Home>Home Maintenance>How Is The Illinois Property Assessment Institute Funded

Home Maintenance

How Is The Illinois Property Assessment Institute Funded

Modified: March 6, 2024

Learn how the Illinois Property Assessment Institute is funded and gain insights into home maintenance. Discover funding sources and support for this institute.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the Illinois Property Assessment Institute! In this article, we will delve into the fascinating world of property assessment and explore how the institute is funded. Property assessment plays a crucial role in determining property values and taxation, making the work of the Illinois Property Assessment Institute vital to homeowners, businesses, and the local government.

Understanding the funding sources of such organizations is essential as it helps shine a light on their operations, sustainability, and overall impact. By delving into the funding structure of the Illinois Property Assessment Institute, we can gain a deeper appreciation for their contributions to the community and the resources required to carry out their important work.

So, let’s dive in and uncover how the Illinois Property Assessment Institute secures the financial resources needed to operate effectively and provide valuable services to property owners across the state.

Key Takeaways:

- The Illinois Property Assessment Institute is funded by government contributions, private donations, training program fees, and fee-based services. This diverse funding ensures the institute can support property assessors and promote fairness in property assessments.

- By securing funding from various sources, the institute can provide valuable resources and training to property assessors, ultimately benefiting property owners and local governments. Understanding the funding structure helps appreciate the institute’s vital role in property assessment practices.

Read more: What Is Property Assessment

Purpose of the Article

The purpose of this article is to shed light on the funding sources of the Illinois Property Assessment Institute. By understanding how the institute is funded, property owners, local governments, and individuals interested in property assessment can gain valuable insights into the organization’s operations and the resources required to carry out their work effectively.

Property assessment is a complex and important process that directly impacts property values and taxation. The Illinois Property Assessment Institute plays a vital role in promoting fairness, accuracy, and professionalism in the property assessment field. Therefore, understanding the funding structure of the institute is key to assessing its capabilities, integrity, and sustainability.

Through this article, we aim to provide a comprehensive overview of the various funding sources that support the Illinois Property Assessment Institute. This includes examining contributions from government entities, private donations and grants, revenue from training and educational programs, as well as fee-based services provided by the institute to generate income.

By shedding light on the financial aspects, we hope to give readers a well-rounded understanding of the institute, its funding mechanisms, and how these resources are utilized to enhance property assessment practices in Illinois. Furthermore, we aim to showcase the significant role that the institute plays in promoting fairness, accuracy, and professionalism in property assessments statewide.

Whether you are a property owner, a local government representative, a professional working in the property assessment field, or simply someone interested in understanding how organizations like the Illinois Property Assessment Institute are funded, this article aims to provide valuable insights and a deeper understanding of the topic.

Overview of the Illinois Property Assessment Institute

The Illinois Property Assessment Institute is a non-profit organization dedicated to promoting excellence and professionalism in property assessment practices throughout the state. Founded in [insert year], the institute serves as a resource hub for property assessors, government officials, and individuals involved in the assessment process.

One of the primary objectives of the Illinois Property Assessment Institute is to provide education and training opportunities to property assessors. They organize seminars, workshops, and conferences where professionals can enhance their knowledge and skills in property assessment techniques, regulations, and best practices.

Furthermore, the institute plays a huge role in advocating for consistent and fair property assessment practices. They collaborate with government agencies and authorities to develop guidelines, standards, and regulations to ensure uniformity and accuracy in property valuations.

Through its programs and initiatives, the Illinois Property Assessment Institute establishes itself as a trusted authority and resource for property assessors in Illinois. The institute also serves as a platform for sharing knowledge, experiences, and ideas among property assessment professionals, fostering a community that promotes continuous learning and improvement in the field.

With a team of experts and experienced professionals, the institute provides guidance, support, and technical assistance to property assessors facing complex assessment challenges. Their mission is to enhance the professionalism and competency of property assessors, ultimately benefiting property owners and the community as a whole.

