Home>Home Maintenance>How To Lower Your Property Assessment In New York City

Home Maintenance

How To Lower Your Property Assessment In New York City

Modified: January 3, 2024

Learn effective home maintenance strategies to lower your property assessment in New York City. Discover practical tips to reduce your property taxes today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to the complex world of property assessments in New York City. As a homeowner, you may have experienced the frustration of receiving a property assessment notice that seems unreasonably high. Fortunately, there are steps you can take to challenge and potentially lower your property assessment. In this guide, we will explore the intricacies of property assessments in New York City and provide actionable advice on how to navigate this process effectively.

Property assessments play a crucial role in determining the property taxes you owe. In New York City, the Department of Finance is responsible for assessing the value of properties to ensure fair and accurate taxation. However, assessment errors can occur, leading to overinflated property values and higher tax bills for homeowners. Understanding how property assessments work and knowing your rights as a property owner is essential for taking control of this situation.

Throughout this guide, we will delve into the key aspects of property assessments, including researching comparable properties, reviewing assessment records, and challenging your property assessment. We will also discuss the option of hiring a professional to assist with assessment appeals, providing valuable insights into the process and empowering you to make informed decisions.

By the end of this guide, you will have a comprehensive understanding of property assessments in New York City and the necessary tools to effectively lower your property assessment. Whether you are a seasoned homeowner or a first-time property owner, the information presented here will equip you with the knowledge and confidence to navigate the property assessment process with ease. Let's embark on this journey to take control of your property assessment and ensure fair taxation for your New York City property.

Key Takeaways:

- Researching comparable properties in your neighborhood can help you build a strong case for a lower property assessment by analyzing market data and identifying relevant comps.

- Thoroughly reviewing your property’s assessment records empowers you to identify potential inaccuracies or oversights, forming the foundation for a well-informed and persuasive appeal.

Understanding Property Assessments in New York City

Property assessments in New York City are a critical component of the taxation system, serving as the basis for determining property taxes. The New York City Department of Finance assesses the value of properties to ensure that each property owner pays their fair share of taxes based on the property’s market value. The market value is the estimated price a property would sell for under current market conditions.

Assessments are conducted periodically, and the Department of Finance utilizes various methods to determine property values. These methods may include analyzing recent sales data, considering the property’s size and location, and evaluating comparable properties in the same neighborhood. While the goal of property assessments is to maintain fairness and accuracy in taxation, errors can occur, leading to overvalued assessments and higher tax burdens for property owners.

It’s important to note that property assessments are not directly linked to the property’s market value. Instead, the Department of Finance applies an assessment ratio to the market value to arrive at the assessed value, which is used to calculate property taxes. Understanding this distinction is crucial for property owners seeking to challenge their assessments and potentially lower their tax liabilities.

In New York City, property owners have the right to challenge their assessments if they believe they are inaccurate or unfairly high. By understanding the intricacies of property assessments and the factors that influence them, homeowners can make informed decisions and take proactive steps to ensure that their properties are assessed fairly.

Throughout this guide, we will delve deeper into the strategies and methods for researching comparable properties, reviewing assessment records, and challenging property assessments. Armed with this knowledge, property owners can navigate the assessment process with confidence and advocate for fair and accurate property assessments in New York City.

Researching Comparable Properties

When challenging a property assessment in New York City, one of the most effective strategies is to research comparable properties in your neighborhood. Comparable properties, often referred to as “comps,” are properties that have similar characteristics to your own, such as size, age, condition, and location. By identifying and analyzing comps, you can gain valuable insights into the fair market value of your property and make a compelling case for a lower assessment.

Start by compiling a list of properties in your neighborhood that closely resemble yours. Look for homes or buildings with similar square footage, lot size, number of bedrooms and bathrooms, and other relevant features. Online real estate databases, local property listings, and public records can be valuable sources of information for identifying potential comps.

