Home>Home Maintenance>How Is Property Assessment Determined For Tax In Sussex County, Delaware?

Home Maintenance

How Is Property Assessment Determined For Tax In Sussex County, Delaware?

Modified: March 6, 2024

Learn how property assessment for tax is determined in Sussex County, Delaware. Understand the process and factors involved. Find out how to ensure accurate home maintenance assessment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

Introduction

Welcome to Sussex County, Delaware, a place rich in natural beauty, vibrant communities, and a strong sense of local heritage. If you own property in Sussex County, you are likely familiar with the importance of property assessment for tax purposes. Property assessment is the process of determining the value of a property for taxation purposes. By understanding how property assessment works in Sussex County, you can gain valuable insights into how your property’s value is determined and how it impacts your tax obligations.

Property assessment is a critical aspect of the taxation system in Sussex County. It ensures that property owners contribute their fair share of taxes based on the value of their property. The revenue generated from property taxes plays a crucial role in funding various local public services and infrastructure development projects, such as schools, parks, and emergency services.

In Sussex County, property taxation is governed by specific laws and regulations. The Sussex County Department of Finance oversees the assessment and collection of property taxes in the county. To accurately determine the value of a property, several factors are taken into consideration, such as the property’s location, size, condition, and any improvements or renovations made to it.

The assessment process in Sussex County follows a set of guidelines and procedures to ensure fairness and accuracy. Trained assessors visit properties periodically to evaluate their value based on market conditions, sales data, and other relevant factors. Property owners are notified of their assessed value, and they have the opportunity to appeal the assessment if they believe it to be inaccurate or unfair.

Property taxes in Sussex County are calculated based on the assessed value of the property and the predetermined tax rate. Property owners can also benefit from various exemptions and deductions, such as the Senior Citizen Tax Credit or the Disabled Individuals Exemption, which can lower their overall tax liability.

Understanding the property assessment process and how it relates to your tax obligations is vital as a property owner in Sussex County. By having a clear understanding of how your property’s value is determined, you can ensure that you are paying your fair share of taxes and make informed decisions regarding your property.

In the following sections, we will delve deeper into the factors considered in property assessment, the assessment process in Sussex County, appealing property assessment, property tax calculation, and exemptions and deductions available to property owners. This comprehensive guide will equip you with the knowledge you need to navigate the property assessment and taxation system in Sussex County, Delaware.

Key Takeaways:

- Understanding Property Assessment

Property assessment determines a property’s value for tax purposes based on factors like location, size, and condition. It ensures fair taxation and helps fund public services and infrastructure. - Appealing Property Assessment

Property owners can appeal their assessed value if they believe it’s unfair. By providing evidence and following the appeal process, they can ensure accurate property assessments and fair taxation.

What is Property Assessment?

Property assessment is the process of determining the value of a property for taxation purposes. It is a crucial step in the property tax system, ensuring that property owners contribute their fair share of taxes based on the value of their property. The assessed value of a property serves as the foundation for calculating property taxes.

Property assessment is conducted by trained assessors who have a deep understanding of local real estate markets and property valuation methods. They take into account several factors to determine the market value of a property, including its location, size, condition, and any improvements or renovations made to it.

The assessed value of a property is not always synonymous with its market value. Market value refers to the price a property would sell for in an open and competitive real estate market, while assessed value is the value assigned by the assessor solely for tax purposes. The assessed value is typically a percentage of the market value, known as the assessment ratio.

Property assessment is essential for maintaining equity in the tax system. By assessing properties fairly and accurately, governments can distribute the tax burden among property owners in a way that reflects the relative value of their properties. This ensures that individuals with higher-valued properties contribute more in taxes than those with lower-valued properties.

In addition to determining property taxes, property assessments also serve other purposes. They can be used by lenders to evaluate the collateral value of a property when granting loans or mortgages. Assessments may also be considered by insurance companies when determining the coverage and premiums for a property owner’s insurance policy.

It is important to note that property assessments are not fixed and can change over time. Assessments may be updated on a regular basis or periodically, depending on local regulations. Changes to the property, such as renovations or additions, changes in market conditions, or improvements in the local infrastructure, can all influence the assessed value of a property.

