Home>Ideas and Tips>Understanding Your Illinois Property Tax Assessment

Ideas and Tips

Understanding Your Illinois Property Tax Assessment

Published: October 26, 2024

Learn how Illinois property tax assessments work, how to calculate your taxes, and steps to appeal if you believe your assessment is unfair.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Storables.com, at no extra cost. Learn more)

In Illinois, property taxes play a crucial role in financing essential public services such as education, infrastructure, public safety, and local government operations. For property owners, understanding the property tax assessment process is essential for effective financial planning and contributing to the community. This article will delve into the intricacies of the property tax system in Illinois, explaining how assessments are determined, how taxes are calculated, and what options are available for appealing an assessment if you believe it is unfair.

The Property Tax System in Illinois

The property tax system in Illinois operates on a cyclical basis, involving two key phases: assessment and collection. This process applies to both residential and commercial properties to ensure that the burden of funding essential services is distributed fairly among property owners.

Assessment Phase

During the assessment phase, local government authorities evaluate the value of real estate properties within their jurisdiction. This evaluation aims to determine the market value of each property, which serves as the basis for calculating property taxes. The assessed value of properties may differ from their actual market value due to factors like property improvements, market conditions, and other relevant considerations.

In Illinois, the statutory assessment level is one-third or 33.33% of market value, unless set otherwise by law. Most property is locally assessed by township and county officials. In all counties except Cook and the 17 commission counties, there is a quadrennial reassessment cycle. Between these assessments, assessors may revalue any property whose value has changed or is incorrect. Farm acreage must be reassessed annually.

The assessment date in Illinois is January 1. On this date, the assessment cycle begins for all real property, which must be valued as to its condition at that point and time. The Property Tax Code requires that on or before this date, the County Clerk's Office (CCAO) receives the assessment books listing all parcels of real estate to be assessed in each township in the county.

Collection Phase

Once the assessments are completed, then begins the property tax collection phase. Property owners are notified of their assessed values and corresponding tax obligations. Tax rates, which are determined by various local taxing districts such as municipalities, school districts, counties, and more, are applied to the assessed values to calculate the actual property tax bills.

Determining Property Value

The determination of market value for tax purposes is the job of assessors, who use one or more of the three basic approaches to estimate market value:

- Sales Comparison Approach: This involves calculating the value of properties by observing and analyzing the selling prices of comparable properties.

- Cost Approach: This includes measuring and describing the improvements on a property to estimate its value.

- Income Approach: This estimates the value of all real property in the jurisdiction and ensures uniformity and equity in the methods used and the market values produced.

Assessing Residential Properties

Residential properties in Illinois are typically assessed using a computer-assisted mass appraisal method. The model is based on sales comparison and includes different value components such as sales of comparable properties, land, location, building square footage, and construction type. These assessments are made using past three to five years of sales information.

In Cook County, residential properties are assessed at a lower rate compared to other parts of the state. The assessment level for residential properties in Cook County is 10%, whereas it is 33.33% for most other properties in Illinois. However, this difference is largely offset by the state equalization factor, which multiplies the initially calculated assessed values by a factor that ensures all assessments reflect 33.33% of fair market value.

Assessing Commercial Properties

Commercial properties in Cook County are assessed by parcel, which is identified by a Property Index Number (PIN). Within a commercial property, there can be more than one parcel taxed, such as when a property contains offices, retail space, and a parking garage.

Commercial properties are assessed at a different percentage of market value compared to residential properties. In Cook County, commercial properties reflect 38% of their estimated fair market value, whereas residential properties are assessed at 16%.

Understanding Your Assessment Notice

When you receive your assessment notice, it will typically include detailed information about your property's assessed value. This notice may include:

- Property Index Number (PIN): A unique identifier for your property.

- Assessment by Township Assessor: The initial assessment made by the township assessor.

- Assessment by CCAO: The assessment made by the County Clerk's Office (CCAO).

- Final Assessment by Board of Review: The final assessment after any appeals have been considered.