The Illinois Property Assessment Institute is a respected organization known for its commitment to excellence and integrity in property assessment. By working closely with assessors, government agencies, and stakeholders, the institute strives to improve property assessment practices, ensure the accuracy and fairness of valuations, and instill public confidence in the assessment process.

Now that we have a general understanding of the Illinois Property Assessment Institute’s role and purpose, let’s explore how they secure the financial resources needed to carry out their important work.

Funding Sources for the Illinois Property Assessment Institute

The Illinois Property Assessment Institute relies on various funding sources to support its operations, training programs, advocacy efforts, and technical assistance initiatives. These funding sources include contributions from government entities, private donations and grants, revenue from training and educational programs, as well as fee-based services provided by the institute.

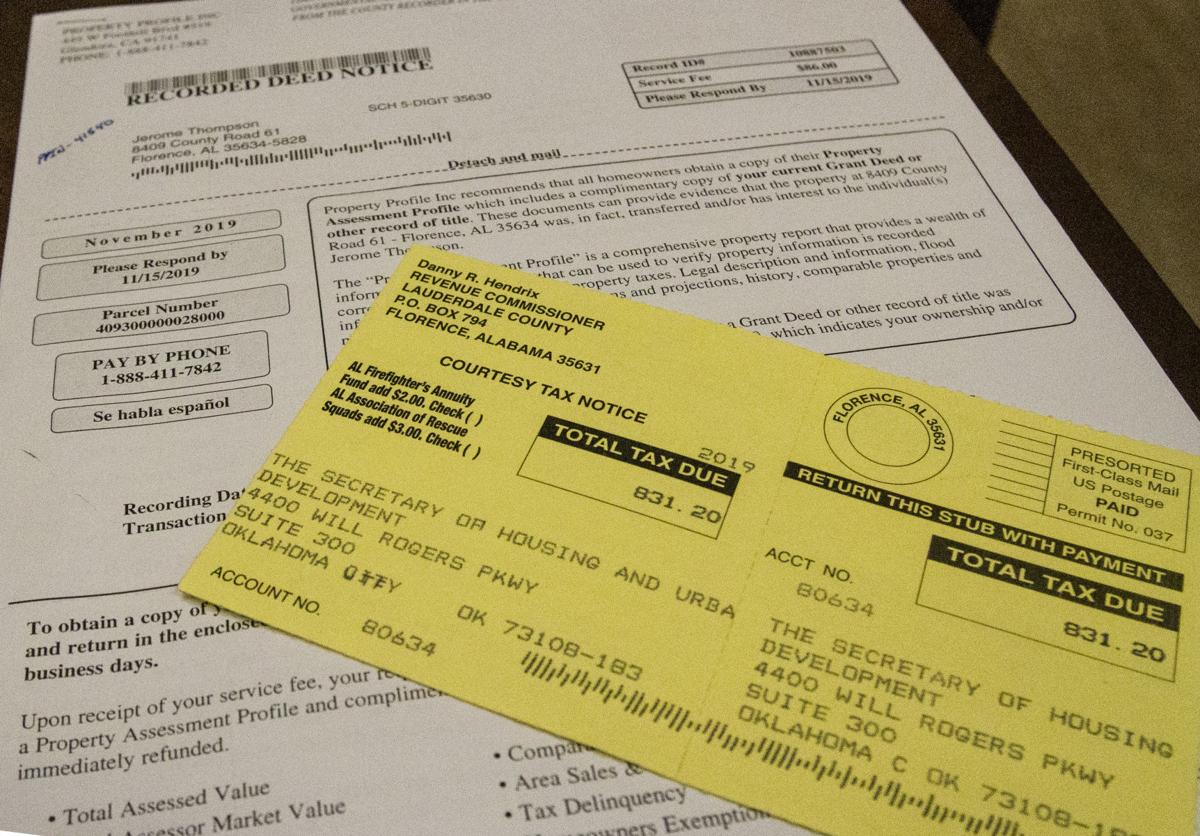

Contributions from Government Entities: The Illinois Property Assessment Institute receives funding from government entities at the local, state, and federal levels. These contributions are often in the form of grants or contracts to support specific projects or initiatives that align with the goals of the institute. The government funding allows the institute to expand its programs and reach a wider audience of property assessors and stakeholders.