Property assessment is a complex process that requires expertise and knowledge in property valuation. Trained assessors employ various methods, such as the sales comparison approach, income approach, and cost approach, to determine the value of a property. These methods involve comparing the property to similar properties in the area, considering its income-generating potential, or calculating the cost to rebuild the property, respectively.

In the next sections, we will explore the importance of property assessment for taxation, the specific property taxation system in Sussex County, Delaware, and the factors considered in property assessment. Understanding these aspects will provide you with a comprehensive understanding of how property assessment works and how it impacts your tax obligations as a property owner.

Importance of Property Assessment for Taxation

Property assessment plays a crucial role in the taxation system, ensuring fairness and equity in the distribution of tax burdens among property owners. Here are some key reasons why property assessment is important for taxation:

### Fairness and Equity

Property assessment ensures that property owners contribute their fair share of taxes based on the value of their property. By accurately assessing the value of each property, the tax burden is distributed in a way that reflects the relative value of the properties. This helps to maintain fairness and equity in the tax system.

### Revenue Generation

Property taxes are a significant source of revenue for local governments. The revenue generated from property taxes is used to fund essential public services such as schools, parks, emergency services, and infrastructure development. An accurate assessment of property values ensures that local government has the necessary funds to provide these services to the community.

### Transparent Taxation System

Property assessment provides transparency in the tax system by establishing a standardized and objective method for determining the value of properties. Assessments are carried out by trained professionals using well-defined guidelines and processes. This helps to build trust and confidence in the taxation system, as property owners can be assured that their taxes are based on an unbiased assessment of their property’s value.

### Market Stability

Property assessments can help stabilize the real estate market by providing an objective evaluation of property values. By accurately assessing the value of properties, potential buyers and sellers can make informed decisions based on the market conditions. Property assessments also serve as a reference point for lenders when determining loan terms and collateral value.

### Planning and Budgeting

Accurate property assessments provide local governments with valuable data for long-term planning and budgeting. By understanding the value and distribution of properties within their jurisdiction, government agencies can make informed decisions regarding community development, infrastructure projects, and allocation of resources.

### Assessing Tax Liability

Property assessment is essential for property owners to accurately assess their tax liability. By knowing the assessed value of their property, owners can estimate their property tax obligations. This allows property owners to plan their finances accordingly and ensure they have the necessary funds to meet their tax obligations.

In summary, property assessment is crucial for the fairness and efficiency of the taxation system. It ensures that property owners contribute their fair share of taxes based on the value of their property. Property assessment also provides transparency, stability, and valuable data for planning and budgeting. Understanding the importance of property assessment can help property owners navigate the taxation system and fulfill their tax obligations more effectively.

Property Taxation in Sussex County, Delaware

In Sussex County, Delaware, property taxation is an essential component of the local government’s revenue generation. Property taxes provide the necessary funds to support various public services and infrastructure development projects within the county. Understanding the property taxation system in Sussex County is crucial for property owners to fulfill their tax obligations and make informed financial decisions. Here is an overview of property taxation in Sussex County, Delaware:

### Tax Rates

Sussex County determines property tax rates annually based on budgetary needs and revenue requirements. The tax rate is expressed in terms of “mills,” which represents the amount of tax assessed per $1,000 of a property’s assessed value. Different property types, such as residential, commercial, and agricultural, may have varying tax rates.

### Assessed Value

The assessed value of a property in Sussex County is determined by the Sussex County Department of Finance. Trained assessors evaluate the property’s market value, taking into account factors such as location, size, condition, and any improvements or renovations made to the property. The assessed value serves as the basis for calculating property taxes.

### Calculation of Property Taxes

Property taxes in Sussex County are calculated by multiplying the assessed value of the property by the appropriate millage rate. The resulting amount represents the annual property tax liability. For example, if a property has an assessed value of $200,000 and the millage rate is 0.5 mills, the property tax would be $1000 (200,000 multiplied by 0.5).

### Tax Payment Schedule

In Sussex County, property taxes are typically due in two installments. The first installment is due on or before September 30th, and the second installment is due on or before March 31st of the following year. It is important to adhere to the payment schedule to avoid late payment penalties or interest charges.

### Delinquent Taxes

If property taxes are not paid by the due dates, they are considered delinquent. Sussex County has provisions in place to collect delinquent taxes, including the assessment of penalties and interest charges. Failure to pay property taxes can result in a tax lien being placed on the property, which may lead to foreclosure if left unresolved.