Once you have identified potential comparable properties, delve deeper into their sales history and recent transactions. Pay attention to the sale prices of these properties and consider any unique factors that may have influenced their value, such as renovations, upgrades, or proximity to amenities. By analyzing this data, you can build a strong case for a lower property assessment based on the actual market value of your property relative to comparable properties.

It’s important to note that the Department of Finance in New York City may have access to its own set of comparable properties when conducting assessments. However, by presenting well-researched and compelling evidence of comparable properties, you can effectively challenge an assessment that does not accurately reflect the market value of your property.

When compiling your list of comparable properties, consider enlisting the expertise of a real estate professional or appraiser. These professionals can provide valuable insights and help you navigate the complexities of property valuation. Additionally, they can assist in identifying the most relevant comps and interpreting the data to support your assessment appeal.

By thoroughly researching and analyzing comparable properties, you can bolster your case for a lower property assessment and ensure that your property is assessed fairly and accurately in line with its true market value.

Reviewing Assessment Records

Before challenging your property assessment in New York City, it is crucial to thoroughly review the assessment records for your property. The assessment records contain detailed information about how the Department of Finance arrived at the assessed value of your property, including any factors or characteristics that may have influenced the assessment.

Start by obtaining a copy of your property’s assessment record from the Department of Finance. This record will outline the assessed value of your property, as well as any relevant details used in the assessment process, such as the property’s physical attributes, recent improvements, and comparable properties considered during the assessment.

Once you have the assessment record in hand, carefully review each component to ensure accuracy and consistency. Pay close attention to the property details and characteristics listed in the assessment record, and verify that they align with the actual features of your property. Look for any discrepancies or inaccuracies that may have contributed to an inflated assessment.

Additionally, examine the comparable properties used in the assessment process. The assessment record may include information about the properties considered as comparables, along with their respective sales data and characteristics. Compare this information with your own research on comparable properties to identify any discrepancies or overlooked factors that could impact the assessment’s accuracy.

It’s also important to review any recent changes or improvements made to your property that may not have been reflected in the assessment record. If you have made upgrades or renovations that could affect the property’s value, ensure that these are accurately documented and considered in the assessment.

During the review process, keep detailed notes of any discrepancies, errors, or omissions in the assessment record. These notes will serve as valuable evidence when challenging the assessment and presenting a compelling case for a lower assessed value.

By thoroughly reviewing your property’s assessment records, you can gain a deeper understanding of how the assessment was conducted and identify potential inaccuracies or oversights. This insight will empower you to effectively challenge the assessment and advocate for a fair and accurate valuation of your property in New York City.

Consider gathering evidence of any structural issues, such as water damage or foundation problems, to support your case for a lower property assessment in New York City.

Challenging Your Property Assessment

Challenging your property assessment in New York City is a proactive step toward ensuring that your property is accurately valued and that you are not overburdened with excessive property taxes. Property owners have the right to challenge their assessments if they believe they are inaccurate, unfair, or not reflective of the property’s true market value.

Before initiating a challenge, it’s essential to gather compelling evidence to support your case. This evidence may include research on comparable properties, a thorough review of assessment records, and any relevant documentation of recent property improvements or changes that could impact the assessment.