Private Donations and Grants: The institute also relies on private donations and grants from organizations and individuals who recognize the importance of fair and accurate property assessments. These donations can come from businesses, foundations, or individuals who are passionate about advancing the field of property assessment and ensuring equitable taxation. Private grants enable the institute to implement innovative projects and initiatives that benefit property assessors and improve assessment practices.

Revenue from Training and Educational Programs: Another significant funding source for the institute is the revenue generated from its training and educational programs. The institute offers a variety of seminars, workshops, and certification courses for property assessors seeking to improve their skills and stay updated with the latest industry trends. By charging fees for these programs, the institute can generate revenue that supports its ongoing operations and the development of new educational resources.

Fee-Based Services Provided by the Illinois Property Assessment Institute: In addition to training programs, the institute offers fee-based consulting and technical assistance services to property assessors, government agencies, and other stakeholders. These services include property valuation analysis, assessment process audits, and customized training sessions. The revenue generated from these services not only contributes to the institute’s funding but also allows it to provide specialized support to property assessors facing complex assessment challenges.

By diversifying its funding sources, the Illinois Property Assessment Institute ensures its financial sustainability and ability to continue providing valuable resources and services to the property assessment community. The support from government entities, private donations, training program fees, and fee-based services enables the institute to advocate for excellence in property assessment, foster professional development, and facilitate the implementation of fair and accurate assessment practices throughout the state.

In the next sections, we will delve deeper into each of these funding sources to gain a more comprehensive understanding of how the Illinois Property Assessment Institute secures its financial resources.

Contributions from Government Entities

The Illinois Property Assessment Institute receives valuable contributions from various government entities at the local, state, and federal levels. These contributions play a significant role in supporting the institute’s initiatives, programs, and advocacy efforts in the field of property assessment.

Government contributions to the Illinois Property Assessment Institute are often in the form of grants or contracts that align with the institute’s mission and objectives. These grants and contracts provide funding for specific projects or initiatives that aim to improve property assessment practices, promote fairness in valuations, and enhance the professionalism of property assessors.

At the local level, county governments and assessors’ offices may allocate funds to support the training and development programs offered by the institute. These contributions help ensure that property assessors in the respective counties have access to quality education and training opportunities, enabling them to excel in their roles and make accurate valuations.

State governments also play a crucial role in funding the institute’s activities. Through government agencies that oversee property assessments, such as the Department of Revenue or the Property Tax Division, funding is allocated to support the institute’s initiatives that align with the state’s goals in property assessment. This may include projects aimed at standardizing assessment practices, developing guidelines, or conducting research studies to improve assessment accuracy and consistency across the state.

Furthermore, federal funding can be obtained through grants or cooperative agreements from agencies with a focus on property assessment and taxation. These federal contributions allow the institute to undertake large-scale projects, research studies, or collaborative efforts that have a broader impact on the field of property assessment beyond the state level.

The contributions from government entities not only provide financial support but also serve as an endorsement of the institute’s work and mission. By receiving funding from government sources, the Illinois Property Assessment Institute demonstrates its credibility and recognized value in advancing property assessment practices.

It is important to note that the specific amount of government funding received by the institute may vary from year to year, depending on the availability of funds and the priorities of the respective government entities. However, the consistent support from government entities highlights the importance placed on accurate property assessments and the recognition of the institute’s role in promoting excellence and professionalism in the field.

In the following sections, we will explore other funding sources that contribute to the financial sustainability of the Illinois Property Assessment Institute, including private donations and grants, revenue from training programs, and fee-based services.

The Illinois Property Assessment Institute is funded through a combination of registration fees for their training programs, grants, and sponsorships from organizations in the property assessment industry.

Read more: How To Do A Property Assessment

Private Donations and Grants

Private donations and grants are crucial sources of funding for the Illinois Property Assessment Institute. These contributions come from organizations, businesses, foundations, and individuals who recognize the importance of fair and accurate property assessments and want to support the institute’s mission and initiatives.