### Tax Exemptions and Deductions

While property owners are responsible for paying property taxes, there are certain exemptions and deductions available in Sussex County. These exemptions can reduce the overall tax liability for eligible property owners. Examples of exemptions include the Senior Citizen Tax Credit and the Disabled Individuals Exemption. Property owners should consult with the Sussex County Department of Finance to determine if they qualify for any exemptions or deductions.

Understanding the property taxation system in Sussex County is essential for property owners to fulfill their tax obligations. By knowing the tax rates, calculation methods, payment schedule, and any available exemptions, property owners can effectively manage their finances and ensure they are contributing their fair share to the local community.

Factors Considered in Property Assessment

Property assessment involves considering several factors to determine the value of a property. The assessment process takes into account various elements that impact a property’s worth. Understanding these factors can provide property owners with valuable insights into how their property’s value is determined. Here are some key factors considered in property assessment:

### Location

The location of a property is a significant factor in determining its value. Properties located in desirable neighborhoods or areas with high demand tend to have higher assessed values. Factors such as proximity to amenities, schools, transportation, and the overall desirability of the neighborhood can influence a property’s value.

### Size and Lot Characteristics

The size of a property and its lot characteristics are important considerations in property assessment. The total land area, as well as the dimensions and shape of the lot, can impact the property’s value. Larger lots or properties with unique features, such as waterfront access or scenic views, tend to have higher assessed values.

### Property Condition

The condition of a property is another vital factor in property assessment. Assessors consider the overall condition of the property, including the structural integrity, age, and maintenance level. Properties that are well-maintained and in good condition typically receive higher assessed values compared to properties in poor condition or in need of significant repairs.

### Improvements and Renovations

Any improvements or renovations made to a property can impact its assessed value. Assessors consider the quality, type, and cost of any additions or upgrades. Renovations that enhance the property’s functionality or aesthetics, such as kitchen remodels or bathroom upgrades, can increase its value. On the other hand, outdated or poorly executed improvements may have a minimal impact or even decrease the assessed value.

### Comparable Properties

Assessors often use comparable properties, also known as “comps,” as a benchmark for assessing property values. They will analyze recent sales data of similar properties in the area to determine how your property compares. Factors such as size, location, condition, and features will be taken into account when assessing the value of the property. The sales prices of these comparable properties provide valuable insights into the current market value.

### Economic Factors

Economic factors, such as supply and demand dynamics, interest rates, and local market conditions, can also influence property assessment. Assessors consider the prevailing economic climate and any trends that may impact property values. For example, during periods of high demand, property values may increase, whereas economic downturns may lead to a decrease in property values.

### Zoning and Land Use Regulations

Assessors also consider the zoning and land-use regulations that govern properties within a jurisdiction. Zoning restrictions, such as residential, commercial, or agricultural designations, can influence the value of a property. Assessors take into account the permitted uses and restrictions within the zoning regulations when assessing a property’s value.

These factors, among others, are considered by trained assessors in the property assessment process. By understanding these factors, property owners can gain insights into how their property’s value is determined and make informed decisions regarding their property.

Determining Property Value

Determining the value of a property is a crucial step in the property assessment process. Assessors employ various methods to assess a property’s value, taking into account numerous factors that contribute to its overall worth. Understanding how property value is determined can provide property owners with valuable insights into how their property’s assessed value is calculated. Here are some key methods and factors used in determining property value:

### Sales Comparison Approach

The sales comparison approach is one of the most common methods used to determine property value. Assessors analyze recent sales of comparable properties in the same area with similar characteristics. They consider factors such as size, location, condition, amenities, and recent market trends. By comparing your property to these recent sales, assessors can estimate its value based on market conditions.

### Income Approach

The income approach is typically used for commercial properties or income-generating properties, such as rental properties or commercial buildings. This method estimates the property’s value based on its income potential. Assessors consider factors such as rental income, expenses, and market rental rates to determine the property’s value. By estimating the net operating income, assessors use capitalization rates to calculate the property value.

### Cost Approach

The cost approach calculates the value of a property by considering the cost to rebuild or replace it. Assessors take into account factors such as the cost of land, construction materials, labor, and any depreciation or obsolescence. This method is often used for new properties or properties that have unique characteristics that make it difficult to find comparable sales data.