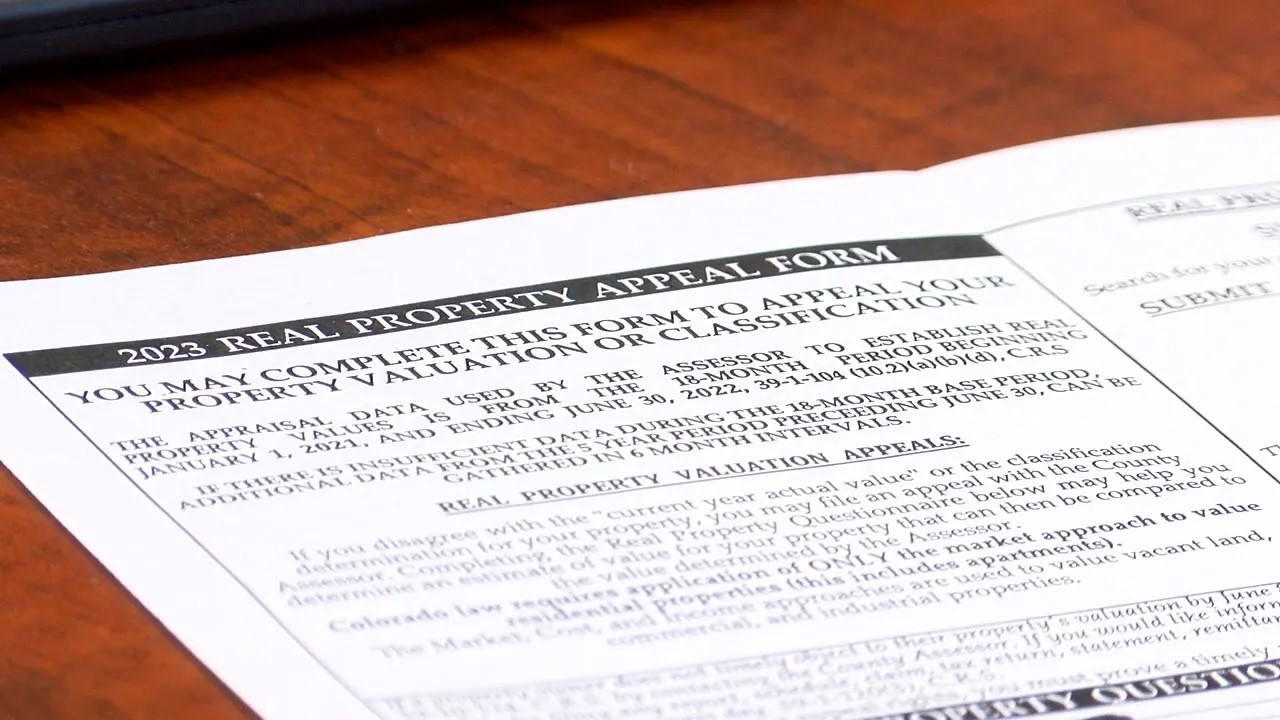

The first step in challenging your property assessment is to file a formal appeal with the New York City Tax Commission. The appeal process typically involves submitting a detailed application, along with supporting evidence and documentation, to present your case for a lower assessed value. The application will require you to outline the reasons for challenging the assessment and provide evidence to substantiate your claims.

When preparing your appeal, it’s crucial to craft a well-structured argument supported by clear and compelling evidence. Highlight any discrepancies between the assessment and the actual market value of your property, and provide a thorough analysis of comparable properties to demonstrate the fairness of your proposed assessment adjustment.

Throughout the appeal process, it’s important to remain diligent and responsive to any requests for additional information from the Tax Commission. Be prepared to present your case in a professional and organized manner, and ensure that all documentation and evidence are presented in a clear and concise format.

Keep in mind that the appeal process may require patience and persistence, as it can involve multiple stages of review and assessment. However, by staying informed and actively participating in the process, you can increase the likelihood of a favorable outcome and a lower property assessment.

While challenging your property assessment may seem daunting, it is a fundamental right that empowers property owners to advocate for fair and accurate valuations. By taking proactive steps to challenge your assessment, you can contribute to a more equitable taxation system and ensure that your property is assessed in line with its true market value in New York City.

Read more: Where Is Garden City New York

Hiring a Professional to Assist with Assessment Appeals

Navigating the complex process of challenging a property assessment in New York City can be daunting, especially for property owners who may not have the expertise or time to handle the appeal process independently. In such cases, enlisting the assistance of a qualified professional, such as a real estate attorney, appraiser, or property tax consultant, can provide invaluable support and expertise to strengthen your assessment appeal.

