building. The information collected during the inspection is then used to determine the assessed value using one or more of the valuation methods mentioned above.

It’s essential to note that the valuation methods used for new construction can vary depending on local laws and regulations. Some jurisdictions may prioritize one method over others or use a combination of approaches to arrive at a fair assessment.

By employing these valuation methods, tax authorities can ensure that the assessed value of new construction reflects its true worth in the market, providing a fair and accurate basis for calculating property taxes.

Appeals and Challenges to Tax Assessments on New Construction

While tax authorities strive to accurately assess the value of new construction for tax purposes, there may be instances where property owners disagree with the assessment. In such cases, they have the option to appeal or challenge the tax assessment. Let’s explore the process of appealing tax assessments on new construction and the potential challenges involved.

When property owners believe that their tax assessment on new construction is incorrect or unfair, they can file an appeal with the appropriate local tax authority. The specific procedures for appeals may vary depending on the jurisdiction, but generally, there are certain steps involved in the process.

The first step is to review the assessment notice carefully, which provides details about the property’s assessed value and the deadline for filing an appeal. It’s essential to understand the basis of the assessment and identify any errors or discrepancies that may have occurred during the valuation process.

Property owners then typically need to gather evidence to support their appeal. This may include recent property appraisals, sales data of comparable properties, building plans, or any other relevant documentation that can help demonstrate that the assessment is inaccurate or inconsistent with market values.

Once the appeal is filed, it will be reviewed by the designated tax assessment appeals board or similar entity. This board will evaluate the evidence provided by the property owner and consider any additional information from the tax assessor’s office before making a decision.

It’s important to note that challenging a tax assessment on new construction can be a complex and time-consuming process. Property owners may encounter challenges such as the burden of proof, administrative procedures, and legal requirements specific to their jurisdiction. It is recommended to seek professional advice or consult a tax attorney to navigate these challenges effectively.

In some cases, tax authorities may offer alternative dispute resolution methods, such as mediation or arbitration, to resolve conflicts between property owners and tax assessors. These methods aim to facilitate a fair and efficient resolution outside of traditional litigation.

Successful appeals can result in a revised assessed value, which may lead to a reduction in property taxes. However, it’s important to be aware that appeals can also result in the assessed value being reaffirmed or even increased, depending on the outcome of the review process.

Overall, the appeals and challenges process provides property owners with the opportunity to address any concerns regarding tax assessments on new construction. By exercising their right to appeal, property owners can ensure that their tax obligations align with the true value of their property.

Tax Exemptions and Incentives for New Construction

To encourage new construction and stimulate economic growth, many jurisdictions offer tax exemptions and incentives to property owners undertaking new construction projects. These exemptions and incentives aim to alleviate the financial burden associated with construction costs and promote development. Let’s explore some common tax exemptions and incentives for new construction.

Property Tax Exemptions: One common form of tax exemption is a property tax exemption for a specific period. This means that the new construction project is exempt from paying property taxes for a certain timeframe, which can range from a few years to several decades depending on local regulations. This exemption allows property owners to allocate more resources towards construction costs and initial investment.

Tax Increment Financing (TIF): Tax increment financing is a financing mechanism used by local governments to fund new construction and redevelopment projects. Under TIF, a portion of the increased property tax revenue generated from the project is redirected towards funding infrastructure improvements, public amenities, or other project-related costs. This incentivizes property owners to undertake new construction projects by providing financial support and potentially increasing the value of the property.

Enterprise Zones: Enterprise zones are designated areas where specific tax benefits and incentives are provided to encourage economic development and new construction. These zones may offer reduced property tax rates, income tax credits, or sales tax exemptions to businesses or individuals investing in new construction projects within the designated area. The goal is to create a favorable environment for new construction and attract investment to economically distressed areas.

Historic Preservation Tax Credits: In some jurisdictions, property owners undertaking new construction projects on historic properties may be eligible for historic preservation tax credits. These credits provide financial incentives for preserving and restoring historically significant buildings. Property owners can receive a tax credit based on a percentage of qualified expenses incurred during the construction process. This encourages the preservation of historic structures while promoting new construction within these properties.

Energy Efficiency and Green Building Incentives: Many jurisdictions provide tax incentives for new construction projects that prioritize energy efficiency and sustainable building practices. These incentives can include tax credits, rebates, or reduced tax rates for incorporating energy-efficient features or using environmentally friendly materials in the construction process. These incentives promote environmentally responsible building practices and can result in long-term cost savings for property owners.

Other Incentives: Depending on the specific location, there may be additional tax incentives and exemptions available for new construction projects. These can include tax credits for job creation, infrastructure development grants, or specialized incentives for specific industries or sectors. It’s important for property owners to research and consult with local authorities to fully understand the range of incentives available in their jurisdiction.

By offering tax exemptions and incentives, governments aim to foster and support new construction projects, leading to economic growth, job creation, and community development. These incentives help mitigate the financial burden of new construction and encourage property owners to invest in the expansion and revitalization of their communities.

Conclusion

Building construction plays a pivotal role in shaping our cities and communities, and understanding the tax assessment process for new construction is crucial for property owners and developers. By exploring the assessment process, factors considered in assessing taxes, valuation methods, challenges to assessments, and tax exemptions and incentives, we have gained insight into the complex landscape of taxes on new construction.

The assessment process involves evaluating the value of the completed building and land on which it stands. Factors such as location, size, quality of construction, market conditions, and additional amenities are considered in determining the assessed value. Different valuation methods, such as the cost approach, market approach, and income approach, help determine the value of new construction for tax purposes.

Property owners have the right to appeal or challenge tax assessments if they believe the assessment is inaccurate or unfair. This process may involve gathering evidence, engaging in administrative procedures, and potentially seeking professional advice. Tax exemptions and incentives, such as property tax exemptions, tax increment financing, and energy efficiency incentives, are available to alleviate the financial burden of new construction and promote economic growth.

In conclusion, the world of taxes on new construction is multifaceted and dynamic. By understanding the assessment process, knowing the factors considered in tax assessments, and exploring available tax exemptions and incentives, property owners can navigate the taxation landscape and ensure their contributions are fair and align with the true value of their properties.

As the building construction industry continues to evolve, it is essential to stay informed about changes in tax laws and regulations to make informed decisions and take advantage of available opportunities. Whether you are a property owner, developer, or investor, a clear understanding of taxes on new construction can help you navigate the landscape and contribute to the growth and development of your local community.

Frequently Asked Questions about How Are Taxes Assessed On New Construction

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How Are Taxes Assessed On New Construction”