### Physical Characteristics

Assessors consider the physical characteristics of a property when determining its value. Factors such as the property’s size, number of bedrooms and bathrooms, layout, architectural style, and overall condition are taken into account. Properties with more desirable physical characteristics tend to have higher assessed values.

### Location and Neighborhood

The location of a property and the characteristics of the surrounding neighborhood play a significant role in determining its value. Assessors consider factors such as proximity to amenities, schools, transportation, and the overall desirability of the neighborhood. Properties in prime locations or sought-after neighborhoods often receive higher assessed values.

### Market Conditions

Assessors analyze current market conditions when determining a property’s value. They consider factors such as supply and demand dynamics, interest rates, and economic trends that may influence property values. Market conditions can shift over time, which can impact the assessed value of a property.

### Legislative and Regulatory Factors

Legislative and regulatory factors, such as zoning regulations, building codes, and land-use restrictions, are also taken into account when determining property value. These factors can influence the potential use and value of a property, which assessors consider when assessing its worth.

By considering these methods and factors, trained assessors determine the value of a property for assessment purposes. Property owners can gain insights into how their property’s assessed value is calculated by understanding these methods and factors. It is important for property owners to keep in mind that assessed value is not always the same as the market value, but rather a value assigned for taxation purposes.

Tip: Property assessment for tax in Sussex County, Delaware is determined based on the property’s market value, taking into account factors like location, size, and condition. It’s important to understand how your property’s assessment is calculated to ensure you’re being taxed fairly.

Assessment Process in Sussex County

The assessment process in Sussex County is carried out by the Sussex County Department of Finance to determine the value of properties for taxation purposes. This process ensures that property owners contribute their fair share of taxes based on their property’s assessed value. Here is an overview of the assessment process in Sussex County:

### Periodic Reassessment

Sussex County conducts periodic reassessments to keep property values up-to-date. The frequency of reassessments may vary, but it is typically done every few years. This ensures that property values reflect current market conditions and any changes to properties over time.

### Property Inspections

Trained assessors from the Sussex County Department of Finance conduct property inspections as part of the assessment process. These assessors visit properties to gather important information about the property’s characteristics, condition, and any improvements or renovations made. Property owners are usually notified in advance of the inspection.

### Data Collection

During property inspections, assessors collect data on various aspects of the property, such as size, layout, number of rooms, amenities, and overall condition. They may also take photographs to support their assessment. This data is used to accurately evaluate the property’s value and determine the assessed value for taxation purposes.

### Market Analysis

Assessors perform a market analysis to determine property values based on current market conditions. They review recent sales data of comparable properties in the area to establish a benchmark for assessing property values. Factors such as size, location, condition, and amenities are considered to determine how a property compares to recently sold properties.

### Value Calculation

Based on the data collected during property inspections and the market analysis, assessors calculate the assessed value of the property. They consider factors such as size, location, condition, improvements, and recent market trends to determine the property’s value. The assessed value is a percentage of the property’s market value, which is used as the basis for calculating property taxes.

