Home>Ideas and Tips>Navigating New York City Property Assessments: What To Know

Ideas and Tips

Navigating New York City Property Assessments: What To Know

Published: October 26, 2024

Learn how NYC property assessments work, factors influencing them, and steps to contest an inaccurate assessment to manage your property taxes effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Property assessments in New York City are a complex and multifaceted process that can significantly impact the financial well-being of property owners. Understanding how property assessments work, the factors that influence them, and the steps you can take to contest an assessment if you believe it is inaccurate is crucial for navigating this aspect of homeownership or property management. This article will provide a comprehensive guide on property assessments in NYC, including the process, determining factors, and how to appeal an assessment.

Understanding Property Assessments in NYC

Property taxes in New York City are based on the assessed value of your property. The assessed value is determined by the New York City Department of Finance (DOF) and is used to calculate the amount of property taxes owed by homeowners and commercial property owners alike. The process of determining this value involves several key steps and considerations.

Determining Market Value

The first step in assessing a property's value is to determine its market value. This is not simply the price at which a property could be sold but rather a calculated figure that takes into account various factors such as property size, location, and condition. The DOF uses recent sales data, property characteristics, and market trends to ensure a fair and accurate representation of a property's value.

Factors Influencing Property Assessments

Several factors influence how properties are assessed for taxation purposes in NYC:

-

Location: The location of a property plays a significant role in its assessment. Properties in desirable neighborhoods or areas with high demand tend to have higher assessments compared to those in less sought-after locations.

-

Size: The size of a property is another important factor. Larger properties generally have higher assessments due to their increased value and potential for greater use.

-

Condition: The condition of a property affects its assessment as well. Well-maintained homes typically receive higher assessments than those in need of repairs or renovations.

-

Property Class: NYC divides properties into several classes, each subject to different tax rates. Residential, commercial, and industrial properties fall into distinct categories, with tax rates carefully calibrated to suit the characteristics of each class.

-

Assessment Ratios: The city applies an assessment ratio to determine the assessed value of a property, which is then used to calculate the property tax. This ratio can vary depending on the property class, adding another layer of complexity to the assessment process.

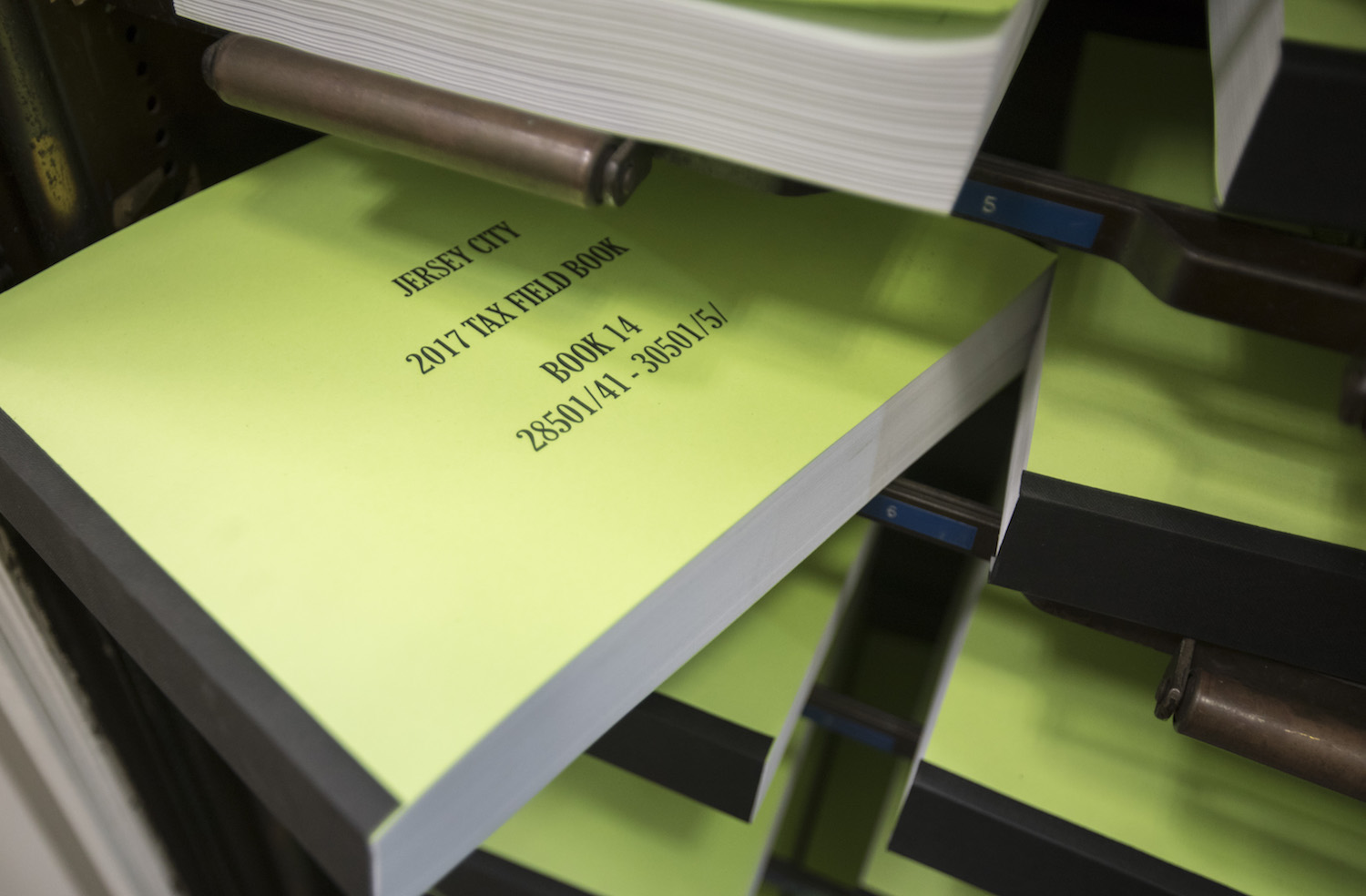

The Property Tax Assessment Process in NYC

The DOF assesses all properties annually. Here are some key factors they consider for both residential and commercial properties:

- Market Value: The estimated selling price of the property.