Private donations provide a vital financial boost to the institute, allowing it to expand its programs, develop new resources, and undertake innovative projects. These donations can be made by individuals who are passionate about property assessment, organizations with a vested interest in promoting fairness and accuracy in valuations, or foundations that support educational and professional development initiatives.

In addition to individual donations, the institute actively seeks grants from various private entities and foundations that provide funding for projects aligned with their goals. These grants can be obtained through a competitive application process, where the institute outlines its proposed project or initiative and demonstrates its potential impact on the property assessment community.

The Illinois Property Assessment Institute maintains strong relationships with private donors and grant-making organizations by providing transparency regarding the use of funds and demonstrating the impact of their contributions. This includes sharing success stories, publishing reports on the outcomes of funded projects, and providing updates on how the institute’s programs have benefited property assessors and the community at large.

The flexibility of private donations and grants allows the institute to allocate funds where they are most needed or where they can have the greatest impact. This can include developing new educational resources, conducting research studies, implementing technology-driven initiatives, or supporting the participation of property assessors in industry conferences and professional development events.

Private donations and grants not only provide financial support but also serve as a testament to the trust and confidence that individuals and organizations have in the institute’s ability to make a positive difference in property assessment practices. The generosity of these private donors and grant-making entities reinforces the institute’s mission and encourages continued excellence in the field of property assessment.

In the following sections, we will explore additional funding sources for the Illinois Property Assessment Institute, including revenue generated from training and educational programs, as well as fee-based services provided by the institute.

Revenue from Training and Educational Programs

Revenue generated from training and educational programs is a significant funding source for the Illinois Property Assessment Institute. The institute offers a wide range of seminars, workshops, certification courses, and educational resources aimed at enhancing the skills and knowledge of property assessors.

By charging fees for these programs, the institute not only covers its operational costs but also generates revenue to support its ongoing activities and the development of new educational resources.

These training and educational programs cater to property assessors at various stages of their careers. They provide opportunities to learn about the latest assessment techniques, regulations, legal updates, and industry best practices. The programs are designed to equip assessors with the necessary knowledge and skills to accurately value properties and ensure fairness in the assessment process.

The fees charged for these programs vary depending on the duration, level of content, and the resources provided. The revenue generated from these programs allows the Illinois Property Assessment Institute to continue improving its educational offerings, update materials, and invest in the latest instructional technologies.

The training and educational programs offered by the institute not only benefit assessors but also contribute to the overall improvement of property assessment practices in Illinois. By providing quality education and training opportunities, the institute enhances the professionalism and competency of property assessors, ultimately benefiting property owners, local governments, and the community at large.

The revenue generated from these programs is a testament to the value that property assessors and stakeholders place on the institute’s educational resources. It also demonstrates the institute’s commitment to delivering high-quality training that meets the evolving needs of the property assessment industry.

In addition to traditional in-person seminars and workshops, the institute may also offer online courses or webinars to reach a wider audience. This flexibility allows assessors to access educational materials and resources from anywhere, further increasing the revenue potential for the institute.

The Illinois Property Assessment Institute’s training and educational programs are designed to continuously enhance the knowledge and skills of property assessors, ensuring they stay informed about the latest industry trends and best practices. By charging fees for these programs, the institute secures the necessary financial resources to support its important work in advancing property assessment practices in Illinois.

In the next section, we will explore another funding source for the institute: fee-based services provided to property assessors and other stakeholders.

Fee-Based Services Provided by the Illinois Property Assessment Institute

One of the funding sources for the Illinois Property Assessment Institute is the provision of fee-based services to property assessors, government agencies, and other stakeholders. These services offer specialized support, consulting, and technical assistance in various aspects of property assessment.

Property assessors often face complex challenges that require expert guidance and assistance. The institute fills this need by offering fee-based consulting services. Property assessors can engage the institute’s experts to conduct property valuation analysis, review assessment processes, provide guidance on specific valuations, or offer advice on implementing new assessment methodologies.