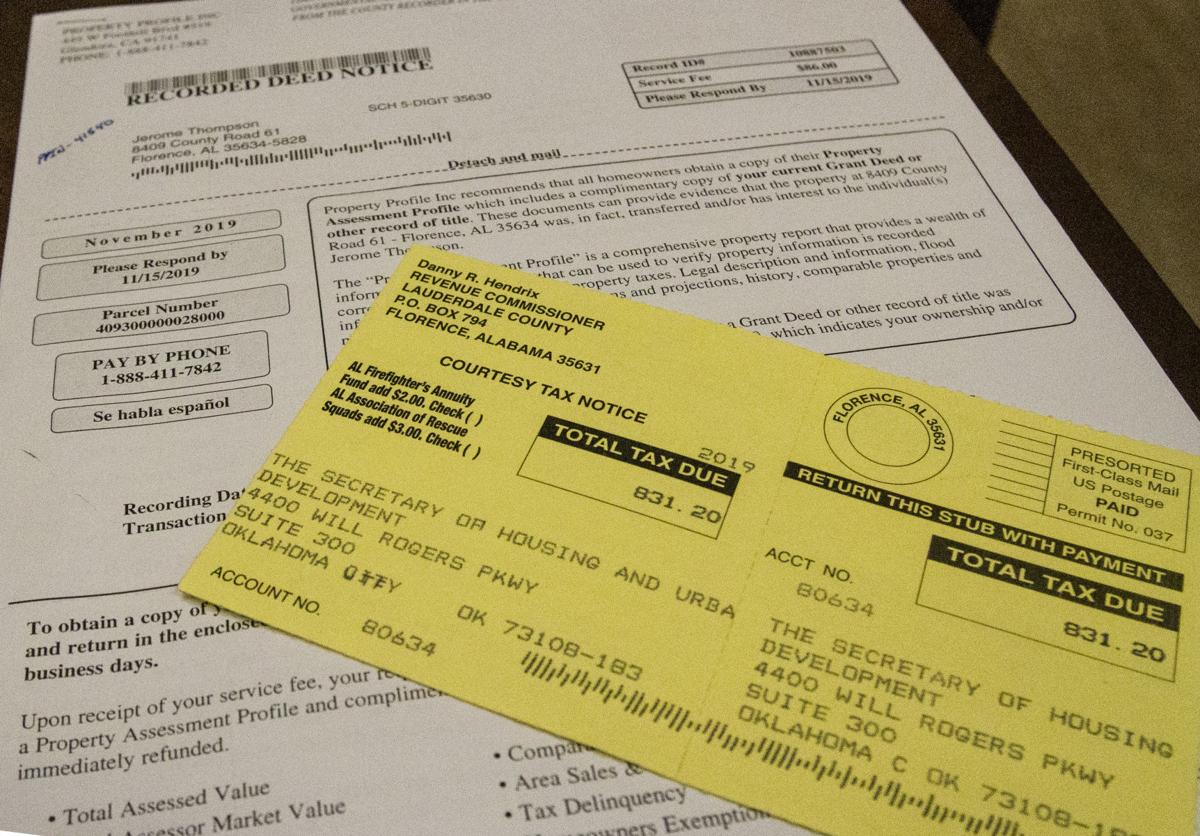

### Notice of Assessment

Once the assessed value has been determined, property owners receive a Notice of Assessment from the Sussex County Department of Finance. This notice informs property owners of their property’s assessed value for tax purposes. Property owners have the right to review and verify the information provided in the notice. If they believe the assessment to be inaccurate or unfair, they have the opportunity to appeal the assessment.

### Assessment Appeals

If property owners disagree with their property’s assessed value, they can file an appeal with the Sussex County Board of Assessment Review. The appeal process involves providing evidence and supporting documentation to challenge the assessed value. The board will review the appeal and make a determination based on the evidence presented.

The assessment process in Sussex County follows these guidelines to ensure fairness and accuracy in property valuation. Property owners are encouraged to review their Notice of Assessment, understand the assessment process, and exercise their right to appeal if they believe the assessment to be incorrect or unfair.

Appealing Property Assessment

Property owners in Sussex County have the right to appeal their property’s assessed value if they believe it is incorrect or unfair. The appeal process provides an opportunity for property owners to present evidence and supporting documentation to challenge the assessment. Here is a step-by-step guide on how to appeal a property assessment in Sussex County:

### Review the Notice of Assessment

Start by carefully reviewing the Notice of Assessment that you received from the Sussex County Department of Finance. This notice contains important information about your property’s assessed value for taxation purposes. Make sure you understand the assessment and the factors that were considered in determining the value.

### Gather Supporting Documentation

Collect any relevant documentation that supports your case for appealing the assessment. This may include recent property appraisals, sales data of comparable properties in your area, photographs or records of any property damage or issues, or any other evidence that shows the assessed value is inaccurate or unfair.

### Contact the Sussex County Department of Finance

Reach out to the Sussex County Department of Finance to inquire about the specific procedures and deadlines for filing an appeal. They will provide you with the necessary forms and instructions to initiate the appeal process. Be sure to adhere to the established deadlines to ensure your appeal is considered.

### Complete the Appeal Application

Fill out the appeal application form provided by the Sussex County Department of Finance. Provide detailed information about your property, the reason for the appeal, and submit any supporting documentation that strengthens your case. Be clear and concise in explaining why you believe the assessed value should be adjusted.

### Submit the Appeal

Submit the completed appeal application and all supporting documentation to the Sussex County Department of Finance. Make sure to keep copies of all documents for your records. You may be required to pay a filing fee, and it’s important to inquire about the fee amount and acceptable payment methods.