- Income Potential: Rental income, vacancy rates, and operating expenses for commercial properties.

- Property Characteristics: Size, location, condition, and usage of the property.

- Comparable Sales: Sales prices of similar properties in the area.

The DOF assigns a market value and then calculates the assessed value (a percentage of the market value). The rate is based on the building’s class and ranges from 6% to 45% of the assessed value.

Required Documentation for Appeals

For commercial property owners in NYC, filing the Real Property Income and Expense Statement (RPIE) is crucial. This form requires detailed financial information, including income and rent, operating expenses, and other relevant financial information. Failure to file the RPIE by the deadline can result in penalties calculated based on the property's assessed value, which can increase with continued non-compliance.

Read more: Where Is Garden City New York

Tips for a Successful Property Tax Appeal

Many property owners unknowingly overpay property taxes due to inaccurate assessments. Appealing your taxes annually can help ensure that your property is assessed accurately year over year. Consistent property assessment appeals create a record of your property’s value, which can help prevent significant increases in the future.

Working with a NYC Tax Professional

While in many cases you can file a grievance yourself, seeking professional help from a tax certiorari attorney and a CPA can significantly increase your chances of a successful tax appeal. An experienced CPA will understand the specific expenses, amortization methods, and calculations and how to navigate unique property features for forms like TC-201 that the city will accept. Form TC-309 offers substantial assurance to the Tax Commission regarding the accuracy of your property's income and expense information.

The Importance of Staying Informed

Navigating property tax filings is crucial for all owners. It ensures compliance, helps with financial planning, and provides opportunities for cost savings. Whether you're a seasoned owner or a new buyer, staying informed about your responsibilities regarding property taxes is essential. By understanding and managing your property tax obligations, you can navigate this aspect of homeownership more effectively.

Preparing to Contest Your Assessment

Before you can contest your property tax assessment, you need to gather evidence to support your claim that the assessed value is too high. This involves researching recent sales of comparable properties, obtaining a professional appraisal, and reviewing the assessment roll for errors.

Gathering Evidence

-

Research Recent Sales: Recent sales data can provide a benchmark for what your property should be worth. If comparable properties in your area are selling for significantly less than your assessed value, this can be a strong basis for your contest.

-

Obtain a Professional Appraisal: A professional appraisal can give you an independent opinion of your property’s value. This can be particularly useful if you believe that the DOF has overvalued your property.

-

Review the Assessment Roll: Errors in the assessment roll, such as incorrect square footage or property classification, can also form the basis of your challenge.

Filing a Grievance with the Local Assessor

The first step in contesting your property tax assessment is to file a grievance with your local assessor’s office. This is usually done by submitting a form called the RP-524, Complaint on Real Property Assessment, which you can obtain from your local assessor’s office or their website.

Filing the Grievance Form

To file a grievance, you need to fill out this form with detailed information about your property, including its address, tax map number, and the reasons why you believe the assessment is incorrect. You must submit this form by the deadline, which is typically the fourth Tuesday in May for most municipalities in New York.

Appealing the Decision

If you are not satisfied with the decision of the Board of Assessment Review, you can further appeal their decision by filing a tax certiorari proceeding. This involves presenting your case before a judge or administrative body and providing evidence to support your claim that the assessment is inaccurate.

The Long-Term Implications of Contesting Your Assessment

Successfully contesting your property tax assessment can provide significant savings on your property taxes, but it is also important to consider the long-term implications. A reduced assessment may affect your property’s market value and could potentially impact future sales or refinancing. Additionally, property tax assessments are typically conducted annually, so you may need to be prepared to contest your assessment again in future years if you believe it remains inaccurate.

Keeping Detailed Records

Keeping detailed records of your property’s value, recent sales, and any improvements or changes can help you be better prepared for future assessments. This includes maintaining records of any renovations or improvements made to the property as these can impact its assessed value.

Conclusion

Navigating property assessments in New York City requires a deep understanding of the process and the factors that influence it. By staying informed about local tax laws, reviewing your assessment notice carefully, and considering appealing if necessary, you can ensure that you are not paying more than your fair share of property taxes. Whether you are a seasoned homeowner or a new buyer, understanding how properties are assessed for taxation purposes is crucial for managing your financial responsibilities effectively. With this knowledge in hand, property owners can confidently steer through the complexities of property taxes in NYC, making informed decisions that will safeguard their financial well-being in the vibrant heart of New York City.

By following these strategies and staying proactive about managing your property taxes, you can navigate this complex system with confidence and ensure that you are getting a fair deal on your property taxes. Whether you are looking to contest an assessment or simply want to understand how property taxes work in NYC, this guide provides a comprehensive overview of what you need to know.

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “Navigating New York City Property Assessments: What To Know”