Real estate attorneys specializing in property tax appeals are well-versed in the intricacies of assessment challenges and can offer expert guidance throughout the appeal process. They can help you navigate the legal aspects of challenging an assessment, ensure that all necessary documentation and evidence are in order, and represent your interests effectively before the Tax Commission.

Appraisers bring a unique skill set to the table, offering expertise in property valuation and market analysis. By hiring an appraiser, you can benefit from a professional assessment of your property’s value, supported by comprehensive market data and analysis. Their insights and expertise can significantly bolster your case for a lower assessment.

Property tax consultants specialize in property tax matters and can provide strategic advice and representation during the assessment appeal process. They have a deep understanding of local property tax laws and regulations, allowing them to navigate the complexities of assessment challenges and advocate for fair valuations on behalf of property owners.

When considering hiring a professional to assist with your assessment appeal, it’s essential to research and select a qualified and reputable individual or firm with a proven track record in property tax matters. Consult with multiple professionals to discuss their experience, approach, and fees, and choose a professional who aligns with your specific needs and objectives for the assessment appeal.

While enlisting the assistance of a professional may involve additional costs, the expertise and support they provide can significantly enhance your chances of a successful assessment appeal. Their guidance and representation can alleviate the burden of navigating the appeal process independently and ensure that your case is presented effectively and persuasively before the Tax Commission.

By hiring a professional to assist with your assessment appeal, you can benefit from their specialized knowledge and experience, ultimately empowering you to achieve a fair and accurate property assessment in New York City.

Conclusion

Congratulations on completing this comprehensive guide to navigating the intricacies of property assessments in New York City. Throughout this journey, you have gained valuable insights into the assessment process, learned effective strategies for challenging assessments, and explored the option of enlisting professional assistance to strengthen your appeal. By empowering yourself with knowledge and proactive steps, you are well-equipped to take control of your property assessment and advocate for fair and accurate valuations.

Understanding the fundamentals of property assessments is crucial for property owners seeking to ensure that their properties are valued fairly and accurately. By delving into the nuances of assessment methodologies and the factors that influence property valuations, you have gained a deeper understanding of the assessment process in New York City.

Researching comparable properties has provided you with a powerful tool for evaluating the fairness of your property assessment. By analyzing market data and identifying relevant comps, you can build a compelling case for a lower assessment based on the true market value of your property.

Reviewing assessment records has empowered you to scrutinize the details of your property’s assessment and identify potential inaccuracies or oversights. This critical examination of assessment records forms the foundation for a well-informed and persuasive appeal.

Challenging your property assessment is a fundamental right that allows you to actively participate in the valuation process and advocate for fair taxation. By crafting a strong appeal supported by compelling evidence, you can contribute to a more equitable assessment system and ensure that your property is valued accurately.

The option of hiring a professional to assist with assessment appeals has provided you with an additional avenue for navigating the appeal process. Whether seeking legal guidance, appraisal expertise, or strategic advice, enlisting professional support can enhance the strength of your appeal and increase the likelihood of a favorable outcome.

As you embark on the journey of challenging your property assessment, remember that persistence and diligence are key. The appeal process may require patience and proactive engagement, but by leveraging the knowledge and strategies presented in this guide, you are well-positioned to navigate the process with confidence and determination.

By taking proactive steps to challenge your property assessment, you are contributing to a fair and equitable property tax system in New York City. Your efforts not only benefit your individual property but also contribute to the integrity and accuracy of property assessments across the city.

Armed with the knowledge and tools presented in this guide, you are prepared to advocate for fair and accurate property assessments, ensuring that your property is valued in line with its true market value. Thank you for embarking on this journey, and best of luck as you navigate the assessment appeal process with confidence and determination.

Frequently Asked Questions about How To Lower Your Property Assessment In New York City

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How To Lower Your Property Assessment In New York City”