### Attend the Appeal Board Hearing

Once your appeal is submitted, you will be notified of the date and time of the appeal board hearing. Attend the hearing and present your case before the Sussex County Board of Assessment Review. This is an opportunity to present your evidence, explain your position, and answer any questions the review board may have.

### Await the Board’s Decision

After the appeal board hearing, the Sussex County Board of Assessment Review will review your case and make a decision. They may adjust the assessed value based on the evidence presented or maintain the original assessment. You will be notified of their decision in writing.

### Further Steps, if Necessary

If you are not satisfied with the board’s decision, you may have further options for appeal. Contact the Sussex County Department of Finance for guidance on the next steps, such as appealing to the state tax board or seeking legal assistance if necessary.

It’s important to note that the appeal process must be initiated within the designated timeframe specified by the Sussex County Department of Finance. Timely action and a thorough presentation of evidence are crucial for a successful appeal. By understanding and following the appeal process, property owners in Sussex County can ensure their property assessments are fair and accurate.

Property Tax Calculation in Sussex County

In Sussex County, property taxes are calculated based on the assessed value of the property and the applicable tax rate. Understanding how property taxes are calculated can help property owners in Sussex County estimate their tax obligations and plan their finances accordingly. Here is an overview of the property tax calculation process:

### Assessed Value

The first step in calculating property taxes is determining the assessed value of the property. The assessed value represents the value assigned to the property by the Sussex County Department of Finance for taxation purposes. Assessors evaluate various factors, such as property size, location, condition, and improvements, in determining the assessed value.

### Millage Rate

Once the assessed value is determined, it is multiplied by the millage rate to calculate the property taxes owed. The millage rate represents the amount of tax assessed per $1,000 of assessed value. Different property types, such as residential, commercial, and agricultural, may have different millage rates.

### Calculation Formula

The formula for calculating property taxes is straightforward. It involves multiplying the assessed value of the property by the millage rate and dividing it by 1,000. This formula can be expressed as:

Property Tax = (Assessed Value × Millage Rate) / 1,000

### Payment Schedule

Property taxes in Sussex County are typically paid in two installments. The first installment is due on or before September 30th, and the second installment is due on or before March 31st of the following year. Property owners should ensure that they adhere to the payment schedule to avoid any penalties or interest charges.

### Delinquent Taxes

If property taxes are not paid by the due dates, they are considered delinquent. Sussex County has provisions in place to collect delinquent taxes, including assessing penalties and interest charges. Failure to pay property taxes can result in a tax lien being placed on the property, which may lead to foreclosure if left unresolved.

### Exemptions and Deductions

Sussex County offers various exemptions and deductions that can lower the overall property tax liability for eligible property owners. Common exemptions include the Senior Citizen Tax Credit and the Disabled Individuals Exemption. Property owners should consult with the Sussex County Department of Finance to determine if they qualify for any exemptions or deductions.

### Annual Assessment Changes

It’s important to note that property taxes can change from year to year due to reassessment or changes in the millage rate. Periodic reassessments ensure that property values remain up-to-date, reflecting current market conditions. Any changes to the millage rate are determined by Sussex County based on budgetary needs and revenue requirements.

By understanding the property tax calculation process in Sussex County, property owners can estimate their tax obligations based on their property’s assessed value and the applicable millage rate. It is crucial to adhere to the payment schedule and take advantage of any available exemptions or deductions to minimize the overall tax liability. For specific information about property tax calculations and payment in Sussex County, property owners are encouraged to contact the Sussex County Department of Finance.

Read more: How Do I Obtain Tax Property Assessment

Exemptions and Deductions

Property owners in Sussex County may be eligible for certain exemptions and deductions that can help lower their overall property tax liability. These exemptions and deductions provide eligible property owners with the opportunity to reduce the amount of taxes owed. Here are some common exemptions and deductions available in Sussex County:

### Senior Citizen Tax Credit

The Senior Citizen Tax Credit is available to eligible senior citizens who are 65 years of age or older. This credit provides a reduction in property taxes based on a sliding scale, depending on the applicant’s income level. The income thresholds and amount of credit vary, so it’s important to check with the Sussex County Department of Finance for the specific eligibility criteria and application process.