Government entities seeking to improve their assessment practices can also enlist the institute’s fee-based services. This can include conducting assessment process audits, providing training and guidance to assessors, or developing customized training programs tailored to the specific needs of a particular jurisdiction.

Additionally, the Illinois Property Assessment Institute offers fee-based technical assistance to assist assessors in navigating complex valuation scenarios. This may involve providing expert advice on assessing unique property types, understanding complex legal requirements, or addressing valuation challenges arising from changes in property use or zoning.

The revenue generated from these fee-based services allows the institute to expand its expertise, hire qualified professionals, and invest in resources necessary to provide high-quality support to assessors and government agencies. It also enables the institute to cover its operating expenses and support its other initiatives.

Property assessors and government agencies value the fee-based services provided by the institute due to its specialized knowledge and deep understanding of the assessment landscape. The revenue generated from these services not only supports the financial sustainability of the institute but also reaffirms its credibility and recognition as a trusted resource in the property assessment field.

By offering fee-based services, the Illinois Property Assessment Institute not only generates income but also establishes stronger connections with assessors and stakeholders. These relationships foster collaboration and knowledge-sharing and help build a more resilient and effective property assessment community.

It is worth noting that while fee-based services contribute to the funding of the institute, they are often priced competitively to ensure accessibility for assessors and government agencies with varying budgets. The primary goal is not profit but rather the provision of valuable services and support that benefit the overall quality and fairness of property assessment in Illinois.

In the next section, we will conclude our exploration of the funding sources for the Illinois Property Assessment Institute and reflect on the importance of these resources in supporting the institute’s mission.

Conclusion

The Illinois Property Assessment Institute relies on a diverse range of funding sources to support its mission of promoting excellence, accuracy, and fairness in property assessment practices throughout the state. Contributions from government entities, private donations and grants, revenue from training and educational programs, and fee-based services all play a crucial role in sustaining the institute’s operations and initiatives.

Government contributions provide essential financial support and endorsement of the institute’s work. Funding from local, state, and federal entities supports specific projects, training programs, and research initiatives that enhance property assessment practices and ensure consistency across the state.

Private donations and grants are invaluable resources that demonstrate the recognition and support of organizations, businesses, foundations, and individuals who share the institute’s vision of fairness and accuracy in property assessments. These contributions enable the institute to expand its programs, implement innovative projects, and enhance the professional development opportunities available to property assessors.

Revenue from training and educational programs not only covers operational costs but also ensures that property assessors have access to quality education and training opportunities. These programs play a vital role in enhancing the skills and knowledge of assessors and ultimately contribute to the improvement of property assessment practices statewide.

Fee-based services provided by the institute offer specialized support and technical assistance to property assessors, government agencies, and stakeholders. By offering these services, the institute generates income that supports its ongoing operations and expertise. It also strengthens its relationships with the assessment community and reaffirms its position as a trusted resource in the field.

Collectively, these funding sources enable the Illinois Property Assessment Institute to carry out its important work in fostering professionalism, accuracy, and fairness in property assessments. The financial support ensures the institute’s sustainability and reinforces its credibility as a trusted authority in the field.

As we have explored in this article, understanding the funding structure of organizations like the Illinois Property Assessment Institute is essential in appreciating the resources required to uphold their mission. By shedding light on the funding sources and mechanisms, we gain a deeper understanding of the institute’s operations and the vital role it plays in property assessment practices in Illinois.

As property assessments continue to shape taxation and property values, the work of organizations like the Illinois Property Assessment Institute becomes increasingly important. Their efforts in promoting fairness, accuracy, and professionalism benefit property owners, local governments, and the community as a whole.

By recognizing and supporting the funding sources that sustain the institute, we can contribute to the continued success and impact of the Illinois Property Assessment Institute in improving property assessment practices and ensuring equitable taxation for all.

Frequently Asked Questions about How Is The Illinois Property Assessment Institute Funded

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How Is The Illinois Property Assessment Institute Funded”