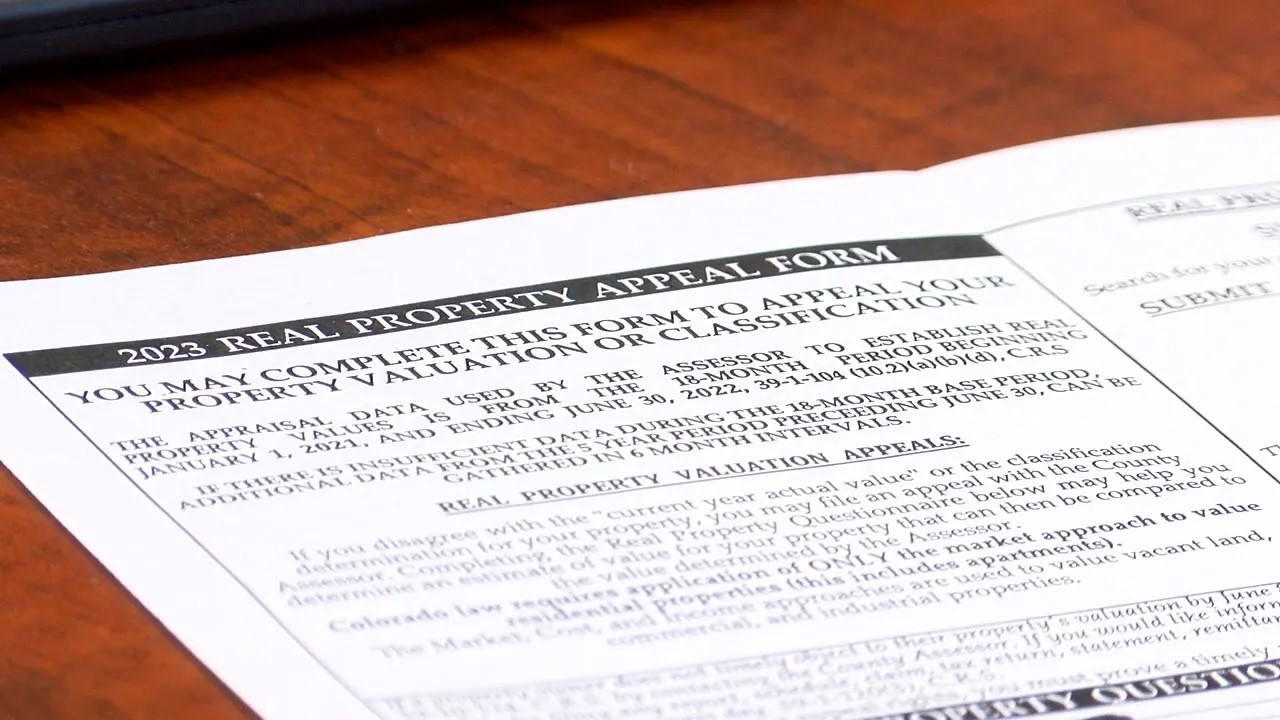

Appealing Your Assessment

If you believe your new proposed assessed valuation is too high compared to similar properties in your area, or if you believe there is an error in the description of your property, you can file an appeal. Here are the steps to follow:

Filing an Appeal with the Assessor's Office

- Gather Information: Collect data on the value of at least five surrounding properties that are comparable in age, square footage, and number of bedrooms and baths. Note any repairs needed on the property as this could impact its value.

- Submit Appeal: File your appeal with the Assessor's Office by the date noted on your reassessment notice. You can seek personal assistance and information from the Taxpayer Services Department or local township assessor.

- Review Board Decision: If you are not satisfied with the Assessor's decision, you can file an additional appeal with the Cook County Board of Review.

Filing an Appeal with the Illinois Property Tax Appeal Board (PTAB)

If you are not satisfied with the Board of Review's decision, you can escalate your appeal to the Illinois Property Tax Appeal Board (PTAB). The PTAB provides an informal hearing before one or more members of the board. You should gather all relevant documentation and evidence to support your case.

Filing a Complaint in Circuit Court

If you are still not satisfied with the PTAB's decision or if you believe that there has been an error in the assessment process, you can file a complaint in circuit court. However, securing a favorable court ruling is less likely unless you've fully explored available administrative remedies.

How Property Taxes Are Calculated

Property taxes are calculated using a simple yet essential equation:

[ text{Property Tax Bill} = (text{Equalized Assessed Value}) times (text{Tax Rate}) ]

Equalized Assessed Value

The equalized assessed value is determined by multiplying the initially calculated assessed value by an equalization factor. This factor ensures that all assessments reflect 33.33% of fair market value across different counties and municipalities.

Read more: How Do I Obtain Tax Property Assessment

Tax Rate

The tax rate is determined by various local taxing districts such as municipalities, school districts, counties, and more. These rates fluctuate annually based on property values and revenue needs, typically subject to voter endorsement under the Property Tax Extension Limitation Law (PTELL).

Property Tax Rates Across Illinois Counties

Property tax rates vary across different counties in Illinois. Cook County has an average property tax rate of 2.19%, which is notably higher than the statewide average of 2.07%. However, this difference is largely offset by the state equalization factor used in Cook County assessments.

Conclusion

Understanding your Illinois property tax assessment is crucial for managing your finances effectively and contributing to the community. By knowing how assessments are determined, how taxes are calculated, and what options are available for appealing an assessment if it is unfair, you can ensure that you are paying a fair share of property taxes.

In summary:

- The property tax system in Illinois operates on a cyclical basis involving assessment and collection phases.

- Assessments are determined based on market value using approaches like sales comparison and cost.

- Residential properties are assessed at 10% in Cook County but 33.33% elsewhere.

- Commercial properties are assessed differently based on parcel identification.

- You can appeal an assessment by filing with the Assessor's Office or higher boards like PTAB or circuit court.

- Property taxes are calculated using equalized assessed value and tax rates determined by local taxing districts.

By following these steps and understanding these principles, you can navigate the complex world of Illinois property taxes with confidence.

Was this page helpful?

At Storables.com, we guarantee accurate and reliable information. Our content, validated by Expert Board Contributors, is crafted following stringent Editorial Policies. We're committed to providing you with well-researched, expert-backed insights for all your informational needs.

0 thoughts on “Understanding Your Illinois Property Tax Assessment”