### Disabled Individuals Exemption

The Disabled Individuals Exemption is designed to assist qualified individuals with disabilities in reducing their property tax burden. Property owners who have a permanent disability or are veterans with a service-connected disability may be eligible for this exemption. Details regarding eligibility requirements, application procedures, and the amount of exemption can be obtained from the Sussex County Department of Finance.

### Homestead Exemption

The Homestead Exemption provides a reduction in property taxes for qualified homeowners who use their property as their primary residence. Eligible homeowners may receive a set percentage reduction in their property’s assessed value, thus lowering their overall tax liability. This exemption is subject to certain requirements, such as the property being the homeowner’s primary residence and meeting specific income thresholds.

### Agricultural Use Exemption

The Agricultural Use Exemption is available to properties that are actively used for agricultural purposes, such as farming or raising livestock. This exemption can provide significant property tax relief for qualifying agricultural properties. Property owners must meet specific criteria, including providing proof of agricultural activities and adhering to any local regulations related to agricultural use exemptions.

### Conservation Easement Exemption

The Conservation Easement Exemption is designed to encourage the preservation of open space and environmentally sensitive areas. Properties that have a legally binding conservation easement may qualify for this exemption, which can result in a reduction in property taxes. Property owners interested in this exemption should consult with the Sussex County Department of Finance and the appropriate conservation authorities to understand the requirements and application process.

### Additional Exemptions and Deductions

In addition to the exemptions mentioned above, Sussex County may offer other exemptions and deductions. These could include exemptions for disabled veterans, certain types of property improvements, historic properties, or renewable energy systems. It’s important for property owners to inquire with the Sussex County Department of Finance to explore all available exemptions and deductions they may qualify for.

Property owners in Sussex County should be aware that each exemption or deduction has specific eligibility criteria and may require an application process. It is recommended to reach out to the Sussex County Department of Finance to obtain detailed information about the exemptions and deductions available, their requirements, and any deadlines for submission.

By taking advantage of available exemptions and deductions, property owners in Sussex County can potentially reduce their property tax liability and ease their financial burden. It is essential to stay informed about these opportunities and explore eligibility to maximize tax savings. Consulting with the Sussex County Department of Finance is highly recommended for accurate and up-to-date information regarding exemptions and deductions.

Conclusion

Understanding the property assessment and taxation system in Sussex County, Delaware is crucial for property owners to navigate their tax obligations and ensure fairness in the distribution of tax burdens. Property assessment determines the value of a property for taxation purposes, ensuring that property owners contribute their fair share based on their property’s assessed value.

Throughout this comprehensive guide, we explored various aspects of property assessment and taxation in Sussex County. We learned that property assessment takes into account factors such as location, size, condition, and market conditions to determine a property’s value. This value is then used to calculate property taxes, which play a vital role in funding public services and infrastructure development.

We discussed the importance of property assessment for taxation, including the need for fairness, transparency, and revenue generation. By accurately assessing property values, governments can ensure that tax burdens are distributed equitably and that sufficient funds are available for essential public services.

Additionally, we examined the property taxation system in Sussex County, discussing factors such as tax rates, payment schedules, and consequences for delinquent taxes. We emphasized the availability of exemptions and deductions that can help lower property tax liabilities for eligible property owners, such as the Senior Citizen Tax Credit and the Disabled Individuals Exemption.

Furthermore, we explored the assessment process in Sussex County, including periodic reassessments, property inspections, data collection, market analysis, and the appeals process. Understanding this process empowers property owners to review their property assessments, provide evidence if necessary, and ensure the accuracy and fairness of their assessed values.

In conclusion, navigating the property assessment and taxation system in Sussex County requires knowledge and understanding. By familiarizing yourself with the factors considered in property assessment, your rights to appeal, and available exemptions and deductions, you can effectively manage your tax obligations and make informed decisions regarding your property.

Remember to consult with the Sussex County Department of Finance for specific information and guidance related to your property assessments, tax calculations, exemptions, and appeals. Stay informed, ask questions, and utilize the available resources to ensure a smooth and equitable experience in managing your property taxes in Sussex County, Delaware.

Frequently Asked Questions about How Is Property Assessment Determined For Tax In Sussex County, Delaware?

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “How Is Property Assessment Determined For Tax In Sussex County, Delaware?”